Mutual Fund vs. Hedge Fund: Understanding the Key Differences

When it comes to investing, individuals are often faced with a plethora of options, each with its own set of characteristics, risks, and potential rewards. Two of the most well-known investment vehicles are mutual funds and hedge funds. While both pool money from investors to pursue investment strategies, they differ significantly in their structure, investment strategies, accessibility, regulation, and fee structures. Understanding these differences is crucial for investors to make informed decisions aligned with their financial goals and risk tolerance. This article delves into a comprehensive comparison of mutual funds and hedge funds, providing clarity on their distinct features.

What is a Mutual Fund?

A mutual fund is a type of investment vehicle that pools money from many investors to purchase a diversified portfolio of assets, such as stocks, bonds, or other securities. The fund is managed by a professional fund manager who makes investment decisions on behalf of the investors. Mutual funds offer a way for individuals to invest in a diversified portfolio without having to individually select and manage each security. They are typically regulated to protect investors and are required to disclose their holdings and performance regularly.

Key Characteristics of Mutual Funds:

- Diversification: Mutual funds invest in a wide range of assets, reducing the risk associated with investing in individual securities.

- Liquidity: Investors can typically buy or sell shares of a mutual fund on any business day.

- Professional Management: Mutual funds are managed by experienced investment professionals.

- Regulation: Mutual funds are subject to strict regulations designed to protect investors.

- Accessibility: Mutual funds are generally accessible to a wide range of investors.

What is a Hedge Fund?

A hedge fund is a type of investment partnership that uses pooled funds to employ a variety of strategies to generate returns for its investors. Unlike mutual funds, hedge funds are typically less regulated and are only available to accredited investors, such as high-net-worth individuals and institutional investors. Hedge funds often employ more complex and aggressive investment strategies, including short selling, leverage, and derivatives, with the goal of generating higher returns. The term “hedge” originally referred to strategies designed to reduce risk, but many modern hedge funds pursue absolute returns regardless of market direction.

Key Characteristics of Hedge Funds:

- Exclusivity: Hedge funds are typically only available to accredited investors.

- Less Regulation: Hedge funds are subject to less regulation than mutual funds.

- Complex Strategies: Hedge funds employ a wide range of complex and often aggressive investment strategies.

- Higher Fees: Hedge funds typically charge higher fees than mutual funds, including performance-based fees.

- Limited Liquidity: Hedge funds often have restrictions on when investors can withdraw their money.

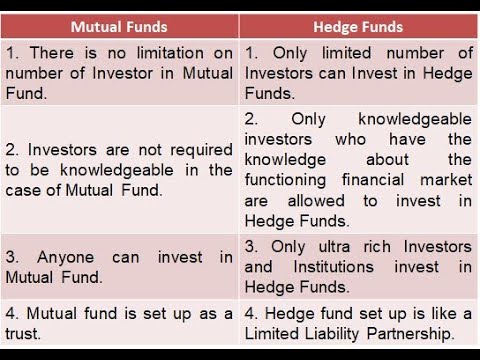

Mutual Fund vs. Hedge Fund: A Detailed Comparison

To further clarify the differences between mutual funds and hedge funds, let’s delve into a more detailed comparison across several key areas:

Investor Accessibility

Mutual funds are designed for a broad range of investors, including individuals with varying levels of wealth. The minimum investment required for mutual funds is often relatively low, making them accessible to even small investors. In contrast, hedge funds are generally only accessible to accredited investors. Accredited investors are individuals or institutions with a high net worth or income, as defined by regulatory bodies. This exclusivity is due to the higher risk and complexity associated with hedge fund investments.

Regulatory Oversight

Mutual funds are heavily regulated by government agencies, such as the Securities and Exchange Commission (SEC) in the United States. These regulations are designed to protect investors by ensuring transparency, preventing fraud, and requiring regular reporting of fund performance and holdings. Hedge funds, on the other hand, are subject to less regulatory oversight. While they are still required to register with regulatory bodies, they have more flexibility in their investment strategies and reporting requirements. This reduced regulation allows hedge funds to pursue more aggressive strategies but also increases the risk for investors.

