Stakeholders vs Shareholders: Understanding the Key Differences

In the world of business and finance, two terms frequently arise: stakeholders and shareholders. While often used interchangeably, they represent distinct groups with differing relationships to a company. Understanding the nuances between stakeholders vs shareholders is crucial for effective business management, corporate governance, and investment decisions. This article will delve into the definitions, differences, and significance of each group.

Defining Stakeholders and Shareholders

What is a Stakeholder?

A stakeholder is any individual, group, or organization that has an interest in or is affected by a company’s actions and outcomes. This broad definition encompasses a wide range of entities beyond just those who own stock. Stakeholders can be internal, such as employees, managers, and owners, or external, including customers, suppliers, communities, governments, and even competitors. The key characteristic of a stakeholder is their direct or indirect involvement with the company’s activities and their potential to be impacted by its successes or failures. Think of stakeholders vs shareholders as concentric circles, with shareholders being a subset of the larger stakeholder group.

What is a Shareholder?

A shareholder, also known as a stockholder, is an individual or entity that owns shares of stock in a company. These shares represent ownership in the company and entitle the shareholder to certain rights, such as voting on corporate matters and receiving dividends if the company distributes profits. Shareholders are primarily concerned with the financial performance of the company and the return on their investment. They are directly invested in the company’s success, as their financial well-being is tied to its profitability and growth. In the context of stakeholders vs shareholders, shareholders have a specific type of stake: a financial one rooted in ownership.

