Navigating the Crypto Bubbles: Understanding, Identifying, and Preparing for Market Cycles

The cryptocurrency market, known for its volatility and rapid innovation, is also prone to periods of intense speculation often referred to as “crypto bubbles.” These bubbles, characterized by unsustainable price increases followed by dramatic crashes, can be both exhilarating and devastating for investors. Understanding the dynamics of crypto bubbles, learning how to identify them, and developing strategies to navigate them are crucial skills for anyone participating in this digital asset class. This article aims to provide a comprehensive overview of crypto bubbles, offering insights into their formation, characteristics, and potential impact, as well as practical advice on how to protect your investments.

What is a Crypto Bubble?

A crypto bubble is a speculative economic bubble specifically within the cryptocurrency market. It occurs when the prices of cryptocurrencies, or specific crypto assets, rise at an unsustainable rate, driven more by hype and speculation than by underlying fundamental value. This rapid price appreciation is often fueled by a fear of missing out (FOMO), leading to a surge in demand and further price increases. Eventually, the bubble bursts, causing a sharp and often prolonged decline in prices as investors rush to sell their holdings.

The Anatomy of a Crypto Bubble

Understanding the stages of a crypto bubble can help investors recognize and potentially avoid its pitfalls. While each bubble is unique, they generally follow a similar pattern:

Stealth Phase

This is the initial phase where a new technology, asset, or idea emerges and begins to gain traction. Early adopters and visionary investors recognize the potential and start investing, leading to a gradual increase in price. During this phase, the asset is often undervalued, and public awareness is limited. For example, early Bitcoin adopters experienced this phase before the wider public understood the technology.

Awareness Phase

As the asset gains recognition, more investors become aware of its existence and potential. Media coverage increases, and discussions about the asset become more prevalent. This increased awareness leads to a faster rate of price appreciation as more people start investing. [See also: Understanding Bitcoin’s Halving Cycle] A good example of this is the rise of Ethereum and its smart contract capabilities which led to more awareness.