Investment Strategies

Mutual funds typically employ more traditional and conservative investment strategies. They often focus on investing in a diversified portfolio of stocks, bonds, or other securities that align with the fund’s stated objectives. Hedge funds, in contrast, employ a much wider range of investment strategies, including short selling, leverage, arbitrage, and derivatives. These strategies are often more complex and riskier than those used by mutual funds, with the goal of generating higher returns regardless of market conditions. [See also: Understanding Investment Strategies]

Fee Structure

Mutual funds typically charge lower fees than hedge funds. Mutual fund fees usually consist of an expense ratio, which is a percentage of the fund’s assets that is used to cover operating expenses and management fees. Hedge funds, on the other hand, typically charge a “2 and 20” fee structure, which means they charge a 2% management fee on assets under management and a 20% performance fee on any profits generated. This higher fee structure reflects the more complex strategies and higher potential returns associated with hedge fund investments. The performance fee incentivizes the hedge fund manager to generate positive returns.

Liquidity

Mutual funds offer high liquidity, meaning investors can typically buy or sell shares of the fund on any business day. This allows investors to easily access their money when needed. Hedge funds often have restrictions on when investors can withdraw their money, such as lock-up periods or redemption fees. These restrictions are in place to allow the hedge fund manager to implement their investment strategies without being forced to sell assets prematurely due to investor withdrawals. The lack of liquidity is a trade-off for the potential for higher returns.

Risk Profile

Mutual funds are generally considered to be less risky than hedge funds due to their diversified portfolios and regulatory oversight. However, the risk level of a mutual fund can vary depending on the types of assets it invests in. Hedge funds are generally considered to be riskier investments due to their complex strategies, use of leverage, and limited regulation. The potential for higher returns comes with a higher risk of loss. Therefore, it’s crucial to carefully consider your risk tolerance before investing in either type of fund.

Who Should Invest in Mutual Funds?

Mutual funds are a suitable investment option for a wide range of investors, including:

- Beginner investors: Mutual funds provide a simple and diversified way to start investing.

- Investors seeking diversification: Mutual funds offer instant diversification across a range of assets.

- Investors looking for professional management: Mutual funds are managed by experienced investment professionals.

- Investors with limited capital: The minimum investment required for mutual funds is often relatively low.

- Investors prioritizing liquidity: Mutual funds offer high liquidity, allowing investors to easily access their money.

Who Should Invest in Hedge Funds?

Hedge funds are generally only suitable for accredited investors who:

- Have a high net worth or income: Hedge funds are only available to accredited investors.

- Understand the risks associated with complex investment strategies: Hedge funds employ complex and often aggressive strategies.

- Are comfortable with limited liquidity: Hedge funds often have restrictions on when investors can withdraw their money.

- Are seeking potentially higher returns: Hedge funds have the potential to generate higher returns than mutual funds.

- Are willing to pay higher fees: Hedge funds typically charge higher fees than mutual funds.

Conclusion

Mutual funds and hedge funds are both investment vehicles that pool money from investors, but they cater to different types of investors and employ different investment strategies. Mutual funds are more accessible, regulated, and offer greater liquidity, making them suitable for a wider range of investors. Hedge funds are more exclusive, less regulated, and employ more complex strategies, making them suitable for accredited investors seeking potentially higher returns and comfortable with higher risks and lower liquidity. Understanding the key differences between mutual funds and hedge funds is crucial for making informed investment decisions that align with your financial goals and risk tolerance. Always conduct thorough research and consult with a financial advisor before making any investment decisions. Carefully consider the fees, risks, and potential rewards of each option before allocating your capital. [See also: Choosing the Right Investment Vehicle]