Shareholder vs. Stakeholder: Understanding the Key Differences

In the complex world of business, understanding the nuances of terminology is crucial for effective communication and strategic decision-making. Two terms that are often used interchangeably but carry distinct meanings are “shareholder” and “stakeholder.” While both groups have an interest in a company’s success, their relationship to the organization and the nature of their interests differ significantly. This article will delve into the shareholder stakeholder difference, exploring their roles, responsibilities, and the implications of prioritizing one over the other.

Defining Shareholders and Stakeholders

A shareholder is an individual, company, or institution that legally owns one or more shares of stock in a public or private corporation. By owning stock, shareholders become part-owners of the company and are entitled to a portion of its profits and assets. Their primary interest lies in maximizing their financial return on investment, which is typically achieved through stock appreciation and dividend payments. Shareholders have voting rights, allowing them to influence corporate decisions, such as electing board members and approving major transactions. Their power is proportional to the number of shares they own.

A stakeholder, on the other hand, is a broader term encompassing any individual, group, or organization that has an interest in or is affected by a company’s actions, decisions, and performance. This includes shareholders, but extends to employees, customers, suppliers, creditors, the local community, and even the government. Stakeholders have a vested interest in the company’s success, but their motivations may extend beyond financial gain. For example, employees are interested in job security and fair wages, customers want quality products and services, and the community desires responsible corporate citizenship.

