Revolutionizing Finance: A Deep Dive into AI Finance Companies

Artificial intelligence (AI) is no longer a futuristic concept; it’s a present-day reality reshaping industries across the globe. The finance sector, in particular, is experiencing a profound transformation driven by AI. This article explores the landscape of AI finance companies, examining their innovative solutions, the impact they’re having on the industry, and the challenges they face. We’ll delve into how these companies are leveraging AI to improve efficiency, reduce risk, and enhance customer experiences. Consider this your comprehensive guide to understanding the role of AI finance companies in the modern financial world. [See also: The Future of Fintech: AI and Blockchain Integration]

The Rise of AI in Finance

The integration of AI into finance stems from the industry’s inherent need for data analysis, risk management, and automation. Traditional financial processes often involve complex calculations, manual data entry, and subjective decision-making, all of which are prone to errors and inefficiencies. AI finance companies address these issues by offering sophisticated algorithms and machine learning models that can analyze vast datasets, identify patterns, and make predictions with greater accuracy and speed.

Several factors have contributed to the rapid adoption of AI in finance:

- Increased Data Availability: The exponential growth of data, often referred to as ‘big data,’ provides the raw material for AI algorithms to learn and improve.

- Advancements in Computing Power: The development of powerful processors and cloud computing infrastructure enables the training and deployment of complex AI models.

- Sophisticated Algorithms: Breakthroughs in machine learning, deep learning, and natural language processing (NLP) have provided the tools necessary to build intelligent financial applications.

- Regulatory Pressures: Increasing regulatory requirements and compliance costs are driving financial institutions to seek more efficient and automated solutions.

