Navigating the Volatile World of Parabola Stock: A Comprehensive Guide

The allure of quick profits often draws investors to what’s known as parabola stock. These stocks exhibit rapid, almost vertical price increases on a chart, resembling a parabolic curve. While the potential for substantial gains is undeniable, understanding the inherent risks and dynamics of parabola stock is crucial for making informed investment decisions. This article delves into the characteristics of parabola stock, the factors driving its ascent, the risks involved, and strategies for navigating this volatile landscape.

Understanding Parabola Stock

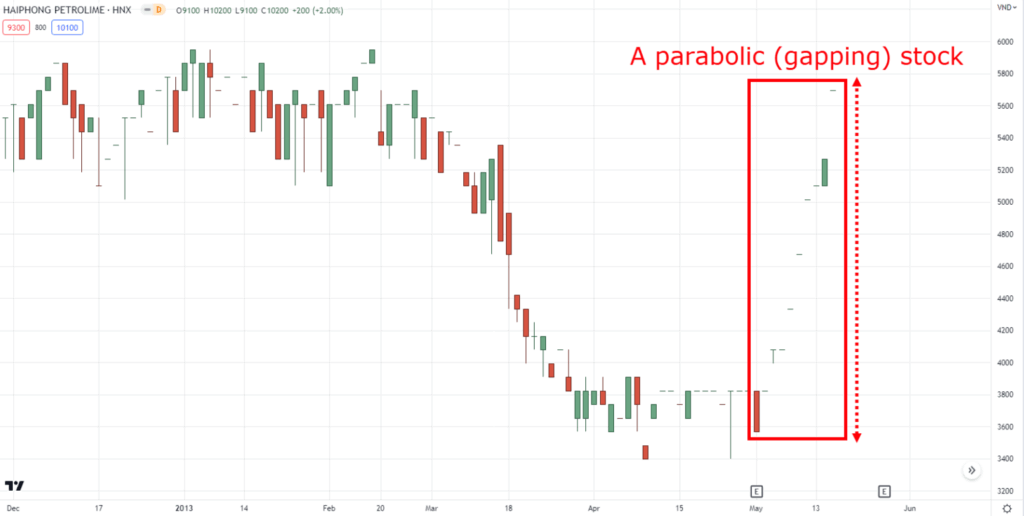

Parabola stock, also sometimes referred to as meme stocks or hype stocks, are characterized by a rapid and sustained increase in price over a relatively short period. This price surge is often driven by factors beyond fundamental analysis, such as social media hype, short squeezes, or a general fear of missing out (FOMO). Unlike stocks that experience gradual and steady growth based on solid financial performance, parabola stock rises exponentially, creating a dramatic curve on a stock chart. Identifying parabola stock early can be challenging, but recognizing the signs is key to potentially capitalizing on the trend or, more importantly, avoiding significant losses.

Key Characteristics of Parabola Stock

- Rapid Price Increase: The defining feature is a near-vertical ascent in price.

- High Volatility: Price swings are extreme and unpredictable.

- Social Media Influence: Often driven by trends and discussions on platforms like Reddit, Twitter, and TikTok.

- Limited Fundamental Basis: The price increase is not necessarily supported by the company’s financial performance or future prospects.

- Short Squeeze Potential: Heavy short selling can fuel the parabolic rise as short sellers are forced to cover their positions.

- FOMO (Fear of Missing Out): Investors rush in to buy the stock, further driving up the price.

Factors Driving the Parabolic Rise

Several factors can contribute to the formation of a parabola stock. Understanding these drivers can help investors assess the sustainability of the trend and make more informed decisions.

Social Media Hype

Social media platforms have become powerful tools for influencing stock prices. A coordinated effort by retail investors to promote a particular stock can create a frenzy, driving up demand and pushing the price into a parabolic trajectory. The spread of information, whether accurate or not, can quickly amplify sentiment and create a self-fulfilling prophecy.

Short Squeezes

A short squeeze occurs when a heavily shorted stock experiences a surge in price. Short sellers, who bet against the stock by borrowing shares and selling them with the expectation of buying them back at a lower price, are forced to cover their positions by buying back the shares to limit their losses. This buying pressure further fuels the price increase, creating a positive feedback loop.

