Navigating the Waters: Understanding Stock Predict Models and Their Limitations

The allure of predicting the stock market’s future has captivated investors and financial analysts for generations. The possibility of anticipating market movements and maximizing returns has fueled the development of various stock predict models. These models, ranging from simple technical analysis tools to complex artificial intelligence systems, aim to forecast future stock prices and trends. But how reliable are these stock predict approaches, and what are their inherent limitations?

This article delves into the world of stock prediction, exploring the different types of models used, the data they rely on, and the challenges they face. We’ll examine the assumptions underlying these models, discuss their potential benefits and drawbacks, and offer a balanced perspective on their utility in the real world of investing.

The Landscape of Stock Predict Models

The field of stock prediction is diverse, encompassing a wide range of methodologies and approaches. Some of the most common types of models include:

- Technical Analysis: This approach focuses on analyzing historical stock prices and trading volume to identify patterns and trends. Technical analysts use charts and indicators to predict future price movements based on past performance. Common tools include moving averages, relative strength index (RSI), and Fibonacci retracements.

- Fundamental Analysis: Fundamental analysis involves evaluating a company’s financial health and performance to determine its intrinsic value. This approach considers factors such as revenue, earnings, debt, and management quality. Investors using fundamental analysis believe that the market price will eventually reflect the company’s true value.

- Time Series Analysis: Time series models use statistical techniques to analyze data points collected over time. These models attempt to identify patterns and trends in the data to forecast future values. Common time series models include ARIMA (Autoregressive Integrated Moving Average) and Exponential Smoothing.

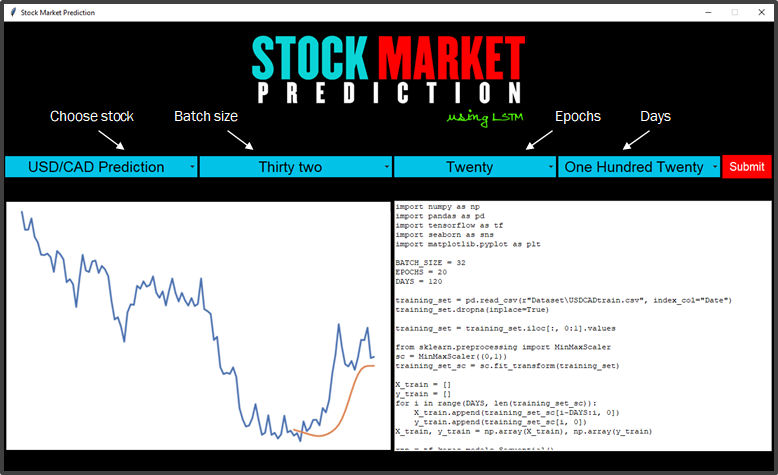

- Machine Learning: Machine learning models use algorithms to learn from data and make predictions. These models can analyze large datasets and identify complex relationships that might be missed by traditional methods. Common machine learning algorithms used in stock predict include neural networks, support vector machines, and random forests.

- Sentiment Analysis: This approach analyzes text data, such as news articles, social media posts, and company reports, to gauge investor sentiment. The idea is that positive sentiment can lead to increased buying pressure and higher stock prices, while negative sentiment can lead to selling pressure and lower stock prices.

Data: The Fuel for Stock Prediction

All stock predict models rely on data to generate forecasts. The quality and quantity of data are crucial factors in determining the accuracy of the predictions. Common data sources include:

- Historical Stock Prices and Trading Volume: This is the most basic data used in stock prediction. It provides information about past price movements and trading activity.

- Financial Statements: Financial statements, such as balance sheets, income statements, and cash flow statements, provide insights into a company’s financial health and performance.

- Economic Data: Economic indicators, such as GDP growth, inflation rates, and interest rates, can influence stock prices.

- News and Social Media: News articles, social media posts, and other text data can provide information about company performance, industry trends, and investor sentiment.