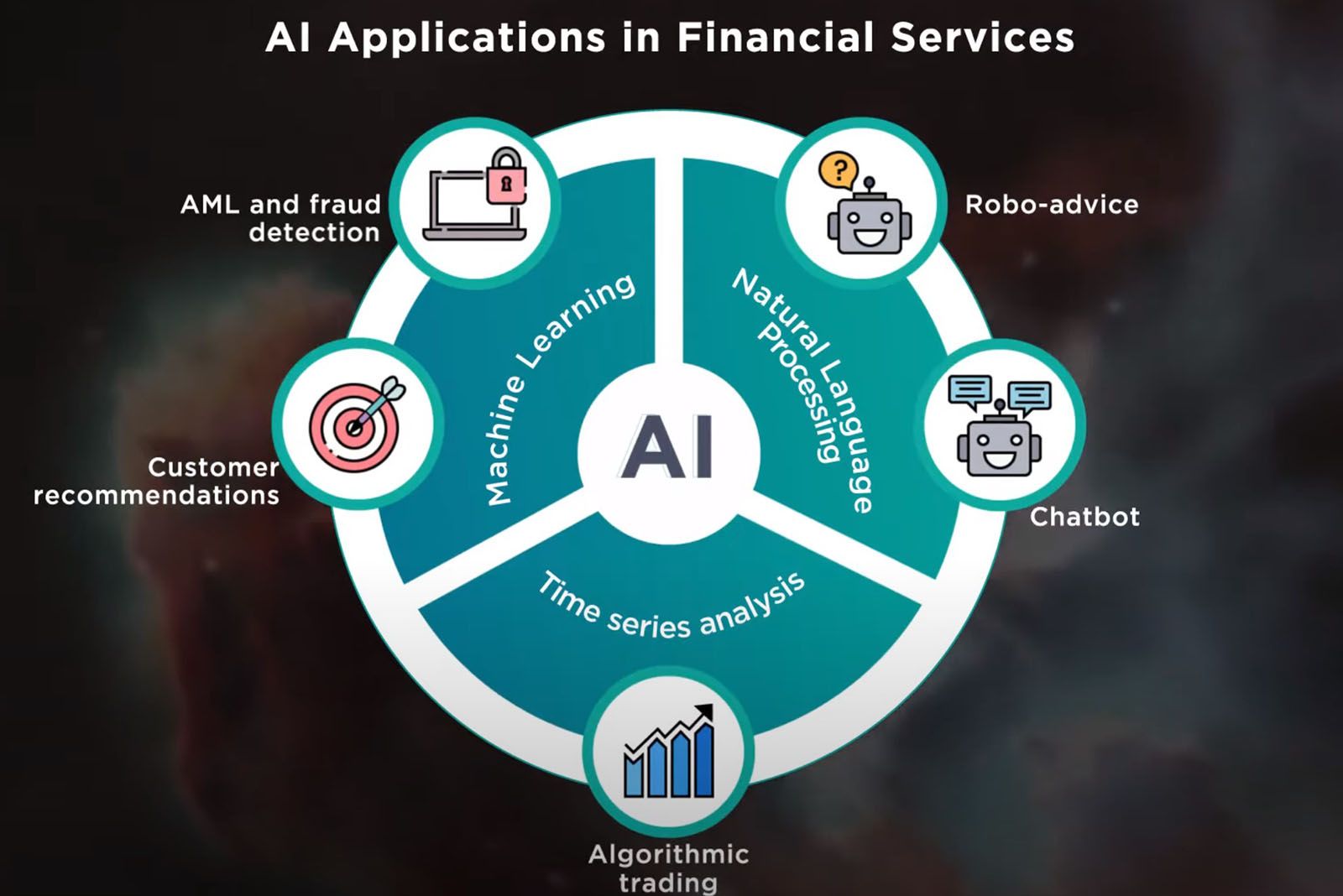

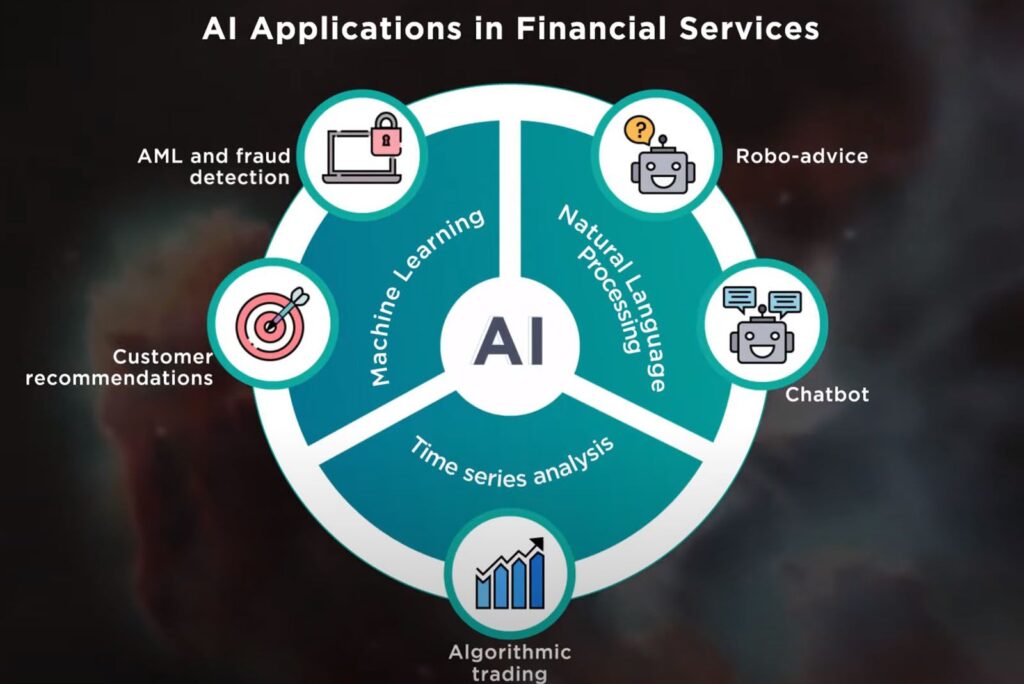

Key Applications of AI in Finance

AI finance companies are applying AI across a wide range of financial functions, including:

Fraud Detection and Prevention

AI algorithms can analyze transaction data in real-time to identify suspicious patterns and flag potentially fraudulent activities. This is a crucial application, as fraud losses continue to plague the financial industry. AI finance companies are developing systems that can detect and prevent various types of fraud, including credit card fraud, identity theft, and money laundering. [See also: The Role of AI in Cybersecurity for Financial Institutions]

Risk Management

AI can improve risk management by providing more accurate and timely assessments of credit risk, market risk, and operational risk. Machine learning models can analyze historical data to identify factors that contribute to risk and predict potential losses. This allows financial institutions to make more informed decisions about lending, investment, and capital allocation. The best AI finance companies offer solutions that help manage and mitigate these risks effectively.

Algorithmic Trading

Algorithmic trading, also known as automated trading, uses AI algorithms to execute trades based on predefined rules and strategies. This can lead to faster execution speeds, reduced transaction costs, and improved trading performance. AI finance companies are developing sophisticated trading algorithms that can adapt to changing market conditions and optimize trading strategies in real-time.

Customer Service and Chatbots

AI-powered chatbots are transforming customer service in the finance industry. These chatbots can handle routine inquiries, provide personalized recommendations, and resolve customer issues quickly and efficiently. This not only improves customer satisfaction but also reduces the workload on human customer service representatives. AI finance companies are at the forefront of developing these intelligent customer service solutions.

