Navigating Uncertainty: Stock Market Prediction and Investment Strategies

The stock market, a complex and dynamic ecosystem, is a subject of intense scrutiny and constant analysis. Investors, economists, and financial analysts alike dedicate significant time and resources attempting to decipher its patterns and, most importantly, predict its future trajectory. The allure of accurately forecasting market movements stems from the potential for substantial financial gain, but the inherent unpredictability of the stock market makes it a challenging endeavor. This article delves into the various methods used for stock market prediction, the factors influencing market behavior, and the strategies investors can employ to navigate the inherent uncertainty.

Understanding the Landscape of Stock Market Prediction

Predicting the stock market is not merely about guessing whether prices will go up or down. It involves a multifaceted approach that considers a vast array of data points and economic indicators. Two primary schools of thought dominate the field: fundamental analysis and technical analysis.

Fundamental Analysis: A Deep Dive into Value

Fundamental analysis focuses on evaluating the intrinsic value of a company. This involves scrutinizing financial statements such as balance sheets, income statements, and cash flow statements. Analysts assess a company’s profitability, debt levels, and management effectiveness to determine if its stock is undervalued or overvalued. Key ratios like price-to-earnings (P/E), price-to-book (P/B), and debt-to-equity (D/E) are crucial tools in this process. Furthermore, fundamental analysts consider macroeconomic factors such as interest rates, inflation, and economic growth, as these can significantly impact a company’s performance. Ultimately, fundamental analysis seeks to identify companies with strong fundamentals that are likely to generate long-term growth and profitability. The stock market prediction based on this method is more likely to be long-term than short-term.

Technical Analysis: Charting the Course of Price Movements

Technical analysis, in contrast, focuses on analyzing historical price and volume data to identify patterns and trends. Technical analysts believe that all relevant information is already reflected in the price of a stock. They use charts and various technical indicators, such as moving averages, relative strength index (RSI), and Fibonacci retracements, to identify potential buying and selling opportunities. Technical analysis is often used for short-term trading strategies, as it aims to capitalize on short-term price fluctuations. Critics argue that technical analysis is subjective and lacks a solid theoretical foundation, while proponents claim that it can provide valuable insights into market sentiment and momentum. The use of algorithms in stock market prediction is common in this form of analysis.

Factors Influencing Stock Market Behavior

Numerous factors can influence the stock market, making accurate prediction a complex task. Understanding these factors is crucial for investors seeking to make informed decisions.

Economic Indicators: The Pulse of the Economy

Economic indicators provide insights into the overall health of the economy. Key indicators include Gross Domestic Product (GDP) growth, inflation rates, unemployment rates, and consumer confidence. Strong economic growth typically leads to higher corporate profits and increased stock prices, while economic downturns can have the opposite effect. Central bank policies, such as interest rate adjustments, also play a significant role in shaping market behavior. Lower interest rates tend to stimulate economic activity and boost stock prices, while higher rates can dampen growth and lead to market corrections. [See also: Understanding Economic Indicators and Their Impact on Investments]

Geopolitical Events: Global Uncertainty

Geopolitical events, such as wars, political instability, and trade disputes, can significantly impact the stock market. These events can create uncertainty and volatility, leading to sharp price swings. For example, a trade war between major economies can disrupt global supply chains and negatively affect corporate earnings. Similarly, political instability in a key region can disrupt commodity markets and impact companies operating in that area. Investors need to closely monitor geopolitical developments and assess their potential impact on their portfolios. The stock market prediction becomes harder with these factors.

Company-Specific News: The Micro Perspective

Company-specific news, such as earnings announcements, product launches, and management changes, can also influence stock prices. Positive news typically leads to higher stock prices, while negative news can have the opposite effect. Investors closely monitor company earnings reports and analyst ratings to gauge the financial health and future prospects of individual companies. Surprise earnings results, either positive or negative, can trigger significant price movements. [See also: Analyzing Company Financials for Investment Decisions]

Investor Sentiment: The Emotional Rollercoaster

Investor sentiment, or the overall mood of the market, can also play a significant role in shaping stock prices. When investors are optimistic and confident, they are more likely to buy stocks, driving prices higher. Conversely, when investors are pessimistic and fearful, they are more likely to sell stocks, leading to price declines. Investor sentiment can be influenced by a variety of factors, including news events, economic data, and social media trends. Understanding investor sentiment can provide valuable insights into potential market movements, but it is important to remember that sentiment can be irrational and unpredictable. Stock market prediction is made more difficult because of this.

