Navigating the Waters: Share Price Forecasts and Investment Strategies

In the dynamic world of finance, understanding share price forecasts is crucial for investors seeking to make informed decisions. These forecasts, while not guarantees, offer valuable insights into potential future stock performance. This article delves into the intricacies of share price forecasts, exploring the methodologies, limitations, and practical applications for both seasoned and novice investors. We will examine various factors influencing these predictions and discuss how they can be integrated into a robust investment strategy. Ultimately, understanding the nuances of share price forecasts empowers investors to navigate the market with greater confidence and potentially enhance their portfolio returns.

Understanding Share Price Forecasts: A Comprehensive Overview

A share price forecast represents an analyst’s or algorithm’s projection of a stock’s future value. These forecasts are generated using a variety of techniques, ranging from fundamental analysis to technical analysis and quantitative modeling. The accuracy of a share price forecast depends heavily on the quality of the data used and the assumptions made by the forecaster. It’s essential to recognize that these predictions are inherently uncertain, as market conditions and unforeseen events can significantly impact stock prices.

The Role of Fundamental Analysis in Share Price Prediction

Fundamental analysis involves evaluating a company’s financial health, industry position, and competitive landscape to determine its intrinsic value. Analysts scrutinize financial statements, including balance sheets, income statements, and cash flow statements, to assess a company’s profitability, solvency, and growth potential. Key metrics such as earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE) are closely examined. Based on this analysis, analysts develop share price forecasts that reflect their assessment of the company’s fair value. A company with strong fundamentals and a promising outlook is likely to receive a positive share price forecast. [See also: Understanding Financial Ratios]

Technical Analysis: Charting the Course of Share Prices

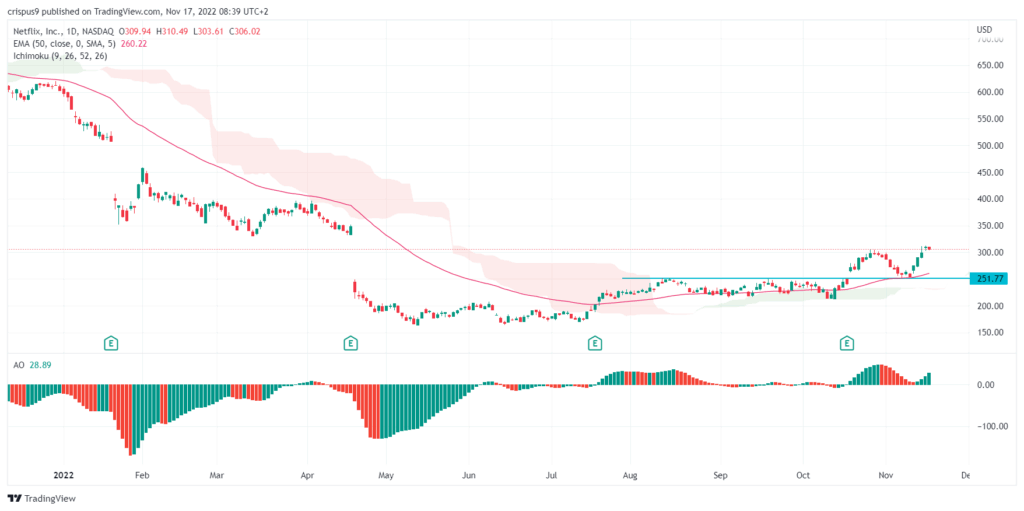

Technical analysis focuses on identifying patterns and trends in historical stock prices and trading volumes to predict future price movements. Technical analysts use charts and indicators to identify support and resistance levels, trend lines, and other technical signals. They believe that stock prices tend to follow predictable patterns and that these patterns can be used to generate share price forecasts. While fundamental analysis focuses on a company’s intrinsic value, technical analysis is more concerned with market sentiment and investor behavior. The effectiveness of technical analysis is a subject of debate, but many investors find it useful for short-term trading and timing their entry and exit points. Some prominent tools include Moving Averages, RSI, and MACD. These tools can help to determine potential buy or sell signals, influencing share price forecasts.

Quantitative Modeling: The Power of Algorithms in Forecasting

Quantitative modeling employs mathematical and statistical techniques to analyze vast amounts of data and generate share price forecasts. These models often incorporate factors such as macroeconomic indicators, market volatility, and company-specific data. Quantitative analysts use algorithms to identify patterns and relationships that may not be apparent through traditional analysis. The advantage of quantitative modeling is its ability to process large datasets and identify subtle trends. However, these models are only as good as the data they are based on, and they can be susceptible to biases and errors. The complexity of quantitative models also makes them difficult for non-experts to understand and interpret. These models contribute to the overall understanding and prediction of share price forecasts.

