Navigating the Crypto Bubbles: Understanding, Identifying, and Avoiding Financial Pitfalls

The cryptocurrency market, known for its volatility and rapid innovation, is also prone to periods of intense speculation that can lead to what are commonly referred to as crypto bubbles. These bubbles represent unsustainable price increases driven by hype and investor exuberance, often detached from the underlying value or utility of the assets involved. Understanding how these bubbles form, how to identify them, and strategies for avoiding the inevitable burst are crucial for anyone participating in the crypto space. This article delves into the anatomy of crypto bubbles, providing insights and practical advice to help you navigate this complex landscape.

What is a Crypto Bubble?

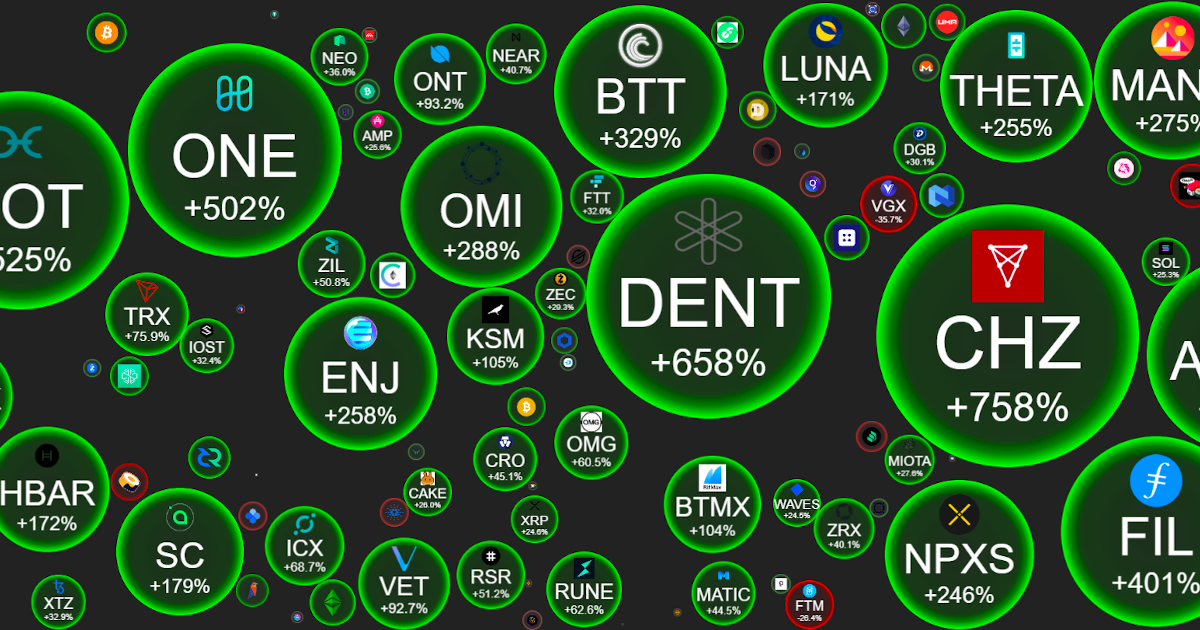

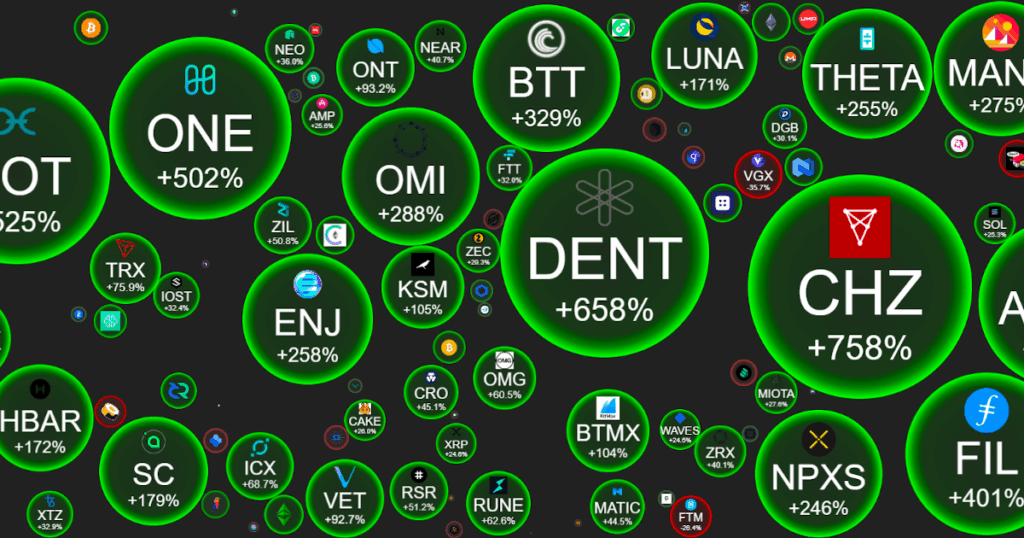

A crypto bubble is characterized by a rapid and often irrational increase in the price of cryptocurrencies or related assets. This surge is typically fueled by speculation, social media hype, and fear of missing out (FOMO), rather than fundamental factors such as adoption rates, technological advancements, or real-world use cases. During a crypto bubble, valuations can become drastically inflated, far exceeding any realistic assessment of the asset’s intrinsic worth.

The lifecycle of a crypto bubble generally follows a predictable pattern: initial interest and price increases, followed by widespread media coverage and investor frenzy, culminating in a sharp and often devastating price correction. Many investors who buy into the market near the peak are left holding assets that have lost significant value, leading to substantial financial losses.

