Navigating the Uncertainties: Market Prediction Today and Beyond

In the fast-paced world of finance and economics, accurate market prediction today is more crucial than ever. Investors, businesses, and policymakers rely on these forecasts to make informed decisions that can significantly impact their bottom lines and the overall economy. However, predicting market movements is a complex and challenging task, fraught with uncertainties and influenced by a multitude of factors. This article delves into the intricacies of market prediction today, exploring the methods, challenges, and potential future trends.

The Landscape of Market Prediction

Market prediction today involves analyzing historical data, current economic indicators, and various other factors to forecast future market trends. This can range from predicting stock prices and currency exchange rates to forecasting commodity prices and overall economic growth. The scope is vast, and the methodologies employed are equally diverse.

Traditional Methods

Traditional methods of market prediction today often rely on fundamental and technical analysis. Fundamental analysis involves examining macroeconomic factors such as GDP growth, inflation rates, interest rates, and employment figures. By assessing the overall health of the economy, analysts attempt to determine the intrinsic value of assets and predict their future performance.

Technical analysis, on the other hand, focuses on historical price and volume data. Technical analysts use charts and various indicators to identify patterns and trends, believing that these patterns can provide insights into future price movements. Common technical indicators include moving averages, relative strength index (RSI), and Fibonacci retracements.