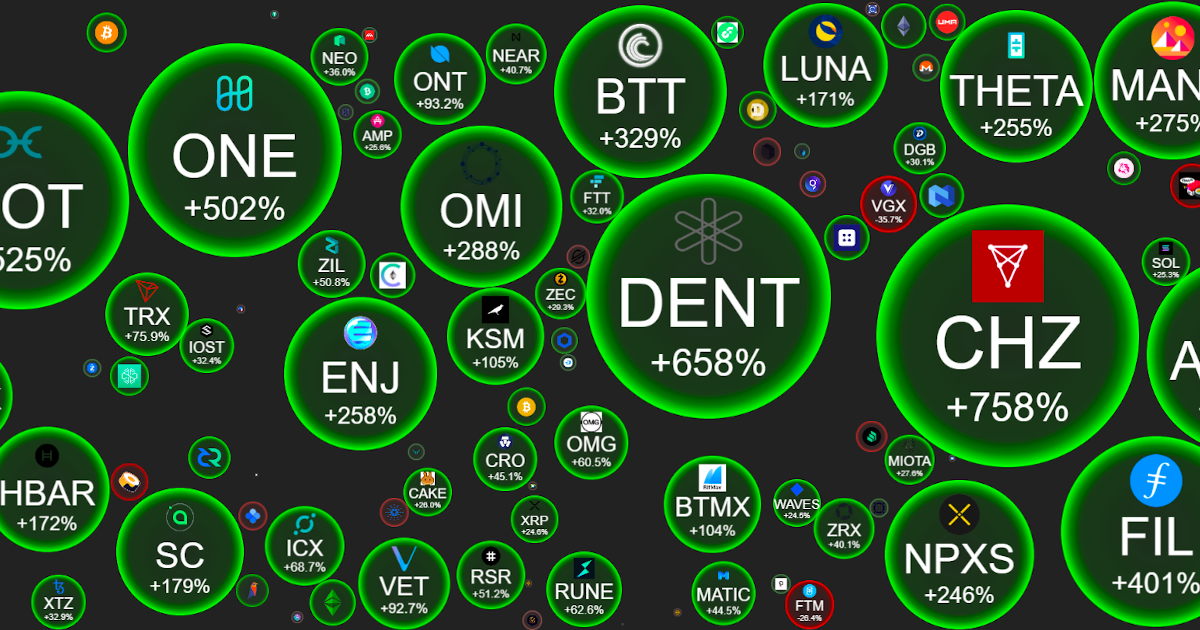

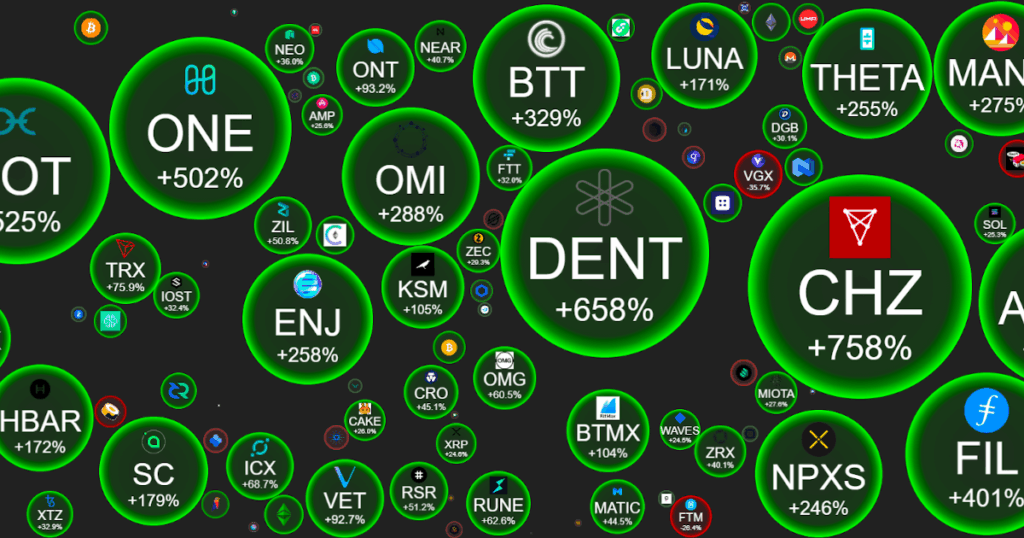

Mania Phase

This is the peak of the crypto bubble, characterized by irrational exuberance and widespread speculation. Prices skyrocket to unsustainable levels, often driven by FOMO and the belief that prices will continue to rise indefinitely. Mainstream media outlets cover the asset extensively, and even novice investors are drawn into the market. Fundamental analysis is often ignored, and prices are based solely on sentiment and hype. This stage is often characterized by the “this time it’s different” mentality.

Blow-Off Phase

The blow-off phase is the inevitable consequence of the mania phase. As prices reach unsustainable levels, some investors begin to take profits, triggering a sell-off. This sell-off can quickly escalate as more investors panic and rush to exit their positions. The price declines rapidly, often wiping out significant portions of the gains made during the mania phase. This phase can be particularly devastating for those who bought into the asset at the peak of the bubble. The 2017 ICO boom and subsequent crash exemplify this phase.

Identifying Crypto Bubbles

Identifying crypto bubbles in real-time can be challenging, but there are several indicators that investors can look for:

- Unsustainable Price Increases: Prices are rising at an exponential rate, far exceeding any reasonable valuation based on fundamental factors.

- Widespread Hype and Media Coverage: The asset is constantly in the news, with exaggerated claims and promises of future riches.

- FOMO (Fear of Missing Out): Investors are driven by the fear of missing out on potential gains, leading them to invest without proper research or due diligence.

- Lack of Fundamental Support: The asset’s price is not supported by underlying fundamentals, such as revenue, user growth, or technological innovation.

- Increased Retail Participation: A large influx of new, inexperienced investors enter the market, often driven by hype and speculation.

- “This Time It’s Different” Mentality: The belief that traditional economic rules and principles do not apply to this particular asset or market.

Strategies for Navigating Crypto Bubbles

While predicting the exact timing of a crypto bubble is impossible, investors can adopt strategies to mitigate their risk and potentially profit from market cycles:

Do Your Own Research (DYOR)

Thorough research is essential before investing in any cryptocurrency. Understand the underlying technology, the team behind the project, the market opportunity, and the potential risks. Don’t rely solely on hype or social media sentiment. Always verify information from multiple sources and conduct independent due diligence. [See also: Guide to Cryptocurrency Research]

Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversify your investments across different cryptocurrencies and asset classes to reduce your overall risk exposure. A diversified portfolio can help cushion the impact of a crypto bubble bursting on any single asset.

Set Realistic Expectations

Understand that the cryptocurrency market is highly volatile and that significant price fluctuations are common. Don’t expect to get rich quickly, and be prepared to hold your investments for the long term. Avoid chasing quick profits or making impulsive decisions based on fear or greed.

Use Stop-Loss Orders

Stop-loss orders are automated instructions to sell your assets if the price falls below a certain level. This can help limit your losses in the event of a market downturn. Set stop-loss orders based on your risk tolerance and investment strategy.

Take Profits Along the Way

As your investments appreciate in value, consider taking profits along the way. This allows you to lock in gains and reduce your exposure to potential losses. You can reinvest these profits back into the market at a later time or use them for other purposes.

Stay Informed and Adapt

The cryptocurrency market is constantly evolving, so it’s important to stay informed about the latest news, trends, and developments. Be prepared to adapt your investment strategy as market conditions change. Don’t be afraid to sell your holdings if you believe the market is becoming overvalued or if the fundamentals of your investments have deteriorated.

Consider Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the price of the asset. This can help reduce the impact of volatility on your portfolio and potentially improve your returns over the long term. DCA can be a particularly useful strategy during periods of market uncertainty or volatility.

The Impact of Crypto Bubbles

Crypto bubbles can have a significant impact on the cryptocurrency market and the broader economy. While they can create opportunities for early investors to profit, they also pose significant risks:

- Financial Losses: Many investors who buy into a crypto bubble at its peak end up losing a significant portion of their investment when the bubble bursts.

- Market Instability: Crypto bubbles can create instability in the cryptocurrency market, leading to increased volatility and uncertainty.

- Reputational Damage: The bursting of a crypto bubble can damage the reputation of the cryptocurrency market, making it more difficult to attract new investors and encourage adoption.

- Regulatory Scrutiny: Crypto bubbles often attract regulatory scrutiny, as governments and regulatory agencies seek to protect investors from fraud and manipulation.

Conclusion

Crypto bubbles are an inherent part of the cryptocurrency market cycle. By understanding their characteristics, learning how to identify them, and developing appropriate investment strategies, investors can mitigate their risk and potentially profit from these market cycles. Remember to do your own research, diversify your portfolio, set realistic expectations, and stay informed about the latest developments in the cryptocurrency market. The crypto market can be rewarding, but understanding the cycles and the associated risks is paramount.