Personalized Financial Advice

AI can analyze a customer’s financial situation, goals, and risk tolerance to provide personalized financial advice. This can help customers make better decisions about saving, investing, and managing their debt. Robo-advisors, which are powered by AI, are becoming increasingly popular as a low-cost alternative to traditional financial advisors. Many AI finance companies specialize in creating and deploying these robo-advisory platforms.

Loan Underwriting

AI can automate the loan underwriting process by analyzing a borrower’s credit history, income, and other relevant data. This can lead to faster loan approvals, reduced underwriting costs, and improved loan performance. AI finance companies are developing systems that can assess creditworthiness more accurately and efficiently than traditional methods.

Examples of Leading AI Finance Companies

Several companies are leading the way in developing and deploying AI solutions for the finance industry. Here are a few notable examples:

- Kabbage: Provides automated lending solutions for small businesses.

- DataRobot: Offers a machine learning platform for building and deploying AI models.

- Zest AI: Focuses on AI-powered credit underwriting for underserved populations.

- Quantopian: A platform for developing and testing algorithmic trading strategies.

- Lemonade: An insurance company that uses AI to automate claims processing.

These are just a few examples of the many AI finance companies that are transforming the industry. Each company has its own unique focus and expertise, but they all share a common goal: to use AI to improve efficiency, reduce risk, and enhance customer experiences.

Challenges and Considerations

While AI offers significant benefits for the finance industry, there are also challenges and considerations that need to be addressed:

Data Privacy and Security

AI algorithms rely on large amounts of data, which raises concerns about data privacy and security. Financial institutions need to ensure that they are collecting, storing, and using data in a responsible and ethical manner. Furthermore, they need to protect data from unauthorized access and cyberattacks. AI finance companies must prioritize data security and privacy in all their operations.

Bias and Fairness

AI algorithms can perpetuate biases that exist in the data they are trained on. This can lead to unfair or discriminatory outcomes, particularly in areas such as loan underwriting and fraud detection. Financial institutions need to be aware of these potential biases and take steps to mitigate them. It’s crucial that AI finance companies develop and deploy AI models that are fair and unbiased.

Regulatory Compliance

The use of AI in finance is subject to increasing regulatory scrutiny. Financial institutions need to ensure that their AI systems comply with all relevant laws and regulations. This includes regulations related to data privacy, consumer protection, and anti-money laundering. The top AI finance companies stay up-to-date on regulatory changes and ensure compliance.

Explainability and Transparency

Some AI algorithms, particularly deep learning models, can be difficult to understand and explain. This lack of explainability can make it difficult to identify and correct errors or biases. Financial institutions need to prioritize explainability and transparency in their AI systems, especially in areas where decisions have significant consequences for customers. More transparent models are essential for responsible innovation in AI finance companies.

Job Displacement

The automation of financial processes through AI could lead to job displacement in some areas. Financial institutions need to consider the potential impact on their workforce and take steps to retrain and reskill employees. While some jobs may be lost, new opportunities will also be created in areas such as AI development and data science. AI finance companies themselves will be a source of many of these new jobs.

The Future of AI in Finance

The future of AI in finance is bright. As AI technology continues to evolve, we can expect to see even more innovative applications emerge. Some potential future developments include:

- More sophisticated fraud detection systems: AI will be able to detect and prevent increasingly sophisticated forms of fraud.

- Improved risk management models: AI will provide more accurate and timely assessments of risk.

- Hyper-personalized financial advice: AI will be able to provide highly personalized financial advice tailored to each individual’s needs and goals.

- Autonomous trading platforms: AI will be able to autonomously manage investment portfolios.

- Decentralized finance (DeFi) applications: AI will play a key role in the development of decentralized finance applications.

AI finance companies are poised to play a central role in shaping the future of the financial industry. By embracing AI and addressing the challenges and considerations outlined above, financial institutions can unlock the full potential of this transformative technology. The ongoing innovation in AI finance companies will continue to drive efficiency, reduce risk, and enhance customer experiences in the years to come. [See also: AI and Blockchain: A Synergistic Partnership in Finance]

Conclusion

AI finance companies are revolutionizing the financial industry by leveraging the power of artificial intelligence. From fraud detection and risk management to customer service and personalized financial advice, AI is transforming the way financial institutions operate. While there are challenges and considerations that need to be addressed, the potential benefits of AI in finance are enormous. As AI technology continues to evolve, we can expect to see even more innovative applications emerge, further solidifying AI’s role as a key driver of change in the financial world. The continued growth and innovation within AI finance companies promise a more efficient, secure, and customer-centric future for the industry.