Modern Approaches

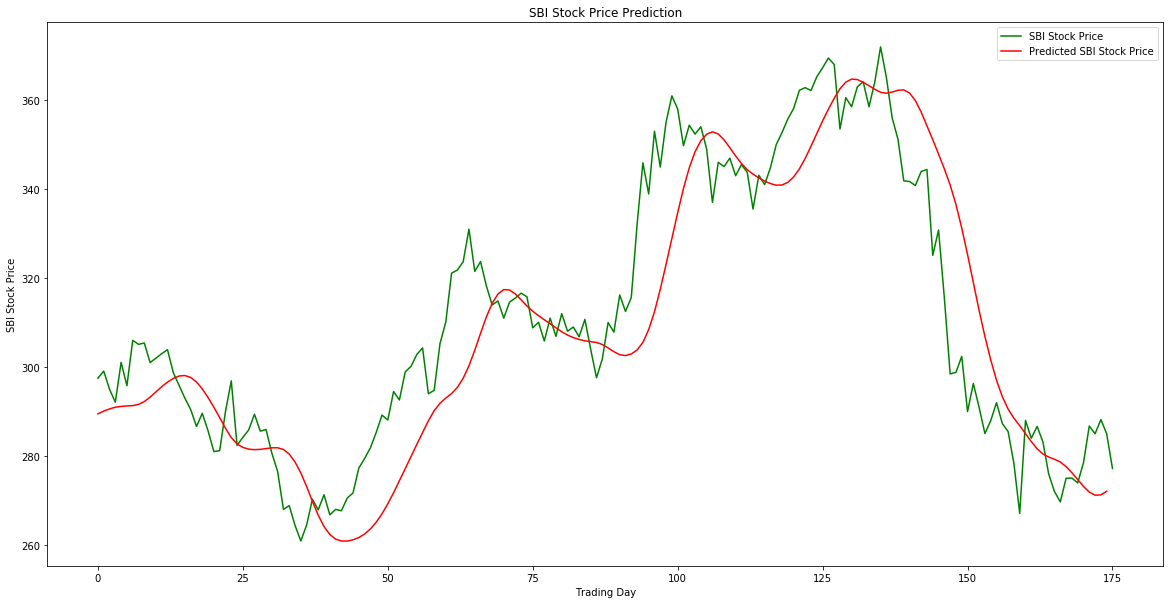

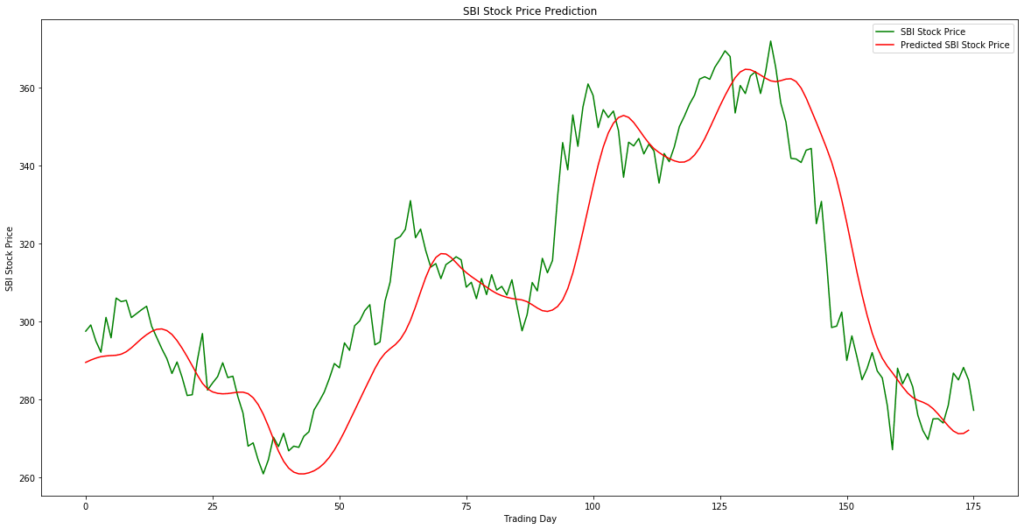

In recent years, modern approaches to market prediction today have gained prominence. These approaches leverage advanced technologies such as artificial intelligence (AI) and machine learning (ML) to analyze vast amounts of data and identify complex patterns that may be missed by traditional methods. AI and ML algorithms can process data from various sources, including news articles, social media feeds, and alternative data sets, to generate more accurate and timely predictions.

One popular application of AI in market prediction today is algorithmic trading. Algorithmic trading systems use predefined rules and algorithms to automatically execute trades based on market conditions. These systems can react to market changes much faster than human traders, potentially leading to increased profits and reduced risk.

Challenges in Market Prediction

Despite the advancements in technology and analytical techniques, market prediction today remains a challenging endeavor. Several factors contribute to the difficulty of accurately forecasting market movements.

Data Limitations

One of the primary challenges is the availability and quality of data. While there is an abundance of data available, not all of it is reliable or relevant. Furthermore, data can be subject to biases and errors, which can skew the results of predictive models. Ensuring data accuracy and completeness is crucial for effective market prediction today.

Market Volatility

Market volatility is another significant challenge. Markets are constantly influenced by a wide range of factors, including economic news, political events, and investor sentiment. These factors can lead to sudden and unpredictable price swings, making it difficult to accurately forecast short-term market movements. Events like unexpected geopolitical tensions or surprise economic announcements can completely disrupt even the most sophisticated market prediction today models.

Human Behavior

Human behavior also plays a significant role in market dynamics. Investors are not always rational, and their decisions can be influenced by emotions such as fear and greed. These emotions can lead to herd behavior, where investors follow the crowd without considering the underlying fundamentals. Understanding and accounting for human behavior is a critical aspect of market prediction today.

Behavioral economics, a field that combines psychology and economics, offers insights into how cognitive biases and emotional factors influence investor decision-making. By incorporating these insights into predictive models, analysts can potentially improve the accuracy of their forecasts. [See also: Understanding Behavioral Finance]

Tools and Technologies Used

Several tools and technologies are employed in market prediction today to enhance accuracy and efficiency:

- Statistical Software: Tools like R and Python are used for data analysis and statistical modeling.

- Machine Learning Platforms: Platforms such as TensorFlow and scikit-learn enable the development of predictive models.

- Data Visualization Tools: Tableau and Power BI help visualize data and identify patterns.

