Navigating Crypto Bubbles: Understanding, Identifying, and Mitigating Risks

The cryptocurrency market, known for its volatility and rapid innovation, is also prone to speculative bubbles. A crypto bubble, much like any other asset bubble, occurs when the price of a cryptocurrency or a group of cryptocurrencies rises to levels unsupported by fundamental value, driven by excessive speculation and investor exuberance. Understanding how these crypto bubbles form, how to identify them, and how to mitigate the associated risks is crucial for anyone participating in the digital asset space.

Understanding Crypto Bubbles

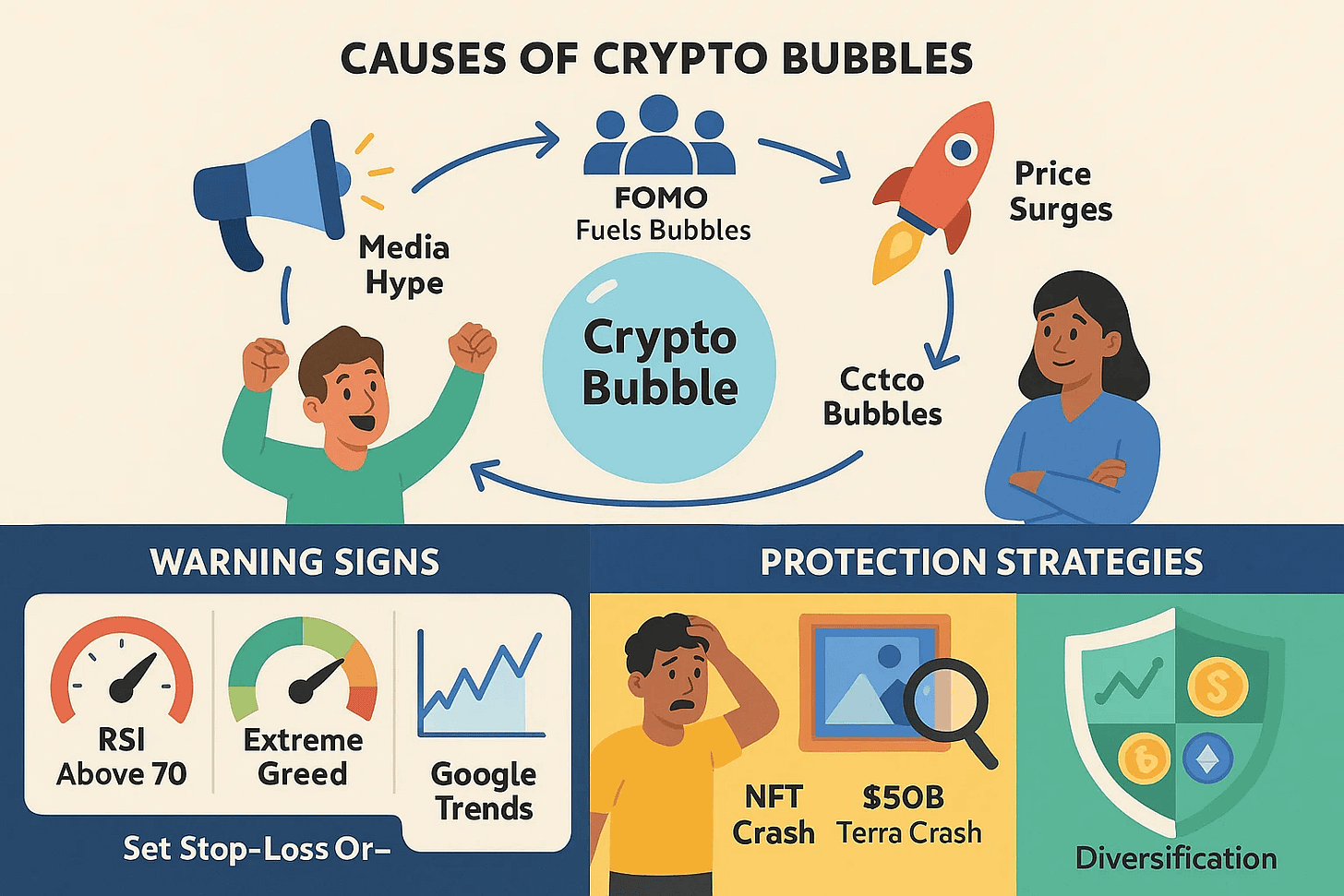

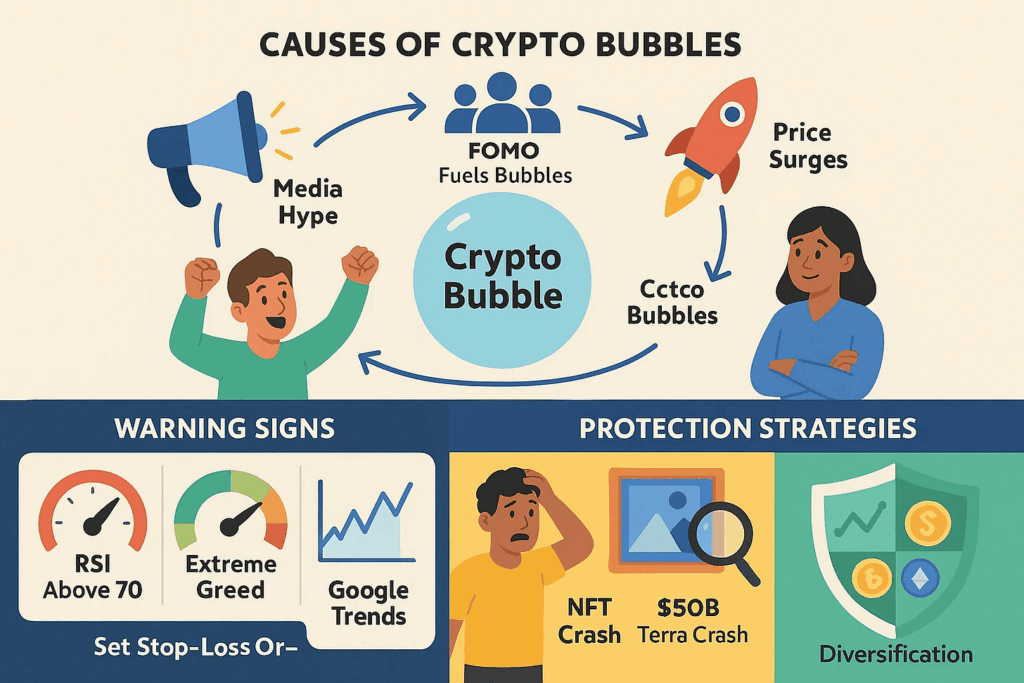

A crypto bubble is characterized by a rapid and unsustainable increase in the price of one or more cryptocurrencies. This surge is often fueled by hype, fear of missing out (FOMO), and a lack of understanding of the underlying technology or economic principles driving the asset’s value. The rise in price attracts more investors, further inflating the bubble. However, this growth is not based on solid fundamentals such as adoption rates, real-world applications, or revenue generation. Eventually, the bubble bursts, leading to a sharp and often devastating decline in prices.

Several factors contribute to the formation of crypto bubbles:

- Speculation: The relative newness and complexity of cryptocurrencies make them susceptible to speculative trading. Many investors are drawn to the potential for quick profits, often without conducting thorough research.

