Spread Betting vs. CFDs: Understanding the Key Differences

Choosing the right trading vehicle is crucial for any aspiring or seasoned trader. Two popular options often considered are spread betting and Contracts for Difference (CFDs). Both offer leveraged trading, allowing you to control a larger position with a smaller initial investment. However, understanding the difference between spread betting and CFDs is paramount to making informed decisions aligned with your trading goals and risk tolerance. This article will delve into the nuances of each, highlighting their key features, advantages, and disadvantages.

What is Spread Betting?

Spread betting is a derivative trading strategy that allows you to speculate on the price movements of various financial instruments, such as stocks, indices, commodities, and currencies. Instead of buying or selling the underlying asset, you’re essentially placing a bet on whether the price will rise or fall. The ‘spread’ refers to the difference between the buying (offer) and selling (bid) prices quoted by the broker. Your profit or loss depends on the accuracy of your prediction and the size of your stake per point movement.

One of the main attractions of spread betting, particularly in the UK and Ireland, is its tax-free status on profits. This is a significant advantage for many traders. However, it’s crucial to remember that tax laws are subject to change and can vary depending on your jurisdiction.

What are CFDs?

Contracts for Difference (CFDs) are another form of derivative trading that allows you to speculate on price movements without owning the underlying asset. Similar to spread betting, you enter into a contract with a broker to exchange the difference in the asset’s price between the time the contract opens and closes. CFDs are available on a wide range of financial instruments, offering flexibility in trading various markets.

Unlike spread betting, CFD trading is generally subject to capital gains tax. However, this can also offer potential tax advantages, such as offsetting losses against other capital gains. The tax implications of CFD trading should be carefully considered and discussed with a qualified tax advisor.

Key Differences Between Spread Betting and CFDs

While both spread betting and CFDs offer leveraged trading, several key differences distinguish them:

Taxation

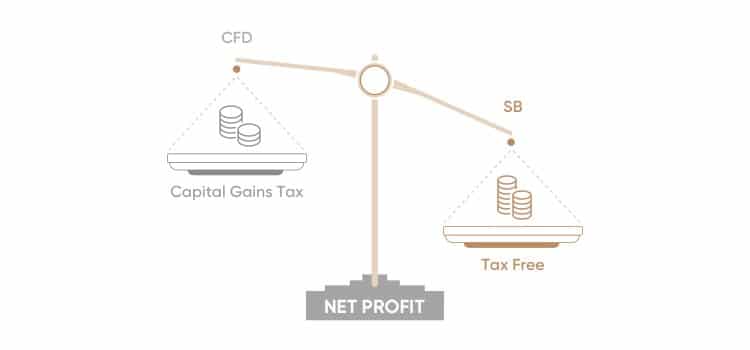

As mentioned earlier, taxation is a significant difference between spread betting and CFDs. In the UK and Ireland, profits from spread betting are generally tax-free, while CFD profits are subject to capital gains tax. This can significantly impact your overall profitability, depending on your individual circumstances.

Pricing and Spreads

The pricing structure can also vary. Spread betting typically involves a wider spread, reflecting the built-in tax advantage. CFDs often have tighter spreads but may also include commissions. It’s essential to compare the overall cost of trading, including spreads and commissions, to determine which option is more cost-effective for your trading style and volume.

Market Access

Both spread betting and CFDs offer access to a wide range of markets, including stocks, indices, commodities, and currencies. However, the specific instruments available may vary depending on the broker. It’s important to check that your chosen broker offers access to the markets you wish to trade.

Regulation

Both spread betting and CFDs are regulated by financial authorities, such as the Financial Conduct Authority (FCA) in the UK. This provides a level of protection for traders, ensuring that brokers adhere to certain standards of conduct and financial stability. However, it’s crucial to choose a reputable and regulated broker to minimize the risk of fraud or mismanagement.

Leverage

Both spread betting and CFDs offer leveraged trading, allowing you to control a larger position with a smaller initial deposit. Leverage can amplify both profits and losses, so it’s essential to use it responsibly and manage your risk effectively. The level of leverage offered can vary depending on the broker and the asset being traded.

