Navigating Negotiable Bearer Bonds: A Comprehensive Guide

In the intricate world of finance, negotiable bearer bonds represent a unique and sometimes controversial instrument. These bonds, unlike registered bonds, do not record the owner’s name, making them transferable simply by physical delivery. This anonymity offers both advantages and disadvantages, contributing to their complex role in global financial markets. Understanding the nuances of negotiable bearer bonds is crucial for investors, financial institutions, and regulatory bodies alike. This guide delves into the characteristics, risks, and implications of these instruments.

What are Negotiable Bearer Bonds?

Negotiable bearer bonds are debt securities that are owned by whoever physically possesses them. The issuer promises to pay the bond’s principal and interest to the bearer, the person holding the bond. This differs significantly from registered bonds, where the owner’s details are recorded by the issuer or a transfer agent. The “negotiable” aspect means these bonds can be easily transferred from one party to another without requiring formal registration or documentation.

The appeal of negotiable bearer bonds lies in their simplicity and anonymity. Historically, they facilitated transactions in jurisdictions with strict privacy laws and allowed for efficient cross-border capital flows. However, this same anonymity has also made them susceptible to illicit activities.

Key Characteristics of Negotiable Bearer Bonds

- Anonymity: The holder of the bond is not registered, providing privacy.

- Negotiability: Transferable by physical delivery, simplifying transactions.

- No Registration: No need to register the bond with the issuer or a transfer agent.

- Coupon Payments: Typically pay interest via coupons that are detached and presented for payment.

- Principal Repayment: The principal is repaid to whoever presents the bond at maturity.

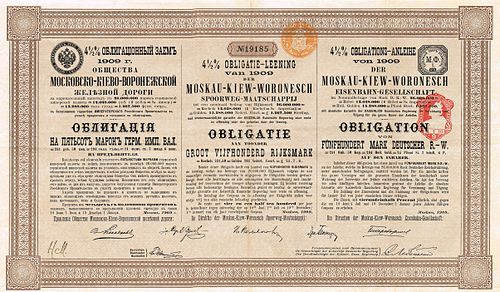

The History of Negotiable Bearer Bonds

Negotiable bearer bonds have a long history, dating back to the early days of modern finance. They were particularly popular in Europe during the 19th and 20th centuries, facilitating international trade and investment. Their anonymity made them attractive to investors seeking to avoid taxes or maintain privacy. However, as financial regulations tightened and concerns about money laundering grew, the use of negotiable bearer bonds declined in many jurisdictions.

The rise of registered bonds and electronic transfer systems further diminished the appeal of negotiable bearer bonds. Many countries have either banned or severely restricted their issuance and trading.

Advantages and Disadvantages

Advantages

- Privacy: Offers anonymity to the bondholder, which can be desirable for legitimate reasons.

- Simplicity: Easy to transfer ownership without complex paperwork.

- Cross-Border Transactions: Facilitates international capital flows, although this is less relevant today due to regulations.

Disadvantages

- Money Laundering: Susceptible to use in illicit activities due to anonymity.

- Tax Evasion: Can be used to avoid paying taxes.

- Loss or Theft: If lost or stolen, the bearer loses ownership with no recourse.

- Regulatory Scrutiny: Subject to strict regulations and reporting requirements in many countries.

Risks Associated with Negotiable Bearer Bonds

Investing in negotiable bearer bonds comes with significant risks. The lack of registration means that if the bond is lost or stolen, the holder has no legal recourse to recover their investment. The anonymity also makes these bonds attractive to criminals involved in money laundering and other illicit activities. Furthermore, the regulatory environment surrounding negotiable bearer bonds is constantly evolving, adding another layer of uncertainty for investors.

Issuers of negotiable bearer bonds also face risks. They must ensure compliance with anti-money laundering regulations and implement robust due diligence procedures to prevent their bonds from being used for illegal purposes. Failure to do so can result in severe penalties and reputational damage.

Regulatory Landscape

The regulatory landscape for negotiable bearer bonds varies significantly across jurisdictions. Many countries have implemented strict regulations to combat money laundering and tax evasion. These regulations often include reporting requirements, restrictions on issuance and trading, and penalties for non-compliance.

The Financial Action Task Force (FATF) has played a key role in promoting international standards for combating money laundering and terrorist financing. Its recommendations have influenced the regulatory approach of many countries towards negotiable bearer bonds. [See also: FATF Recommendations on Securities]

In the United States, the Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA) significantly restricted the issuance of negotiable bearer bonds. The law imposed penalties on issuers of unregistered bonds, effectively discouraging their use. Similar restrictions have been implemented in other countries as well.

The Future of Negotiable Bearer Bonds

The future of negotiable bearer bonds is uncertain. While they still exist in some jurisdictions, their use is likely to continue to decline as regulatory pressures mount and alternative investment instruments become more readily available. The advantages of anonymity and simplicity are increasingly outweighed by the risks of money laundering and tax evasion.

Technological advancements, such as blockchain and digital currencies, could potentially offer new ways to achieve privacy and efficiency in financial transactions. However, these technologies also pose new challenges for regulators, who must balance the benefits of innovation with the need to combat illicit activities. [See also: The Role of Blockchain in Finance]

Alternatives to Negotiable Bearer Bonds

For investors seeking privacy and flexibility, there are several alternatives to negotiable bearer bonds. Registered bonds held in nominee accounts can provide a degree of anonymity while still complying with regulatory requirements. Offshore investment vehicles and trusts can also be used to manage assets discreetly. [See also: Understanding Offshore Investments]

However, it is important to note that these alternatives also come with their own risks and regulatory considerations. Investors should seek professional advice to ensure that they are complying with all applicable laws and regulations.

Case Studies

Several high-profile cases have highlighted the risks associated with negotiable bearer bonds. These cases have involved money laundering, tax evasion, and other illicit activities. They have also underscored the importance of strong regulatory oversight and international cooperation in combating financial crime.

One notable example involved the use of negotiable bearer bonds to launder drug money. The bonds were purchased with illicit funds and then transferred through a series of shell companies to conceal the origin of the money. The case ultimately led to the conviction of several individuals and the seizure of millions of dollars in assets.

Conclusion

Negotiable bearer bonds are a complex financial instrument with a rich history and a controversial present. While they offer certain advantages, such as privacy and simplicity, they also pose significant risks, particularly in the areas of money laundering and tax evasion. The regulatory landscape surrounding negotiable bearer bonds is constantly evolving, and investors and issuers must stay informed to ensure compliance with all applicable laws and regulations.

As financial markets become more transparent and interconnected, the future of negotiable bearer bonds is uncertain. While they may continue to exist in some niche markets, their overall importance is likely to diminish as alternative investment instruments and regulatory pressures increase. Understanding the characteristics, risks, and implications of negotiable bearer bonds is essential for anyone involved in the global financial system.

Ultimately, the decision to invest in or issue negotiable bearer bonds should be made with careful consideration of the risks and rewards, as well as a thorough understanding of the applicable legal and regulatory framework. Seeking professional advice is crucial to navigate the complexities of this unique financial instrument.