Navigating Uncertainty: Stock Market Predictions and Strategies for 2024

The stock market, a complex and dynamic ecosystem, is perpetually subject to predictions. Investors, analysts, and economists constantly attempt to forecast its future performance. Understanding these predictions on the stock market is crucial for anyone looking to make informed investment decisions. This article delves into the various factors influencing these predictions on the stock market, explores some of the prevalent forecasts for 2024, and offers strategies for navigating the inherent uncertainties.

Understanding the Landscape of Stock Market Predictions

Making accurate predictions on the stock market is notoriously difficult. Numerous variables interact in complex ways, often leading to unexpected outcomes. Some of the key factors that influence market behavior and, consequently, stock market predictions, include:

- Economic Indicators: GDP growth, inflation rates, unemployment figures, and consumer spending all play a significant role.

- Interest Rates: Decisions made by central banks regarding interest rates can dramatically impact borrowing costs and investment returns.

- Geopolitical Events: Global events such as political instability, trade wars, and international conflicts can create volatility and uncertainty.

- Company Earnings: The financial performance of individual companies, particularly those with large market capitalization, influences overall market sentiment.

- Technological Advancements: Breakthroughs in technology can disrupt industries and create new investment opportunities.

- Investor Sentiment: Market psychology and investor confidence can drive short-term price fluctuations.

Predictions on the Stock Market for 2024: A Mixed Bag

Looking ahead to 2024, predictions on the stock market are varied. Some analysts foresee continued growth, driven by a resilient economy and strong corporate earnings. Others anticipate a correction, citing concerns about inflation, rising interest rates, and potential recessionary pressures. It’s important to note that no single prediction is definitive, and investors should consider a range of perspectives.

Bullish Scenarios

Optimistic stock market predictions often hinge on the expectation that inflation will gradually cool down, allowing central banks to ease monetary policy. This could lead to lower interest rates, boosting economic growth and corporate profitability. Furthermore, continued innovation in sectors such as artificial intelligence and renewable energy could fuel market momentum.

Bearish Scenarios

Pessimistic stock market predictions focus on the risks of a prolonged period of high inflation, which could force central banks to maintain tight monetary policies for longer than anticipated. This could lead to a slowdown in economic growth, potentially triggering a recession. Geopolitical instability and supply chain disruptions are also cited as potential headwinds.

