Share Market Prediction Today: Navigating Volatility and Identifying Opportunities

In the dynamic world of finance, share market prediction today is a topic of immense interest to investors, traders, and financial analysts alike. The allure of accurately forecasting market movements stems from the potential to capitalize on emerging trends, mitigate risks, and ultimately, enhance investment returns. However, the inherent complexity and numerous influencing factors make precise share market prediction today a challenging endeavor. This article aims to provide a comprehensive overview of the methodologies employed, the factors considered, and the inherent limitations associated with predicting the stock market. It also explores strategies for navigating market volatility and identifying potential investment opportunities.

Understanding the Landscape of Share Market Prediction

The stock market is a complex ecosystem influenced by a myriad of factors, ranging from macroeconomic indicators to geopolitical events. Before delving into specific prediction methods, it’s crucial to understand the key drivers that shape market movements. These include:

- Economic Indicators: GDP growth, inflation rates, unemployment figures, and interest rate policies play a significant role in influencing investor sentiment and market performance.

- Company Performance: Earnings reports, revenue growth, and strategic decisions of individual companies directly impact their stock prices.

- Geopolitical Events: Global events such as trade wars, political instability, and natural disasters can trigger market volatility.

- Investor Sentiment: Market psychology and investor confidence can drive short-term price fluctuations, often independent of fundamental factors.

- Technological Advancements: Disruptive technologies and innovations can reshape industries and influence investment decisions.

Methods Employed for Share Market Prediction

Various methodologies are utilized in an attempt to forecast share market prediction today. These can be broadly categorized into:

Technical Analysis

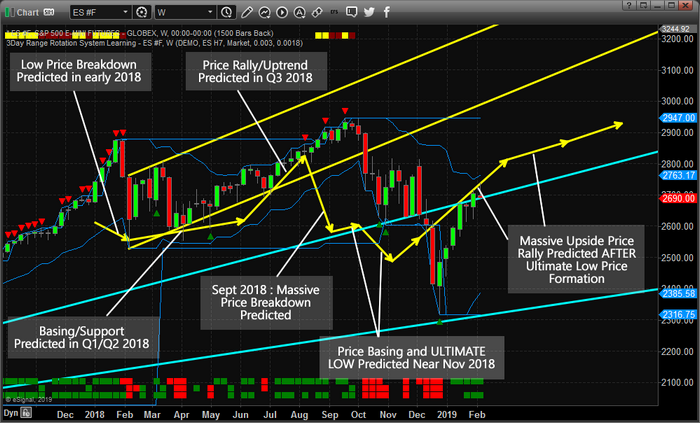

Technical analysis involves studying historical price and volume data to identify patterns and trends that may indicate future price movements. Technical analysts use charts, indicators, and oscillators to analyze market sentiment and make trading decisions. Common technical indicators include Moving Averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence). While technical analysis can be useful for identifying short-term trading opportunities, its effectiveness in predicting long-term market trends is often debated.

Fundamental Analysis

Fundamental analysis focuses on evaluating the intrinsic value of a company by examining its financial statements, industry trends, and competitive landscape. Fundamental analysts assess factors such as revenue, earnings, debt levels, and management quality to determine whether a stock is undervalued or overvalued. This approach aims to identify companies with strong fundamentals that are likely to generate long-term growth and profitability. Fundamental analysis is often considered a more reliable method for long-term share market prediction today than technical analysis.

Quantitative Analysis

Quantitative analysis employs mathematical and statistical models to analyze market data and identify investment opportunities. Quantitative analysts use algorithms and computer programs to process large datasets and identify patterns that may not be apparent through traditional methods. This approach often involves developing trading strategies based on statistical arbitrage, factor investing, and other quantitative techniques. Quantitative analysis has become increasingly popular in recent years due to the availability of vast amounts of data and the increasing sophistication of computing power.

