Spread Betting vs. CFD Trading: Unveiling the Key Differences

Understanding the nuanced world of financial trading can be daunting, especially when navigating the various instruments available. Two popular options, spread betting and Contracts for Difference (CFDs), often cause confusion among novice and even seasoned traders. While both allow you to speculate on the price movements of assets without owning them, they operate with distinct mechanisms and have different tax implications. This article will delve into the core difference between spread betting and CFD trading, providing a comprehensive overview to help you make informed decisions.

What is Spread Betting?

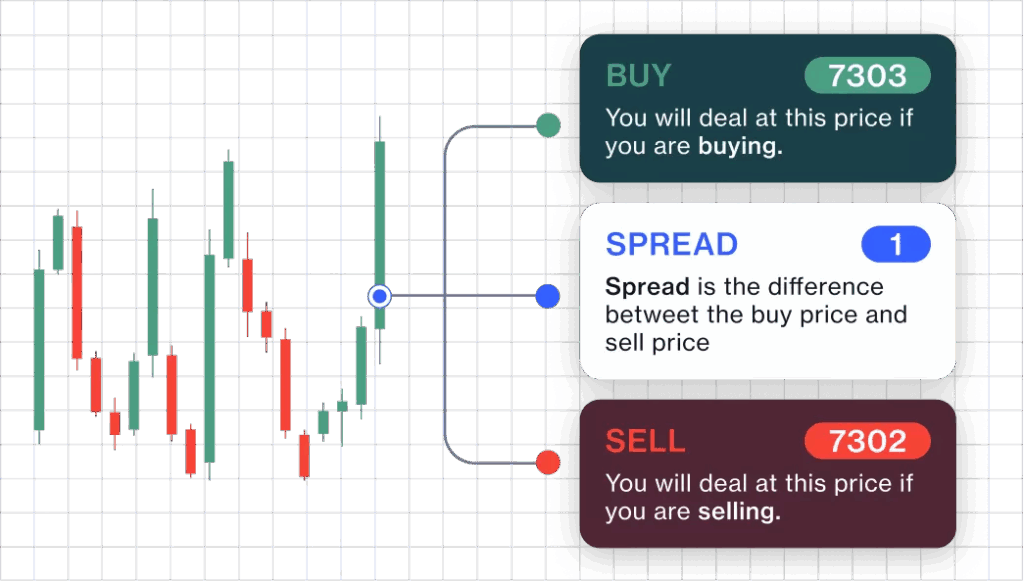

Spread betting is a form of derivative trading that allows you to speculate on the direction of an asset’s price movement. Instead of buying or selling the underlying asset, you’re essentially placing a bet on whether its price will rise (going long) or fall (going short). The ‘spread’ refers to the difference between the buying and selling price quoted by the broker. Your profit or loss is determined by the accuracy of your prediction and the size of your stake per point movement.

For example, if you believe the price of gold will increase, you might place a spread bet, staking £5 per point. If gold’s price rises 10 points, you’ll earn £50 (10 points x £5). Conversely, if the price falls 10 points, you’ll lose £50. A key advantage of spread betting in certain jurisdictions, notably the UK and Ireland, is that profits are often tax-free because it’s classified as gambling rather than investment income. However, this depends on individual circumstances and tax laws, so it’s crucial to seek professional advice.

What are CFDs (Contracts for Difference)?

CFDs, or Contracts for Difference, are another type of derivative product that allows you to speculate on the price movements of various financial assets, including stocks, indices, commodities, and currencies. Similar to spread betting, you don’t own the underlying asset. Instead, you enter into a contract with a broker to exchange the difference in the asset’s price between the time the contract is opened and when it is closed.

With CFDs, you profit if your prediction is correct. If you anticipate a price increase and buy a CFD (go long), you’ll profit if the price rises. Conversely, if you expect a price decrease and sell a CFD (go short), you’ll profit if the price falls. Your profit or loss is the difference between the opening and closing price multiplied by the number of CFDs you hold. Unlike spread betting, CFD profits are typically subject to capital gains tax.