Factors Influencing Share Price Forecasts

Numerous factors can influence share price forecasts, making it crucial for investors to understand the underlying drivers of stock prices. These factors can be broadly categorized into company-specific factors, industry trends, macroeconomic conditions, and market sentiment.

Company-Specific Factors: The Foundation of Value

A company’s financial performance, management quality, and competitive position are key determinants of its share price forecast. Strong earnings growth, efficient operations, and a solid balance sheet can boost investor confidence and drive up the stock price. Conversely, weak financial performance, poor management decisions, and increased competition can negatively impact the share price forecast. Company announcements, such as earnings releases, product launches, and mergers and acquisitions, can also significantly influence investor sentiment and stock prices. A positive earnings surprise, for example, is likely to lead to an upward revision of the share price forecast. [See also: Analyzing Company Financial Statements]

Industry Trends: Riding the Wave of Growth

The overall health and growth prospects of the industry in which a company operates can also affect its share price forecast. Companies in rapidly growing industries, such as technology and healthcare, are likely to attract more investor interest and experience higher stock prices. Conversely, companies in declining industries may face headwinds and see their stock prices stagnate or decline. Industry-specific regulations, technological disruptions, and changes in consumer preferences can also impact share price forecasts. Understanding industry dynamics is crucial for making informed investment decisions.

Macroeconomic Conditions: The Big Picture

Macroeconomic factors, such as economic growth, inflation, interest rates, and unemployment, can have a significant impact on stock prices. A strong economy typically leads to higher corporate profits and increased investor confidence, which can drive up stock prices. Conversely, a weak economy can lead to lower profits and reduced investor confidence, which can depress stock prices. Interest rate hikes can make stocks less attractive compared to bonds, while inflation can erode corporate earnings. Monitoring macroeconomic indicators and understanding their potential impact on stock prices is essential for developing accurate share price forecasts.

Market Sentiment: The Emotional Rollercoaster

Market sentiment, or the overall mood of investors, can play a significant role in determining stock prices. Positive market sentiment, driven by optimism and confidence, can lead to a bull market, where stock prices rise steadily. Negative market sentiment, driven by fear and uncertainty, can lead to a bear market, where stock prices decline sharply. Market sentiment can be influenced by a variety of factors, including news events, political developments, and investor psychology. While it can be difficult to predict market sentiment, understanding its potential impact on stock prices is crucial for managing investment risk. Changes in market sentiment can dramatically affect share price forecasts.

Limitations of Share Price Forecasts

It is crucial to acknowledge the inherent limitations of share price forecasts. These forecasts are based on assumptions and models that may not accurately reflect future market conditions. Unforeseen events, such as geopolitical crises, natural disasters, and technological breakthroughs, can significantly impact stock prices and render forecasts obsolete. Furthermore, share price forecasts are often influenced by biases and conflicts of interest. Analysts may be pressured to issue positive forecasts to attract investment banking business or maintain good relationships with companies they cover. Investors should therefore view share price forecasts with a healthy dose of skepticism and conduct their own independent research before making investment decisions.

Integrating Share Price Forecasts into Investment Strategies

Despite their limitations, share price forecasts can be a valuable tool for investors when used in conjunction with other sources of information. Investors should consider a variety of forecasts from different sources and compare them to their own analysis. It is also important to understand the assumptions and methodologies underlying each forecast and to assess their credibility. Share price forecasts can be used to identify potentially undervalued or overvalued stocks, to assess the risk-reward profile of an investment, and to time entry and exit points. However, investors should never rely solely on share price forecasts when making investment decisions. A diversified portfolio and a long-term investment horizon are essential for mitigating risk and achieving financial goals. When considering different share price forecasts, it’s important to evaluate the track record of the forecaster and the transparency of their methods.

Conclusion: Navigating the Future with Informed Predictions

Share price forecasts offer valuable insights into potential future stock performance, but they should not be treated as guarantees. Investors should understand the methodologies, limitations, and potential biases associated with these forecasts. By integrating share price forecasts with their own research and analysis, investors can make more informed decisions and navigate the market with greater confidence. Remember that a diversified portfolio, a long-term investment horizon, and a healthy dose of skepticism are essential for achieving long-term financial success. Understanding the nuances of share price forecasts allows for a more strategic approach to investing and portfolio management. The key takeaway is that while share price forecasts are helpful, they should be used as one piece of the puzzle in a comprehensive investment strategy.