Speculation Investment: Navigating the High-Risk, High-Reward Landscape

The world of finance encompasses a spectrum of investment strategies, ranging from conservative, low-yield options to more aggressive, high-growth approaches. At the far end of this spectrum lies speculation investment, a practice characterized by its high-risk, high-reward potential. This article delves into the intricacies of speculation investment, exploring its definition, characteristics, potential benefits, associated risks, and strategies for mitigating those risks. Understanding speculation investment is crucial for any investor considering venturing into this volatile yet potentially lucrative area.

Understanding Speculation Investment

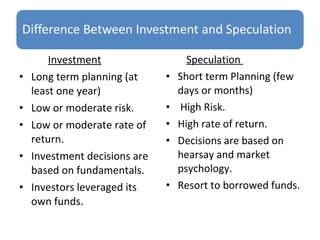

Speculation investment fundamentally differs from traditional investment. While traditional investing focuses on long-term growth and stability, speculation investment aims for short-term profits from rapid price fluctuations. Speculators often target assets with high volatility, such as penny stocks, cryptocurrencies, certain commodities, or options, hoping to capitalize on market inefficiencies or anticipated events. The core principle is to buy low and sell high within a relatively short timeframe, sometimes even within the same day.

Unlike investors who conduct thorough fundamental analysis and hold assets for extended periods, speculators rely heavily on technical analysis, market sentiment, and news events. They are less concerned with the intrinsic value of an asset and more focused on predicting its short-term price movements. This approach requires a keen understanding of market psychology and the ability to react quickly to changing conditions.

Key Characteristics of Speculation Investment

- High Risk: This is the defining characteristic. The potential for significant losses is substantial.

- Short-Term Focus: Speculators aim for quick profits, often within days, weeks, or months.

- Leverage: Speculators frequently use leverage (borrowed funds) to amplify potential gains (and losses).

- Volatility: Speculative investments typically involve assets with high price volatility.

- Market Sentiment: Speculators are highly sensitive to market sentiment and news events.

- Technical Analysis: Technical analysis, charting patterns, and indicators are often used to predict price movements.

Potential Benefits of Speculation Investment

Despite the inherent risks, speculation investment can offer several potential benefits:

- High Potential Returns: The possibility of generating substantial profits in a short period is the primary allure.

- Diversification: Speculative investments can provide diversification benefits, particularly if they are uncorrelated with traditional asset classes.

- Market Liquidity: Speculators can contribute to market liquidity by actively trading assets.

- Opportunity to Capitalize on Market Inefficiencies: Speculators can profit from temporary mispricings or inefficiencies in the market.

Associated Risks of Speculation Investment

The risks associated with speculation investment are significant and should not be underestimated:

- High Probability of Loss: The potential for substantial losses is very real. Many speculators lose money.

- Leverage Amplification: Leverage magnifies both potential gains and potential losses.

- Market Volatility: Volatility can lead to rapid and unpredictable price swings.

- Emotional Decision-Making: The pressure of short-term trading can lead to impulsive and emotional decisions.

- Lack of Fundamental Value: Speculative assets may lack underlying fundamental value, making them vulnerable to sudden price collapses.

- Market Manipulation: Some speculative markets are susceptible to manipulation, which can lead to artificial price movements.

Strategies for Mitigating Risks in Speculation Investment

While speculation investment inherently involves risk, there are strategies that can help mitigate those risks:

Thorough Research and Due Diligence

Before investing in any speculative asset, conduct thorough research and due diligence. Understand the asset’s fundamentals (if any), the market dynamics, and the potential risks involved. Don’t rely solely on rumors or hype.

Risk Management and Position Sizing

Implement a robust risk management strategy. Determine the maximum amount of capital you are willing to risk on any single trade. Use stop-loss orders to limit potential losses. Practice proper position sizing to avoid overexposure.

Diversification

Avoid putting all your eggs in one basket. Diversify your speculative investments across different asset classes and markets. This can help reduce the impact of any single losing trade.

Use of Stop-Loss Orders

Always use stop-loss orders to automatically exit a trade if the price moves against you. This can help limit potential losses and prevent emotional decision-making.

Discipline and Emotional Control

Develop a disciplined trading plan and stick to it. Avoid making impulsive or emotional decisions based on fear or greed. Be patient and wait for the right opportunities.

Continuous Learning and Adaptation

The market is constantly evolving. Stay informed about market trends, news events, and new investment strategies. Be willing to adapt your approach as needed.

Understanding Leverage

If using leverage, fully understand its implications. Leverage can significantly amplify both gains and losses. Use leverage cautiously and only if you have a clear understanding of the risks involved. [See also: Understanding Leverage in Investing]

Examples of Speculation Investment

Several types of investments are commonly associated with speculation:

- Penny Stocks: Low-priced stocks of small companies with limited operating history.

- Cryptocurrencies: Digital currencies with volatile price fluctuations.

- Options: Contracts that give the holder the right, but not the obligation, to buy or sell an asset at a specific price.

- Futures Contracts: Agreements to buy or sell an asset at a future date and price.

- Certain Commodities: Some commodities, such as precious metals or energy products, can be subject to speculative trading.

- Meme Stocks: Stocks that experience rapid price increases due to social media hype and coordinated buying.

The Role of Speculation in Financial Markets

While often viewed negatively, speculation plays a crucial role in financial markets. Speculators provide liquidity, help to discover prices, and can contribute to market efficiency. By taking on risk, speculators allow other market participants to hedge their positions and manage their exposure. However, excessive speculation can also lead to market bubbles and crashes.

Regulation of Speculation

Governments and regulatory agencies oversee speculative activities to protect investors and maintain market integrity. Regulations may include margin requirements, position limits, and disclosure requirements. The goal is to prevent market manipulation and ensure fair trading practices. [See also: Financial Market Regulations]

Conclusion

Speculation investment is a high-risk, high-reward endeavor that requires a deep understanding of market dynamics, risk management skills, and emotional discipline. While it can offer the potential for substantial profits, it also carries a significant risk of loss. Before venturing into speculation investment, investors should carefully assess their risk tolerance, financial resources, and investment goals. A well-defined strategy, coupled with strict risk management practices, is essential for navigating this volatile landscape. Remember that speculation investment is not suitable for all investors, and it should only be undertaken by those who are prepared to accept the potential for significant losses. The allure of quick riches should not overshadow the inherent dangers involved in speculation investment. Understanding the nuances of speculation investment empowers investors to make informed decisions and navigate the financial markets with greater confidence. Always remember that responsible investing involves a balanced approach, and speculation investment should only constitute a small portion of a well-diversified portfolio. The key to success in speculation investment lies in combining knowledge, discipline, and a healthy dose of caution. Good luck, and invest wisely!