Maximize Your Forex Trade Profit: The Ultimate Calculator Guide

In the fast-paced world of Forex trading, precision and informed decision-making are paramount. One critical tool that every trader, from novice to expert, should utilize is a forex trade profit calculator. This guide delves into the intricacies of these calculators, exploring how they work, why they are essential, and how to use them effectively to enhance your trading strategy and ultimately, maximize your forex trade profit.

Understanding Forex Trade Profit Calculators

A forex trade profit calculator is a simple yet powerful tool designed to estimate the potential profit or loss of a Forex trade. It takes into account several key factors, including:

- Currency Pair: The specific currencies being traded (e.g., EUR/USD, GBP/JPY).

- Trade Size (Lot Size): The volume of currency being traded, typically measured in lots (standard, mini, micro).

- Entry Price: The price at which the trade is opened.

- Exit Price: The price at which the trade is closed.

- Leverage (Optional): The ratio of borrowed capital to the trader’s own capital.

By inputting these parameters into a forex trade profit calculator, traders can quickly determine the potential financial outcome of a trade before even executing it. This allows for more informed decisions and better risk management.

Why Use a Forex Trade Profit Calculator?

The benefits of using a forex trade profit calculator are numerous:

- Risk Management: Accurately assess potential losses before entering a trade, helping you manage risk effectively.

- Profit Target Setting: Determine realistic profit targets based on your trading strategy and risk tolerance.

- Trade Planning: Evaluate different scenarios and adjust your trade parameters to optimize potential profits.

- Emotional Control: Make decisions based on calculated data rather than impulsive emotions, leading to more consistent results.

- Strategy Development: Analyze past trades using the calculator to identify areas for improvement in your trading strategy.

How to Use a Forex Trade Profit Calculator Effectively

While using a forex trade profit calculator is straightforward, understanding how to interpret the results and integrate them into your overall trading strategy is crucial. Here’s a step-by-step guide:

Step 1: Gather Your Trade Parameters

Before using the calculator, gather all the necessary information for your trade. This includes the currency pair you intend to trade, the lot size, your anticipated entry price, and your planned exit price (based on your technical analysis or trading signals). If you’re using leverage, note the leverage ratio.

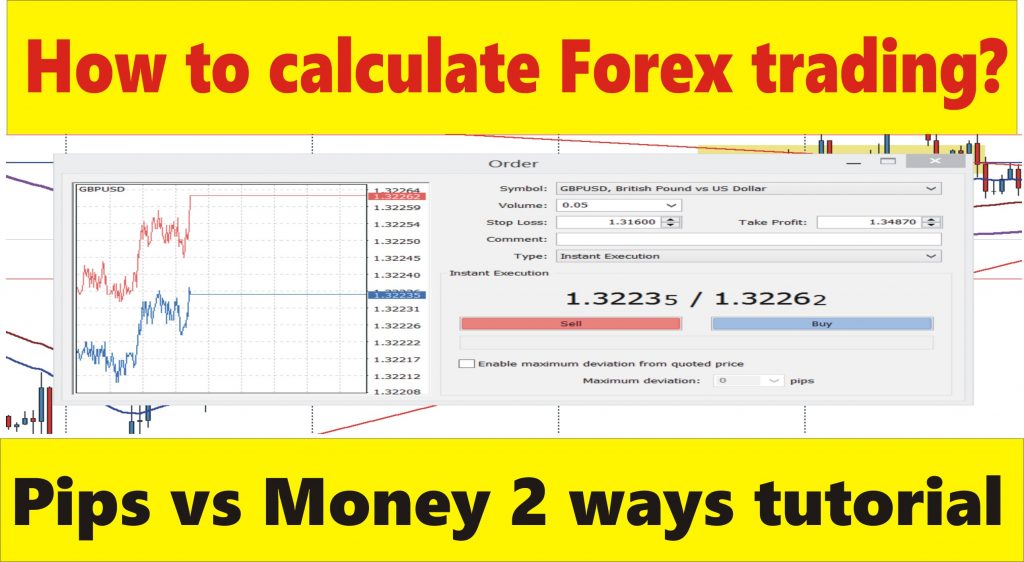

Step 2: Input the Data into the Calculator

Most forex trade profit calculators have a user-friendly interface with clearly labeled fields. Enter the data you gathered in Step 1 into the corresponding fields. Double-check your entries to ensure accuracy.

Step 3: Analyze the Results

Once you’ve entered the data, the calculator will display the potential profit or loss of the trade. Pay close attention to both the positive and negative scenarios. Consider whether the potential profit justifies the risk involved. If the potential loss exceeds your risk tolerance, you may need to adjust your trade parameters or reconsider the trade altogether.

