Mutual Funds vs. Hedge Funds: Understanding the Key Differences

When navigating the world of investments, two prominent options often arise: mutual funds and hedge funds. Both are investment vehicles that pool money from multiple investors, but they differ significantly in their structure, investment strategies, regulation, and accessibility. Understanding the nuances between mutual funds vs. hedge funds is crucial for investors to make informed decisions aligned with their financial goals and risk tolerance. This article delves into a comprehensive comparison of these two investment giants.

What are Mutual Funds?

Mutual funds are investment vehicles that pool money from numerous investors to invest in a diversified portfolio of stocks, bonds, or other assets. They are managed by professional fund managers who make investment decisions based on the fund’s stated objectives. Mutual funds are highly regulated and designed to be accessible to a broad range of investors.

Key Characteristics of Mutual Funds:

- Diversification: Mutual funds offer instant diversification, reducing risk by spreading investments across various assets.

- Liquidity: Investors can typically buy or sell shares of mutual funds on any business day.

- Regulation: Heavily regulated by government agencies, ensuring transparency and investor protection.

- Accessibility: Generally accessible to retail investors with relatively low minimum investment requirements.

- Transparency: Mutual funds are required to disclose their holdings and performance regularly.

What are Hedge Funds?

Hedge funds are investment partnerships that also pool capital from investors, but they employ more complex and often riskier investment strategies. They aim to generate higher returns, often by using leverage, short-selling, and other sophisticated techniques. Hedge funds are less regulated and typically cater to accredited investors and institutional clients.

Key Characteristics of Hedge Funds:

- Sophisticated Strategies: Employ complex strategies such as arbitrage, leverage, and short-selling.

- Limited Liquidity: Investors may face restrictions on when they can withdraw their money.

- Less Regulation: Subject to less stringent regulatory oversight compared to mutual funds.

- Accredited Investors: Typically only accessible to accredited investors with high net worth or income.

- Higher Fees: Charge higher management and performance fees, often following the “2 and 20” model (2% management fee and 20% of profits).

Mutual Funds vs. Hedge Funds: A Detailed Comparison

To better understand the differences between mutual funds vs. hedge funds, let’s examine them across several key parameters:

Investment Strategies

Mutual funds typically follow a more conservative approach, focusing on long-term growth and diversification. They invest in a mix of stocks, bonds, and other securities aligned with their stated objectives, such as growth, income, or a combination of both. The strategies employed are generally less risky and more straightforward.

Hedge funds, on the other hand, are known for their aggressive and complex investment strategies. They may use leverage to amplify returns, engage in short-selling to profit from declining prices, and invest in derivatives and other complex instruments. These strategies aim to generate high returns regardless of market conditions, but they also carry significantly higher risk. [See also: Understanding Investment Risk Tolerance]

Regulation and Oversight

Mutual funds are subject to strict regulations by government agencies like the Securities and Exchange Commission (SEC) in the United States. These regulations are designed to protect investors by ensuring transparency, fair pricing, and proper management of fund assets. Mutual funds must regularly disclose their holdings, performance, and fees to investors.

Hedge funds face less stringent regulatory oversight. While they are still subject to some regulations, they have more flexibility in their investment strategies and reporting requirements. This reduced regulation allows them to pursue more aggressive strategies but also exposes investors to potentially higher risks. The lack of transparency is a key difference when evaluating mutual funds vs. hedge funds.

Investor Accessibility

Mutual funds are designed to be accessible to a broad range of investors, including retail investors with relatively small amounts of capital. Minimum investment requirements are typically low, and shares can be easily bought and sold on any business day.

Hedge funds are generally only accessible to accredited investors, which are individuals or institutions with high net worth or income. This restriction is due to the higher risks and complexity associated with hedge fund investments. Accredited investors are presumed to have the financial sophistication and resources to understand and bear these risks. Therefore, comparing mutual funds vs. hedge funds, accessibility is a major factor.

Fees and Expenses

Mutual funds charge management fees, which are a percentage of the fund’s assets used to cover the costs of managing the fund. These fees are typically lower than those charged by hedge funds. Additionally, mutual funds may have other expenses, such as administrative costs and marketing fees.

Hedge funds typically charge higher fees than mutual funds. The standard fee structure is often referred to as “2 and 20,” which means a 2% management fee on assets under management and 20% of any profits generated. This performance-based fee structure incentivizes hedge fund managers to generate high returns but also means that investors pay a significant portion of the profits. When considering mutual funds vs. hedge funds, it’s crucial to analyze the fee structure.

Liquidity

Mutual funds offer high liquidity, allowing investors to buy or sell shares on any business day at the fund’s net asset value (NAV). This liquidity makes mutual funds a convenient option for investors who may need to access their capital quickly.

Hedge funds often have limited liquidity. Investors may face restrictions on when they can withdraw their money, such as lock-up periods or redemption fees. These restrictions are designed to protect the fund from large outflows of capital that could disrupt its investment strategies. The difference in liquidity is an important consideration when assessing mutual funds vs. hedge funds.

Risk Profile

Mutual funds generally have a lower risk profile compared to hedge funds. Their diversified portfolios and regulated investment strategies help to mitigate risk. However, the level of risk can vary depending on the fund’s investment objectives and the types of assets it holds.

Hedge funds are inherently riskier due to their aggressive investment strategies, use of leverage, and limited regulation. While they have the potential to generate high returns, they also carry a higher risk of losses. Investors in hedge funds must be prepared to accept significant volatility and potential losses. Evaluating the risk profile is vital when choosing between mutual funds vs. hedge funds.

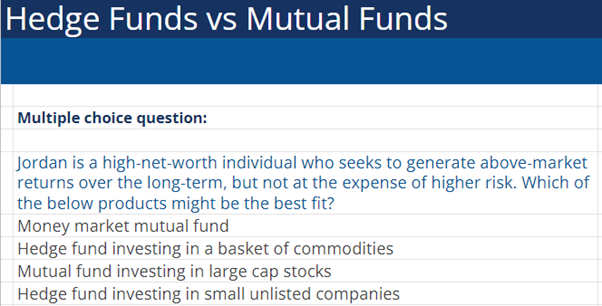

Who Should Invest in Mutual Funds?

Mutual funds are a suitable investment option for:

- Retail investors seeking diversified exposure to the market.

- Investors with a long-term investment horizon.

- Those who prefer a more conservative investment approach.

- Investors who value liquidity and transparency.

Who Should Invest in Hedge Funds?

Hedge funds are a suitable investment option for:

- Accredited investors with high net worth or income.

- Investors seeking higher returns and willing to accept higher risk.

- Those with a sophisticated understanding of financial markets and complex investment strategies.

- Investors who do not require immediate liquidity.

Conclusion

In the debate of mutual funds vs. hedge funds, the choice depends largely on an investor’s financial goals, risk tolerance, and investment knowledge. Mutual funds offer a diversified, regulated, and accessible investment option suitable for a broad range of investors. Hedge funds, on the other hand, provide an opportunity for higher returns through more aggressive strategies but come with higher risks and are typically only accessible to accredited investors. Understanding these key differences is essential for making informed investment decisions and building a well-rounded portfolio. Carefully consider your personal circumstances and consult with a financial advisor to determine which investment vehicle is right for you. [See also: Choosing the Right Investment Strategy]