Navigating the Volatility: Understanding Parabola Stock Trends and Investment Strategies

The stock market is a dynamic environment, constantly influenced by a myriad of factors. Among the various patterns observed in stock price movements, the ‘parabola stock’ trend is particularly noteworthy, characterized by a rapid and often unsustainable increase in price. Understanding this trend is crucial for investors seeking to manage risk and capitalize on potential opportunities. This article delves into the characteristics of parabola stocks, the factors driving their ascent, and strategies for navigating the inherent volatility.

What is a Parabola Stock?

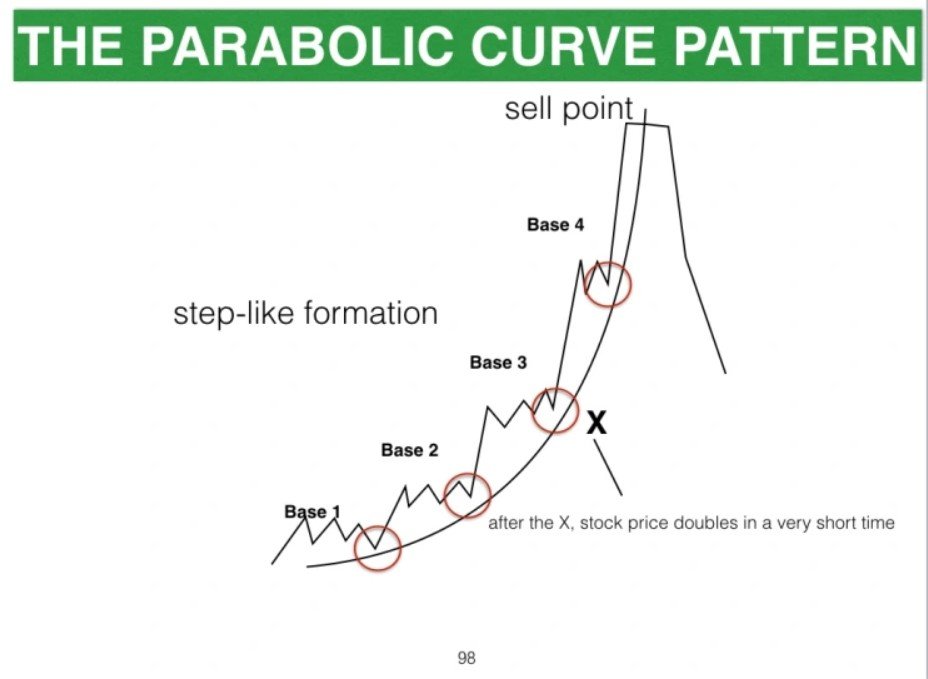

A parabola stock, in simple terms, refers to a stock whose price chart resembles a parabolic curve. This means the price initially rises slowly, then accelerates upward at an increasing rate, forming a steep, almost vertical climb. This rapid appreciation is often driven by hype, speculation, or a combination of both. While the initial gains can be substantial, parabola stocks are notorious for their equally rapid and devastating declines.

The key characteristic is the unsustainable rate of growth. Unlike stocks with steady, fundamental-driven growth, parabola stocks defy gravity for a limited time before inevitably succumbing to market forces. This makes them both attractive and perilous for investors.

Factors Driving Parabola Stock Growth

Several factors can contribute to the formation of a parabola stock pattern. These often intersect and amplify each other, creating a perfect storm for explosive price growth:

- Hype and Social Media: In the age of instant information and online communities, hype can spread like wildfire. Social media platforms, online forums, and even mainstream media can amplify positive news (or rumors) about a company, leading to increased investor interest and buying pressure.

- Short Squeeze: A short squeeze occurs when a significant number of investors have bet against a stock (shorted it). If the stock price unexpectedly rises, these short sellers are forced to cover their positions by buying back the stock, further driving up the price and exacerbating the parabolic climb.

- Low Float: Stocks with a limited number of shares available for trading (low float) are more susceptible to price swings. A surge in demand can quickly overwhelm the available supply, leading to a rapid price increase.

- Breakout Momentum: When a stock breaks through a significant resistance level (a price point it has struggled to surpass), it can trigger a wave of buying as traders and investors jump on the bandwagon, fueling the parabolic ascent.

