Navigating the Market: Understanding Stock Forecasts and Their Limitations

In the dynamic world of finance, investors are constantly seeking an edge, a glimpse into the future that can guide their investment decisions. This quest often leads them to stock forecasts, predictions about the future value of a company’s stock. While the allure of accurately predicting market movements is strong, it’s crucial to understand the nature of stock forecasts, their inherent limitations, and how to use them responsibly. This article will delve into the world of stock forecasts, exploring their methodologies, examining their accuracy, and providing a framework for investors to make informed decisions.

What are Stock Forecasts?

Stock forecasts are estimates of a stock’s future price, typically based on various analytical methods. These methods can range from fundamental analysis, which examines a company’s financial health and industry outlook, to technical analysis, which focuses on historical price and volume data. The goal of a stock forecast is to provide investors with a potential target price and a timeframe for reaching that price.

Methods Used in Stock Forecasting

- Fundamental Analysis: This approach involves analyzing a company’s financial statements (balance sheet, income statement, cash flow statement), industry trends, and overall economic conditions to determine the intrinsic value of its stock. Forecasters using fundamental analysis consider factors like revenue growth, profitability, debt levels, and competitive landscape.

- Technical Analysis: Technical analysts believe that historical price patterns and trading volumes can provide insights into future price movements. They use charts, indicators, and other tools to identify trends and potential trading opportunities. Common technical indicators include moving averages, relative strength index (RSI), and MACD.

- Quantitative Analysis: This method uses mathematical and statistical models to identify patterns and predict stock prices. Quantitative analysts often employ algorithms and computer programs to analyze large datasets and generate stock forecasts.

- Sentiment Analysis: This approach attempts to gauge investor sentiment towards a particular stock or the market as a whole. Sentiment analysis uses various sources of information, such as news articles, social media posts, and online forums, to determine whether investors are generally bullish (optimistic) or bearish (pessimistic).

The Accuracy of Stock Forecasts: A Reality Check

Despite the sophistication of forecasting methods, it’s important to acknowledge that stock forecasts are not guarantees. The stock market is inherently unpredictable, influenced by a multitude of factors that are difficult to foresee with certainty. Economic shocks, geopolitical events, and unexpected company news can all significantly impact stock prices, rendering even the most carefully crafted stock forecasts inaccurate.

Numerous studies have examined the accuracy of stock forecasts, and the results are often mixed. Some studies have found that certain forecasting methods can provide a slight edge in predicting short-term price movements, while others have concluded that stock forecasts are no better than random guesses in the long run. The consensus among most experts is that while stock forecasts can be a useful tool for investors, they should not be relied upon as the sole basis for investment decisions. [See also: Investment Strategies for Beginners]

Factors Affecting Forecast Accuracy

- Time Horizon: Generally, short-term stock forecasts tend to be more accurate than long-term forecasts. The further out into the future a forecast extends, the more uncertainty there is and the greater the likelihood of unforeseen events impacting the stock price.

- Market Volatility: During periods of high market volatility, stock forecasts are often less accurate. Rapid and unpredictable price swings can make it difficult for forecasters to identify reliable patterns and trends.

- Company Specific Factors: The accuracy of stock forecasts can also be affected by company-specific factors, such as management changes, product launches, and regulatory developments. These events can have a significant impact on a company’s stock price, making it challenging to predict future performance.

Using Stock Forecasts Responsibly

While stock forecasts should not be treated as gospel, they can still be a valuable tool for investors when used responsibly. Here are some guidelines for incorporating stock forecasts into your investment strategy:

Diversification is Key

Never put all your eggs in one basket. Diversifying your portfolio across different asset classes, industries, and geographic regions can help mitigate the risk of relying too heavily on any single stock forecast. [See also: Building a Diversified Portfolio]