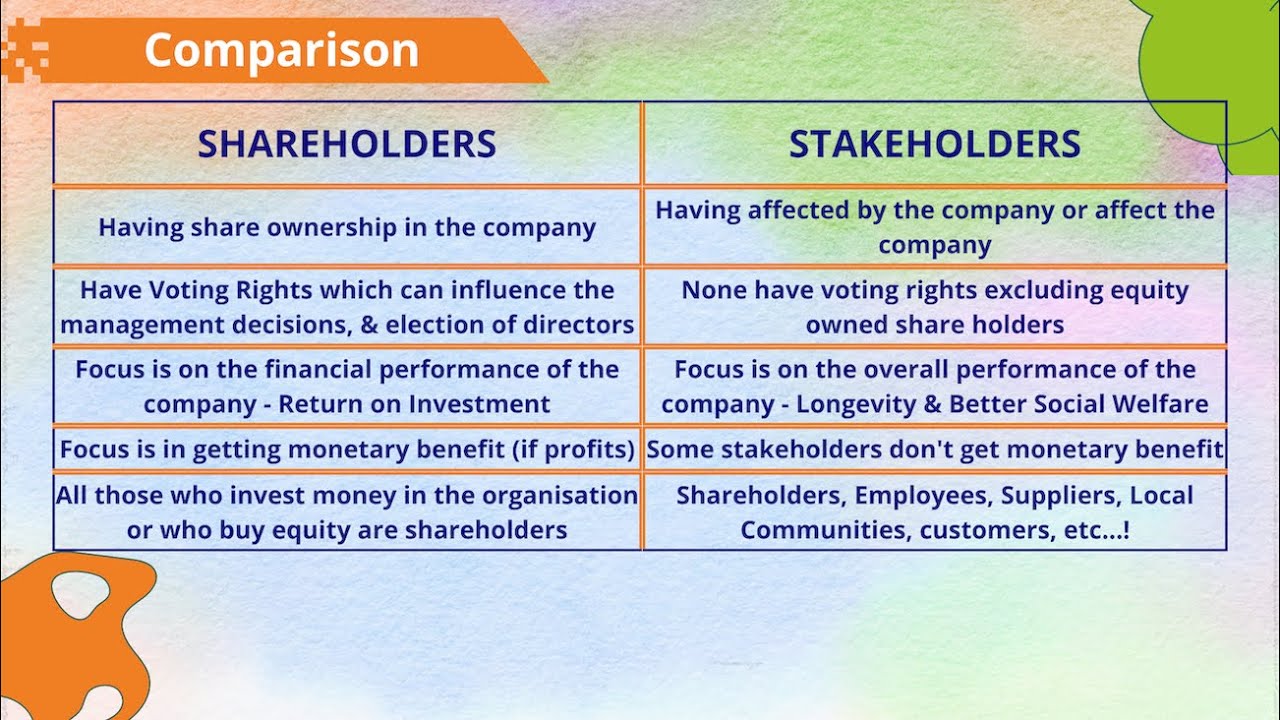

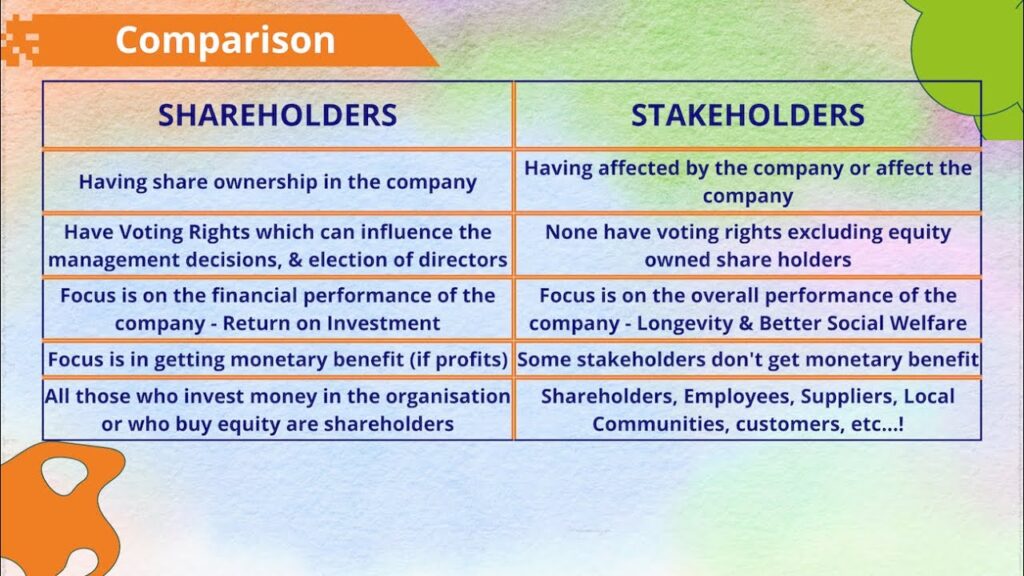

Key Differences Between Stakeholders and Shareholders

The distinction between stakeholders vs shareholders lies primarily in their relationship to the company and their motivations. Here’s a breakdown of the key differences:

- Relationship: Shareholders are owners of the company, while stakeholders have an interest in the company’s performance, regardless of ownership.

- Motivation: Shareholders are primarily motivated by financial returns, such as dividends and stock appreciation. Stakeholders have diverse motivations, including job security, product quality, community well-being, and environmental sustainability.

- Impact: Shareholders have a direct financial impact on the company, as their investment provides capital. Stakeholders can impact the company through various means, such as employee productivity, customer loyalty, supplier relationships, and community support.

- Rights: Shareholders have specific legal rights, such as voting rights and the right to receive financial information. Stakeholders may not have legal rights but can exert influence through advocacy, boycotts, or other forms of pressure.

- Time Horizon: Shareholders often have a shorter-term focus, concerned with quarterly earnings and immediate stock performance. Stakeholders may have a longer-term perspective, considering the company’s long-term sustainability and impact on society.

Understanding these differences between stakeholders vs shareholders is fundamental for companies aiming to build sustainable and ethical business practices.

The Importance of Stakeholder Management

Effective stakeholder management is crucial for the long-term success of any organization. By understanding and addressing the needs and concerns of various stakeholder groups, companies can build stronger relationships, foster trust, and mitigate risks. Ignoring stakeholder interests can lead to negative consequences, such as decreased employee morale, customer boycotts, regulatory scrutiny, and reputational damage. A company carefully balancing the needs of stakeholders vs shareholders is more likely to succeed in the long run.

Here are some benefits of effective stakeholder management:

- Improved decision-making: Considering diverse perspectives leads to more informed and robust decisions.