Contract Size

In spread betting, you typically trade in terms of a stake per point movement. For example, you might bet £10 per point on the FTSE 100. In CFDs, you trade in terms of the number of contracts, each representing a specific quantity of the underlying asset. Understanding the contract size is crucial for calculating your potential profit or loss.

Advantages and Disadvantages of Spread Betting

Advantages

- Tax-free profits (in the UK and Ireland): This is a significant advantage for many traders.

- Ease of Use: Spread betting platforms are often user-friendly and straightforward to navigate.

- Fixed Spreads: Some brokers offer fixed spreads, providing certainty about your trading costs.

Disadvantages

- Wider Spreads: Spreads can be wider than those offered for CFDs.

- Limited Asset Choice: The range of assets available for spread betting may be more limited compared to CFDs.

- Risk of Over-Leveraging: The ease of use can lead to over-leveraging and increased risk.

Advantages and Disadvantages of CFDs

Advantages

- Tighter Spreads: Spreads are often tighter than those offered for spread betting.

- Wider Asset Choice: CFDs offer access to a broader range of assets.

- Potential Tax Advantages: Losses can be offset against other capital gains.

Disadvantages

- Subject to Capital Gains Tax: Profits are subject to capital gains tax.

- Commissions: Some brokers charge commissions on CFD trades.

- Complexity: CFD trading can be more complex than spread betting.

Choosing Between Spread Betting and CFDs

The best choice between spread betting and CFDs depends on your individual circumstances, trading style, and risk tolerance. Consider the following factors:

- Tax Implications: Evaluate the tax implications of each option in your jurisdiction.

- Trading Costs: Compare the overall costs of trading, including spreads, commissions, and overnight funding charges.

- Market Access: Ensure that your chosen broker offers access to the markets you wish to trade.

- Trading Style: Consider your trading frequency and holding period.

- Risk Tolerance: Assess your risk tolerance and choose an option that aligns with your comfort level.

Understanding the difference between spread betting and CFDs is essential for making informed trading decisions. Both offer leveraged trading opportunities, but they also have distinct features and implications. Before engaging in either, it’s crucial to conduct thorough research, understand the risks involved, and seek professional advice if needed. Both methods require a strong understanding of risk management. [See also: Risk Management Strategies for Leveraged Trading]

Risk Management Considerations

Regardless of whether you choose spread betting or CFDs, effective risk management is paramount. Leverage can amplify both profits and losses, so it’s crucial to implement strategies to protect your capital. Consider using stop-loss orders to limit potential losses and manage your position size carefully. Never risk more than you can afford to lose.

Conclusion

The difference between spread betting and CFDs lies primarily in their tax treatment and pricing structures. Spread betting, with its potential for tax-free profits (in certain jurisdictions), can be attractive to some traders. CFDs, on the other hand, offer tighter spreads and a wider range of assets. Ultimately, the best choice depends on your individual needs and preferences. By carefully considering the factors outlined in this article, you can make an informed decision and choose the trading vehicle that best suits your goals.

Before making any decisions, research different brokers and read reviews. Understanding the difference between spread betting and CFDs fully requires due diligence. Remember that both spread betting and CFDs are complex financial instruments and carry a high level of risk. It is possible to lose all of your invested capital. Make sure you understand the risks involved and seek independent financial advice if necessary. The difference between spread betting and CFDs can significantly impact your trading outcome, so choose wisely. The key difference between spread betting and CFDs to remember is often the tax implication. Choosing the right platform to trade is influenced by understanding the difference between spread betting and CFDs. Always consider the risks involved in financial trading, regardless of the instrument. The difference between spread betting and CFDs is not just about taxation; it’s also about the trading experience. Fully grasping the difference between spread betting and CFDs is crucial for informed financial decisions. The difference between spread betting and CFDs can also affect your trading strategy. Considering the difference between spread betting and CFDs is a critical step for any trader.