Spread Betting vs CFD Trading: Understanding the Key Differences

For those venturing into the world of financial trading, the options can seem overwhelming. Two popular methods, spread betting and CFD (Contract for Difference) trading, often get compared. While both allow you to speculate on the price movements of various assets without owning them directly, they operate under different regulatory frameworks and have distinct tax implications. This article will delve into the nuances of spread betting vs CFD trading, helping you make an informed decision about which approach best suits your trading style and financial goals.

What is Spread Betting?

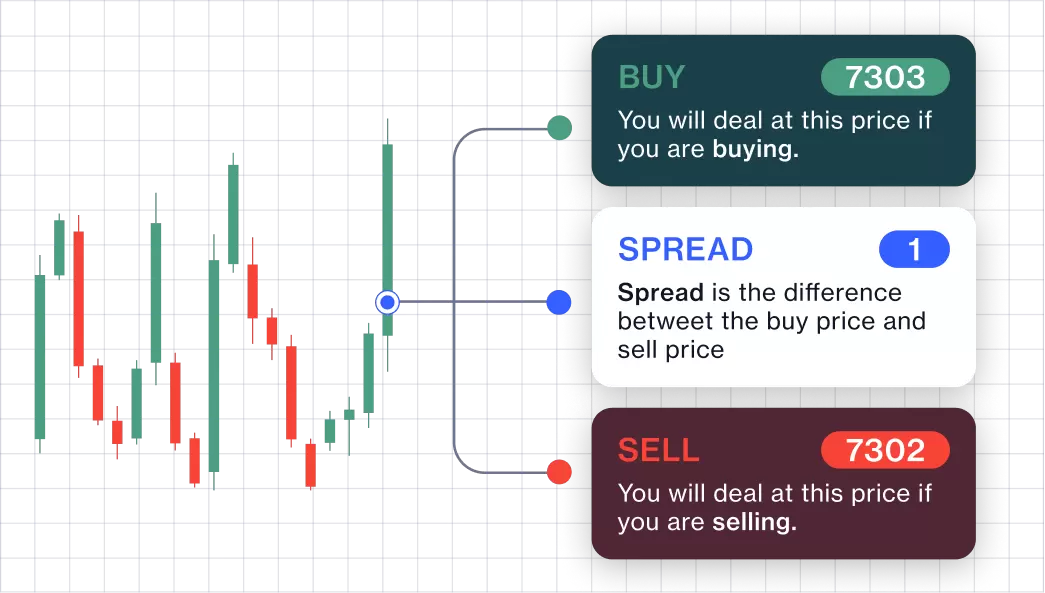

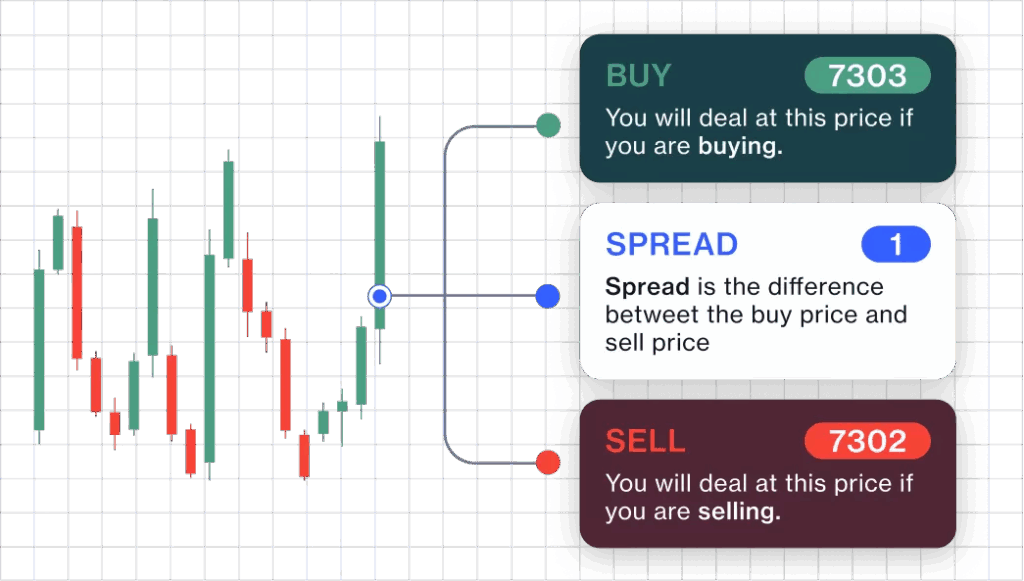

Spread betting involves speculating on the direction of an asset’s price movement. Instead of buying or selling the underlying asset, you’re betting on whether its price will rise or fall. The ‘spread’ is the difference between the buying and selling price quoted by the broker. Your profit or loss is determined by the accuracy of your prediction and the size of your stake per point movement.