- Narrative-Driven Investing: Sometimes, a compelling narrative surrounding a company or industry can drive investor enthusiasm, even if the underlying fundamentals don’t fully support the valuation. This is particularly common in emerging technologies or sectors with high growth potential.

The Inevitable Correction

What goes up must come down. This adage holds particularly true for parabola stocks. The unsustainable nature of their growth means that a correction is inevitable. The timing and severity of the correction are difficult to predict, but several factors can trigger the downfall:

- Profit Taking: As the stock price reaches extreme levels, early investors and traders may begin to take profits, selling their shares and putting downward pressure on the price.

- Reality Check: Eventually, the market may realize that the company’s fundamentals don’t justify the inflated valuation. This realization can lead to a sell-off as investors re-evaluate their positions.

- Negative News: Any negative news about the company, such as disappointing earnings, regulatory challenges, or competitive pressures, can shatter investor confidence and trigger a rapid decline.

- Market Sentiment Shift: A broader shift in market sentiment, such as a correction in the overall market or a change in investor risk appetite, can also trigger a sell-off in parabola stocks.

Strategies for Navigating Parabola Stocks

Investing in parabola stocks can be tempting due to the potential for quick gains. However, it’s crucial to approach these investments with caution and a well-defined strategy:

Due Diligence is Key

Before investing in any stock, especially a parabola stock, thorough due diligence is essential. This includes:

- Analyzing the Company’s Fundamentals: Evaluate the company’s financial statements, business model, competitive landscape, and growth prospects. Are the fundamentals strong enough to support the current valuation?

- Understanding the Market Sentiment: Assess the level of hype and speculation surrounding the stock. Is the price driven by genuine investor interest or simply by herd mentality?

- Identifying Potential Risks: Identify any potential risks that could trigger a correction, such as regulatory challenges, competitive pressures, or changes in market sentiment.

Risk Management is Paramount

Given the inherent volatility of parabola stocks, risk management is crucial. Consider the following strategies:

- Position Sizing: Limit your investment in any single parabola stock to a small percentage of your overall portfolio. This will minimize the impact of a potential loss.

- Stop-Loss Orders: Use stop-loss orders to automatically sell your shares if the price falls below a certain level. This can help protect your capital from significant losses.

- Profit Taking: Establish a target price at which you will sell your shares and take profits. Don’t get greedy and hold on too long, hoping for even greater gains.

Trading Strategies for Parabola Stocks

Several trading strategies can be employed when dealing with parabola stocks, each with its own risks and rewards:

- Momentum Trading: This strategy involves buying the stock as it breaks out to new highs, capitalizing on the upward momentum. However, it’s crucial to be quick and disciplined, as the momentum can quickly reverse.

- Short Selling: This strategy involves betting against the stock by borrowing shares and selling them, hoping to buy them back at a lower price. This is a high-risk strategy that should only be attempted by experienced traders.

- Options Trading: Options contracts can be used to leverage your investment and potentially generate higher returns. However, options trading is complex and requires a thorough understanding of the risks involved.

Long-Term Investing vs. Short-Term Trading

Parabola stocks are generally not suitable for long-term investing. The unsustainable nature of their growth makes them more appropriate for short-term trading strategies. If you’re a long-term investor, it’s best to focus on companies with strong fundamentals and sustainable growth prospects.

Examples of Parabola Stocks

Throughout history, numerous stocks have exhibited parabolic price patterns. While specific examples change over time, the underlying dynamics remain consistent. Identifying these patterns requires careful analysis and a critical assessment of the factors driving the stock’s price.

Conclusion

Parabola stocks present both opportunities and risks for investors. While the potential for quick gains can be alluring, it’s crucial to understand the inherent volatility and implement a well-defined strategy. Thorough due diligence, risk management, and a disciplined approach are essential for navigating the parabola stock phenomenon successfully. Remember that the market can remain irrational longer than you can remain solvent, so proceed with caution and always prioritize capital preservation. [See also: Value Investing vs Growth Investing] [See also: Understanding Stock Market Corrections] [See also: Risk Management Strategies for Investors]