Revolutionizing Finance: A Deep Dive into AI Finance Companies

Artificial intelligence (AI) is no longer a futuristic concept; it’s a present-day reality transforming industries across the globe. Among the sectors experiencing a profound shift, finance stands out. AI finance companies are at the forefront of this revolution, leveraging machine learning, natural language processing, and other AI technologies to enhance efficiency, accuracy, and decision-making. This article delves into the world of AI finance companies, exploring their applications, benefits, challenges, and the future landscape they are shaping.

The Rise of AI in Finance

The financial industry generates vast amounts of data daily, from transactions and market trends to customer interactions and regulatory filings. Traditionally, analyzing this data was a cumbersome and time-consuming process. AI offers a powerful solution by automating data analysis, identifying patterns, and generating insights that would be impossible for humans to detect manually. This capability is driving the rapid growth of AI finance companies.

Several factors have contributed to the rise of AI in finance:

- Increased Data Availability: The explosion of digital data provides the fuel for AI algorithms to learn and improve.

- Advancements in AI Technology: Breakthroughs in machine learning, deep learning, and natural language processing have made AI more powerful and accessible.

- Decreasing Computational Costs: Cloud computing and advancements in hardware have made it more affordable to train and deploy AI models.

- Growing Demand for Efficiency and Automation: Financial institutions are under pressure to reduce costs, improve efficiency, and enhance customer experience.

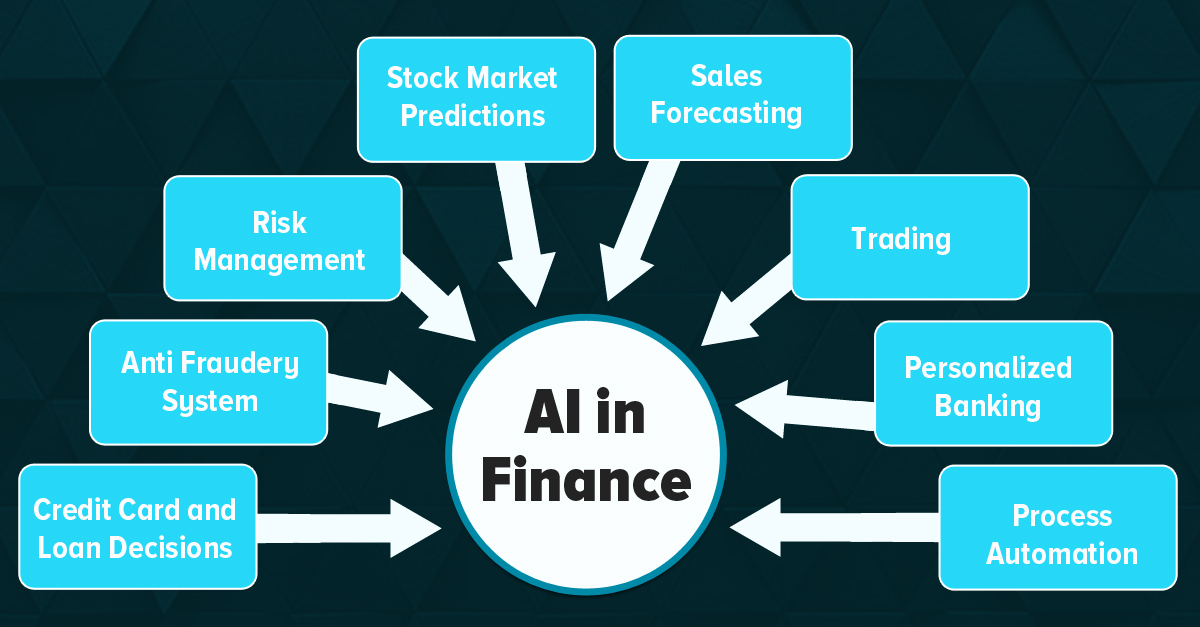

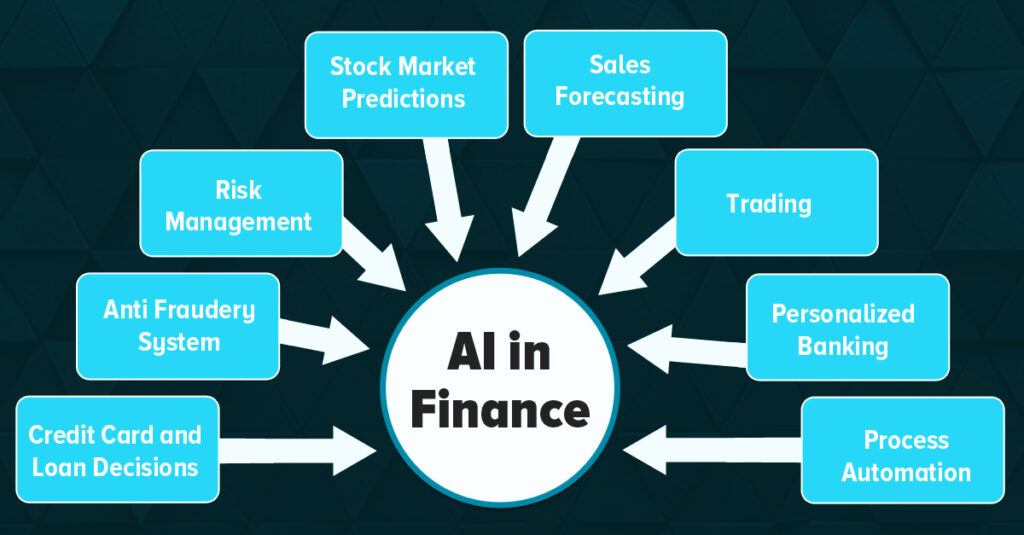

Key Applications of AI in Finance

AI finance companies are deploying AI solutions across a wide range of applications, transforming various aspects of the financial industry. Here are some key areas:

Fraud Detection and Prevention

AI algorithms can analyze transaction data in real-time to identify suspicious patterns and flag potentially fraudulent activities. This is a critical application, given the increasing sophistication of cybercriminals. AI finance companies are using machine learning models to detect anomalies in transaction data, identify fraudulent account openings, and prevent credit card fraud.