A crucial element of spread betting is its tax-free status in the UK and Ireland. This is a significant advantage for many traders, as profits are exempt from capital gains tax. However, it’s important to remember that tax laws can change, and it’s always advisable to seek professional financial advice.

Key Features of Spread Betting:

- Tax-Free Profits (UK & Ireland): A major draw for many traders.

- Fixed Spreads: Often offer fixed spreads, making it easier to calculate potential profits and losses.

- Leverage: Allows you to control a larger position with a smaller initial deposit.

- Limited Markets: May offer a slightly narrower range of markets compared to CFDs.

What is CFD Trading?

CFD trading, or Contract for Difference trading, allows you to speculate on the price fluctuations of various assets, including stocks, indices, commodities, and currencies. Similar to spread betting, you don’t own the underlying asset. Instead, you enter into a contract with a broker to exchange the difference in the asset’s price between the time the contract opens and closes.

Unlike spread betting, profits from CFD trading are subject to capital gains tax. However, CFD trading offers access to a wider range of markets and can be used for hedging purposes. [See also: Hedging Strategies for Beginners]

Key Features of CFD Trading:

- Wider Market Access: Typically offers a broader selection of markets compared to spread betting.

- Subject to Capital Gains Tax: Profits are taxable, which needs to be factored into your trading strategy.

- Variable Spreads: Spreads can fluctuate depending on market conditions.

- Hedging Capabilities: Useful for hedging existing investment portfolios.

Spread Betting vs CFD: A Detailed Comparison

To fully understand the differences between spread betting vs CFD trading, let’s break down the key aspects:

Tax Implications

This is arguably the most significant difference. In the UK and Ireland, spread betting profits are generally tax-free, while CFD trading profits are subject to capital gains tax. This can have a substantial impact on your overall profitability, especially if you’re a frequent trader.

Market Access

Generally, CFD trading provides access to a broader range of markets than spread betting. While both offer major indices, currencies, and commodities, CFDs often include a wider selection of individual stocks and less liquid assets. If you’re looking to trade in niche markets, CFDs might be the better option. [See also: Exploring Different Financial Markets]

Spreads and Commissions

Spread betting often features fixed spreads, which can be advantageous in volatile markets. CFD trading, on the other hand, typically involves variable spreads that can widen during periods of high market activity. In addition, some CFD brokers may charge commissions on trades, which can impact your overall costs.

Leverage

Both spread betting and CFD trading offer leverage, allowing you to control a larger position with a smaller initial deposit. While leverage can amplify your profits, it can also magnify your losses. It’s crucial to use leverage responsibly and understand the risks involved. Regulators often impose limits on leverage to protect retail traders.

Regulation

Both spread betting and CFD trading are regulated by financial authorities, such as the Financial Conduct Authority (FCA) in the UK. This provides a level of protection for traders, ensuring that brokers adhere to certain standards and regulations. However, it’s essential to choose a reputable and regulated broker to minimize the risk of fraud or mismanagement.

Which is Right for You?

The best choice between spread betting vs CFD trading depends on your individual circumstances and trading preferences. Consider the following factors:

- Tax Situation: If you’re based in the UK or Ireland and want to avoid capital gains tax, spread betting might be the more attractive option.

- Market Focus: If you need access to a wider range of markets, CFD trading might be more suitable.

- Risk Tolerance: Both involve risk. Understand the risks associated with leverage and choose a strategy that aligns with your risk appetite.

- Trading Style: Consider whether you prefer fixed or variable spreads and whether you’re comfortable paying commissions.

Example Scenarios

Let’s illustrate with a couple of examples:

Scenario 1: A UK-based trader wants to speculate on the price of a major stock index. They are primarily concerned with minimizing their tax liability. In this case, spread betting might be the better choice, as any profits would be tax-free.

Scenario 2: A trader wants to hedge their existing stock portfolio against potential losses. They need access to a wide range of individual stocks. In this case, CFD trading might be more appropriate, as it offers a broader selection of markets and can be used for hedging purposes.

Risk Management in Spread Betting and CFD Trading

Regardless of whether you choose spread betting or CFD trading, effective risk management is crucial. This includes setting stop-loss orders to limit potential losses, using appropriate leverage, and diversifying your portfolio. It’s also important to stay informed about market developments and adjust your strategy accordingly. [See also: Essential Risk Management Techniques for Traders]

Remember that both spread betting and CFD trading are high-risk activities and are not suitable for all investors. It’s essential to understand the risks involved and to only trade with capital that you can afford to lose.

Conclusion

Spread betting and CFD trading offer distinct advantages and disadvantages. Understanding the key differences, particularly regarding tax implications, market access, and spreads, is crucial for making an informed decision. By carefully considering your individual circumstances and trading preferences, you can choose the approach that best aligns with your financial goals. Remember to prioritize risk management and to seek professional financial advice if needed. Ultimately, the choice between spread betting vs CFD trading is a personal one, and the best option will depend on your unique needs and objectives. Always remember to conduct thorough research and practice responsible trading habits.