Navigating the Labyrinth: Understanding Stocks Predictions in Today’s Market

The stock market, a dynamic arena where fortunes are made and lost, has always captivated investors. At the heart of this fascination lies the quest to predict future stock prices. Stocks predictions are not just a matter of speculation; they represent a complex interplay of economic indicators, company performance, and investor sentiment. This article delves into the world of stocks predictions, examining the methodologies, challenges, and the realities of forecasting in an inherently uncertain environment. We’ll explore the different approaches used, the potential pitfalls, and what investors should consider when evaluating such forecasts.

The Allure and Limitations of Stocks Predictions

The desire to foresee the future of stock prices is understandable. Accurate stocks predictions could lead to substantial financial gains. However, it’s crucial to acknowledge the inherent limitations. The stock market is influenced by a multitude of factors, many of which are unpredictable. Geopolitical events, sudden economic shifts, and even unforeseen technological advancements can all impact stock prices, making precise forecasting exceedingly difficult.

While perfect accuracy remains elusive, various techniques and models are employed to generate stocks predictions. These range from fundamental analysis, which focuses on a company’s financial health and industry outlook, to technical analysis, which studies historical price patterns and trading volumes. Quantitative models, leveraging statistical analysis and algorithms, also play a significant role. Each approach has its strengths and weaknesses, and none offers a guaranteed path to success.

Fundamental Analysis: A Deep Dive into Company Value

Fundamental analysis is a cornerstone of stocks predictions. This approach involves a thorough examination of a company’s financial statements, including its balance sheet, income statement, and cash flow statement. Analysts assess key metrics such as revenue growth, profitability, debt levels, and management effectiveness to determine a company’s intrinsic value. By comparing this intrinsic value to the current market price, analysts can form an opinion on whether a stock is undervalued or overvalued.

Furthermore, fundamental analysis extends beyond the company itself to consider the broader industry and economic environment. Factors such as industry trends, competitive landscape, regulatory changes, and macroeconomic conditions are all taken into account. This holistic perspective aims to provide a comprehensive understanding of the company’s potential for future growth and profitability. [See also: Understanding Financial Statements for Stock Analysis]

Key Metrics in Fundamental Analysis

- Earnings per Share (EPS): A measure of a company’s profitability, calculated by dividing net income by the number of outstanding shares.

- Price-to-Earnings (P/E) Ratio: Compares a company’s stock price to its earnings per share. A high P/E ratio may indicate that a stock is overvalued.

- Debt-to-Equity Ratio: Measures a company’s financial leverage by comparing its total debt to its shareholders’ equity. A high ratio may indicate a higher risk of financial distress.

- Return on Equity (ROE): Measures a company’s profitability relative to its shareholders’ equity. A high ROE may indicate that a company is effectively utilizing its assets to generate profits.

Technical Analysis: Decoding Price Patterns

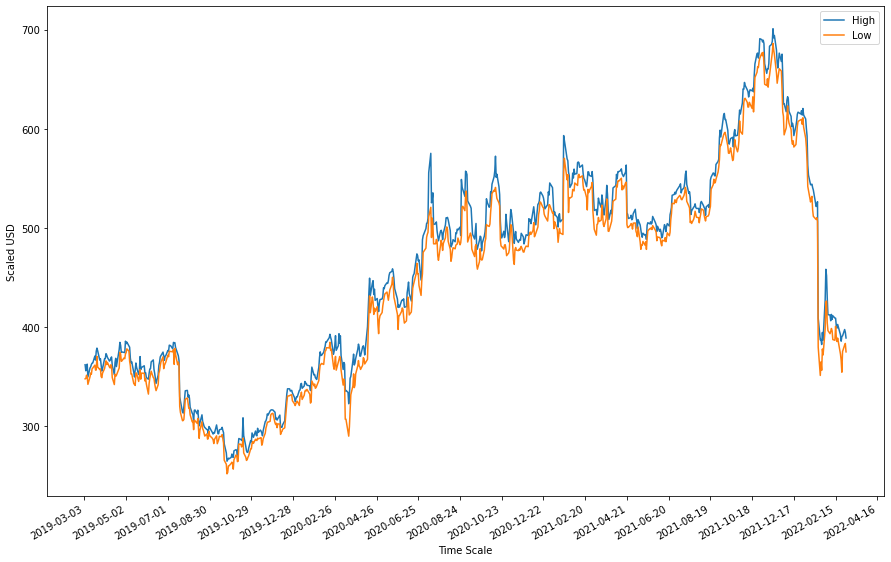

In contrast to fundamental analysis, technical analysis focuses on historical price and volume data to identify patterns and trends that may indicate future price movements. Technical analysts use charts and indicators to analyze these patterns, seeking to predict when a stock is likely to rise or fall. This approach assumes that all known information is already reflected in the stock price, making fundamental analysis less relevant.