Sentiment Analysis

Sentiment analysis involves gauging investor sentiment by analyzing news articles, social media posts, and other sources of information. This approach aims to identify shifts in market psychology that may influence price movements. Sentiment analysis tools use natural language processing (NLP) techniques to extract sentiment from text and quantify investor optimism or pessimism. This information can be used to identify potential buying or selling opportunities. However, sentiment analysis is often subjective and can be influenced by biases and misinformation.

Factors Influencing the Accuracy of Share Market Prediction

Despite the sophistication of these methods, accurately predicting the share market prediction today remains a significant challenge. Several factors contribute to the inherent uncertainty of market forecasting:

- Market Volatility: Unexpected events and sudden shifts in investor sentiment can lead to significant market volatility, making it difficult to predict short-term price movements.

- Information Asymmetry: Some investors may have access to privileged information that is not available to the general public, giving them an unfair advantage in the market.

- Behavioral Biases: Investor behavior is often influenced by emotions and cognitive biases, leading to irrational decision-making and unpredictable market outcomes.

- Black Swan Events: Unforeseen events with significant impact, such as financial crises or pandemics, can disrupt market trends and invalidate existing predictions.

- Model Limitations: All prediction models are based on assumptions and simplifications, which may not accurately reflect the complexities of the real world.

Strategies for Navigating Market Volatility

Given the inherent uncertainty of share market prediction today, investors should focus on developing strategies for navigating market volatility and managing risk. Some effective strategies include:

- Diversification: Spreading investments across different asset classes, sectors, and geographic regions can reduce the impact of any single investment on overall portfolio performance.

- Long-Term Investing: Focusing on long-term investment goals and avoiding short-term speculation can help investors weather market fluctuations.

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals, regardless of market conditions, can reduce the risk of buying high and selling low.

- Risk Management: Setting stop-loss orders and using other risk management tools can help limit potential losses.

- Staying Informed: Keeping abreast of market news and economic developments can help investors make informed decisions and adjust their portfolios accordingly.

Identifying Potential Investment Opportunities

While accurately predicting the share market prediction today is difficult, investors can still identify potential investment opportunities by focusing on fundamental analysis and identifying companies with strong growth prospects. Some key factors to consider include:

- Industry Trends: Identifying industries with strong growth potential can lead to attractive investment opportunities.

- Competitive Advantage: Companies with a strong competitive advantage, such as a unique product or service, are more likely to generate sustainable profits.

- Management Quality: Companies with strong and experienced management teams are more likely to execute their strategies effectively.

- Financial Health: Companies with strong balance sheets and healthy cash flow are better positioned to weather economic downturns.

- Valuation: Assessing the valuation of a company relative to its peers and historical performance can help identify undervalued stocks.

The Role of AI in Share Market Prediction

Artificial intelligence (AI) is increasingly being used in share market prediction today. Machine learning algorithms can analyze vast amounts of data and identify patterns that humans may miss. AI-powered trading systems can execute trades automatically based on predefined rules and algorithms. However, it’s important to recognize that AI is not a foolproof solution. AI models are only as good as the data they are trained on, and they can be susceptible to biases and overfitting. Furthermore, AI models may struggle to adapt to unforeseen events and changing market conditions. [See also: Algorithmic Trading Strategies]

The Importance of Due Diligence

Regardless of the methods used, thorough due diligence is crucial before making any investment decisions. This involves researching companies, analyzing financial statements, and understanding the risks involved. Investors should also be wary of investment scams and unrealistic promises of high returns. Consulting with a qualified financial advisor can provide valuable insights and help investors make informed decisions. Remember that share market prediction today, while enticing, should not be the sole basis for investment decisions. A well-rounded approach incorporating fundamental analysis, risk management, and a long-term perspective is essential for successful investing. [See also: Risk Management in Investing]

Conclusion

While the quest for accurately predicting the share market prediction today continues, investors should recognize the inherent limitations and focus on developing sound investment strategies. By understanding the factors that influence market movements, diversifying their portfolios, and conducting thorough due diligence, investors can navigate market volatility and identify potential opportunities for long-term growth. The key to successful investing lies not in predicting the future, but in preparing for it.