Parabolic Stock Meaning: Understanding the Exponential Growth Pattern

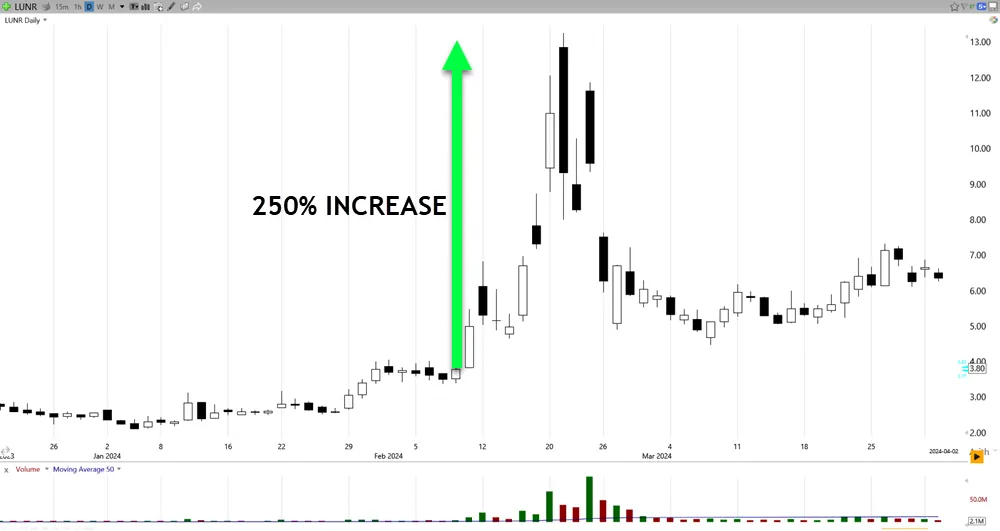

In the dynamic world of stock trading, understanding different price patterns is crucial for making informed investment decisions. One such pattern is the parabolic stock movement. The parabolic stock meaning refers to a situation where a stock’s price experiences a rapid, almost vertical increase over a short period. This pattern resembles a parabola on a chart, hence the name. Understanding the parabolic stock meaning is vital because it often signals a potential peak and subsequent correction.

What is a Parabolic Stock?

A parabolic stock is characterized by an accelerating upward price trend. Initially, the stock might experience steady growth, but as the trend gains momentum, the price increases become more dramatic. This creates a curved, almost vertical ascent on a price chart, resembling a parabola. The parabolic stock meaning in this context signifies heightened investor enthusiasm and often speculative buying.

Several factors can contribute to a stock exhibiting parabolic behavior. These include:

- Strong positive news: A groundbreaking announcement, such as a new product launch, a significant contract win, or unexpectedly high earnings, can trigger a surge in investor interest.

- Social media hype: In the age of social media, viral trends and online communities can significantly influence stock prices, leading to rapid and sometimes irrational price increases.

- Short squeeze: When a heavily shorted stock experiences positive momentum, short sellers may be forced to cover their positions, further driving up the price.

- Low float: Stocks with a limited number of shares available for trading can be more susceptible to parabolic movements, as even relatively small buying pressure can have a significant impact on the price.

Identifying a Parabolic Stock Pattern

Recognizing a parabolic stock pattern requires careful observation of price charts and trading volume. Here are some key indicators:

- Exponential price increase: The most obvious sign is a sharp, accelerating upward trend in the stock’s price.

- Increased trading volume: Parabolic moves are often accompanied by a significant increase in trading volume, indicating heightened investor activity.

- Gaps up: The stock may experience frequent gaps up, where the opening price is significantly higher than the previous day’s closing price.

- Overbought conditions: Technical indicators like the Relative Strength Index (RSI) often show the stock is in overbought territory, suggesting it may be due for a correction.

The Risks Associated with Parabolic Stocks

While the allure of quick profits can be tempting, investing in parabolic stocks carries significant risks. The rapid price increase is often unsustainable, and the stock is prone to a sharp and sudden correction.

Here are some of the potential risks:

- Price Correction: What goes up must come down. Parabolic stocks are highly susceptible to corrections. The faster the rise, the sharper the fall is likely to be.

- FOMO (Fear of Missing Out): The fear of missing out on potential gains can drive investors to buy into parabolic stocks at inflated prices, just before the peak.

