Navigating the Future: Mastering Trading Prediction in Today’s Markets

In the dynamic world of finance, trading prediction stands as both an art and a science. The ability to foresee market movements, even with a degree of uncertainty, can be the key to unlocking substantial profits and mitigating potential losses. This article delves into the multifaceted aspects of trading prediction, exploring various methodologies, tools, and strategies employed by seasoned traders and analysts. From fundamental analysis to technical indicators, and from machine learning algorithms to sentiment analysis, we will dissect the core components that contribute to informed and effective trading prediction.

Understanding the Basics of Trading Prediction

At its core, trading prediction involves forecasting future price movements of financial instruments such as stocks, currencies, commodities, and cryptocurrencies. This is achieved by analyzing historical data, current market conditions, and a plethora of other influencing factors. While no method can guarantee perfect accuracy, a combination of techniques can significantly improve the odds of making profitable trades. The goal is to identify patterns, trends, and potential inflection points that can inform strategic decision-making.

Fundamental Analysis

Fundamental analysis is a method of evaluating securities by attempting to measure their intrinsic value. This involves examining macroeconomic factors, industry trends, and company-specific financials. Key indicators include GDP growth, inflation rates, interest rates, and unemployment figures. For individual companies, analysts scrutinize financial statements, such as balance sheets, income statements, and cash flow statements, to assess their profitability, solvency, and efficiency. A strong understanding of these fundamentals can help predict the long-term performance of an asset and identify undervalued or overvalued opportunities.

Technical Analysis

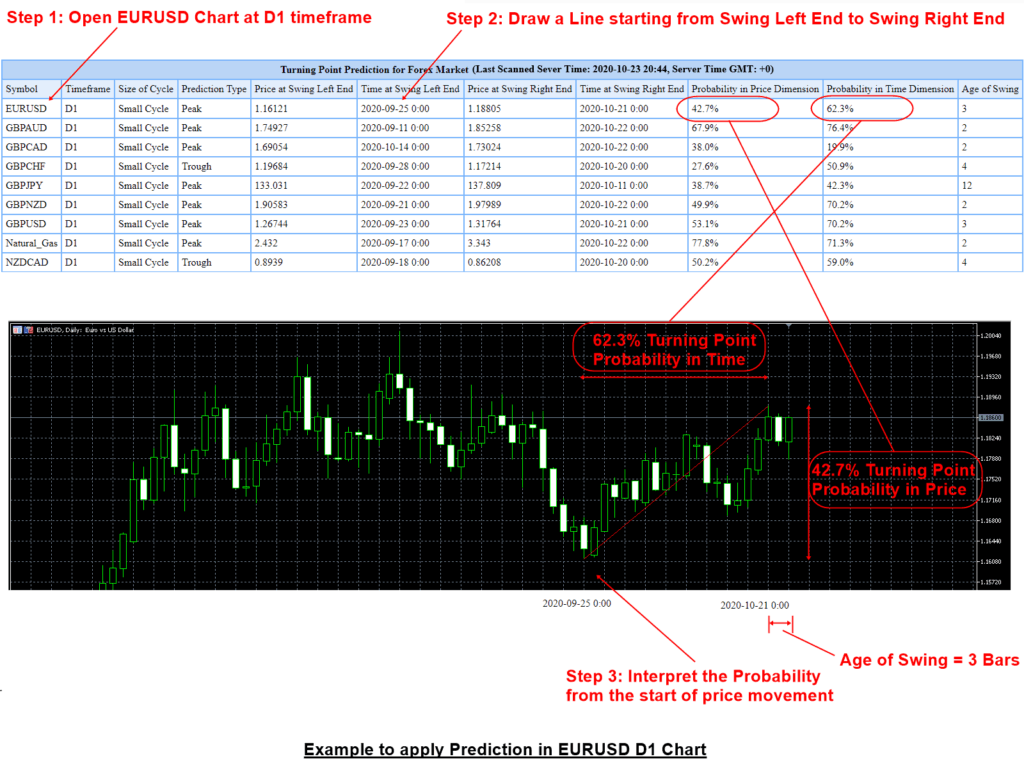

Technical analysis, on the other hand, focuses on analyzing historical price and volume data to identify patterns and trends. Technical analysts use a variety of tools, including charts, indicators, and oscillators, to predict future price movements. Common technical indicators include moving averages, relative strength index (RSI), Moving Average Convergence Divergence (MACD), and Fibonacci retracements. Technical analysis is particularly useful for short-term trading prediction, as it can help traders identify entry and exit points based on specific price patterns.

Advanced Techniques in Trading Prediction

Beyond the traditional methods of fundamental and technical analysis, advanced techniques are increasingly being used in trading prediction. These methods leverage the power of technology and data science to uncover insights that might be missed by human analysts.

Machine Learning and AI

Machine learning (ML) and artificial intelligence (AI) are transforming the landscape of trading prediction. ML algorithms can analyze vast amounts of data, identify complex patterns, and make predictions with remarkable accuracy. These algorithms can be trained on historical price data, news articles, social media sentiment, and other relevant information to develop sophisticated trading prediction models. AI-powered trading systems can also adapt to changing market conditions and optimize trading strategies in real-time. However, it’s crucial to understand that these models are only as good as the data they are trained on, and they require careful monitoring and validation to avoid overfitting and other potential pitfalls.