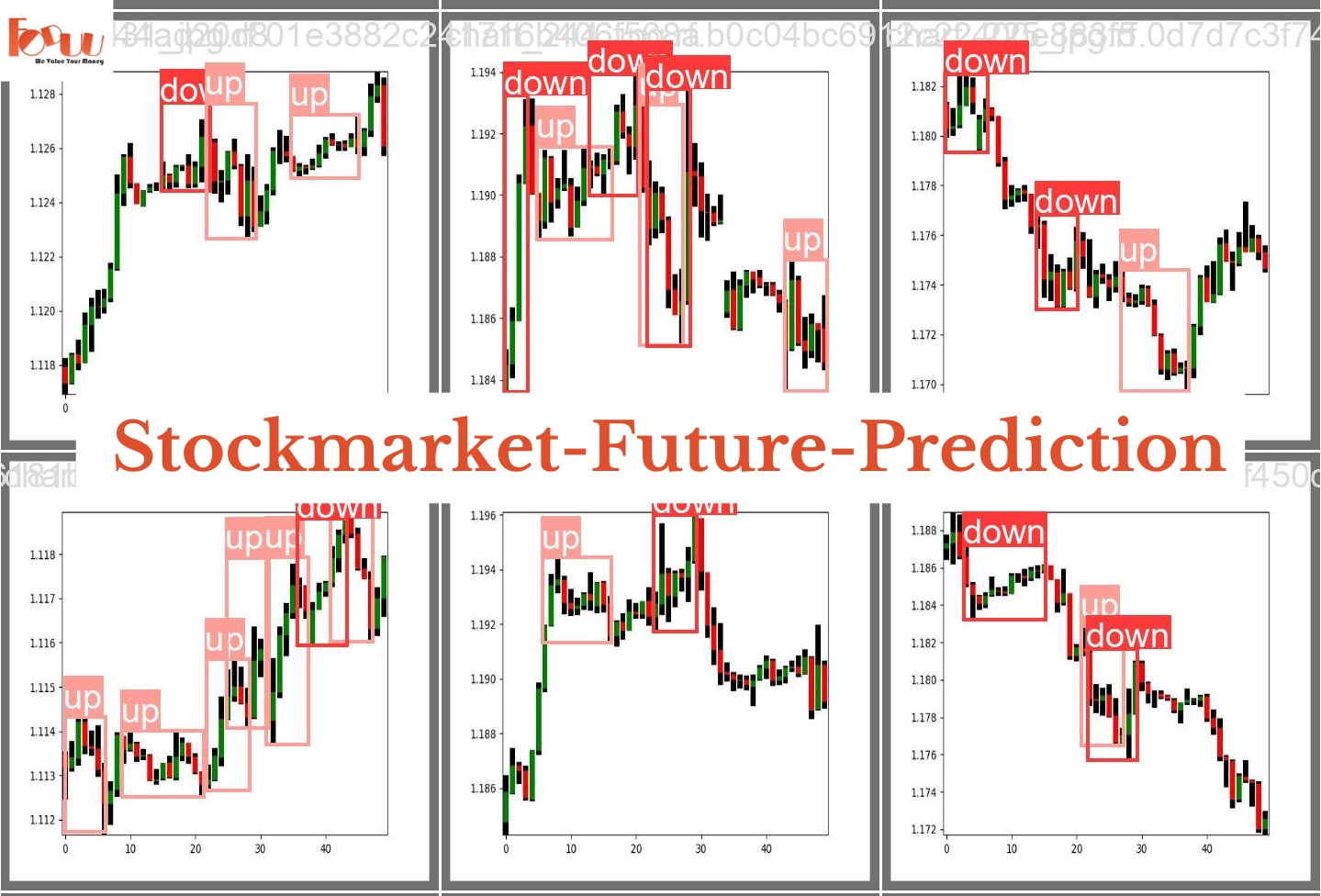

The Role of Artificial Intelligence in Stock Market Predictions

Artificial intelligence (AI) is increasingly being used in stock market predictions. AI algorithms can analyze vast amounts of data, identify patterns, and generate forecasts. While AI can be a valuable tool, it’s essential to recognize its limitations. AI models are only as good as the data they are trained on, and they may not be able to accurately predict unforeseen events. [See also: The Impact of AI on Financial Markets]

Strategies for Navigating Uncertainty in the Stock Market

Given the inherent uncertainty of predictions on the stock market, it’s crucial for investors to adopt a prudent and diversified approach. Here are some strategies for navigating market volatility:

Diversification

Spreading investments across different asset classes, sectors, and geographic regions can help mitigate risk. Diversification reduces the impact of any single investment performing poorly.

Long-Term Perspective

Adopting a long-term investment horizon can help investors weather short-term market fluctuations. Trying to time the market based on stock market predictions is often a losing strategy.

Dollar-Cost Averaging

Investing a fixed amount of money at regular intervals, regardless of market conditions, can help reduce the risk of buying high and selling low.

Risk Management

Understanding one’s risk tolerance and setting appropriate stop-loss orders can help protect against significant losses.

Staying Informed

Keeping abreast of economic news, company earnings reports, and geopolitical events can help investors make more informed decisions. However, it’s important to critically evaluate information and avoid being swayed by sensational headlines.

Consulting with a Financial Advisor

Seeking professional advice from a qualified financial advisor can provide valuable guidance and support in navigating the complexities of the stock market. A financial advisor can help investors develop a personalized investment strategy based on their individual circumstances and goals. [See also: Choosing the Right Financial Advisor]

The Psychology of Stock Market Predictions

It’s crucial to understand the psychological factors that can influence stock market predictions and investor behavior. Fear and greed are powerful emotions that can drive market bubbles and crashes. Investors should be aware of their own biases and avoid making impulsive decisions based on emotional reactions to market news.

Confirmation Bias

Confirmation bias is the tendency to seek out information that confirms one’s existing beliefs and to ignore information that contradicts them. This can lead investors to selectively focus on stock market predictions that align with their own views, even if those predictions are not supported by evidence.

Herd Mentality

Herd mentality is the tendency to follow the crowd, even if the crowd is making irrational decisions. This can lead to market bubbles and crashes, as investors pile into assets that are already overvalued or panic sell during market downturns.

Overconfidence

Overconfidence is the tendency to overestimate one’s own abilities and knowledge. This can lead investors to take on excessive risk and to make poor investment decisions based on flawed stock market predictions.

Analyzing the Accuracy of Stock Market Predictions

Evaluating the historical accuracy of stock market predictions can provide valuable insights into the limitations of forecasting. Studies have shown that many stock market predictions are inaccurate, particularly in the short term. This underscores the importance of not relying solely on forecasts when making investment decisions.

Furthermore, the track record of different forecasting methods varies widely. Some methods, such as fundamental analysis, may be more reliable than others, such as technical analysis. However, even the most sophisticated forecasting methods are subject to error.

Beyond the Numbers: Qualitative Factors in Stock Market Predictions

While quantitative data plays a crucial role in stock market predictions, qualitative factors are also important. These factors include:

- Management Quality: The competence and integrity of a company’s management team can significantly impact its performance.

- Competitive Landscape: The competitive dynamics of an industry can influence a company’s ability to generate profits.

- Regulatory Environment: Changes in regulations can create opportunities or challenges for companies.

- Social Trends: Shifts in consumer preferences and social values can impact the demand for certain products and services.

Conclusion: Navigating the Future with Informed Decisions

Predictions on the stock market are an integral part of the investment landscape, but they should be viewed with a healthy dose of skepticism. The market is inherently unpredictable, and no single forecast can guarantee success. By understanding the factors that influence market behavior, adopting a diversified and long-term investment approach, and staying informed, investors can navigate the uncertainties of the stock market and achieve their financial goals. Remember to consult with a qualified financial advisor to develop a personalized investment strategy that aligns with your individual circumstances and risk tolerance. The key is to make informed decisions based on a comprehensive understanding of the market, rather than relying solely on stock market predictions.