Low Float

Stocks with a low float, meaning a small number of shares available for public trading, are more susceptible to price manipulation. A sudden surge in demand can quickly overwhelm the limited supply, leading to a rapid price increase.

Market Sentiment

Overall market sentiment can also play a role. During periods of high optimism and risk appetite, investors are more likely to jump on the bandwagon of parabola stock, further fueling the price increase. Conversely, during periods of market uncertainty, the parabolic trend can quickly reverse as investors become more risk-averse.

The Risks Associated with Parabola Stock

Investing in parabola stock is inherently risky. The rapid price increase is often unsustainable, and the subsequent correction can be swift and devastating. Understanding the risks is crucial for protecting your capital.

The Inevitable Correction

What goes up must come down. The parabolic rise is almost always followed by a sharp correction. The higher the stock climbs, the further it has to fall. Investors who buy in at the peak of the parabola are likely to suffer significant losses when the trend reverses. This is why timing is everything with a parabola stock.

Lack of Fundamental Support

The price of parabola stock is often divorced from the company’s underlying fundamentals. This means that the stock is overvalued and unsustainable in the long run. When the hype dies down, the stock price is likely to revert to its fair value, which can be significantly lower than the peak price.

Volatility and Liquidity

Parabola stock is characterized by extreme volatility. Price swings can be large and unpredictable, making it difficult to manage risk. Additionally, liquidity can dry up quickly during a correction, making it difficult to sell your shares at a reasonable price. [See also: Understanding Stock Volatility]

Potential for Manipulation

The low float and social media influence associated with parabola stock make them vulnerable to manipulation. Organized groups can artificially inflate the price of the stock and then dump their shares at a profit, leaving other investors holding the bag.

Strategies for Navigating Parabola Stock

While investing in parabola stock is risky, it is possible to navigate this volatile landscape and potentially profit from the trend. However, it requires a disciplined approach and a clear understanding of the risks involved.

Do Your Research

Before investing in any stock, it’s essential to do your research. Understand the company’s business model, financial performance, and future prospects. Be wary of stocks that are solely driven by hype and lack fundamental support.

Set Realistic Expectations

Don’t expect to get rich quick. Parabola stock is a short-term play, and the potential for profit is limited. Set realistic expectations and be prepared to lose money. Never invest more than you can afford to lose.

Use Stop-Loss Orders

Stop-loss orders can help limit your losses. A stop-loss order is an instruction to your broker to sell your shares if the price falls below a certain level. This can help protect you from significant losses during a correction. A trailing stop-loss order can be even more effective, as it automatically adjusts the stop-loss level as the stock price rises.

Take Profits Regularly

Don’t get greedy. As the stock price rises, take profits regularly. This will help you lock in your gains and reduce your risk. Remember, the parabolic trend is unlikely to last forever.

Be Disciplined

Discipline is key to successfully navigating parabola stock. Stick to your investment plan and avoid making impulsive decisions based on emotions. Don’t let FOMO drive your investment decisions.

Consider Options Strategies

More advanced investors might consider using options strategies to profit from the volatility of parabola stock. Strategies like straddles or strangles can be used to profit from large price swings, regardless of the direction. However, options trading is complex and requires a thorough understanding of the risks involved. [See also: Options Trading for Beginners]

Examples of Parabola Stock

Several stocks have exhibited parabolic trends in recent years, often fueled by social media hype and short squeezes. Examples include GameStop (GME), AMC Entertainment (AMC), and Bed Bath & Beyond (BBBY). These stocks experienced rapid price increases followed by sharp corrections, highlighting the risks associated with parabola stock.

Conclusion

Parabola stock offers the potential for quick profits but also carries significant risks. Understanding the characteristics of parabola stock, the factors driving its ascent, and the risks involved is crucial for making informed investment decisions. By doing your research, setting realistic expectations, using stop-loss orders, and taking profits regularly, you can potentially navigate this volatile landscape and profit from the trend. However, it’s important to remember that investing in parabola stock is inherently risky, and you should never invest more than you can afford to lose. Always consult with a qualified financial advisor before making any investment decisions. Investing in parabola stock requires a high tolerance for risk and a deep understanding of market dynamics. The potential for high returns comes with an equally high risk of substantial losses. Therefore, proceed with caution and always prioritize protecting your capital.