- Lack of Fundamentals: Often, the price increase of a parabolic stock is not supported by strong underlying fundamentals. This makes the stock vulnerable to a correction once the hype subsides.

- Volatility: These stocks exhibit extreme volatility, making them unsuitable for risk-averse investors.

Strategies for Trading Parabolic Stocks

Trading parabolic stocks requires a disciplined approach and a clear understanding of risk management. Here are some potential strategies:

- Early Entry: Identifying a potential parabolic stock early in its upward trend can offer the best risk-reward ratio. However, this requires careful analysis and the ability to anticipate future growth.

- Profit Taking: If you’re already holding a parabolic stock, consider taking profits as the price continues to rise. Don’t get greedy and risk losing your gains in a subsequent correction.

- Shorting: Experienced traders may consider shorting parabolic stocks when they believe the price has reached its peak. However, this is a high-risk strategy that should only be attempted by those with a strong understanding of market dynamics.

- Stop-Loss Orders: Always use stop-loss orders to limit your potential losses. This is especially important when trading volatile parabolic stocks.

- Diversification: Don’t put all your eggs in one basket. Diversify your portfolio to reduce your overall risk.

Examples of Parabolic Stocks

Throughout history, numerous stocks have exhibited parabolic behavior. While specific examples change frequently, the underlying dynamics remain the same. Companies experiencing rapid growth due to technological breakthroughs, unexpected earnings surprises, or social media-driven hype often become parabolic stocks. It is important to remember that past performance is not indicative of future results, and each parabolic stock situation should be evaluated individually.

The Role of News and Social Media

In today’s interconnected world, news and social media play a significant role in shaping investor sentiment and driving stock prices. A positive news article or a viral social media post can quickly propel a stock into parabolic territory. Conversely, negative news or a shift in social media sentiment can trigger a rapid correction.

Investors should be cautious of relying solely on news and social media when making investment decisions. It’s essential to conduct thorough research, analyze the company’s fundamentals, and consider the overall market conditions.

Technical Analysis and Parabolic Stocks

Technical analysis can be a valuable tool for identifying and trading parabolic stocks. Chart patterns, trendlines, and technical indicators can provide insights into the stock’s price movement and potential future direction.

Some commonly used technical indicators for analyzing parabolic stocks include:

- Relative Strength Index (RSI): Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Moving Averages: Smooth out price data to identify trends and potential support and resistance levels.

- Volume: Provides insights into the strength of a trend and potential reversal points.

- Fibonacci Retracements: Identify potential support and resistance levels based on Fibonacci ratios.

Psychology of Parabolic Stock Movements

Understanding the psychology behind parabolic stock movements is crucial for successful trading. Fear and greed often drive investor behavior during these periods, leading to irrational decision-making.

During the early stages of a parabolic move, investors may be hesitant to buy, fearing a potential pullback. However, as the price continues to rise, the fear of missing out (FOMO) kicks in, and more and more investors jump on board. This creates a self-fulfilling prophecy, driving the price even higher.

Eventually, the price becomes unsustainable, and a correction is inevitable. At this point, fear and panic set in, leading to a mass exodus and a sharp decline in the stock’s price.

The Importance of Due Diligence

Before investing in any stock, especially a parabolic stock, it’s essential to conduct thorough due diligence. This involves researching the company’s financials, understanding its business model, and assessing its competitive landscape. [See also: Fundamental Analysis Techniques]

Don’t rely solely on hype or speculation. Make informed decisions based on solid research and analysis.

Conclusion: Navigating the Parabolic Stock Landscape

Parabolic stocks offer the potential for quick profits, but they also carry significant risks. Understanding the parabolic stock meaning, identifying the pattern, and implementing a disciplined trading strategy are essential for navigating this volatile landscape. Remember to conduct thorough research, manage your risk, and avoid getting caught up in the hype. By understanding the parabolic stock meaning, traders can make more informed decisions.

Ultimately, successful investing requires a long-term perspective and a focus on building a diversified portfolio of high-quality assets. While parabolic stocks can be tempting, they should be approached with caution and a clear understanding of the risks involved. The parabolic stock meaning is a high-risk, high-reward scenario. Remember to always do your own research and consult with a financial advisor before making any investment decisions. The parabolic stock meaning can be a valuable tool in your investment strategy if used wisely.