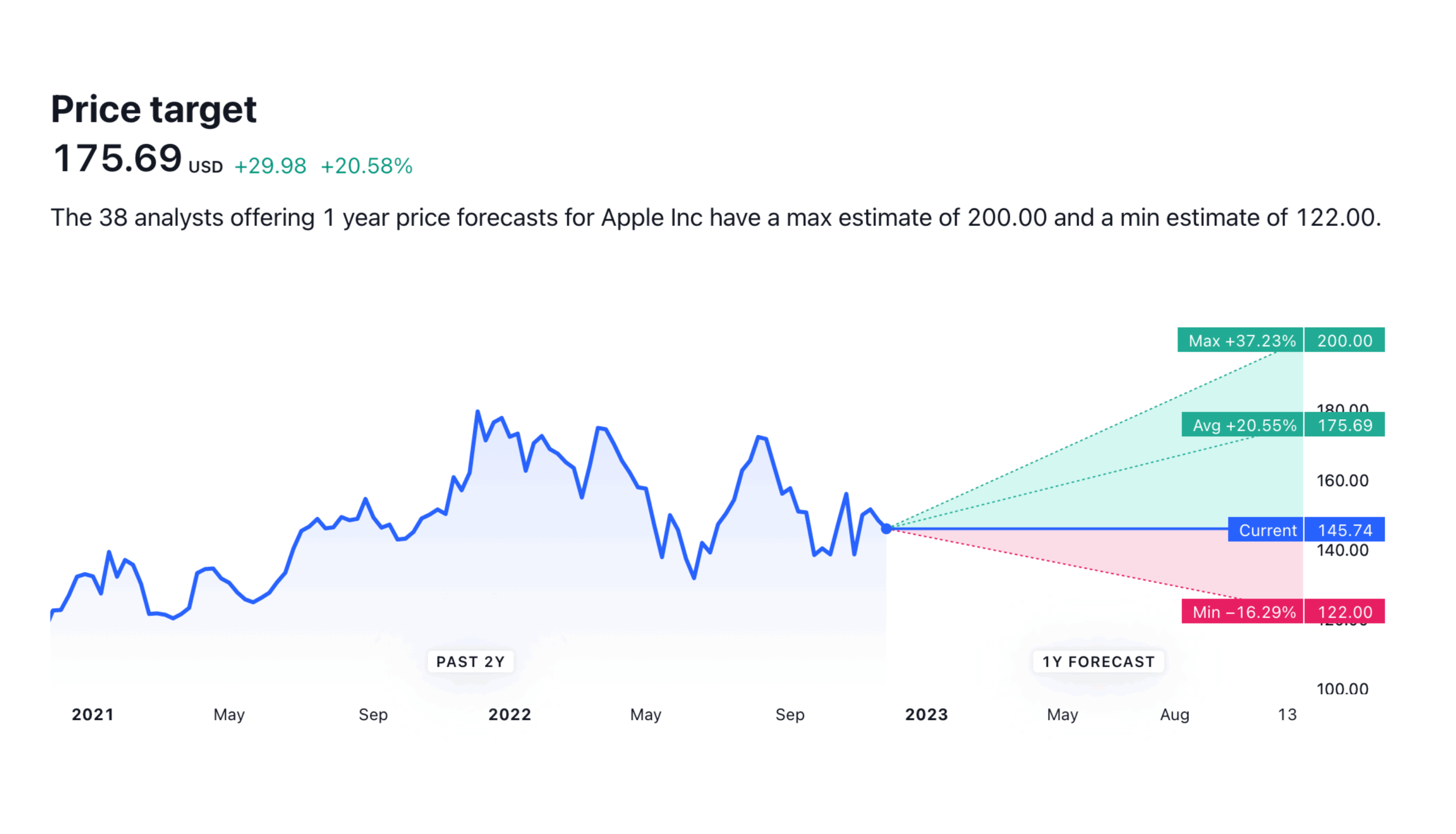

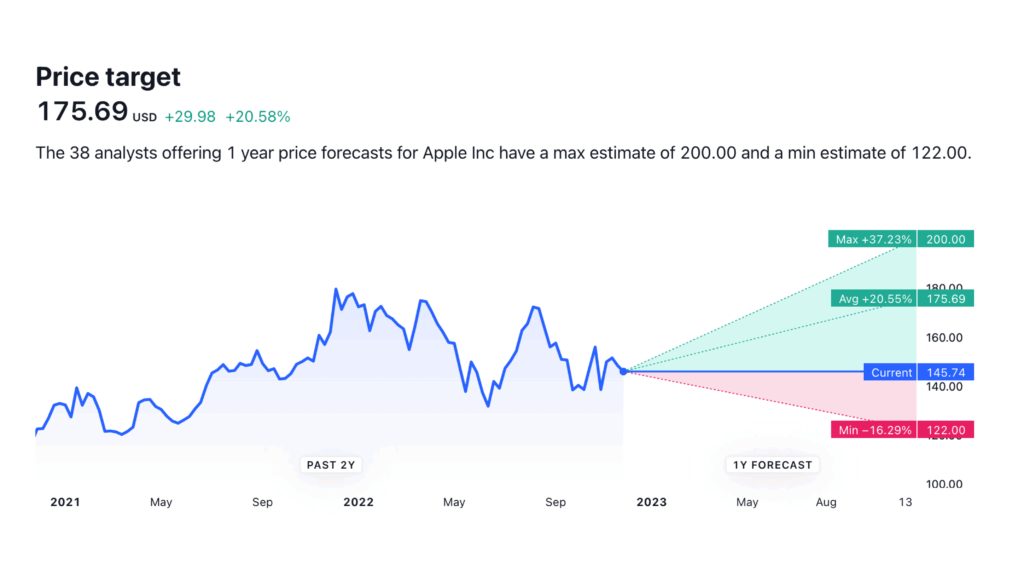

Consider Multiple Sources

Don’t rely on a single stock forecast from one source. Seek out multiple perspectives from different analysts and research firms. Compare their forecasts, methodologies, and assumptions to get a more well-rounded view of the potential risks and rewards.

Understand the Assumptions

Pay close attention to the assumptions underlying each stock forecast. What economic conditions are the forecasters assuming? What are their expectations for the company’s future performance? Understanding these assumptions can help you assess the credibility of the forecast and determine whether it aligns with your own views.

Do Your Own Research

Stock forecasts should be used as a starting point for your own research, not as a substitute for it. Conduct your own due diligence on the company and the industry before making any investment decisions. Read company filings, analyze financial statements, and stay informed about industry trends. [See also: Fundamental Analysis Techniques]

Focus on the Long Term

Avoid getting caught up in short-term market noise and focus on the long-term fundamentals of the companies you invest in. Stock forecasts can be useful for identifying potential investment opportunities, but the best way to build wealth over time is to invest in fundamentally sound companies with strong growth prospects and hold them for the long term. A good stock forecast is a helpful data point, but should not drive your investment strategy.

Be Aware of Biases

Recognize that stock forecasts can be influenced by biases. Analysts may have incentives to issue optimistic forecasts to attract clients or maintain relationships with companies. Be critical of forecasts that seem overly positive or negative, and always consider the potential for bias.

Re-evaluate Regularly