- Financial Data Providers: Bloomberg and Refinitiv provide real-time market data and analytics.

The Role of Economic Indicators

Economic indicators are crucial inputs for market prediction today. These indicators provide insights into the overall health of the economy and can help predict future market trends. Key economic indicators include:

- Gross Domestic Product (GDP): Measures the total value of goods and services produced in a country.

- Inflation Rate: Measures the rate at which prices are rising.

- Unemployment Rate: Measures the percentage of the labor force that is unemployed.

- Interest Rates: Influenced by central banks and affect borrowing costs and investment decisions.

- Consumer Confidence Index (CCI): Measures consumer sentiment about the economy.

Monitoring these indicators and understanding their implications is essential for making informed market predictions.

Expert Opinions on Market Prediction

Experts hold diverse views on the accuracy and reliability of market prediction today. Some argue that markets are inherently unpredictable and that attempts to forecast their movements are futile. Others believe that, while prediction is challenging, it is possible to gain an edge by leveraging advanced analytical techniques and staying informed about market trends.

Renowned economist Burton Malkiel, author of “A Random Walk Down Wall Street,” argues that stock prices follow a random walk and are therefore impossible to predict consistently. On the other hand, quantitative analysts and hedge fund managers often rely on sophisticated models to generate investment strategies and predict market movements.

Future Trends in Market Prediction

The field of market prediction today is constantly evolving, driven by advancements in technology and the increasing availability of data. Several trends are expected to shape the future of market forecasting.

Increased Use of AI and ML

AI and ML are likely to play an even greater role in market prediction today in the future. As these technologies continue to improve, they will be able to analyze increasingly complex data sets and identify subtle patterns that are beyond the capabilities of human analysts. This could lead to more accurate and timely predictions, particularly in volatile market conditions.

Greater Focus on Alternative Data

Alternative data, such as social media sentiment, satellite imagery, and credit card transactions, is becoming increasingly important in market prediction today. These data sources can provide valuable insights into consumer behavior and economic activity, which can be used to improve the accuracy of forecasts. As the availability of alternative data continues to grow, its role in market prediction will likely become even more significant.

Enhanced Data Visualization

Data visualization tools are becoming more sophisticated, allowing analysts to explore and communicate complex data sets more effectively. Enhanced data visualization can help identify patterns and trends that might otherwise be missed, leading to better-informed predictions. Interactive dashboards and real-time visualizations are becoming increasingly popular in the world of market prediction today.

Integration of Behavioral Economics

The integration of behavioral economics into predictive models is expected to become more prevalent. By incorporating insights into how cognitive biases and emotional factors influence investor decision-making, analysts can potentially improve the accuracy of their forecasts. This could lead to more robust and reliable predictions, particularly in markets driven by sentiment and speculation.

Practical Tips for Investors

While accurate market prediction today is challenging, investors can take steps to improve their decision-making process:

- Diversify your portfolio: Spreading investments across different asset classes can reduce risk.

- Stay informed: Keep up-to-date with economic news and market trends.

- Understand your risk tolerance: Invest in assets that align with your risk appetite.

- Seek professional advice: Consult with a financial advisor for personalized guidance.

- Be patient: Avoid making impulsive decisions based on short-term market fluctuations.

Conclusion

Market prediction today is a complex and evolving field, influenced by a multitude of factors. While accurate forecasting remains a challenge, advancements in technology and analytical techniques are continually improving our ability to understand and anticipate market movements. By staying informed, leveraging advanced tools, and understanding the limitations of predictive models, investors and businesses can make more informed decisions and navigate the uncertainties of the global economy. The key is to approach market prediction today with a balanced perspective, recognizing both its potential and its limitations, and to use it as one tool among many in the decision-making process. The ability to adapt and learn from past predictions is also crucial for long-term success. Remember that no market prediction today is foolproof, and a well-diversified strategy is always the best approach to mitigate risk.