- Enhanced reputation: Demonstrating social responsibility builds trust and enhances brand image.

- Reduced risks: Identifying and addressing potential conflicts minimizes disruptions and avoids costly crises.

- Increased employee engagement: Valuing employee contributions fosters loyalty and improves productivity.

- Stronger community relations: Building positive relationships with local communities enhances social license to operate.

Ultimately, a company’s ability to manage its relationships with stakeholders vs shareholders directly impacts its bottom line and its long-term viability.

Examples of Stakeholders and Their Interests

To further illustrate the concept of stakeholders, let’s consider some specific examples and their respective interests:

- Employees: Job security, fair wages, safe working conditions, opportunities for advancement.

- Customers: High-quality products/services, competitive prices, excellent customer service.

- Suppliers: Fair contracts, timely payments, long-term partnerships.

- Communities: Economic development, environmental protection, social responsibility.

- Governments: Tax revenue, regulatory compliance, job creation.

- Shareholders: Profitability, stock appreciation, dividends.

Each of these groups has a vested interest in the company’s success, but their priorities may differ. Balancing the needs of these diverse stakeholders vs shareholders is a complex but essential task for effective management.

The Stakeholder Theory

The stakeholder theory, developed by R. Edward Freeman, posits that a company should consider the interests of all stakeholders, not just shareholders. This theory challenges the traditional view that a company’s primary responsibility is to maximize shareholder value. Instead, it argues that companies should create value for all stakeholders, including employees, customers, suppliers, communities, and shareholders. The stakeholder theory emphasizes the importance of ethical behavior, social responsibility, and long-term sustainability. Thinking critically about stakeholders vs shareholders is at the heart of this theory.

The stakeholder theory has gained increasing prominence in recent years, as companies face growing pressure to address social and environmental issues. Many companies are now adopting stakeholder-centric approaches to business, recognizing that long-term success depends on building strong relationships with all stakeholders.

Balancing the Interests of Stakeholders and Shareholders

One of the biggest challenges for companies is balancing the often-competing interests of stakeholders and shareholders. While shareholders may prioritize short-term profits, stakeholders may be more concerned with long-term sustainability and social impact. Finding a balance that satisfies both groups requires careful consideration and strategic decision-making. It’s a constant negotiation between stakeholders vs shareholders.

Here are some strategies for balancing stakeholder and shareholder interests:

- Transparency and communication: Openly communicate with stakeholders about the company’s goals, performance, and challenges.

- Stakeholder engagement: Actively solicit feedback from stakeholders and incorporate their perspectives into decision-making.

- Long-term perspective: Focus on long-term value creation rather than short-term profits.

- Ethical behavior: Adhere to high ethical standards and demonstrate social responsibility.

- Performance measurement: Track and report on both financial and non-financial performance, including social and environmental impact.

By adopting these strategies, companies can build trust, foster collaboration, and create value for both stakeholders vs shareholders.

The Future of Stakeholder Capitalism

The concept of stakeholder capitalism is gaining momentum as businesses increasingly recognize the importance of considering the interests of all stakeholders. Stakeholder capitalism is an economic system in which businesses are accountable to all stakeholders, not just shareholders. This model emphasizes the importance of creating long-term value for all stakeholders, including employees, customers, suppliers, communities, and shareholders.

The World Economic Forum has been a leading advocate for stakeholder capitalism, arguing that it is essential for building a more sustainable and equitable global economy. As companies face growing pressure to address social and environmental issues, stakeholder capitalism is likely to become increasingly prevalent in the years to come. Understanding the dynamic between stakeholders vs shareholders is key to navigating this shift.

Conclusion

The distinction between stakeholders vs shareholders is fundamental to understanding the complexities of modern business. While shareholders are owners with a primary focus on financial returns, stakeholders encompass a broader group with diverse interests and concerns. Effective stakeholder management is crucial for long-term success, as it enables companies to build stronger relationships, foster trust, and mitigate risks. By balancing the needs of both stakeholders and shareholders, companies can create value for all and contribute to a more sustainable and equitable future. [See also: Corporate Social Responsibility: A Guide] [See also: ESG Investing: What You Need to Know]