The market is constantly evolving, so it’s important to re-evaluate your investment decisions regularly. Monitor the performance of your investments, stay informed about company news and industry trends, and adjust your portfolio as needed. Don’t blindly follow stock forecasts without considering new information and changing market conditions.

The Role of AI in Stock Forecasting

Artificial intelligence (AI) is increasingly being used in stock forecasting. AI algorithms can analyze vast amounts of data, identify patterns, and make predictions with speed and accuracy that are beyond human capabilities. However, even AI-powered stock forecasts are not foolproof. AI models are only as good as the data they are trained on, and they can be susceptible to biases and overfitting. Overfitting is where the model learns the training data too well and cannot generalize to new data. Therefore, it’s important to use AI-powered stock forecasts with caution and to supplement them with your own research and analysis. [See also: The Future of AI in Finance]

Conclusion

Stock forecasts can be a valuable tool for investors, but they should not be treated as a crystal ball. The stock market is inherently unpredictable, and even the most sophisticated forecasting methods are subject to limitations. By understanding the nature of stock forecasts, their inherent limitations, and how to use them responsibly, investors can make more informed decisions and increase their chances of success in the market. Remember to diversify your portfolio, consider multiple sources, understand the assumptions behind each forecast, do your own research, and focus on the long term. Finally, be aware of potential biases and re-evaluate your investment decisions regularly. Using these guidelines, you can navigate the market with a more informed and balanced perspective. The key takeaway is that stock forecasts should be used as one input amongst many when making investment decisions. It is important to consider other factors such as your risk tolerance, investment goals, and time horizon. Approaching the stock market with a healthy dose of skepticism and a commitment to continuous learning is the best way to achieve long-term success.