- FOMO: The fear of missing out on potential gains can drive investors to buy into cryptocurrencies, even at inflated prices. This herd mentality exacerbates the bubble.

- Limited Understanding: Many investors lack a deep understanding of the technology, economics, and regulatory landscape surrounding cryptocurrencies. This lack of knowledge can lead to irrational investment decisions.

- Market Manipulation: The unregulated nature of some cryptocurrency exchanges can allow for market manipulation, such as pump-and-dump schemes, which can artificially inflate prices.

- Media Hype: Positive media coverage and endorsements from celebrities or influencers can generate hype and attract new investors, further fueling the bubble.

Identifying a Crypto Bubble

Recognizing a crypto bubble early on can help investors avoid significant losses. While it’s impossible to predict the exact timing of a bubble’s burst, several indicators can suggest that a crypto bubble is forming:

- Parabolic Price Increases: A rapid and exponential increase in price, far exceeding historical performance or reasonable growth expectations, is a classic sign of a bubble.

- Lack of Fundamental Support: If the price of a cryptocurrency is rising rapidly without corresponding growth in its user base, adoption rate, or real-world applications, it may be a sign of a bubble.

- Irrational Exuberance: When investors become overly enthusiastic and confident, ignoring risks and disregarding fundamental analysis, it’s a warning sign.

