Speculation Investment: Navigating the Risks and Rewards

In the world of finance, the term “speculation investment” often evokes a sense of both excitement and trepidation. It represents a high-stakes approach to investing, characterized by the pursuit of substantial returns within a relatively short timeframe. Unlike traditional investment strategies that prioritize long-term growth and stability, speculation investment focuses on capitalizing on perceived market inefficiencies, short-term trends, and anticipated future events. This article delves into the intricacies of speculation investment, exploring its defining characteristics, potential benefits, inherent risks, and best practices for those considering venturing into this dynamic realm.

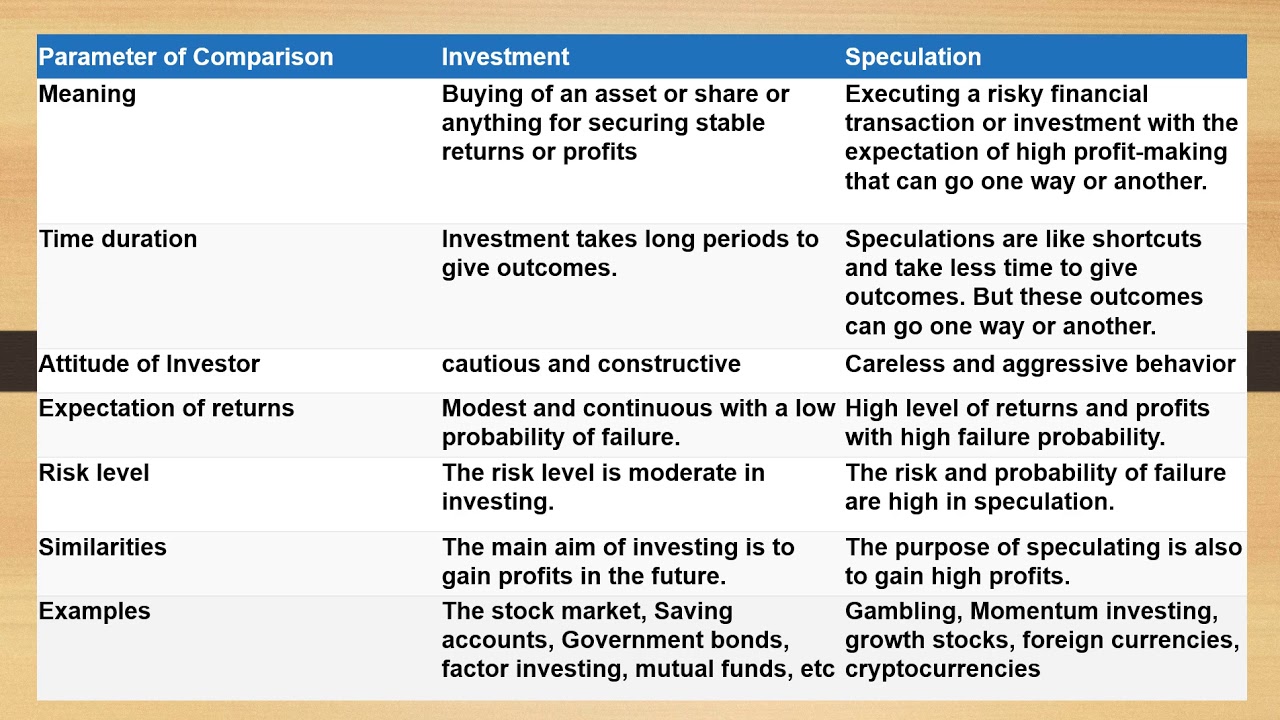

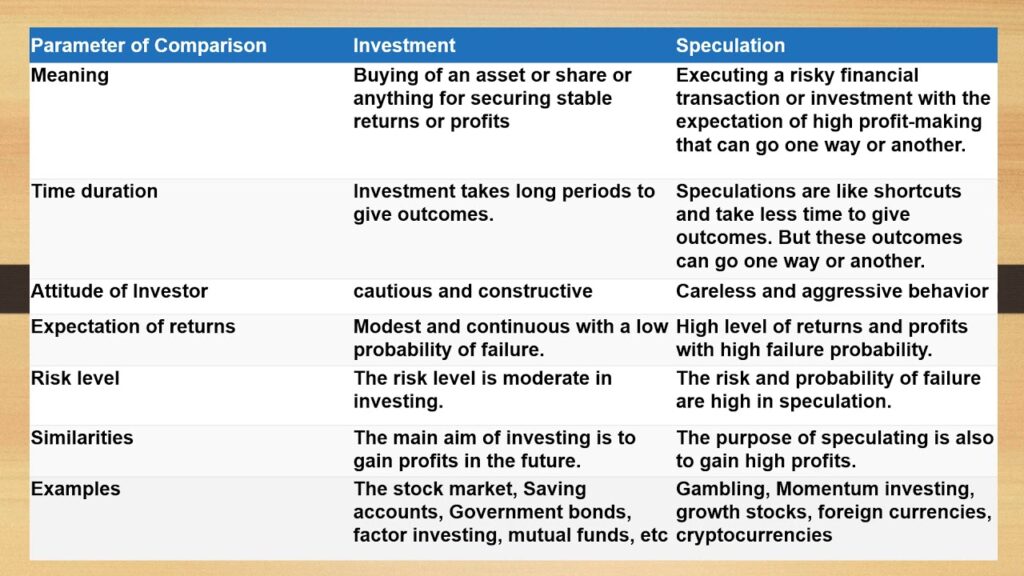

Understanding Speculation Investment

Speculation investment is distinguished by its emphasis on short-term profits and a willingness to accept a higher degree of risk. Speculators aim to predict future price movements, often relying on technical analysis, market sentiment, and news events to inform their decisions. The underlying asset itself may not hold significant intrinsic value; rather, the speculator’s focus is on the potential for rapid price appreciation. This differs significantly from value investing, where the focus is on identifying undervalued assets with strong fundamentals.

