Navigating the Stock Market: Demystifying Stock Predict Models and Their Accuracy

The allure of predicting the stock market has captivated investors, analysts, and academics for decades. The ability to accurately forecast stock prices promises significant financial rewards. This article delves into the complex world of stock predict models, examining their underlying principles, strengths, limitations, and the inherent challenges in achieving consistent accuracy. Whether you are a seasoned investor or a curious newcomer, understanding the intricacies of stock predict methodologies is crucial for making informed decisions.

Understanding the Landscape of Stock Prediction Models

Stock predict models encompass a wide array of approaches, each with its own set of assumptions and techniques. These models can be broadly categorized into two main types: fundamental analysis and technical analysis. Fundamental analysis focuses on evaluating a company’s intrinsic value by examining its financial statements, industry trends, and macroeconomic factors. Technical analysis, on the other hand, relies on historical price and volume data to identify patterns and predict future price movements. There are also quantitative models that use algorithms and statistical methods for stock predict. These include time series analysis, machine learning, and deep learning.

Fundamental Analysis: A Deep Dive

Fundamental analysis is the cornerstone of long-term investing. It involves scrutinizing a company’s balance sheet, income statement, and cash flow statement to assess its financial health and profitability. Key metrics such as earnings per share (EPS), price-to-earnings (P/E) ratio, debt-to-equity ratio, and return on equity (ROE) are carefully analyzed. Furthermore, fundamental analysts consider industry trends, competitive landscape, and macroeconomic factors such as interest rates, inflation, and GDP growth. Ultimately, the goal is to determine whether a stock is undervalued or overvalued relative to its intrinsic value. However, even the most thorough fundamental analysis can be thwarted by unforeseen events or changes in market sentiment. The accuracy of stock predict using fundamental analysis is heavily dependent on the quality and availability of information.

Technical Analysis: Charting the Course

Technical analysis takes a different approach, focusing solely on historical price and volume data. Technical analysts believe that all relevant information is already reflected in the stock’s price, and that patterns in price movements can be used to predict future price movements. Common technical indicators include moving averages, relative strength index (RSI), moving average convergence divergence (MACD), and Fibonacci retracements. Technical analysts use these tools to identify trends, support and resistance levels, and potential buy or sell signals. While technical analysis can be useful for short-term trading, its effectiveness for long-term stock predict is debatable. Critics argue that technical analysis is subjective and prone to self-fulfilling prophecies. Using technical analysis for stock predict requires a certain level of expertise and is not guaranteed to be accurate.

