Navigating the Uncertainty: Market Prediction Today and Tomorrow

The relentless churn of global markets demands constant vigilance. Understanding market prediction today is crucial for investors, businesses, and policymakers alike. Predicting future market trends is not an exact science, but a blend of data analysis, economic modeling, and a healthy dose of informed speculation. This article aims to provide a comprehensive overview of the current landscape of market forecasting, exploring the methodologies employed, the challenges faced, and the potential implications for the future.

The Art and Science of Market Forecasting

Market prediction today relies on a complex interplay of factors. Econometric models, technical analysis, and sentiment analysis form the bedrock of most forecasting efforts. Econometric models utilize historical data to identify patterns and correlations between economic variables and market performance. Technical analysis focuses on price charts and trading volumes to identify potential buy and sell signals. Sentiment analysis, on the other hand, attempts to gauge market psychology by analyzing news articles, social media posts, and other sources of information.

However, these methods are not without their limitations. Econometric models are often criticized for their reliance on historical data, which may not accurately reflect future conditions. Technical analysis is subjective and can be prone to interpretation bias. Sentiment analysis can be noisy and difficult to interpret, especially in volatile market environments.

Key Factors Influencing Market Prediction

Several key factors can significantly impact the accuracy of market prediction today. These include:

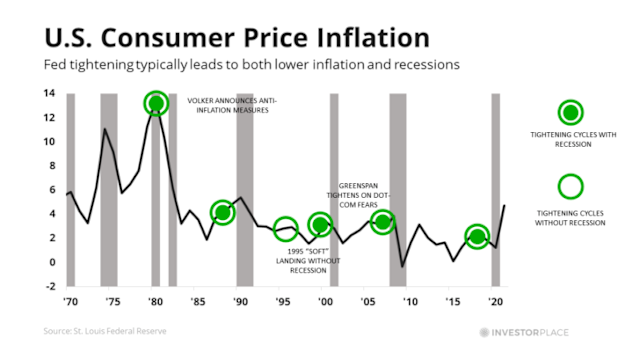

- Economic Indicators: GDP growth, inflation rates, unemployment figures, and interest rates are all closely watched indicators that can influence market sentiment.

- Geopolitical Events: Political instability, trade wars, and international conflicts can create significant market volatility.

- Technological Disruptions: Breakthrough technologies can disrupt existing industries and create new investment opportunities.

- Consumer Behavior: Changes in consumer spending patterns can have a profound impact on corporate earnings and market valuations.

- Monetary Policy: Central bank policies, such as interest rate adjustments and quantitative easing, can significantly impact market liquidity and asset prices.

Understanding these factors and their potential impact is essential for making informed investment decisions. [See also: Understanding Economic Indicators for Investment]

Current Market Trends and Predictions

As of today, several trends are shaping the market prediction landscape. Inflation remains a persistent concern, prompting central banks to maintain a hawkish stance on monetary policy. The ongoing war in Ukraine continues to create uncertainty in global energy markets and supply chains. Technological innovations, such as artificial intelligence and renewable energy, are driving growth in specific sectors.

Market predictions today vary depending on the source and the methodology employed. Some analysts predict a continued period of volatility and moderate growth, while others foresee a potential recession. The consensus appears to be that investors should exercise caution and focus on long-term value investments.

The Role of Artificial Intelligence in Market Prediction

Artificial intelligence (AI) is playing an increasingly important role in market prediction today. AI algorithms can analyze vast amounts of data and identify patterns that would be impossible for humans to detect. Machine learning models can be trained to predict market movements with a high degree of accuracy.

However, AI-powered market prediction tools are not foolproof. They are still susceptible to biases in the data and can be fooled by unexpected events. It is important to use AI tools in conjunction with human judgment and critical thinking.

Challenges in Market Prediction

Market prediction today faces several significant challenges. These include:

- Data Availability and Quality: Accurate market prediction requires access to high-quality data. However, data can be incomplete, inconsistent, or biased.

- Model Complexity: Building accurate market prediction models requires a deep understanding of economic theory and statistical methods.

- Unforeseen Events: Black swan events, such as pandemics or financial crises, can disrupt even the most sophisticated market prediction models.

- Behavioral Biases: Investor psychology and behavioral biases can significantly impact market movements, making it difficult to predict outcomes.

- Regulatory Changes: Changes in regulations can alter the competitive landscape and impact market valuations.

Overcoming these challenges requires a multidisciplinary approach that combines data science, economics, and behavioral finance. [See also: Overcoming Cognitive Biases in Investing]

Strategies for Navigating Market Uncertainty

Given the inherent uncertainty in market prediction today, investors should adopt a diversified and risk-managed approach. Some strategies for navigating market uncertainty include:

- Diversification: Spreading investments across different asset classes, sectors, and geographic regions can reduce overall portfolio risk.

- Long-Term Investing: Focusing on long-term value investments can help to weather short-term market volatility.

- Risk Management: Setting clear risk tolerance levels and using stop-loss orders can help to protect capital.

- Due Diligence: Thoroughly researching investment opportunities and understanding the risks involved is essential.

- Staying Informed: Keeping abreast of market trends and economic developments can help investors make informed decisions.

The Future of Market Prediction

The future of market prediction is likely to be shaped by advancements in artificial intelligence, big data, and behavioral finance. AI-powered market prediction tools will become increasingly sophisticated and accurate. Big data will provide access to more comprehensive and granular market information. Behavioral finance will help to better understand the psychological factors that drive market movements.

However, market prediction will never be a perfect science. The inherent complexity and unpredictability of financial markets will always present challenges. Investors should remain vigilant, adaptable, and focused on long-term value creation.

Conclusion: Embracing Uncertainty in Today’s Market

Market prediction today is a complex and challenging endeavor. While sophisticated tools and methodologies can provide valuable insights, the inherent uncertainty of financial markets requires a cautious and disciplined approach. By understanding the key factors influencing market prediction, adopting a diversified investment strategy, and staying informed about market trends, investors can navigate the uncertainties and achieve their financial goals. The key to successful investing lies not in predicting the future with certainty, but in adapting to changing conditions and managing risk effectively. The landscape of market prediction is constantly evolving, requiring continuous learning and adaptation to stay ahead of the curve. Remember that no market prediction is ever guaranteed. The best approach is to combine different sources of information, apply critical thinking, and make informed decisions based on your own risk tolerance and investment goals. Ultimately, success in the market hinges on understanding the limitations of market prediction today and embracing a proactive, risk-aware investment strategy.