Key characteristics of speculation investment include:

- Short-term focus: Investments are typically held for a short duration, ranging from days to months.

- High risk tolerance: Speculators are willing to accept the possibility of significant losses in pursuit of substantial gains.

- Leverage: Speculation often involves the use of leverage (borrowed funds) to amplify potential returns (and losses).

- Active management: Requires constant monitoring and quick decision-making.

Common Avenues for Speculation

Several asset classes are frequently used for speculation investment:

- Stocks: Particularly volatile stocks, penny stocks, and companies undergoing significant changes.

- Options: Derivatives that give the holder the right, but not the obligation, to buy or sell an asset at a specific price.

- Futures: Contracts to buy or sell an asset at a predetermined price and date.

- Currencies (Forex): Trading on the fluctuations in exchange rates between different currencies.

- Cryptocurrencies: Digital or virtual currencies that use cryptography for security. [See also: Cryptocurrency Investment Strategies]

- Real Estate: Flipping properties or investing in areas undergoing rapid development.

The Allure and Potential Benefits of Speculation

Despite its inherent risks, speculation investment can be appealing for several reasons:

- Potential for High Returns: Successful speculation can generate substantial profits in a short period.

- Market Efficiency: Speculators can help to correct market inefficiencies by identifying and exploiting mispriced assets.

- Liquidity: Speculation can increase liquidity in certain markets by providing a ready buyer or seller.

- Excitement and Challenge: For some, the fast-paced nature and potential rewards of speculation can be intellectually stimulating and engaging.

The Inherent Risks of Speculation

It is crucial to acknowledge the significant risks associated with speculation investment:

- High Probability of Loss: The odds of success are often lower than in traditional investing.

- Volatility: Speculative assets are prone to rapid and unpredictable price swings.

- Leverage Amplification: While leverage can magnify gains, it also magnifies losses.

- Emotional Decision-Making: The pressure and excitement of speculation can lead to impulsive and irrational decisions.

- Market Manipulation: Speculative markets can be susceptible to manipulation and fraud.

- Lack of Fundamental Analysis: Often, decisions are based on trends and momentum rather than a company’s underlying value.

Mitigating the Risks: Strategies for Responsible Speculation

While speculation investment inherently involves risk, there are strategies that can help to mitigate potential losses:

- Thorough Research: Conduct extensive research on the asset, market, and relevant factors before investing.

- Risk Management: Set clear stop-loss orders to limit potential losses.

- Diversification: Avoid putting all your capital into a single speculative investment. Spread your risk across multiple assets.

- Emotional Control: Develop a disciplined trading plan and stick to it, avoiding impulsive decisions based on fear or greed.

- Start Small: Begin with a small amount of capital to gain experience and test your strategies.

- Understand Leverage: Use leverage cautiously and be fully aware of its potential impact on your portfolio.

- Continuous Learning: Stay informed about market trends, economic developments, and regulatory changes.

Is Speculation Investment Right for You?

Speculation investment is not suitable for all investors. It is generally best suited for individuals with:

- A high-risk tolerance: The ability to withstand significant losses without emotional distress.

- Sufficient capital: Only invest money that you can afford to lose.

- A strong understanding of financial markets: Knowledge of technical analysis, market dynamics, and risk management principles.

- Time and dedication: The willingness to actively monitor their investments and make quick decisions.

If you are new to investing or have a low-risk tolerance, it is generally advisable to avoid speculation investment and focus on more conservative strategies.

Examples of Speculative Investments Gone Wrong

History is littered with examples of speculative bubbles and investment fads that ended in disaster. The dot-com bubble of the late 1990s, the housing market crash of 2008, and the recent meme stock frenzy serve as cautionary tales. These events highlight the dangers of investing based on hype and speculation rather than sound fundamentals. In each instance, investors, driven by the fear of missing out (FOMO), piled into assets without fully understanding the risks, leading to massive losses when the bubbles eventually burst.

The Role of Regulation in Speculation

Regulators play a crucial role in overseeing speculative markets to protect investors from fraud and manipulation. Measures such as margin requirements, disclosure rules, and trading restrictions are designed to promote fair and transparent markets. However, regulation can only go so far, and ultimately, it is the responsibility of individual investors to exercise due diligence and make informed decisions.

The Future of Speculation Investment

Speculation investment is likely to remain a prominent feature of financial markets, driven by technological advancements, globalization, and the ever-present human desire for quick profits. The rise of online trading platforms and social media has made it easier than ever for individuals to participate in speculative markets, but it has also increased the risk of misinformation and herd behavior. As new asset classes emerge, such as cryptocurrencies and NFTs, the opportunities for speculation will continue to evolve. [See also: Understanding NFT Investments]. However, the fundamental principles of risk management and due diligence will remain essential for success in this challenging and potentially rewarding arena.

Conclusion

Speculation investment offers the potential for high returns, but it also carries significant risks. It is crucial to understand the characteristics of speculative investments, the factors that drive their price movements, and the strategies for managing risk. Before venturing into this realm, carefully assess your risk tolerance, financial resources, and investment knowledge. Remember that speculation is not a substitute for sound financial planning and long-term investment strategies. If approached with caution and discipline, speculation investment can be a part of a diversified portfolio. However, it should never be undertaken lightly or without a thorough understanding of the potential consequences. Always prioritize informed decision-making and responsible risk management.