Sentiment Analysis

Sentiment analysis involves gauging the overall sentiment or attitude towards a particular asset or market. This can be achieved by analyzing news articles, social media posts, and other textual data. Natural language processing (NLP) techniques are used to extract and quantify sentiment, which can then be used as an input into trading prediction models. For example, a surge in positive sentiment towards a company might indicate a potential increase in its stock price, while negative sentiment could suggest a decline. Sentiment analysis provides a valuable perspective on market psychology and can help traders anticipate potential shifts in investor behavior. [See also: Understanding Market Sentiment in Trading]

Tools and Platforms for Trading Prediction

A wide range of tools and platforms are available to assist traders in trading prediction. These tools provide access to real-time data, charting capabilities, technical indicators, and other analytical features. Some platforms also offer advanced features such as backtesting, algorithmic trading, and portfolio management. Popular trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, and Bloomberg Terminal. These platforms empower traders with the resources they need to conduct thorough analysis and make informed trading decisions. Choosing the right platform depends on individual needs and preferences, but it’s essential to select a platform that is reliable, user-friendly, and offers the necessary tools for effective trading prediction.

Strategies for Effective Trading Prediction

Developing a sound trading prediction strategy is crucial for success in the financial markets. A well-defined strategy should outline the specific methods and techniques used for analysis, the risk management protocols, and the trading rules that will be followed. Here are some key considerations for developing an effective trading prediction strategy:

Risk Management

Risk management is paramount in trading prediction. No matter how accurate your predictions are, there will always be a degree of uncertainty. Therefore, it’s essential to implement robust risk management measures to protect your capital. This includes setting stop-loss orders to limit potential losses, diversifying your portfolio to reduce exposure to any single asset, and using appropriate position sizing to control the amount of capital at risk on each trade. A disciplined approach to risk management is essential for long-term success in trading.

Backtesting

Backtesting involves testing your trading prediction strategy on historical data to assess its performance. This allows you to evaluate the strategy’s profitability, risk profile, and other key metrics before deploying it in live trading. Backtesting can help identify potential weaknesses in your strategy and refine it for better performance. However, it’s important to be aware of the limitations of backtesting, as past performance is not necessarily indicative of future results. Market conditions can change, and a strategy that worked well in the past may not be as effective in the future.

Continuous Learning and Adaptation

The financial markets are constantly evolving, and trading prediction requires continuous learning and adaptation. Traders must stay informed about the latest market trends, economic developments, and technological advancements. They should also be willing to adjust their strategies as market conditions change. This requires a commitment to ongoing education, experimentation, and self-reflection. Successful traders are those who are able to adapt to changing circumstances and continuously improve their trading prediction skills.

The Role of News and Information in Trading Prediction

Staying informed is crucial for anyone involved in trading prediction. News and information can significantly impact market sentiment and asset prices. Traders need to be aware of major economic announcements, geopolitical events, and company-specific news that could affect their investments. Access to reliable and timely information is essential for making informed trading decisions. [See also: The Impact of Global News on Trading Strategies]

Sources of Information

A variety of sources can provide valuable information for trading prediction. These include financial news outlets, economic calendars, company press releases, and social media platforms. It’s important to critically evaluate the information you receive and to verify its accuracy before making trading decisions. Be wary of biased or unreliable sources, and always consider multiple perspectives before forming an opinion.

Interpreting News

<

Interpreting news and information effectively is a critical skill for trading prediction. Traders need to understand how different types of news events are likely to impact asset prices. For example, a positive earnings report from a company is likely to boost its stock price, while a negative economic announcement could trigger a market sell-off. However, the actual impact of a news event can depend on a variety of factors, including market expectations, investor sentiment, and the overall economic climate. Therefore, it’s important to consider the context and to analyze the potential implications of a news event before making trading decisions.

Ethical Considerations in Trading Prediction

Ethical considerations are an important aspect of trading prediction. Traders have a responsibility to act with integrity and to avoid engaging in unethical or illegal practices. This includes avoiding insider trading, market manipulation, and other forms of fraud. It also means being transparent and honest in your dealings with other market participants. Upholding ethical standards is essential for maintaining trust and integrity in the financial markets.

Conclusion: The Future of Trading Prediction

Trading prediction is a complex and challenging endeavor that requires a combination of analytical skills, technical expertise, and a disciplined approach. While no method can guarantee perfect accuracy, a combination of fundamental analysis, technical analysis, machine learning, and sentiment analysis can significantly improve the odds of making profitable trades. Staying informed, managing risk effectively, and continuously learning are essential for long-term success in trading prediction. As technology continues to evolve, the future of trading prediction will likely be shaped by advancements in AI, machine learning, and big data analytics. Traders who embrace these advancements and adapt to changing market conditions will be best positioned to succeed in the years to come. The key to mastering trading prediction lies in a commitment to continuous learning, rigorous analysis, and a disciplined approach to risk management.