Navigating Uncertainty: A Comprehensive Look at Stock Market Prediction

The allure of predicting the stock market has captivated investors, economists, and mathematicians for decades. The potential to foresee market movements and capitalize on them is undeniably attractive. However, the reality of stock market prediction is far more complex than simple speculation. This article delves into the various methods, challenges, and realities of attempting to forecast the future of the stock market.

The Elusive Nature of Stock Market Prediction

Stock market prediction isn’t about having a crystal ball; it’s about analyzing data, identifying trends, and understanding the multitude of factors that influence market behavior. The stock market is a dynamic, complex system influenced by a vast array of variables, including economic indicators, political events, investor sentiment, and even global pandemics. This inherent complexity makes accurate, consistent prediction exceedingly difficult.

Traditional economic models often fall short because they struggle to account for unpredictable events and the irrational behavior of market participants. Behavioral economics highlights how human emotions like fear and greed can drive market fluctuations, often overriding rational analysis. Therefore, any successful approach to stock market prediction must consider both quantitative and qualitative factors.

Methods Employed in Stock Market Forecasting

Technical Analysis: Charting the Course

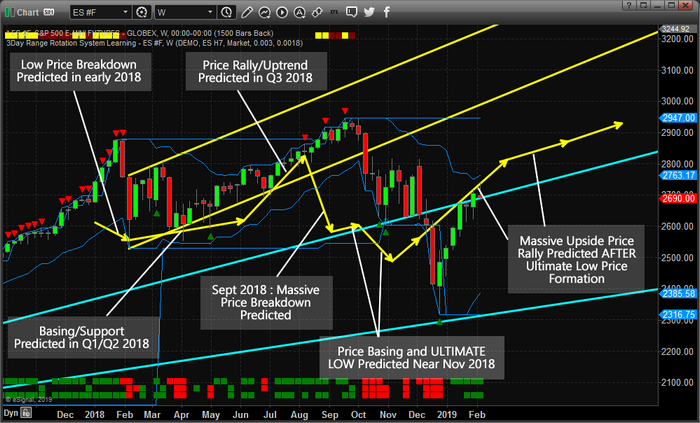

Technical analysis involves studying historical price and volume data to identify patterns and trends. Technical analysts use charts and indicators to predict future price movements based on the assumption that history tends to repeat itself. Common tools include moving averages, trend lines, and oscillators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). While technical analysis can be useful for short-term trading, its effectiveness for long-term stock market prediction is debated.

Fundamental Analysis: Assessing Intrinsic Value

Fundamental analysis focuses on evaluating the intrinsic value of a company by examining its financial statements, industry outlook, and competitive position. Fundamental analysts look at factors like revenue growth, profitability, debt levels, and management quality to determine whether a stock is overvalued or undervalued. This approach is often used for long-term investing and can provide insights into the potential future performance of individual companies, which can indirectly inform broader stock market prediction.

Quantitative Analysis: The Power of Algorithms

Quantitative analysis employs mathematical and statistical models to identify trading opportunities. Quants use algorithms to analyze vast amounts of data and automate trading decisions. These models often incorporate factors like macroeconomic data, market sentiment, and trading volume. Machine learning and artificial intelligence are increasingly being used in quantitative analysis to improve the accuracy of stock market prediction. However, even the most sophisticated algorithms are not foolproof and can be susceptible to unexpected market shocks.

Sentiment Analysis: Gauging Market Mood

Sentiment analysis involves monitoring news articles, social media posts, and other sources of information to gauge investor sentiment. The idea is that market psychology can significantly influence stock prices. Tools like natural language processing (NLP) are used to analyze text and identify positive or negative sentiment. While sentiment analysis can provide valuable insights into market mood, it is often difficult to translate sentiment into concrete stock market prediction.

Challenges in Predicting the Stock Market

Several factors make accurate stock market prediction a formidable challenge:

- Randomness: The stock market is inherently influenced by random events, such as unexpected economic news or geopolitical crises.

- Complexity: The sheer number of variables that affect the stock market makes it difficult to build accurate predictive models.

- Human Behavior: Investor emotions and biases can lead to irrational market movements that are difficult to predict.

- Data Limitations: Historical data may not be a reliable indicator of future performance, especially in rapidly changing market conditions.

- Feedback Loops: Predictions themselves can influence market behavior, creating feedback loops that invalidate the original forecast.

The Role of Economic Indicators

Economic indicators play a crucial role in understanding the overall health and direction of the economy, which in turn influences the stock market. Key indicators include:

- Gross Domestic Product (GDP): A measure of the total value of goods and services produced in a country.

- Inflation Rate: The rate at which the general level of prices for goods and services is rising.

- Unemployment Rate: The percentage of the labor force that is unemployed.

- Interest Rates: The cost of borrowing money, which can impact investment decisions.

- Consumer Confidence Index: A measure of how optimistic consumers are about the economy.

While these indicators can provide valuable insights, they are not perfect predictors of stock market prediction. The relationship between economic indicators and the stock market is complex and can vary over time.

The Impact of Global Events

Global events, such as political instability, trade wars, and pandemics, can have a significant impact on the stock market. These events can create uncertainty and volatility, making stock market prediction even more challenging. For example, the COVID-19 pandemic caused a sharp decline in stock markets worldwide, followed by a rapid recovery. Predicting the timing and magnitude of such events is virtually impossible, but understanding their potential impact is crucial for investors.

The Future of Stock Market Prediction

Advancements in technology, particularly in the fields of artificial intelligence and machine learning, are transforming the landscape of stock market prediction. These technologies can analyze vast amounts of data and identify patterns that humans may miss. However, even the most sophisticated AI models are not immune to the inherent uncertainties of the stock market. The future of stock market prediction likely involves a combination of human expertise and advanced technology.

One promising area is the development of more sophisticated sentiment analysis tools that can better capture the nuances of market psychology. Another is the use of alternative data sources, such as satellite imagery and credit card transactions, to gain insights into economic activity. Ultimately, the goal is to create more robust and reliable predictive models that can help investors make more informed decisions.

Practical Implications for Investors

While accurate stock market prediction remains elusive, investors can still benefit from understanding the various methods and challenges involved. Here are some practical implications:

- Diversification: Diversifying your portfolio across different asset classes can help reduce risk.

- Long-Term Perspective: Focusing on long-term investment goals can help you weather short-term market volatility.

- Risk Management: Understanding your risk tolerance and setting appropriate stop-loss orders can help protect your capital.

- Continuous Learning: Staying informed about market trends and economic developments can help you make more informed investment decisions.

- Seek Professional Advice: Consider consulting with a financial advisor who can provide personalized guidance.

Remember that past performance is not indicative of future results, and no investment strategy can guarantee profits. The key is to approach the stock market with a realistic understanding of its complexities and uncertainties.

Conclusion: Embracing Uncertainty

Stock market prediction is a complex and challenging endeavor. While various methods and technologies can provide valuable insights, the inherent uncertainties of the market make accurate, consistent prediction exceedingly difficult. Instead of trying to predict the future, investors should focus on building a diversified portfolio, managing risk, and staying informed about market trends. Embracing uncertainty and focusing on long-term goals is the key to successful investing.

[See also: Understanding Market Volatility]

[See also: The Role of AI in Finance]

[See also: Investing for Beginners]