Technical analysis relies on the concept that history tends to repeat itself. By identifying recurring patterns, analysts attempt to anticipate future price movements. However, it’s important to note that technical analysis is not foolproof. Patterns can be subjective, and false signals can occur, leading to incorrect stocks predictions. [See also: Introduction to Technical Analysis Indicators]

Common Technical Analysis Tools

- Moving Averages: Smooth out price data to identify trends.

- Relative Strength Index (RSI): Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): Identifies changes in the strength, direction, momentum, and duration of a trend in a stock’s price.

- Fibonacci Retracements: Used to identify potential support and resistance levels based on Fibonacci ratios.

Quantitative Models: The Power of Algorithms

Quantitative models utilize statistical analysis and algorithms to generate stocks predictions. These models often incorporate a wide range of data, including fundamental data, technical indicators, and macroeconomic variables. Quantitative analysts, or quants, develop and refine these models to identify patterns and relationships that may not be apparent through traditional analysis methods.

The advantage of quantitative models is their ability to process vast amounts of data quickly and efficiently. They can also remove emotional biases that may influence human judgment. However, these models are only as good as the data and assumptions on which they are based. Overfitting, where a model is too closely tailored to historical data and performs poorly on new data, is a common challenge. Furthermore, the stock market is constantly evolving, and models need to be continuously updated to remain effective.

The Role of Investor Sentiment

Investor sentiment, or the overall attitude of investors towards the market, can significantly impact stock prices. Positive sentiment can drive prices higher, while negative sentiment can lead to sell-offs. Gauging investor sentiment is challenging, but various indicators are used to assess the prevailing mood. These include surveys of investor confidence, put/call ratios, and volatility indices.

Social media has also emerged as a powerful force in shaping investor sentiment. Online forums and platforms can amplify both positive and negative views, potentially leading to rapid price swings. Understanding the dynamics of investor sentiment is crucial for making informed investment decisions. Stocks predictions must take into account this often volatile and unpredictable element.

The Challenges of Forecasting Accuracy

Despite the sophistication of various prediction methods, achieving consistent accuracy in stocks predictions remains a significant challenge. The stock market is inherently complex and influenced by a multitude of factors, many of which are unpredictable. Economic shocks, geopolitical events, and unforeseen technological advancements can all disrupt even the most carefully crafted forecasts.

Furthermore, the very act of making predictions can influence market behavior. If a large number of investors act on a particular forecast, it can become a self-fulfilling prophecy, driving prices in the predicted direction. This feedback loop can further complicate the task of accurate forecasting. The impact of news and media coverage also plays a substantial role. [See also: How News Affects Stock Prices]

Evaluating Stocks Predictions: A Critical Approach

Given the inherent limitations of stocks predictions, it’s essential to approach them with a critical mindset. Investors should not rely solely on forecasts when making investment decisions. Instead, they should conduct their own independent research and analysis, considering a variety of factors before committing capital. Here are some key considerations when evaluating stocks predictions:

- Source Credibility: Assess the credibility of the source making the prediction. Consider their track record, expertise, and potential biases.

- Methodology: Understand the methodology used to generate the prediction. Is it based on sound principles and supported by evidence?

- Assumptions: Identify the key assumptions underlying the prediction. Are these assumptions reasonable and realistic?

- Time Horizon: Consider the time horizon of the prediction. Short-term forecasts are generally more difficult to make accurately than long-term forecasts.

- Risk Tolerance: Assess your own risk tolerance. Are you comfortable with the potential for losses if the prediction proves to be incorrect?

The Future of Stocks Predictions

The field of stocks predictions is constantly evolving. Advancements in artificial intelligence (AI) and machine learning (ML) are opening new possibilities for analyzing vast amounts of data and identifying patterns that may be invisible to human analysts. AI-powered models can learn from historical data and adapt to changing market conditions, potentially improving forecasting accuracy.

However, even with these advancements, it’s unlikely that perfect accuracy will ever be achieved. The stock market will always be subject to unpredictable events and human emotions. Therefore, investors should view stocks predictions as one tool among many, rather than a crystal ball. A diversified investment strategy, based on sound financial principles and a thorough understanding of risk, remains the most prudent approach to long-term wealth creation. Always consult with a qualified financial advisor before making any investment decisions.