Navigating the Crypto Bubbles: Understanding, Identifying, and Surviving Market Hype

The cryptocurrency market, known for its volatility and rapid innovation, is no stranger to booms and busts. These periods of intense speculative fervor, often referred to as crypto bubbles, can be both exhilarating and devastating for investors. Understanding what constitutes a crypto bubble, how to identify one, and strategies for navigating these turbulent waters are crucial for anyone participating in this dynamic market. This article will delve into the anatomy of crypto bubbles, providing practical insights and actionable advice to help you make informed decisions and protect your investments.

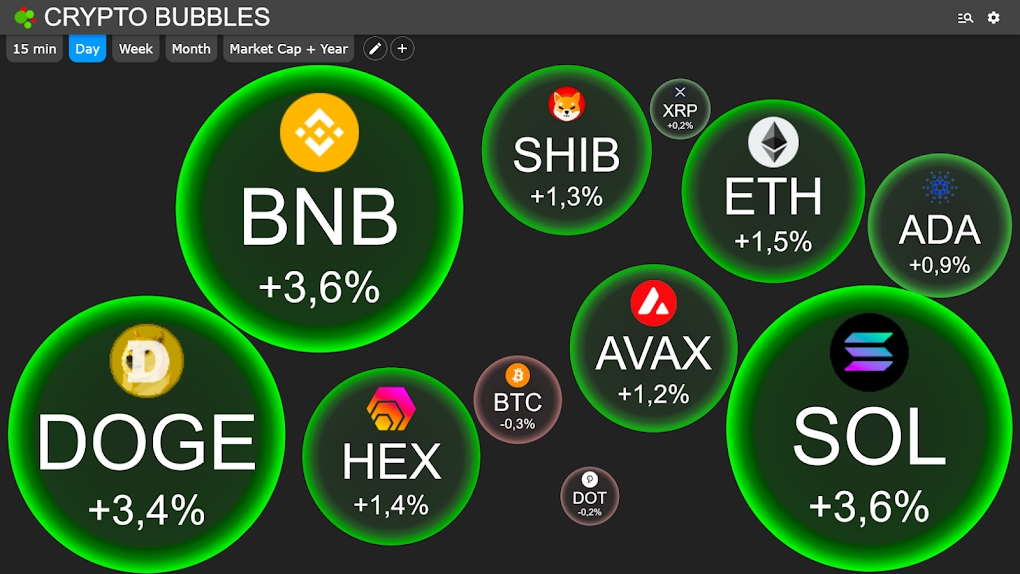

What is a Crypto Bubble?

A crypto bubble, much like any other asset bubble, occurs when the price of cryptocurrencies, or specific crypto assets, rises rapidly and unsustainably, driven by speculation and hype rather than fundamental value. This inflated price is disconnected from the underlying utility, adoption rate, or technological advancements of the cryptocurrency. The rapid ascent eventually leads to an inevitable correction, often a sharp and painful crash, as the bubble bursts.

Several factors contribute to the formation of crypto bubbles. Media attention and social media hype play a significant role, amplifying the fear of missing out (FOMO) among investors. This FOMO drives more people to buy into the asset, further inflating the price. A lack of understanding of the technology and market dynamics also fuels speculation, with many investors simply following the crowd without conducting proper due diligence. The relative novelty and unregulated nature of the crypto market also contribute to the potential for bubbles to form and inflate.

Identifying a Crypto Bubble: Key Indicators

Recognizing the signs of a crypto bubble can save you from significant financial losses. While predicting the exact timing of a bubble’s burst is nearly impossible, certain indicators can help you assess the risk level of the market.

Unprecedented Price Increases

One of the most obvious signs is a parabolic price increase that seems detached from reality. If a cryptocurrency’s price is doubling or tripling in a matter of weeks or months without a corresponding increase in its user base, real-world applications, or technological advancements, it’s a red flag.

Mainstream Media Hype and FOMO

When cryptocurrencies become a regular topic of conversation in mainstream media outlets and social media platforms, it can indicate excessive hype. If everyone, from your barber to your grandmother, is talking about a particular cryptocurrency and urging you to invest, be cautious. This widespread enthusiasm often signals that the market is overheated and due for a correction. The prevalence of FOMO, driven by stories of overnight millionaires, can be a powerful indicator of a bubble.

Lack of Fundamental Value

A crucial aspect of identifying a crypto bubble is assessing the underlying value of the cryptocurrency. Does the cryptocurrency solve a real-world problem? Does it have a viable use case? Is there a strong development team behind the project? If the answer to these questions is no, or if the cryptocurrency’s value is primarily based on speculation and hype, it’s likely a bubble.