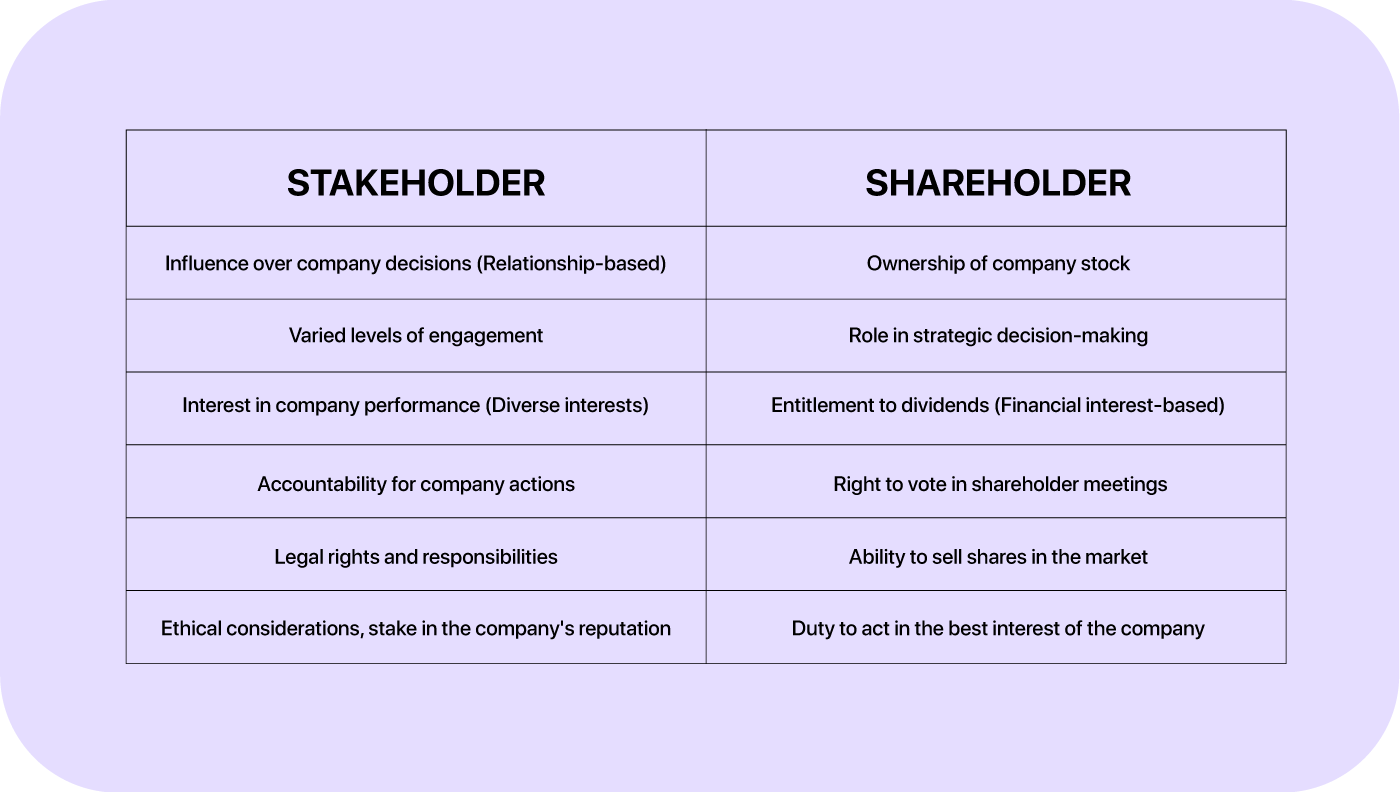

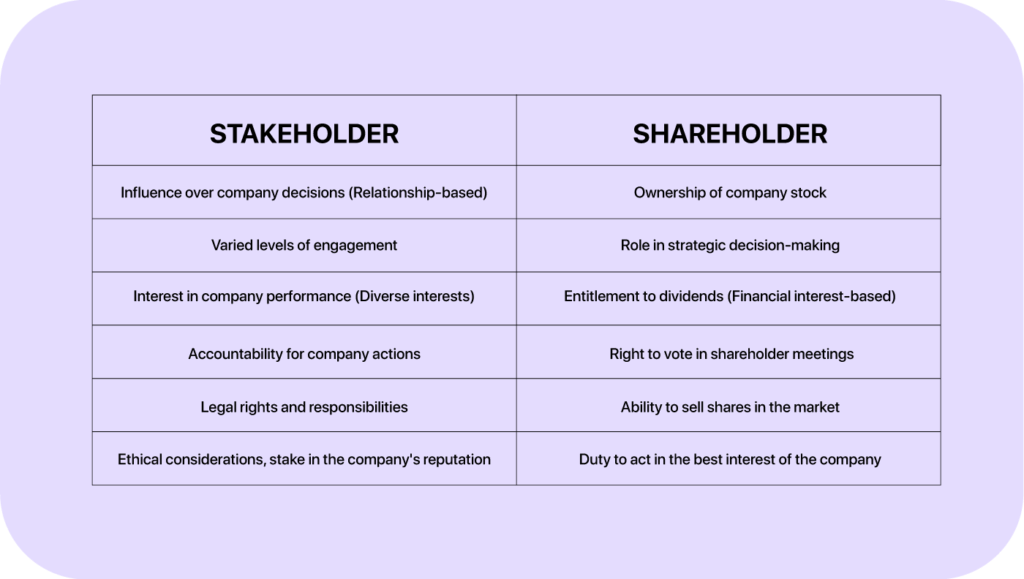

Key Differences Between Shareholders and Stakeholders

The shareholder stakeholder difference is multi-faceted. Here’s a breakdown of the key distinctions:

- Ownership vs. Interest: Shareholders are owners of the company, while stakeholders have an interest in the company’s performance.

- Financial Return vs. Broader Concerns: Shareholders are primarily motivated by financial returns, while stakeholders have broader concerns, including social, ethical, and environmental considerations.

- Voting Rights vs. Influence: Shareholders have voting rights to influence corporate decisions, while stakeholders exert influence through various means, such as advocacy, boycotts, or lobbying.

- Limited Scope vs. Wide Scope: The term shareholder is limited to those who own shares, while stakeholder encompasses a wider range of individuals and groups.

- Legal Obligation vs. Ethical Consideration: Companies have a legal obligation to act in the best interests of their shareholders, while their responsibility to stakeholders is often viewed as an ethical consideration.

The Importance of Balancing Shareholder and Stakeholder Interests

Historically, the prevailing view in corporate governance has been that companies should prioritize shareholder interests above all else. This perspective, often associated with the shareholder primacy theory, argues that maximizing shareholder value is the primary responsibility of corporate management. However, this view has come under increasing scrutiny in recent years, as concerns about social inequality, environmental sustainability, and corporate social responsibility have grown.

