Navigating the World of Token Exchanges: A Comprehensive Guide

In the rapidly evolving landscape of digital finance, token exchanges stand as pivotal hubs for the trading and management of various cryptocurrencies and digital assets. These platforms facilitate the seamless exchange of tokens, connecting buyers and sellers in a decentralized and often global marketplace. Understanding the intricacies of token exchanges is crucial for anyone looking to participate in the crypto economy, whether as a seasoned investor or a curious newcomer. This comprehensive guide will delve into the different types of token exchanges, their functionalities, key considerations for choosing the right platform, and the future trends shaping this dynamic sector.

What are Token Exchanges?

At their core, token exchanges are digital marketplaces where users can buy, sell, and trade various cryptocurrencies and other digital tokens. These platforms operate by matching buy and sell orders, providing liquidity and price discovery for the assets listed. Think of them as the stock exchanges of the crypto world, but often operating 24/7 and globally accessible.

The primary function of a token exchange is to provide a secure and efficient environment for trading digital assets. This includes:

- Order Matching: Connecting buyers and sellers based on price and quantity.

- Asset Custody: Storing and managing users’ digital assets.

- Price Discovery: Facilitating the determination of fair market prices for tokens.

- Liquidity Provision: Ensuring sufficient trading volume to allow for efficient transactions.

- Security Measures: Implementing robust security protocols to protect users’ funds and data.

Types of Token Exchanges

Token exchanges come in various forms, each with its own unique characteristics and target audience. Understanding these different types is essential for choosing the platform that best suits your needs.

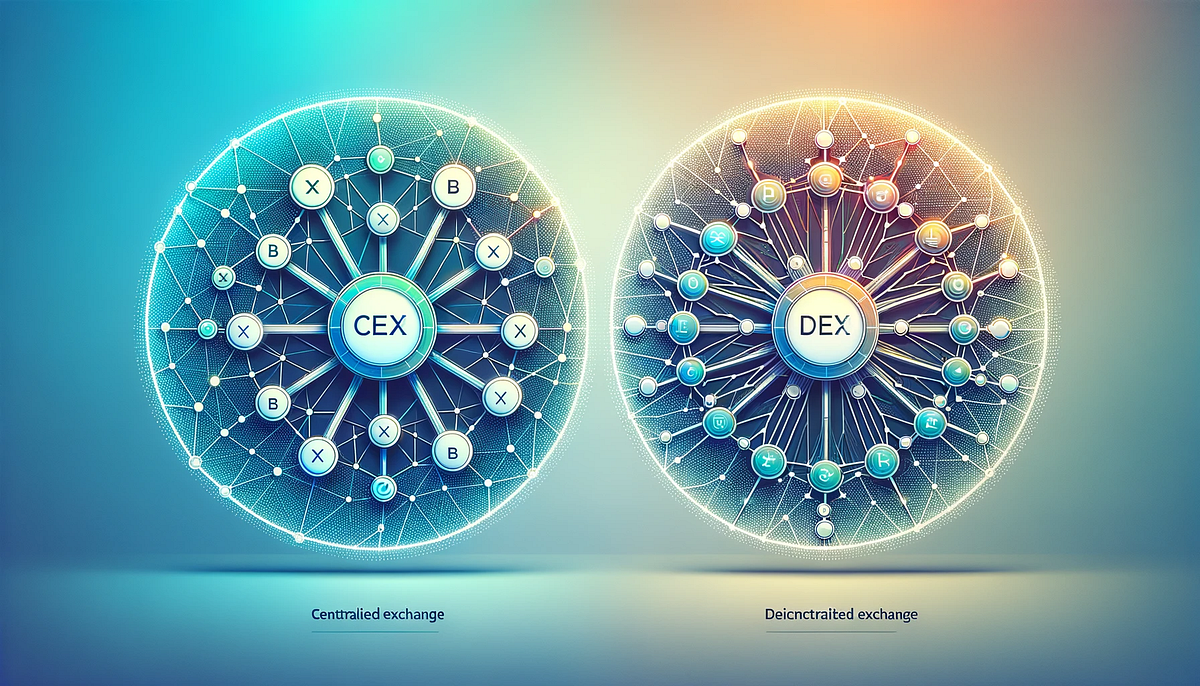

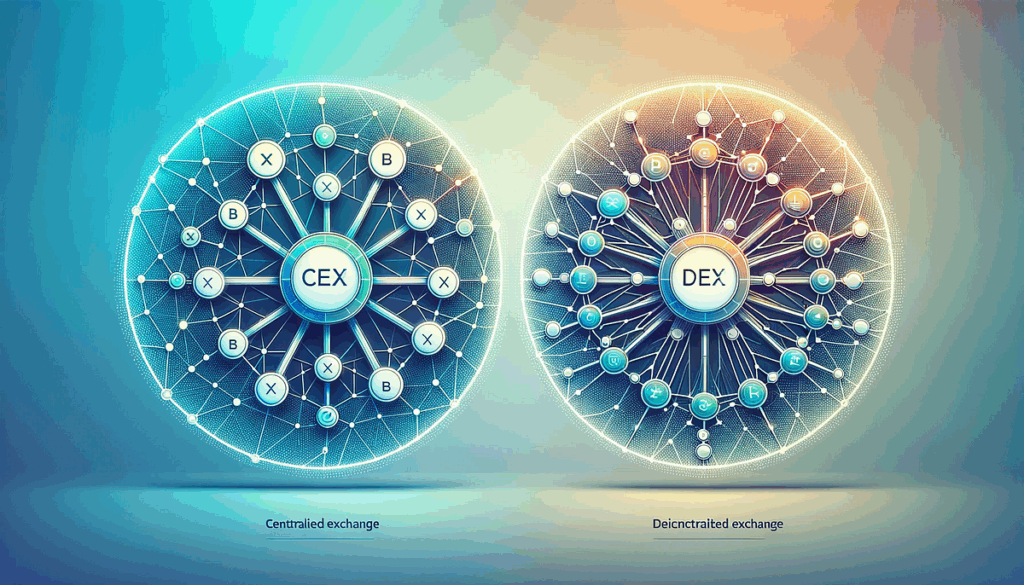

Centralized Exchanges (CEXs)

Centralized exchanges are the most common type of token exchange. They are operated by a central authority, typically a company, that oversees all aspects of the platform. CEXs offer a user-friendly interface, high liquidity, and a wide range of trading pairs. However, they also require users to trust the central authority with their funds and personal information.