Algorithmic Trading

AI-powered trading algorithms can analyze market data, identify trends, and execute trades automatically, often at speeds that are impossible for human traders. These algorithms can react to market changes in real-time, potentially generating higher returns and reducing risk. AI finance companies are developing sophisticated trading platforms that leverage machine learning to optimize trading strategies.

Risk Management

AI can be used to assess and manage various types of financial risk, including credit risk, market risk, and operational risk. By analyzing large datasets, AI models can identify potential risks and provide early warnings, allowing financial institutions to take proactive measures to mitigate those risks. AI finance companies are providing risk management solutions that help financial institutions make more informed decisions about lending, investment, and other financial activities.

Customer Service and Chatbots

AI-powered chatbots can provide instant customer support, answer frequently asked questions, and resolve simple issues. This can significantly improve customer satisfaction and reduce the workload on human customer service representatives. AI finance companies are developing sophisticated chatbots that can handle a wide range of customer inquiries, from account balances to transaction histories.

Personalized Financial Advice

AI can analyze a customer’s financial data, including income, expenses, and investment goals, to provide personalized financial advice. This can help customers make better decisions about saving, investing, and managing their finances. AI finance companies are developing robo-advisors that provide automated investment advice based on a customer’s risk tolerance and financial goals.

Loan Underwriting

AI algorithms can analyze loan applications and assess creditworthiness more quickly and accurately than traditional methods. This can speed up the loan approval process and reduce the risk of defaults. AI finance companies are using machine learning to develop more accurate credit scoring models.

Benefits of AI in Finance

The adoption of AI in finance offers numerous benefits, including:

- Increased Efficiency: AI automates many tasks, freeing up human employees to focus on more complex and strategic activities.

- Improved Accuracy: AI algorithms can analyze data more accurately than humans, reducing errors and improving decision-making.

- Reduced Costs: AI can automate tasks and improve efficiency, leading to significant cost savings for financial institutions.

- Enhanced Customer Experience: AI-powered chatbots and personalized financial advice can improve customer satisfaction and loyalty.

- Better Risk Management: AI can identify and mitigate risks more effectively, protecting financial institutions from losses.

Challenges and Considerations

While the potential benefits of AI in finance are significant, there are also challenges and considerations that need to be addressed:

- Data Privacy and Security: Financial data is highly sensitive, and protecting it from breaches and unauthorized access is paramount. AI finance companies must implement robust security measures to protect customer data.

- Algorithmic Bias: AI algorithms can be biased if they are trained on biased data. This can lead to unfair or discriminatory outcomes. It’s crucial to ensure that AI models are fair and unbiased.

- Regulatory Compliance: The financial industry is heavily regulated, and AI finance companies must comply with all applicable regulations.

- Explainability and Transparency: It can be difficult to understand how AI algorithms make decisions, which can be a concern for regulators and customers. Efforts are being made to develop more explainable and transparent AI models.

- Job Displacement: The automation of tasks through AI could lead to job displacement in the financial industry. Financial institutions need to consider the impact of AI on their workforce and provide training and support for employees who may be affected.

Examples of Leading AI Finance Companies

Several AI finance companies are leading the way in developing and deploying innovative AI solutions. These companies are transforming the financial industry and shaping the future of finance. Here are a few examples:

- DataRobot: Provides an enterprise AI platform that helps financial institutions automate and accelerate the development and deployment of AI models.

- Kensho: Offers AI-powered analytics and decision-making tools for financial professionals.

- Zest AI: Develops AI-powered credit scoring models that help lenders make more accurate and fair lending decisions.

- Personetics: Provides AI-powered personalized financial guidance and insights to bank customers.

- Signifyd: Offers AI-powered fraud protection solutions for e-commerce merchants and financial institutions.

The Future of AI in Finance

The future of AI in finance is bright. As AI technology continues to advance, we can expect to see even more innovative applications of AI in the financial industry. AI finance companies will continue to play a key role in driving this innovation. Some potential future trends include:

- More Sophisticated AI Models: AI models will become more sophisticated and capable of handling more complex tasks.

- Increased Integration of AI into Financial Workflows: AI will become increasingly integrated into all aspects of the financial industry.

- Greater Use of AI for Personalized Financial Services: AI will be used to provide more personalized and tailored financial services to individual customers.

- Expansion of AI into New Areas of Finance: AI will be applied to new areas of finance, such as insurance and real estate.

- Increased Collaboration between Humans and AI: Humans and AI will work together more closely, with AI augmenting human capabilities and improving decision-making.

In conclusion, AI finance companies are revolutionizing the financial industry by leveraging the power of artificial intelligence. While challenges remain, the potential benefits of AI in finance are undeniable. As AI technology continues to evolve, we can expect to see even more transformative changes in the years to come. The key is to embrace AI responsibly, ensuring that it is used to create a more efficient, accurate, and equitable financial system. [See also: AI in Banking: Transforming Customer Experience] and [See also: The Ethical Implications of AI in Finance]