Mutual Funds vs. Hedge Funds: Understanding the Key Differences

When navigating the complex world of investments, understanding the distinctions between different types of funds is crucial. Two prominent options are mutual funds and hedge funds. While both pool money from investors to pursue investment strategies, they operate under vastly different structures, regulations, and investment approaches. This article provides a comprehensive comparison of mutual funds vs hedge funds, highlighting their key differences to help investors make informed decisions.

What are Mutual Funds?

Mutual funds are investment vehicles that pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other assets. These funds are managed by professional fund managers who aim to achieve a specific investment objective, such as capital appreciation or income generation. Mutual funds are typically regulated and accessible to the general public.

Key Characteristics of Mutual Funds:

- Accessibility: Widely available to retail investors with relatively low minimum investment requirements.

- Regulation: Heavily regulated by government agencies like the Securities and Exchange Commission (SEC) to protect investors.

- Transparency: Required to disclose their holdings, performance, and fees regularly.

- Liquidity: Investors can typically buy or sell shares of mutual funds at the end of each trading day at the fund’s net asset value (NAV).

- Investment Strategy: Generally follow a more conservative and diversified investment approach.

What are Hedge Funds?

Hedge funds are alternative investment vehicles that also pool money from investors, but they employ more complex and often riskier investment strategies. They aim to generate higher returns than traditional investments by using techniques like leverage, short selling, and derivatives. Hedge funds are typically less regulated and only accessible to accredited investors.

Key Characteristics of Hedge Funds:

- Accessibility: Primarily available to accredited investors, such as high-net-worth individuals and institutional investors.

- Regulation: Less heavily regulated compared to mutual funds, providing more flexibility in investment strategies.

- Transparency: Offer less transparency regarding their holdings and strategies.

- Liquidity: Often have lock-up periods, restricting when investors can withdraw their money.

- Investment Strategy: Employ more aggressive and complex investment strategies, often involving higher risk.

Mutual Funds vs. Hedge Funds: A Detailed Comparison

Let’s delve deeper into the specific differences between mutual funds and hedge funds across several key areas:

Investor Eligibility

Mutual funds are designed for a broad range of investors, including individuals with modest savings. The minimum investment requirements are usually low, making them accessible to the general public. In contrast, hedge funds are typically reserved for accredited investors who meet specific income or net worth requirements. This restriction is in place because of the higher risks associated with hedge fund investments.

Regulatory Oversight

Mutual funds are subject to stringent regulations by the SEC, which mandates transparency and investor protection. These regulations cover aspects such as fund governance, disclosure requirements, and investment limitations. Hedge funds, on the other hand, operate with significantly less regulatory oversight. While they are still subject to some regulations, they have more freedom to pursue unconventional investment strategies. This decreased oversight allows for greater flexibility but also increases the potential for risk.

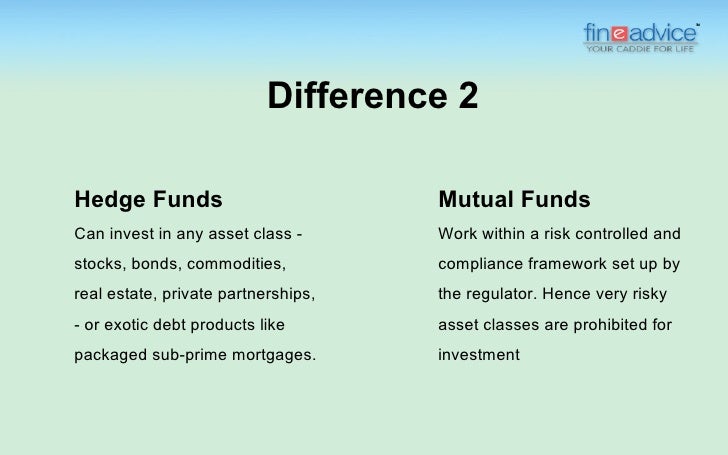

Investment Strategies

Mutual funds generally follow more conservative and diversified investment strategies. They typically invest in a broad range of stocks, bonds, or other assets to mitigate risk. Hedge funds employ a wider range of strategies, including leverage, short selling, arbitrage, and derivatives. These strategies can potentially generate higher returns, but they also carry greater risk. The investment strategies of hedge funds are often more complex and may involve taking concentrated positions in specific assets or markets.

Fees and Expenses

Mutual funds typically charge lower fees than hedge funds. Mutual fund fees usually include an expense ratio, which covers the fund’s operating expenses, and may also include sales loads or redemption fees. Hedge funds often charge a “2 and 20” fee structure, which means they charge a 2% management fee on assets under management and a 20% performance fee on any profits generated. This fee structure can result in significantly higher costs for investors in hedge funds.

Transparency

Mutual funds are required to provide regular disclosures about their holdings, performance, and fees. This transparency allows investors to understand the fund’s investment strategy and assess its performance. Hedge funds offer less transparency, making it more difficult for investors to evaluate their performance and risk profile. The lack of transparency is often justified by the proprietary nature of hedge fund strategies.

Liquidity

Mutual funds are generally highly liquid, meaning investors can buy or sell shares at the end of each trading day at the fund’s NAV. Hedge funds often have lock-up periods, restricting when investors can withdraw their money. These lock-up periods can range from a few months to several years. The illiquidity of hedge funds is a trade-off for the potential for higher returns.

The Role of Risk Tolerance and Investment Goals

The choice between mutual funds and hedge funds depends heavily on an investor’s risk tolerance and investment goals. Mutual funds are typically more suitable for investors with a lower risk tolerance who seek diversified exposure to the market. They offer a relatively stable and transparent investment option. Hedge funds are better suited for sophisticated investors with a higher risk tolerance who are willing to accept greater volatility in exchange for the potential for higher returns. Investors should carefully consider their financial situation, investment objectives, and risk appetite before investing in either type of fund.

Examples to Illustrate the Differences

To further clarify the differences between mutual funds and hedge funds, consider these examples:

- Mutual Fund Example: A large-cap equity mutual fund might invest in the stocks of the 500 largest publicly traded companies in the United States. The fund aims to track the performance of the S&P 500 index and provide investors with broad market exposure.

- Hedge Fund Example: A global macro hedge fund might use leverage to bet on currency fluctuations or interest rate changes. The fund aims to generate profits regardless of the overall market direction by taking both long and short positions.

Making an Informed Decision

Investing in either mutual funds or hedge funds requires careful consideration and due diligence. Investors should thoroughly research the fund’s investment strategy, fees, and risk profile before making a decision. It’s also important to understand the regulatory framework governing each type of fund. Consulting with a qualified financial advisor can help investors assess their suitability for either type of investment. Understanding the distinctions between mutual funds and hedge funds is crucial for building a well-diversified and risk-appropriate investment portfolio.

Conclusion

In summary, while both mutual funds and hedge funds are pooled investment vehicles, they cater to different types of investors with varying risk tolerances and investment goals. Mutual funds offer accessibility, transparency, and diversification, making them suitable for a broad range of investors. Hedge funds, on the other hand, provide the potential for higher returns through more complex and riskier strategies, but they are typically reserved for accredited investors. By understanding the key differences between mutual funds vs hedge funds, investors can make more informed decisions and choose the investment option that best aligns with their individual circumstances.

[See also: Understanding Investment Risk Tolerance]

[See also: Diversifying Your Investment Portfolio]