New Investors Entering the Market

A surge of new, inexperienced investors entering the market is another warning sign. These individuals are often driven by the promise of quick riches and may not fully understand the risks involved. Their buying pressure can further inflate the bubble, making it even more vulnerable to a crash. [See also: Understanding Cryptocurrency Volatility]

Overly Optimistic Sentiment

During a crypto bubble, market sentiment is overwhelmingly positive. Any dissenting voices or warnings about potential risks are often dismissed or ridiculed. This echo chamber of optimism can blind investors to the reality of the situation and prevent them from making rational decisions.

Surviving a Crypto Bubble: Strategies for Investors

Navigating a crypto bubble requires a disciplined and rational approach. Here are some strategies to help you protect your investments and potentially profit from the market’s volatility:

Do Your Own Research (DYOR)

Before investing in any cryptocurrency, conduct thorough research. Understand the technology, the team behind the project, the use case, and the potential risks. Don’t rely solely on information from social media or online forums. Consult reputable sources and conduct your own independent analysis. Understanding the fundamentals is key to discerning real value from hype.

Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversify your cryptocurrency portfolio across multiple assets with different risk profiles. This will help mitigate your losses if one particular cryptocurrency crashes. Consider also diversifying your investments beyond cryptocurrencies into other asset classes, such as stocks, bonds, or real estate. [See also: Building a Diversified Crypto Portfolio]

Set Realistic Expectations

Avoid getting caught up in the hype and setting unrealistic expectations for returns. Cryptocurrency investments are inherently risky, and you should be prepared to lose money. Set realistic goals and be wary of any investment that promises guaranteed or excessively high returns. Remember, if it sounds too good to be true, it probably is.

Use Stop-Loss Orders

A stop-loss order is an instruction to automatically sell your cryptocurrency if its price falls below a certain level. This can help you limit your losses during a market downturn. Setting appropriate stop-loss orders is crucial for managing risk and protecting your capital. It’s important to set these orders based on technical analysis and your risk tolerance, not based on fear or panic.

Take Profits Regularly

As your cryptocurrency investments appreciate in value, consider taking profits along the way. This will help you lock in gains and reduce your exposure to potential losses. Don’t be greedy and try to time the market perfectly. Taking profits regularly is a prudent strategy for managing risk and maximizing your returns over the long term.

Stay Informed and Adapt

The cryptocurrency market is constantly evolving, so it’s essential to stay informed about the latest developments. Follow reputable news sources, attend industry events, and engage with the cryptocurrency community. Be prepared to adapt your investment strategy as the market changes. Don’t be afraid to sell your holdings if you believe the market is heading for a correction.

Avoid Leverage and Margin Trading

Leverage and margin trading can amplify both your gains and your losses. During a crypto bubble, the temptation to use leverage to increase your potential profits can be strong. However, this is a risky strategy that can quickly lead to significant losses if the market turns against you. It’s generally advisable to avoid leverage and margin trading, especially if you are a new or inexperienced investor.

Consider Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money in a cryptocurrency at regular intervals, regardless of its price. This strategy can help you mitigate the risk of buying at the peak of a bubble and can smooth out your returns over time. DCA is a particularly useful strategy for long-term investors who believe in the fundamental value of a cryptocurrency.

The Aftermath of a Crypto Bubble

The bursting of a crypto bubble can be a painful experience for investors. Prices can plummet rapidly, leaving many with significant losses. The market can take months or even years to recover, and some cryptocurrencies may never recover at all. However, the aftermath of a bubble can also present opportunities for savvy investors.

Once the dust settles, fundamentally strong cryptocurrencies with viable use cases and strong development teams are more likely to survive and thrive. These cryptocurrencies may be available at significantly discounted prices, presenting an opportunity to buy in at a more attractive valuation. It’s important to conduct thorough research and due diligence before investing in any cryptocurrency after a bubble bursts. [See also: Long-Term Cryptocurrency Investment Strategies]

Conclusion

Crypto bubbles are an inherent part of the cryptocurrency market. Understanding what they are, how to identify them, and strategies for navigating them are crucial for protecting your investments and potentially profiting from the market’s volatility. By conducting thorough research, diversifying your portfolio, setting realistic expectations, and staying informed, you can increase your chances of surviving a crypto bubble and achieving your financial goals in the long term. Remember that the crypto market is a marathon, not a sprint, and a disciplined, rational approach is essential for success.