Navigating the Market: Understanding Stock Forecasts and Their Role in Investment Decisions

In the dynamic world of finance, investors are constantly seeking an edge. One tool frequently employed in this quest is the stock forecast. These predictions, offered by analysts, financial institutions, and increasingly, algorithmic models, attempt to anticipate the future performance of publicly traded companies. But how reliable are stock forecasts, and what role should they play in your investment strategy? This article will delve into the intricacies of stock forecasts, exploring their methodologies, limitations, and ultimately, how to use them wisely.

What is a Stock Forecast?

A stock forecast is an attempt to predict the future price of a company’s stock. These forecasts can range from short-term predictions, spanning days or weeks, to long-term projections that look several years into the future. The methodologies used to generate these forecasts are diverse, often combining fundamental analysis, technical analysis, and increasingly, data science techniques.

Fundamental Analysis

Fundamental analysis involves evaluating a company’s intrinsic value by examining its financial statements, industry trends, and overall economic outlook. Analysts using this approach scrutinize factors such as revenue, earnings, debt levels, and management quality to determine whether a stock is overvalued or undervalued. Based on this assessment, they generate a stock forecast, predicting whether the stock price is likely to rise or fall.

Technical Analysis

Technical analysis, on the other hand, focuses on historical price and volume data to identify patterns and trends. Technical analysts use charts and indicators to predict future price movements, believing that market psychology and momentum can provide valuable insights. This method relies less on a company’s financials and more on the collective behavior of investors. Technical analysis can be used to generate a stock forecast for shorter time horizons.

Quantitative Analysis and Algorithmic Models

The rise of big data and advanced computing has led to the development of quantitative analysis and algorithmic models for stock forecasts. These models use statistical techniques and machine learning algorithms to analyze vast amounts of data, including financial statements, news articles, social media sentiment, and economic indicators. The goal is to identify correlations and patterns that humans might miss, potentially leading to more accurate predictions. However, these models are not without their limitations, as they are only as good as the data they are trained on and can be susceptible to overfitting.

Factors Influencing Stock Forecasts

Numerous factors can influence a stock forecast, making it a complex and challenging endeavor. These factors can be broadly categorized into internal and external influences.

Internal Factors

Internal factors relate to the company itself, including its financial performance, management decisions, and competitive positioning. Strong earnings growth, innovative product launches, and effective cost management can positively impact a stock forecast. Conversely, declining revenues, scandals, or increased competition can negatively affect predictions.

External Factors

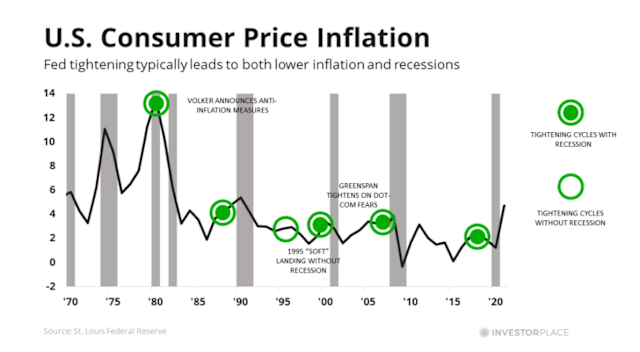

External factors encompass broader economic conditions, industry trends, and geopolitical events. Economic growth, interest rate changes, and inflation can all influence stock prices. Similarly, shifts in consumer preferences, technological advancements, and regulatory changes can impact a company’s prospects and, consequently, its stock forecast. Unexpected events, such as natural disasters or political instability, can also introduce volatility and uncertainty into the market, making accurate stock forecasts even more difficult.

Limitations of Stock Forecasts

While stock forecasts can be a valuable tool for investors, it’s crucial to acknowledge their limitations. No forecast is ever guaranteed to be accurate, and relying solely on predictions can be a risky strategy.

Inherent Uncertainty

The future is inherently uncertain, and predicting stock prices is akin to predicting the weather – there are simply too many variables at play. Unexpected events can disrupt even the most carefully crafted stock forecast. Market sentiment, investor psychology, and unforeseen circumstances can all influence stock prices in unpredictable ways.

Bias and Conflicts of Interest

Stock forecasts can be subject to bias and conflicts of interest. Analysts may have an incentive to issue positive forecasts to maintain relationships with the companies they cover or to generate trading commissions. Similarly, financial institutions may promote certain stocks to benefit their own investment portfolios. It’s important to be aware of these potential biases and to critically evaluate the source and motivation behind any stock forecast.

Overreliance on Historical Data

Many stock forecasts rely heavily on historical data, which may not be a reliable indicator of future performance. Market conditions change over time, and past trends may not necessarily continue. Overreliance on historical data can lead to inaccurate predictions, especially during periods of significant economic or technological disruption.

How to Use Stock Forecasts Wisely

Despite their limitations, stock forecasts can still be a valuable tool for investors when used wisely. Here are some tips for incorporating forecasts into your investment strategy:

Diversify Your Sources

Don’t rely on a single stock forecast. Consult multiple sources, including different analysts, financial institutions, and research reports. Compare and contrast the different perspectives to get a more comprehensive understanding of the potential risks and rewards.

Consider the Time Horizon

Pay attention to the time horizon of the stock forecast. Short-term forecasts are generally less reliable than long-term projections, as they are more susceptible to market volatility. Consider your own investment goals and time horizon when evaluating a forecast.

Focus on the Underlying Assumptions

Don’t just focus on the headline price target. Understand the underlying assumptions and rationale behind the stock forecast. What factors are driving the analyst’s optimism or pessimism? Do you agree with their assumptions? Critical evaluation is key.

Use Forecasts as a Starting Point for Research

Treat stock forecasts as a starting point for your own research, not as the final word. Conduct your own due diligence, analyze the company’s financials, and assess its competitive positioning. Form your own informed opinion before making any investment decisions. [See also: How to Research Stocks Effectively]

Don’t Chase Short-Term Gains

Avoid chasing short-term gains based on stock forecasts. Investing is a long-term game, and trying to time the market based on predictions is a recipe for disaster. Focus on building a diversified portfolio of high-quality companies that you believe will grow over time. [See also: Building a Long-Term Investment Portfolio]

Understand Your Risk Tolerance

Before acting on any stock forecast, understand your own risk tolerance. Are you comfortable with the potential for losses? Are you willing to hold onto a stock even if it declines in value? Make sure your investment decisions align with your risk profile.

The Future of Stock Forecasts

The field of stock forecasts is constantly evolving, driven by advancements in technology and data science. Algorithmic models are becoming increasingly sophisticated, and the availability of data is expanding rapidly. In the future, we can expect to see more personalized and data-driven stock forecasts that take into account individual investor preferences and risk profiles. However, it’s important to remember that no matter how advanced the technology becomes, the future will always remain uncertain. The best approach is to use stock forecasts as one tool among many, and to always exercise critical thinking and independent judgment.

In conclusion, stock forecasts can be a useful resource for investors, but they should be treated with caution. Understanding their methodologies, limitations, and potential biases is crucial for making informed investment decisions. By diversifying your sources, focusing on the underlying assumptions, and conducting your own research, you can use stock forecasts to enhance your investment strategy without blindly relying on predictions. Always remember that investing involves risk, and there are no guarantees of success. [See also: Risk Management in Investing]