How Crypto Bubbles Form

Several factors contribute to the formation of crypto bubbles:

- Speculation: The decentralized and often unregulated nature of the crypto market makes it particularly susceptible to speculative trading. Investors often focus on short-term price movements rather than long-term value.

- FOMO (Fear of Missing Out): As prices rise rapidly, many individuals are drawn into the market by the fear of missing out on potential gains. This influx of new investors can further inflate prices, creating a self-fulfilling prophecy.

- Social Media Hype: Social media platforms play a significant role in amplifying market sentiment and creating hype around specific cryptocurrencies or projects. Influencers and online communities can drive significant price movements, often based on unsubstantiated claims or misleading information.

- Lack of Regulation: The relative lack of regulatory oversight in the crypto market allows for greater price manipulation and fraudulent activities, which can contribute to bubble formation.

- Easy Access to Trading: The proliferation of online cryptocurrency exchanges and trading platforms has made it easier than ever for individuals to invest in crypto, even with limited knowledge or experience.

Identifying Potential Crypto Bubbles

Recognizing the signs of a potential crypto bubble is crucial for protecting your investments. Here are some key indicators to watch out for:

Unrealistic Price Increases

A sudden and dramatic price surge that is not supported by fundamental factors or real-world adoption is a major red flag. If a cryptocurrency’s price is increasing exponentially without any corresponding increase in its utility or user base, it may be entering bubble territory.

Excessive Media Hype

Widespread media coverage and social media buzz can be a sign of a crypto bubble. Be wary of articles and posts that promote unrealistic expectations or make unsubstantiated claims about a cryptocurrency’s potential.

Irrational Investor Behavior

During a crypto bubble, investors often exhibit irrational behavior, such as ignoring fundamental analysis, investing based on emotions, and chasing quick profits. If you notice widespread panic buying or a general lack of due diligence, it may be a sign that the market is overheated.

Lack of Fundamental Value

A cryptocurrency’s fundamental value is based on factors such as its underlying technology, its use cases, its adoption rate, and its team. If a cryptocurrency lacks a strong foundation in these areas, it is more likely to be a target for speculative trading and bubble formation.

New Investors Entering the Market

A surge in new investors entering the market, especially those with limited experience or knowledge of crypto, can be a sign of a crypto bubble. These investors are often more susceptible to FOMO and hype, which can further inflate prices.

Strategies for Avoiding Crypto Bubble Bursts

Protecting yourself from the negative consequences of a crypto bubble requires a disciplined and informed approach to investing. Here are some strategies to consider:

Do Your Own Research (DYOR)

Before investing in any cryptocurrency, it is essential to conduct thorough research. Understand the underlying technology, the team behind the project, the use cases, and the potential risks. Don’t rely solely on social media hype or the opinions of others. [See also: Understanding Blockchain Technology]

Diversify Your Portfolio

Diversification is a key risk management strategy in any investment portfolio. Don’t put all your eggs in one basket. Spread your investments across a variety of cryptocurrencies and other asset classes to reduce your exposure to any single asset. [See also: Building a Diversified Crypto Portfolio]

Invest for the Long Term

Focus on investing in cryptocurrencies with strong fundamentals and long-term potential. Avoid chasing short-term gains or trying to time the market. A long-term investment horizon can help you weather the volatility of the crypto market and avoid being caught in a crypto bubble burst.

Set Realistic Expectations

Be realistic about the potential returns on your investments. Don’t expect to get rich quick. The crypto market is highly volatile, and there are no guarantees of profit. Setting realistic expectations can help you avoid making emotional decisions and chasing unrealistic gains during a crypto bubble.

Use Stop-Loss Orders

Stop-loss orders can help you limit your losses in the event of a market downturn. A stop-loss order automatically sells your assets when they reach a certain price level, preventing you from losing more than you are willing to risk.

Take Profits Regularly

When your investments appreciate in value, consider taking profits regularly. This can help you lock in gains and reduce your exposure to potential losses. Don’t be greedy. Remember that no market can go up forever.

Stay Informed and Adapt

The crypto market is constantly evolving. Stay informed about the latest developments and be prepared to adapt your investment strategy as needed. Follow reputable news sources, attend industry events, and engage with the crypto community. [See also: Top Crypto News Websites]

The Psychology of Crypto Bubbles

Understanding the psychological factors that drive crypto bubbles is crucial for making rational investment decisions. Fear, greed, and herd mentality can all contribute to irrational behavior during a crypto bubble. Recognizing these biases in yourself and others can help you avoid making costly mistakes.

Fear of Missing Out (FOMO)

FOMO is a powerful emotion that can drive investors to buy into a crypto bubble even when they know it is unsustainable. The fear of missing out on potential gains can override rational judgment and lead to impulsive decisions.

Greed

Greed can also play a significant role in crypto bubble formation. The desire to make quick profits can lead investors to take on excessive risk and ignore warning signs.

Herd Mentality

Herd mentality refers to the tendency of individuals to follow the actions of a larger group, even when those actions are irrational. During a crypto bubble, investors may be influenced by the actions of others, leading to a self-reinforcing cycle of buying and price increases.

Conclusion

Crypto bubbles are a recurring phenomenon in the cryptocurrency market, driven by speculation, hype, and irrational investor behavior. While they can present opportunities for short-term gains, they also carry significant risks. By understanding how these bubbles form, how to identify them, and strategies for avoiding the inevitable burst, you can protect your investments and navigate the crypto market with greater confidence. Remember to always do your own research, diversify your portfolio, invest for the long term, and stay informed about the latest developments. The key to success in the crypto market is to remain disciplined, rational, and adaptable.