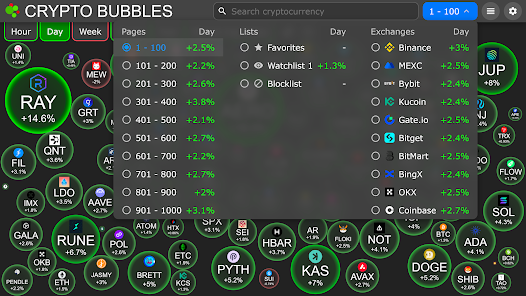

Navigating Crypto Bubbles: Understanding, Identifying, and Mitigating Risks

The cryptocurrency market, known for its volatility and rapid innovation, is no stranger to periods of intense speculation and price surges often referred to as crypto bubbles. These bubbles can attract both seasoned investors and newcomers alike, drawn by the allure of quick profits. However, understanding the nature of these bubbles, how to identify them, and strategies for mitigating the inherent risks is crucial for anyone participating in the digital asset space. This article delves into the intricacies of crypto bubbles, providing a comprehensive guide to navigating these potentially treacherous market conditions.

What is a Crypto Bubble?

A crypto bubble, much like any other asset bubble, occurs when the price of a cryptocurrency or a group of cryptocurrencies rises rapidly and unsustainably, driven by speculation rather than fundamental value. This surge is often fueled by hype, fear of missing out (FOMO), and a lack of understanding of the underlying technology or economic principles. The inflated prices eventually detach from reality, leading to a sharp correction or crash as the bubble bursts.

Several factors contribute to the formation of crypto bubbles. These include:

- Speculation: The primary driver is often speculative investment, where individuals buy cryptocurrencies not for their utility but with the expectation of reselling them at a higher price.

- FOMO (Fear of Missing Out): As prices rise, more people are drawn in, fearing they will miss out on potential gains, further inflating the bubble.

- Media Hype: Positive media coverage and celebrity endorsements can amplify the hype and attract even more investors.

- Lack of Regulation: The relatively unregulated nature of the cryptocurrency market can make it easier for scams and fraudulent projects to thrive, contributing to inflated valuations.

- Market Manipulation: Price manipulation schemes, such as pump-and-dumps, can artificially inflate prices and create a false sense of momentum.

Identifying Potential Crypto Bubbles

Recognizing a crypto bubble before it bursts is challenging but not impossible. By paying attention to certain indicators, investors can better assess the risk and make informed decisions. Here are some key signs to watch out for:

Rapid Price Appreciation

An exponential and unsustainable price increase is a classic sign of a bubble. If a cryptocurrency’s price doubles or triples in a short period without a corresponding increase in its fundamental value or adoption, it’s a red flag.

Lack of Fundamental Value

A healthy cryptocurrency ecosystem is built on solid fundamentals, such as a strong development team, a clear use case, a robust technology platform, and growing adoption. If a cryptocurrency’s price is rising despite a lack of these fundamentals, it’s likely being driven by speculation.

Excessive Media Hype

While media coverage can be beneficial, excessive and uncritical hype can be a sign of a bubble. Be wary of articles and reports that focus solely on price predictions and ignore the underlying risks.

Social Media Frenzy

A surge in social media mentions and online discussions about a particular cryptocurrency can indicate growing hype. However, it’s important to distinguish between genuine interest and coordinated marketing campaigns designed to pump up the price. [See also: Crypto Social Media Marketing]

New Investors Entering the Market

A significant influx of new investors, particularly those with limited experience in cryptocurrency investing, can be a sign that the market is becoming overheated. These investors are often more susceptible to FOMO and may not fully understand the risks involved.

Irrational Exuberance

When investors start behaving irrationally, such as taking on excessive risk or ignoring warning signs, it’s a clear indication of a bubble. This can manifest as a belief that prices will only go up and that anyone who doesn’t invest is missing out on a guaranteed fortune.

Mitigating Risks During Crypto Bubbles

Even if you can’t perfectly predict when a crypto bubble will burst, you can take steps to mitigate your risk and protect your investments. Here are some strategies to consider:

Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversifying your portfolio across multiple cryptocurrencies and asset classes can help to reduce your overall risk. Consider allocating a portion of your portfolio to more established cryptocurrencies with strong fundamentals.

Invest Only What You Can Afford to Lose

This is a fundamental principle of investing, but it’s especially important during crypto bubbles. The cryptocurrency market is inherently volatile, and prices can fluctuate dramatically. Never invest more than you can comfortably afford to lose without impacting your financial well-being.

Do Your Own Research (DYOR)

Don’t rely solely on the opinions of others or the latest hype. Conduct your own thorough research on any cryptocurrency you’re considering investing in. Understand the technology, the team, the use case, and the potential risks. [See also: Crypto Research Tools]

Set Realistic Expectations

Avoid getting caught up in the hype and set realistic expectations for your investments. Don’t expect to get rich quick. Cryptocurrency investing is a long-term game, and patience is key.

Use Stop-Loss Orders

Stop-loss orders can help to limit your losses if the price of a cryptocurrency starts to decline. A stop-loss order automatically sells your cryptocurrency when it reaches a predetermined price, helping to protect you from further losses.

Take Profits Along the Way

If your cryptocurrency investments are performing well, consider taking some profits along the way. This can help to lock in gains and reduce your overall risk. You can always reinvest later if you believe the cryptocurrency still has potential.

Stay Informed and Adapt

The cryptocurrency market is constantly evolving, so it’s important to stay informed about the latest news and developments. Be prepared to adapt your investment strategy as the market changes. [See also: Crypto News Aggregators]

The Aftermath of a Crypto Bubble

When a crypto bubble bursts, the consequences can be severe. Prices can plummet, and many investors can lose a significant portion of their investments. The aftermath of a bubble can also have a negative impact on the overall cryptocurrency market, eroding trust and confidence.

However, it’s important to remember that not all cryptocurrencies are created equal. Some projects with strong fundamentals and real-world utility may be able to weather the storm and even emerge stronger after a bubble bursts. These are the projects that are most likely to survive and thrive in the long term.

Conclusion

Crypto bubbles are a recurring phenomenon in the cryptocurrency market. While they can offer opportunities for quick profits, they also pose significant risks. By understanding the nature of these bubbles, learning how to identify them, and implementing strategies for mitigating risk, investors can navigate these treacherous waters more effectively and protect their investments. Remember that informed decision-making, patience, and a long-term perspective are essential for success in the cryptocurrency market. Recognizing the characteristics of a crypto bubble is the first step, followed by careful analysis and risk management. The potential for substantial gains exists, but so does the possibility of significant losses. Therefore, proceed with caution, conduct thorough research, and only invest what you can afford to lose. The future of cryptocurrency is still being written, and prudent investors who understand the risks and rewards will be best positioned to benefit from its long-term potential. Understanding the cycles of booms and busts is key to long-term success in the volatile world of crypto bubbles.