Parabolic Stock Meaning: Understanding the Exponential Growth Pattern

The term “parabolic stock” is often thrown around in investment circles, but what does it really mean? Understanding the parabolic stock meaning is crucial for both seasoned investors and those just starting to navigate the complexities of the stock market. Simply put, a parabolic stock is one that experiences a rapid and exponential increase in its price over a relatively short period. This surge resembles the shape of a parabola, hence the name. However, identifying and understanding the implications of a parabolic stock requires careful analysis and a solid grasp of market dynamics.

What is a Parabolic Stock? A Deeper Dive

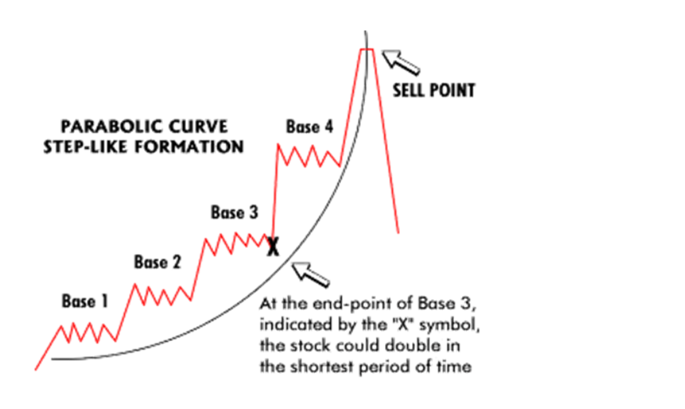

A parabolic stock‘s trajectory is characterized by an almost vertical ascent, often driven by a combination of factors such as strong earnings reports, positive news, industry trends, or simply investor hype. These stocks often capture the attention of retail investors, leading to even more buying pressure and further fueling the price increase. Recognizing the parabolic stock meaning involves understanding that this rapid growth is typically unsustainable in the long run.

Key Characteristics of Parabolic Stocks

- Rapid Price Increase: The most obvious characteristic is the steep upward climb in the stock’s price.

- High Trading Volume: Increased investor interest leads to a significant surge in trading volume.

- News and Hype: Positive news, social media buzz, and general market hype often contribute to the parabolic movement.

- Fear of Missing Out (FOMO): Investors driven by FOMO jump in, further accelerating the price increase.

- Unsustainable Growth: The rapid growth is rarely sustainable and is usually followed by a sharp correction.

Factors Contributing to Parabolic Stock Movements

Several factors can contribute to a stock entering a parabolic phase. Understanding these can help investors better anticipate and potentially profit from these movements, while also mitigating the associated risks. Let’s explore some common drivers behind parabolic stock rallies.

Strong Earnings and Positive News

Consistently exceeding earnings expectations and receiving positive news coverage can significantly boost a stock’s price. If these positive developments are viewed as a sign of long-term growth, investors may rush to buy, driving the price upward. This is a key aspect of the parabolic stock meaning – the perception of continued positive performance.

Industry Trends and Disruptive Technologies

Stocks in industries experiencing rapid growth or those associated with disruptive technologies often attract significant investor attention. For example, companies involved in renewable energy, artificial intelligence, or electric vehicles have seen parabolic stock movements due to the perceived potential of these industries.

Social Media and Investor Sentiment

Social media platforms and online investment communities can play a significant role in driving parabolic stock movements. Viral trends, coordinated buying activity, and the spread of misinformation can all contribute to rapid price increases, often detached from the underlying fundamentals of the company. The rise of meme stocks is a prime example of this phenomenon. [See also: Understanding Meme Stock Investing]

Short Squeezes

A short squeeze occurs when a stock that is heavily shorted experiences a sudden price increase, forcing short sellers to cover their positions by buying back the stock. This buying pressure can further accelerate the price increase, leading to a parabolic stock movement. The GameStop saga is a well-known example of a short squeeze that resulted in a parabolic stock rally.

The Risks Associated with Parabolic Stocks

While the potential for quick profits may be tempting, investing in parabolic stocks carries significant risks. Understanding these risks is crucial for making informed investment decisions and avoiding substantial losses. The parabolic stock meaning inherently implies an eventual correction.

High Volatility

Parabolic stocks are known for their extreme volatility. The rapid price increases are often followed by equally rapid and dramatic price declines. This volatility can make it difficult to time your entry and exit points, increasing the risk of losses. [See also: Managing Investment Volatility]

Overvaluation

The rapid price increases of parabolic stocks often lead to overvaluation, where the stock’s price is significantly higher than its intrinsic value. This means that the stock is trading at a price that is not supported by its underlying fundamentals, such as earnings, revenue, and growth prospects. When the market realizes that the stock is overvalued, a sharp correction can occur.

Market Sentiment and Hype

Parabolic stocks are often driven by market sentiment and hype rather than fundamental analysis. This makes them vulnerable to sudden shifts in investor sentiment. Negative news, a change in market trends, or even a single tweet can trigger a sell-off, leading to a significant price decline.

The Inevitable Correction

The most significant risk associated with parabolic stocks is the inevitable correction. What goes up must come down, and parabolic stocks are no exception. The rapid price increases are unsustainable in the long run, and a sharp correction is usually just around the corner. Investors who buy in at the peak of the parabola risk losing a significant portion of their investment when the correction occurs.

Strategies for Trading Parabolic Stocks

While investing in parabolic stocks carries significant risks, there are strategies that traders can use to potentially profit from these movements while managing their risk. However, it’s crucial to remember that these strategies are speculative and require a high degree of skill and discipline.

Technical Analysis

Technical analysis involves studying price charts and using technical indicators to identify potential entry and exit points. Traders may use indicators such as moving averages, relative strength index (RSI), and MACD to identify overbought conditions and potential reversal points. This can help them time their trades and manage their risk. Understanding the parabolic stock meaning through technical analysis can provide valuable insights.

Risk Management

Risk management is crucial when trading parabolic stocks. Traders should always use stop-loss orders to limit their potential losses. They should also be prepared to take profits quickly, as the rapid price increases can be followed by equally rapid declines. It’s also important to avoid investing more than you can afford to lose. [See also: Essential Risk Management Techniques]

Short Selling (with Caution)

Experienced traders may consider short selling parabolic stocks when they believe that the stock is overvalued and due for a correction. However, short selling is a high-risk strategy, as potential losses are unlimited. It’s important to have a solid understanding of short selling and to use appropriate risk management techniques.

Examples of Parabolic Stocks in History

Throughout history, there have been numerous examples of stocks that have experienced parabolic movements. Examining these examples can provide valuable insights into the dynamics of parabolic stocks and the risks involved. Some notable examples include:

- GameStop (GME): The meme stock frenzy of 2021 saw GameStop’s stock price skyrocket due to coordinated buying activity on social media.

- Tesla (TSLA): While Tesla has a strong underlying business, its stock price experienced a parabolic rise in 2020, fueled by investor enthusiasm for electric vehicles.

- Bitcoin (BTC): Bitcoin has experienced several parabolic rallies throughout its history, driven by increasing adoption and speculative investment.

Conclusion: Navigating the World of Parabolic Stocks

Understanding the parabolic stock meaning is essential for any investor looking to navigate the complexities of the stock market. While the potential for quick profits may be tempting, investing in parabolic stocks carries significant risks. By understanding the factors that contribute to parabolic stock movements, the risks involved, and potential trading strategies, investors can make more informed decisions and potentially profit from these opportunities while managing their risk. Remember that thorough research, careful risk management, and a disciplined approach are crucial for success in the world of parabolic stocks. Always consider consulting with a financial advisor before making any investment decisions.