Examples of popular centralized exchanges include Binance, Coinbase, Kraken, and KuCoin. These platforms often provide additional services such as staking, lending, and margin trading.

Decentralized Exchanges (DEXs)

Decentralized exchanges operate without a central authority, relying instead on smart contracts to facilitate trades. DEXs offer greater privacy and security compared to CEXs, as users retain control of their funds at all times. However, DEXs can be more complex to use and may have lower liquidity than CEXs.

Examples of popular decentralized exchanges include Uniswap, SushiSwap, and PancakeSwap. These platforms typically use automated market makers (AMMs) to provide liquidity and determine prices.

Hybrid Exchanges

Hybrid exchanges aim to combine the best features of both centralized and decentralized exchanges. They may offer a centralized order book with decentralized custody of funds or vice versa. Hybrid exchanges are still relatively new, but they have the potential to offer a more balanced approach to token exchange.

Key Considerations When Choosing a Token Exchange

Selecting the right token exchange is a crucial decision that can significantly impact your trading experience. Here are some key factors to consider:

- Security: Look for exchanges with robust security measures, such as two-factor authentication, cold storage of funds, and regular security audits.

- Liquidity: Choose exchanges with high trading volume to ensure that you can easily buy and sell tokens at fair prices.

- Fees: Compare the trading fees charged by different exchanges, as these can vary significantly.

- Supported Tokens: Ensure that the exchange supports the tokens that you are interested in trading.

- User Interface: Opt for an exchange with a user-friendly interface that is easy to navigate.

- Customer Support: Check the quality of the exchange’s customer support, as you may need assistance with technical issues or account problems.

- Regulation: Consider the regulatory environment in which the exchange operates, as this can impact the security and legality of your transactions.

The Future of Token Exchanges

The world of token exchanges is constantly evolving, driven by technological advancements and changing regulatory landscapes. Here are some key trends shaping the future of this sector:

- Increased Regulation: Governments around the world are increasingly scrutinizing token exchanges, which is likely to lead to stricter regulations and compliance requirements.

- DeFi Integration: Decentralized finance (DeFi) protocols are becoming increasingly integrated with token exchanges, offering new opportunities for trading, lending, and staking. [See also: DeFi Explained: A Beginner’s Guide]

- Cross-Chain Trading: The ability to trade tokens across different blockchain networks is becoming increasingly important, leading to the development of cross-chain token exchanges.

- Institutional Adoption: Institutional investors are increasingly entering the crypto market, driving demand for more sophisticated token exchanges with institutional-grade security and compliance.

- Improved User Experience: Token exchanges are constantly improving their user interfaces and features to make them more accessible to a wider audience.

Token Exchange Security Best Practices

While token exchanges implement their own security measures, users also play a vital role in safeguarding their assets. Here are some essential security best practices:

- Enable Two-Factor Authentication (2FA): This adds an extra layer of security to your account by requiring a code from your phone or another device in addition to your password.

- Use Strong, Unique Passwords: Avoid using easily guessable passwords and never reuse passwords across multiple accounts.

- Be Wary of Phishing Scams: Be cautious of emails or messages that attempt to trick you into revealing your login credentials or private keys. Always verify the sender’s identity before clicking on any links.

- Store Your Cryptocurrency in a Secure Wallet: Consider using a hardware wallet or a reputable software wallet to store your cryptocurrency offline. This reduces the risk of your funds being stolen if the exchange is hacked.

- Regularly Review Your Account Activity: Monitor your account activity for any suspicious transactions. Report any unauthorized activity to the exchange immediately.

- Understand the Risks: Be aware of the risks associated with trading cryptocurrency, including market volatility, security vulnerabilities, and regulatory uncertainty.

The Role of Token Exchanges in the Crypto Ecosystem

Token exchanges are fundamental to the health and growth of the cryptocurrency ecosystem. They provide the necessary infrastructure for price discovery, liquidity, and market access. Without token exchanges, it would be significantly more difficult for individuals and institutions to buy, sell, and trade cryptocurrencies.

Moreover, token exchanges play a crucial role in supporting the development of new blockchain projects. By listing new tokens, exchanges provide a platform for these projects to raise capital, gain exposure, and build a community.

Conclusion

Token exchanges are essential gateways to the world of cryptocurrencies and digital assets. Understanding the different types of exchanges, key considerations for choosing a platform, and future trends shaping the sector is crucial for anyone looking to participate in the crypto economy. By following security best practices and staying informed about the latest developments, you can navigate the world of token exchanges with confidence and maximize your potential for success. The future of token exchanges is bright, with increasing regulation, DeFi integration, and institutional adoption all pointing towards a more mature and sophisticated market. As you embark on your crypto journey, remember to conduct thorough research, exercise caution, and always prioritize security. Choosing the right token exchange is the first step towards unlocking the vast potential of the digital asset revolution.