Step 4: Adjust Your Trade Parameters (If Necessary)

Based on the calculator’s results, you can adjust your trade parameters to optimize your potential profit and manage your risk. For example, you might adjust your stop-loss order to limit potential losses, or you might modify your take-profit order to increase your potential profit. Experiment with different scenarios to find the optimal balance between risk and reward.

Step 5: Integrate the Results into Your Trading Strategy

The forex trade profit calculator is just one tool in your trading arsenal. It should be used in conjunction with other forms of analysis, such as technical analysis, fundamental analysis, and sentiment analysis. Use the calculator’s results to inform your overall trading strategy and make more informed decisions. [See also: Forex Trading Strategies for Beginners]

Key Considerations When Using a Forex Trade Profit Calculator

While forex trade profit calculators are valuable tools, it’s important to be aware of their limitations and potential pitfalls:

- Slippage: The calculator assumes that your trades will be executed at the exact prices you enter. However, in reality, slippage can occur, especially during periods of high volatility or low liquidity. Slippage can cause your actual profit or loss to deviate from the calculator’s estimate.

- Spreads and Commissions: Some calculators may not fully account for spreads (the difference between the bid and ask price) and commissions charged by your broker. These costs can reduce your overall profit. Be sure to factor in these costs when using the calculator.

- Leverage Risks: While leverage can amplify your profits, it can also amplify your losses. Be cautious when using leverage and ensure that you understand the risks involved. The forex trade profit calculator can help you assess the potential impact of leverage on your trades.

- Market Volatility: Forex markets are constantly fluctuating, and unexpected events can cause prices to move rapidly. The calculator provides an estimate based on current market conditions, but these conditions can change quickly. Be prepared to adjust your trades as needed in response to market volatility.

Choosing the Right Forex Trade Profit Calculator

Numerous forex trade profit calculators are available online, and selecting the right one can be overwhelming. Here are some factors to consider when choosing a calculator:

- Accuracy: Look for a calculator that is known for its accuracy and reliability. Read reviews and compare the results of different calculators to ensure that they are consistent.

- User-Friendliness: Choose a calculator with a user-friendly interface that is easy to navigate and understand. The calculator should be intuitive and require minimal effort to input data and interpret the results.

- Features: Some calculators offer additional features, such as the ability to calculate margin requirements, pip values, and swap rates. Consider whether these features are important to you and choose a calculator that meets your needs.

- Mobile Compatibility: If you trade on the go, look for a calculator that is compatible with your mobile device. This will allow you to quickly assess potential profits and losses from anywhere.

Advanced Strategies for Maximizing Forex Trade Profit

Beyond basic calculations, a forex trade profit calculator can be used to implement more advanced trading strategies.

Risk-Reward Ratio Analysis

Calculate the risk-reward ratio for each trade. A favorable risk-reward ratio (e.g., 1:2 or 1:3) indicates that the potential profit is significantly greater than the potential loss. Use the forex trade profit calculator to determine the potential profit and loss of each trade and calculate the risk-reward ratio accordingly.

Position Sizing

Determine the optimal position size for each trade based on your risk tolerance and account balance. The forex trade profit calculator can help you assess the potential impact of different position sizes on your account. Avoid risking more than a small percentage of your account balance on any single trade.

Correlation Analysis

Analyze the correlation between different currency pairs. Trading correlated pairs can increase your potential profit, but it can also increase your risk. Use the forex trade profit calculator to assess the potential impact of trading correlated pairs on your overall portfolio. [See also: Understanding Forex Correlation]

The Future of Forex Trade Profit Calculators

As technology advances, forex trade profit calculators are becoming more sophisticated and integrated into trading platforms. Expect to see calculators with more advanced features, such as:

- Real-Time Data Integration: Calculators that automatically update with real-time market data, providing more accurate and timely estimates.

- Automated Risk Management: Calculators that automatically adjust trade parameters based on your risk tolerance and market conditions.

- AI-Powered Analysis: Calculators that use artificial intelligence to analyze market trends and predict potential profits and losses.

Conclusion

A forex trade profit calculator is an indispensable tool for any Forex trader looking to improve their risk management, set realistic profit targets, and develop a more informed trading strategy. By understanding how these calculators work and using them effectively, you can significantly enhance your chances of success in the Forex market. Remember to consider the limitations of the calculator and use it in conjunction with other forms of analysis. As technology continues to evolve, expect to see even more sophisticated and powerful forex trade profit calculators emerge, further empowering traders to make informed decisions and maximize their forex trade profit. Embrace the power of calculation, and trade with confidence.