Quantitative Models: The Rise of Algorithms

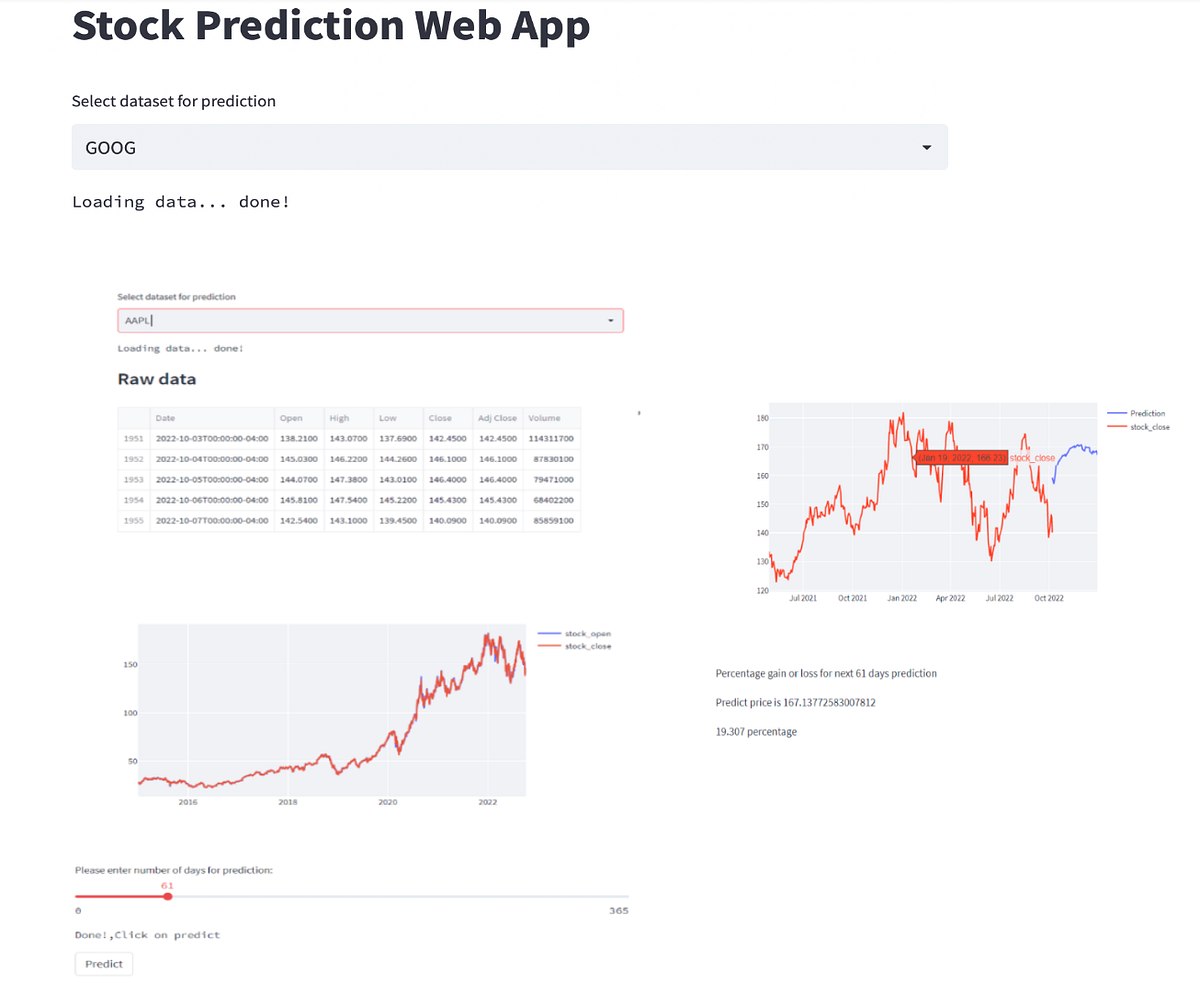

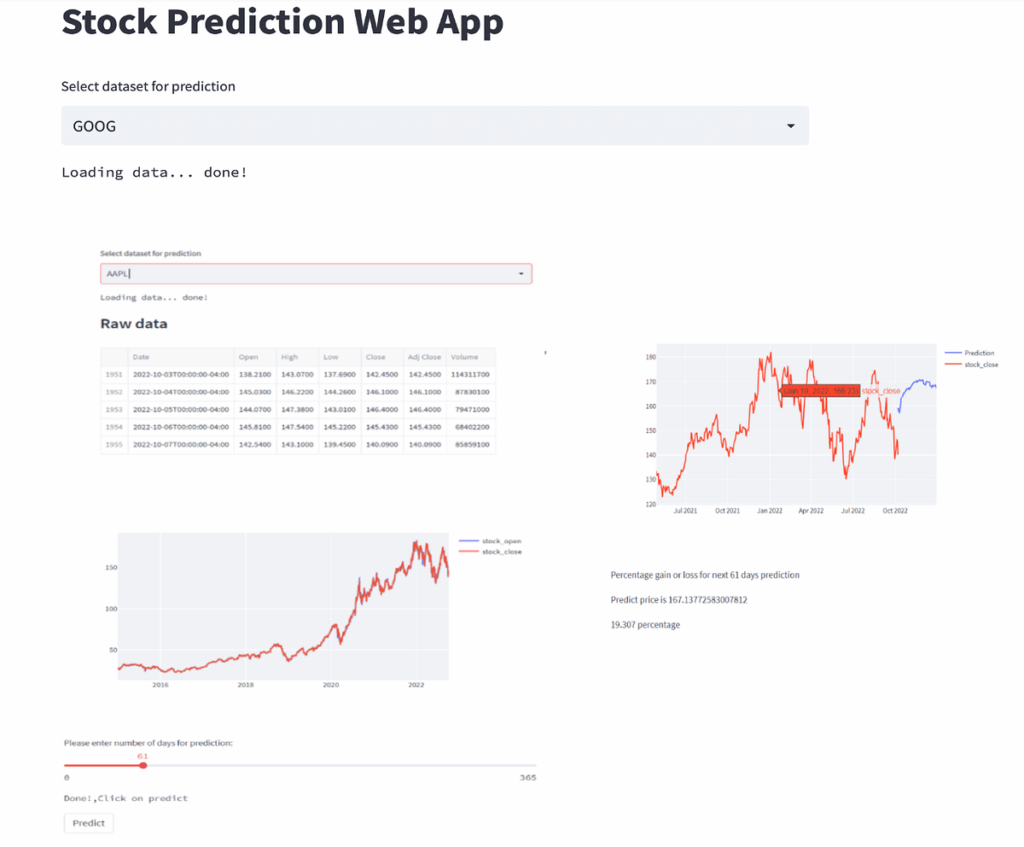

Quantitative models leverage the power of algorithms and statistical methods to stock predict. Time series analysis, such as ARIMA (Autoregressive Integrated Moving Average), is used to forecast future stock prices based on past price movements. Machine learning techniques, such as regression analysis, decision trees, and neural networks, are increasingly being used to identify patterns and predict stock prices. Deep learning, a subset of machine learning, utilizes artificial neural networks with multiple layers to analyze vast amounts of data and make predictions. Quantitative models can be highly sophisticated, but they are only as good as the data they are trained on. Overfitting, a common problem in machine learning, occurs when a model is too closely tailored to the training data and fails to generalize to new data. Therefore, careful validation and testing are essential to ensure the reliability of quantitative stock predict models.

Factors Influencing Stock Prediction Accuracy

The accuracy of stock predict models is influenced by a multitude of factors, including market volatility, data quality, model complexity, and unforeseen events. Market volatility, characterized by rapid and unpredictable price swings, can render even the most sophisticated models ineffective. High-quality data is essential for training and validating models. Inaccurate or incomplete data can lead to biased predictions. Model complexity is a double-edged sword. While more complex models may be able to capture subtle patterns in the data, they are also more prone to overfitting. Unforeseen events, such as economic crises, political instability, or natural disasters, can have a significant impact on stock prices and are difficult to predict. The effectiveness of any stock predict model is therefore limited by these factors.

The Role of Market Efficiency

The efficient market hypothesis (EMH) posits that stock prices fully reflect all available information. According to the EMH, it is impossible to consistently outperform the market using any stock predict strategy. There are three forms of EMH: weak form, semi-strong form, and strong form. The weak form asserts that historical price data cannot be used to predict future prices. The semi-strong form states that all publicly available information is already reflected in stock prices. The strong form claims that all information, including insider information, is already reflected in stock prices. While the EMH has been challenged by behavioral finance research, it remains a significant theoretical framework for understanding the challenges of stock predict.