- Alternative Data: This includes non-traditional data sources, such as satellite imagery, credit card transactions, and web traffic data. Alternative data can provide unique insights into company performance and market trends.

Challenges and Limitations of Stock Prediction

Despite the sophistication of modern stock predict models, accurately forecasting stock prices remains a significant challenge. Several factors contribute to the difficulty of stock prediction:

- Market Volatility: The stock market is inherently volatile, influenced by a complex interplay of factors, including economic news, political events, and investor sentiment. This volatility can make it difficult to identify stable patterns and trends.

- Randomness: Some argue that stock prices are largely random and unpredictable. The Efficient Market Hypothesis (EMH) suggests that all available information is already reflected in stock prices, making it impossible to consistently outperform the market.

- Data Limitations: Even with vast amounts of data, it can be difficult to capture all the factors that influence stock prices. Data may be incomplete, inaccurate, or biased, leading to inaccurate predictions.

- Overfitting: Machine learning models can be prone to overfitting, which means they learn the training data too well and fail to generalize to new data. This can lead to inaccurate predictions in real-world scenarios.

- Black Swan Events: Unexpected and unpredictable events, such as pandemics, financial crises, and geopolitical shocks, can have a significant impact on stock prices and invalidate even the most sophisticated stock predict models.

- Human Behavior: Investor psychology and behavior can be irrational and unpredictable, making it difficult to model market movements accurately. Fear, greed, and herd mentality can drive market bubbles and crashes.

The Role of Assumptions

All stock predict models rely on certain assumptions about the market and investor behavior. These assumptions can significantly impact the accuracy of the predictions. For example, many technical analysis tools assume that historical price patterns will repeat themselves in the future. However, this may not always be the case, as market conditions and investor sentiment can change over time.

Similarly, fundamental analysis assumes that the market price will eventually reflect a company’s intrinsic value. However, this process can take a long time, and the market price may deviate significantly from the intrinsic value in the short term. It’s crucial to understand the underlying assumptions of any stock predict model before relying on its predictions.

Using Stock Predict Models Wisely

While stock predict models have limitations, they can still be valuable tools for investors. However, it’s essential to use them wisely and avoid relying on them blindly. Here are some tips for using stock prediction effectively:

- Understand the Limitations: Be aware of the challenges and limitations of stock prediction. No model is perfect, and all predictions should be taken with a grain of salt.

- Use Multiple Models: Don’t rely on a single model. Use a combination of different approaches to get a more comprehensive view of the market.

- Consider the Context: Take into account the broader economic and political context when interpreting predictions. Major events can significantly impact stock prices.

- Manage Risk: Don’t invest more than you can afford to lose. Use stop-loss orders to limit your potential losses.

- Focus on the Long Term: Don’t try to get rich quick. Focus on long-term investing and building a diversified portfolio.

- Continuously Learn: The field of stock prediction is constantly evolving. Stay up-to-date on the latest research and developments.

Stock predict tools can provide valuable insights, but they are not a substitute for sound investment judgment. Always do your own research and consult with a financial advisor before making any investment decisions.

The Future of Stock Prediction

The field of stock prediction is likely to continue to evolve in the coming years. Advances in artificial intelligence, machine learning, and data analytics are opening up new possibilities for forecasting stock prices. However, the fundamental challenges of stock prediction will likely remain. The market will always be subject to volatility, randomness, and human behavior, making it difficult to predict with certainty.

Despite these challenges, stock predict models will likely continue to play an important role in the investment process. As technology advances, these models may become more sophisticated and accurate. However, it’s crucial to remember that no model can predict the future with perfect accuracy. Investors should use stock prediction tools as one piece of the puzzle, along with their own research and judgment.

Ultimately, successful investing requires a combination of knowledge, skill, and discipline. By understanding the limitations of stock predict models and using them wisely, investors can improve their chances of achieving their financial goals.

[See also: Algorithmic Trading Strategies] [See also: Understanding Market Volatility] [See also: The Efficient Market Hypothesis]