The Role of Technology in Stock Market Prediction

Technology has revolutionized the way the stock market operates, and it has also had a significant impact on the field of stock market prediction. Algorithmic trading, artificial intelligence (AI), and machine learning are increasingly being used to analyze vast amounts of data and identify potential trading opportunities.

Algorithmic Trading: Speed and Efficiency

Algorithmic trading involves using computer programs to execute trades based on pre-defined rules and parameters. These algorithms can analyze market data in real-time and execute trades much faster than human traders. Algorithmic trading is often used for high-frequency trading (HFT), which involves executing a large number of trades in a very short period of time. While algorithmic trading can improve efficiency and reduce transaction costs, it can also contribute to market volatility. [See also: The Impact of Algorithmic Trading on Market Stability]

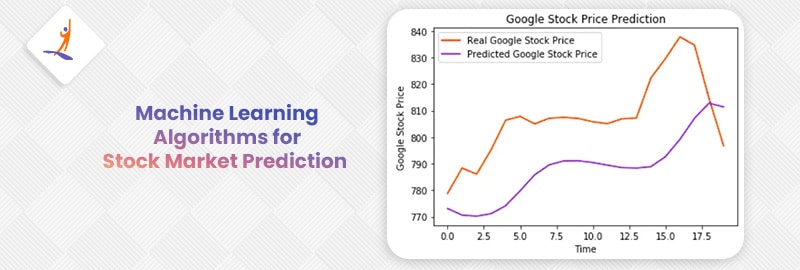

Artificial Intelligence and Machine Learning: The Future of Prediction?

AI and machine learning are increasingly being used to analyze complex market data and identify patterns that humans might miss. Machine learning algorithms can be trained on historical data to predict future price movements. These algorithms can also adapt and learn from new data, improving their accuracy over time. While AI and machine learning hold great promise for stock market prediction, they are not foolproof. The stock market is a complex and dynamic system, and even the most sophisticated algorithms can be fooled by unexpected events. The reliance on this technology for stock market prediction is growing rapidly.

Strategies for Navigating Market Uncertainty

Given the inherent unpredictability of the stock market, investors need to adopt strategies that can help them navigate uncertainty and manage risk.

Diversification: Spreading the Risk

Diversification is a fundamental principle of investing. It involves spreading your investments across a variety of asset classes, sectors, and geographic regions. By diversifying your portfolio, you can reduce your exposure to any single investment and mitigate the impact of market volatility. A well-diversified portfolio should include a mix of stocks, bonds, and other assets, such as real estate and commodities. This is a key strategy when stock market prediction is difficult.

Long-Term Investing: Time in the Market, Not Timing the Market

Trying to time the market, or predict short-term price movements, is a risky and often unsuccessful strategy. Instead, investors should focus on long-term investing, which involves holding investments for several years or even decades. Long-term investing allows you to ride out market fluctuations and benefit from the long-term growth of the economy. It also reduces the need to constantly monitor the market and make frequent trading decisions.

Dollar-Cost Averaging: Investing Regularly

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market price. This strategy can help you avoid the risk of investing a large sum of money at the peak of the market. When prices are low, you buy more shares, and when prices are high, you buy fewer shares. Over time, this can result in a lower average cost per share and higher returns. This strategy is especially useful when accurate stock market prediction is impossible.

Staying Informed: Continuous Learning

The stock market is constantly evolving, and investors need to stay informed about the latest trends and developments. This involves reading financial news, attending industry conferences, and consulting with financial advisors. By continuously learning and adapting, investors can make more informed decisions and improve their chances of success. This is critical even with sophisticated stock market prediction tools.

Conclusion: Embracing Uncertainty

Stock market prediction is a complex and challenging endeavor. While various methods and technologies can provide valuable insights, the market remains inherently unpredictable. Investors should focus on understanding the factors that influence market behavior, adopting strategies that can help them navigate uncertainty, and staying informed about the latest trends and developments. By embracing uncertainty and focusing on long-term goals, investors can increase their chances of achieving financial success. The key is to manage risk effectively and avoid the temptation to make impulsive decisions based on short-term market fluctuations. The ability to forecast the stock market prediction is not a guarantee of success, but a well-informed and disciplined approach can significantly improve investment outcomes.