Behavioral Finance and Market Anomalies

Behavioral finance challenges the assumption of rationality underlying the EMH. It argues that psychological biases and emotional factors can influence investor behavior and lead to market inefficiencies. Common behavioral biases include herding, confirmation bias, and loss aversion. Market anomalies, such as the January effect and the momentum effect, are patterns in stock prices that cannot be explained by the EMH. These anomalies suggest that it may be possible to outperform the market by exploiting behavioral biases and market inefficiencies. However, these anomalies are often short-lived and difficult to consistently profit from. The field of behavioral finance offers valuable insights into the limitations of stock predict models based on rational expectations.

The Ethical Considerations of Stock Prediction

The pursuit of accurate stock predict raises several ethical considerations. One concern is the potential for insider trading. If someone has access to non-public information, they could use it to make profitable trades, which is illegal and unethical. Another concern is the potential for market manipulation. Sophisticated algorithms could be used to artificially inflate or deflate stock prices, harming unsuspecting investors. Furthermore, the use of artificial intelligence in stock predict raises questions about transparency and accountability. It is important to ensure that these models are used responsibly and ethically, and that investors are protected from fraud and manipulation. Regulations and oversight are crucial to maintain the integrity of the stock market and prevent abuse of stock predict technologies.

Conclusion: The Future of Stock Prediction

Stock predict remains a challenging but fascinating field. While no model can consistently predict the future with certainty, advancements in data science, machine learning, and behavioral finance are constantly improving our understanding of the stock market. Investors should be aware of the limitations of stock predict models and should not rely solely on them for making investment decisions. A diversified investment strategy, based on sound fundamental analysis and risk management principles, is still the best approach for achieving long-term financial success. The future of stock predict will likely involve a combination of quantitative models, fundamental analysis, and behavioral insights, with a focus on transparency, accountability, and ethical considerations. [See also: Understanding Market Volatility], [See also: The Basics of Investing], [See also: Risk Management Strategies for Investors]