- Increased Media Hype: A surge in media coverage, often accompanied by sensational headlines and unsubstantiated claims, can indicate a bubble.

- Influx of New Investors: A sudden influx of new investors, particularly those with limited knowledge of cryptocurrencies, can signal that the market is becoming overheated.

- Extreme Volatility: While cryptocurrencies are inherently volatile, a significant increase in volatility, with large price swings in short periods, can be a sign of a bubble.

- Overleveraging: When investors are using excessive leverage to trade cryptocurrencies, it amplifies both potential gains and losses, increasing the risk of a sharp correction.

Mitigating Risks During a Crypto Bubble

Even if you can’t avoid investing in a cryptocurrency during a crypto bubble, there are several strategies you can use to mitigate your risks:

- Do Your Own Research (DYOR): Thoroughly research any cryptocurrency before investing. Understand the technology, team, use case, and market dynamics. Don’t rely solely on media hype or social media sentiment.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your cryptocurrency investments across different projects with varying risk profiles.

- Invest What You Can Afford to Lose: Only invest money that you can afford to lose without impacting your financial stability. Cryptocurrencies are inherently risky, and prices can fluctuate dramatically.

- Set Realistic Expectations: Don’t expect to get rich quick. Cryptocurrency investing is a long-term game. Set realistic expectations for returns and be prepared for periods of volatility.

- Use Stop-Loss Orders: Stop-loss orders automatically sell your cryptocurrency holdings if the price falls below a certain level. This can help limit your losses during a market downturn.

- Take Profits: When your investments appreciate in value, consider taking profits. This can help you lock in gains and reduce your exposure to potential losses.

- Avoid FOMO: Don’t let the fear of missing out drive your investment decisions. Stick to your investment strategy and avoid chasing hyped-up cryptocurrencies.

- Stay Informed: Keep up to date with the latest news and developments in the cryptocurrency market. This will help you make informed investment decisions.

- Consider Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of the price. This can help smooth out your returns and reduce the impact of market volatility.

- Be Patient: Cryptocurrency investing requires patience. Don’t panic sell during market downturns. Stay focused on your long-term investment goals.

Historical Examples of Crypto Bubbles

The cryptocurrency market has experienced several notable crypto bubbles throughout its history. Examining these past events can provide valuable insights into the dynamics of crypto bubbles and the potential consequences of investing during these periods.

- The 2017-2018 Bubble: This was one of the most significant crypto bubbles in history. Bitcoin’s price surged from under $1,000 in early 2017 to nearly $20,000 by December 2017, fueled by widespread media attention and investor enthusiasm. Altcoins also experienced significant gains. However, the bubble burst in early 2018, with Bitcoin’s price plummeting to around $3,000 by the end of the year. Many altcoins lost even more value, and some projects disappeared entirely.

- The 2013 Bubble: Bitcoin experienced its first major bubble in 2013, with its price rising from around $13 in January to over $1,000 in December. This surge was driven by increased adoption and media coverage. However, the bubble burst shortly thereafter, with Bitcoin’s price falling back to around $200.

- DeFi Summer 2020: The decentralized finance (DeFi) sector experienced a boom in the summer of 2020, with many DeFi tokens experiencing rapid price increases. This surge was driven by the promise of high yields and innovative financial applications. However, the bubble eventually burst, with many DeFi tokens losing a significant portion of their value.

The Future of Crypto Bubbles

Crypto bubbles are likely to continue occurring in the future as the cryptocurrency market evolves. The combination of speculation, FOMO, and limited understanding of the technology will continue to create opportunities for bubbles to form. However, as the market matures and more investors become educated about cryptocurrencies, the frequency and severity of crypto bubbles may decrease.

Increased regulation and institutional adoption could also help to stabilize the market and reduce the risk of crypto bubbles. However, it’s important to remember that cryptocurrencies are inherently volatile and that investing in them carries significant risks.

Conclusion

Crypto bubbles are a recurring phenomenon in the cryptocurrency market. Understanding how they form, how to identify them, and how to mitigate the associated risks is crucial for anyone participating in the digital asset space. By conducting thorough research, diversifying your portfolio, setting realistic expectations, and managing your risk, you can increase your chances of success in the cryptocurrency market and avoid the pitfalls of crypto bubbles.

[See also: Investing in Cryptocurrency: A Beginner’s Guide]

[See also: Understanding Blockchain Technology]

[See also: The Risks and Rewards of Cryptocurrency Trading]