Key Differences: Spread Betting vs. CFD Trading

While both spread betting and CFD trading offer similar functionality, several key distinctions exist:

Tax Implications

This is arguably the most significant difference between spread betting and CFD trading. In the UK and Ireland, profits from spread betting are often tax-free, treated as gambling winnings. Conversely, profits from CFD trading are generally subject to capital gains tax. This can significantly impact your net profit, especially for larger trading volumes. Remember to consult with a tax advisor to determine your individual tax obligations.

Unit of Trading

In spread betting, you typically trade in terms of a stake per point movement (e.g., £5 per point). Your profit or loss is calculated based on the number of points the asset’s price moves in your favor or against you. With CFDs, you trade a specific number of contracts. Your profit or loss is the difference between the opening and closing price multiplied by the number of contracts.

Spreads and Commissions

Both spread betting and CFD brokers make money through the spread – the difference between the buying and selling price. However, CFD brokers may also charge commissions on each trade, in addition to the spread. Spread betting brokers typically only charge the spread. Therefore, it’s essential to compare the overall costs, including spreads and commissions, to determine which option is more cost-effective for your trading style.

Leverage

Both spread betting and CFD trading offer leverage, which allows you to control a larger position with a smaller amount of capital. While leverage can amplify your profits, it can also magnify your losses. The level of leverage available varies depending on the broker, the asset being traded, and regulatory restrictions. High leverage can be particularly risky, especially for inexperienced traders. Understanding and managing leverage is crucial for risk management. [See also: Understanding Leverage in Trading]

Regulation

Both spread betting and CFD trading are regulated in many jurisdictions. However, the specific regulations and regulatory bodies may differ. For example, in the UK, both are regulated by the Financial Conduct Authority (FCA). It’s important to choose a broker that is regulated by a reputable authority to ensure the safety of your funds and fair trading practices.

Advantages and Disadvantages

Spread Betting

- Advantages: Potential tax-free profits (in certain jurisdictions), simple stake-per-point trading, no commissions.

- Disadvantages: Limited asset selection compared to CFDs, wider spreads in some cases.

CFD Trading

- Advantages: Wider range of assets available, tighter spreads on some assets, potentially lower margin requirements.

- Disadvantages: Profits subject to capital gains tax, potential commissions, more complex pricing structure.

Which is Right for You?

The best choice between spread betting and CFD trading depends on your individual circumstances, trading style, and risk tolerance. Consider the following factors:

- Tax Situation: If you’re in a jurisdiction where spread betting profits are tax-free, this can be a significant advantage.

- Trading Style: If you prefer a simple stake-per-point trading approach, spread betting might be more suitable. If you need access to a wider range of assets, CFDs might be a better option.

- Risk Tolerance: Both spread betting and CFD trading involve risk. Understand the leverage offered and manage your risk accordingly.

- Cost: Compare the overall costs, including spreads and commissions, to determine which option is more cost-effective.

Ultimately, the decision depends on your personal preferences and financial goals. It’s recommended to start with a demo account to practice and familiarize yourself with both spread betting and CFD trading before risking real capital. [See also: Risk Management Strategies for Traders]

Opening an Account

Opening an account for either spread betting or CFD trading typically involves a similar process. You’ll need to provide personal information, verify your identity, and deposit funds into your account. Brokers will often assess your trading experience and knowledge to ensure you understand the risks involved. Choose a reputable broker that is regulated by a recognized authority and offers the assets and features you’re looking for.

Risk Management

Regardless of whether you choose spread betting or CFD trading, effective risk management is crucial. Use stop-loss orders to limit your potential losses, and avoid risking more than you can afford to lose. Diversify your portfolio to spread your risk across different assets. Stay informed about market news and events that could impact your trades. Remember that trading involves risk, and it’s possible to lose money. Never invest more than you can afford to lose. [See also: The Importance of Stop-Loss Orders]

Conclusion

The difference between spread betting and CFD trading lies primarily in their tax implications and pricing structures. While spread betting often offers tax-free profits (in certain jurisdictions) and a simpler stake-per-point approach, CFD trading provides access to a wider range of assets and potentially tighter spreads. Carefully consider your individual circumstances, trading style, and risk tolerance before choosing the option that’s right for you. Always prioritize risk management and seek professional advice if needed. Understanding the nuances of each instrument is paramount for successful and responsible trading. Remember, both spread betting and CFD trading are leveraged products and carry a high level of risk to your capital.