Many now argue that a more balanced approach, which takes into account the interests of all stakeholders, is essential for long-term success. This stakeholder-centric approach recognizes that a company’s success is inextricably linked to the well-being of its employees, customers, suppliers, and the community in which it operates. By considering the needs of all stakeholders, companies can build stronger relationships, enhance their reputation, and create a more sustainable and equitable business model. Ignoring the needs of stakeholders can lead to negative consequences, such as employee disengagement, customer boycotts, and regulatory scrutiny.

The shareholder stakeholder difference highlights the different priorities these groups possess, but a successful business must acknowledge the importance of both. [See also: Corporate Social Responsibility Strategies].

Examples of Shareholder vs. Stakeholder Conflicts and Resolutions

Conflicts between shareholder and stakeholder interests are not uncommon. For example, a company may decide to cut employee wages or benefits in order to increase profits and boost shareholder returns. This decision may be beneficial for shareholders in the short term, but it can have negative consequences for employees, leading to decreased morale, reduced productivity, and higher turnover. Similarly, a company may choose to pollute the environment in order to reduce production costs, benefiting shareholders but harming the community and potentially leading to legal repercussions. [See also: Ethical Business Practices].

Resolving these conflicts requires careful consideration and a willingness to compromise. Companies can adopt a number of strategies to balance shareholder and stakeholder interests, including:

- Stakeholder Engagement: Actively engaging with stakeholders to understand their concerns and incorporate their perspectives into decision-making.

- Sustainability Initiatives: Implementing sustainability initiatives to minimize environmental impact and promote social responsibility.

- Fair Labor Practices: Adopting fair labor practices to ensure that employees are treated with respect and dignity.

- Corporate Social Responsibility (CSR) Programs: Investing in CSR programs to address social and environmental issues in the community.

- Transparent Communication: Communicating openly and transparently with all stakeholders about the company’s performance and decisions.

The Evolving Landscape of Corporate Governance

The landscape of corporate governance is evolving, with increasing emphasis on stakeholder capitalism. This approach recognizes that companies have a responsibility to create value for all stakeholders, not just shareholders. Stakeholder capitalism is gaining traction among investors, policymakers, and business leaders, who believe that it is a more sustainable and equitable model for the future. The shareholder stakeholder difference is becoming less a matter of opposing sides, and more of a spectrum of interests that must be balanced.

One example of this shift is the growing popularity of Environmental, Social, and Governance (ESG) investing. ESG investors consider environmental, social, and governance factors when making investment decisions, seeking to support companies that are committed to sustainability, social responsibility, and ethical governance. This trend is putting pressure on companies to improve their ESG performance and demonstrate their commitment to stakeholder interests. [See also: Impact Investing Strategies].

The Role of Leadership in Balancing Interests

Effective leadership is crucial for balancing shareholder and stakeholder interests. Leaders must be able to articulate a clear vision that aligns with the values and expectations of all stakeholders. They must also be able to build trust and foster collaboration among different groups. Strong leadership can help companies navigate complex challenges and create a more sustainable and equitable future. Understanding the shareholder stakeholder difference is the foundation upon which a leader can build a balanced approach.

Leaders who prioritize stakeholder interests are more likely to build a strong reputation, attract and retain top talent, and create a more resilient and sustainable business. They are also more likely to earn the trust and loyalty of their customers, employees, and the community. Ultimately, a stakeholder-centric approach can lead to greater long-term success for both the company and its stakeholders.

Conclusion: Embracing a Stakeholder-Centric Approach

The shareholder stakeholder difference is a critical distinction that businesses must understand. While shareholders play a vital role in providing capital and driving financial performance, stakeholders represent a broader range of interests that are essential for long-term success. By embracing a stakeholder-centric approach, companies can create a more sustainable, equitable, and resilient business model that benefits all. Recognizing the needs of all parties involved is key to fostering a healthy and thriving business environment. The future of corporate governance lies in balancing the interests of shareholders and stakeholders, ensuring that companies are not only profitable but also responsible and sustainable.