Stakeholders vs Shareholders: Understanding the Key Differences

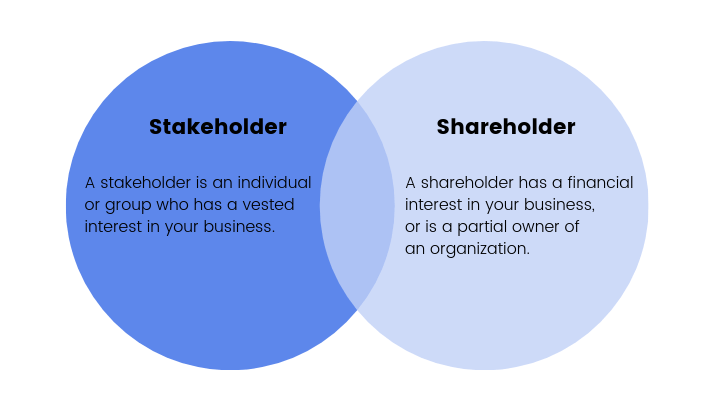

In the world of business and finance, two terms frequently surface: stakeholders and shareholders. While often used interchangeably, they represent distinct groups with differing interests and relationships to a company. Understanding the nuances between stakeholders and shareholders is crucial for effective corporate governance, strategic decision-making, and fostering long-term success. This article delves into the specific characteristics of each group, highlighting their roles, responsibilities, and the potential conflicts that can arise.

Defining Stakeholders

A stakeholder is any individual, group, or organization that has an interest in or is affected by the actions of a business. This broad definition encompasses a wide range of entities, including employees, customers, suppliers, communities, government agencies, and even competitors. Stakeholders are invested in the success of a company because they are directly impacted by its operations, policies, and performance. Their involvement can be voluntary or involuntary, and their influence can vary depending on their relationship with the company.

Examples of Stakeholders

- Employees: Their livelihood depends on the company’s success. They are concerned with fair wages, safe working conditions, and opportunities for advancement.

- Customers: They rely on the company for products or services and are interested in quality, value, and customer service.

- Suppliers: They depend on the company for revenue and are concerned with timely payments and fair contracts.

- Communities: They are affected by the company’s environmental impact, job creation, and community involvement.

- Government Agencies: They regulate the company’s activities and are concerned with compliance with laws and regulations.

Defining Shareholders

A shareholder, also known as a stockholder, is an individual or entity that owns shares of stock in a company. These shares represent ownership in the company and entitle the shareholder to a portion of the company’s profits and assets. Shareholders are primarily concerned with the financial performance of the company and its ability to generate returns on their investment. Their primary goal is to maximize their investment and receive dividends or capital appreciation.

Rights and Responsibilities of Shareholders

- Voting Rights: Shareholders typically have the right to vote on important company matters, such as the election of directors and major corporate decisions.

- Dividends: Shareholders may receive dividends, which are a portion of the company’s profits distributed to them.

- Capital Appreciation: Shareholders benefit from the increase in the value of their shares over time.

- Liability: Shareholders generally have limited liability, meaning their personal assets are protected from the company’s debts and obligations.

Key Differences: Stakeholders vs. Shareholders

The primary difference between stakeholders and shareholders lies in their relationship to the company and their motivations. Shareholders are owners of the company, while stakeholders have an interest in the company’s performance, regardless of ownership. Here’s a breakdown of the key distinctions:

| Feature | Stakeholders | Shareholders |

|---|---|---|

| Relationship to Company | Interested party | Owner |

| Primary Motivation | Varied; can include financial, social, or environmental concerns | Financial gain |

| Scope of Interest | Broad; concerned with all aspects of the company’s operations | Primarily concerned with financial performance |

| Influence | Can influence company decisions through various means, such as lobbying, boycotts, or public pressure | Influence company decisions through voting rights and ownership |

| Risk | Risk losing benefits associated with the company (e.g., job, product access) | Risk losing investment |

Potential Conflicts Between Stakeholders and Shareholders

While the interests of stakeholders and shareholders can align, conflicts can also arise. For example, decisions that maximize shareholder value, such as cost-cutting measures or outsourcing, may negatively impact employees or communities. Balancing the needs of different stakeholders is a complex challenge for corporate management. Companies must consider the ethical and social implications of their decisions and strive to create value for all stakeholders, not just shareholders. [See also: Corporate Social Responsibility Initiatives]

Examples of Conflicts

- Environmental Concerns: Shareholders may prioritize short-term profits over environmental sustainability, leading to conflicts with communities and environmental groups.

- Labor Practices: Shareholders may pressure companies to reduce labor costs, leading to conflicts with employees and labor unions.

- Product Safety: Shareholders may resist investing in product safety improvements if they believe it will negatively impact profits, leading to conflicts with customers.

Stakeholder Theory vs. Shareholder Primacy

The debate over whether companies should prioritize stakeholder interests or shareholder interests has led to the development of two competing theories: stakeholder theory and shareholder primacy. Stakeholder theory argues that companies should consider the interests of all stakeholders when making decisions, while shareholder primacy argues that companies should primarily focus on maximizing shareholder value. The stakeholder theory suggests that considering a wider range of interests leads to more sustainable and ethical business practices. It posits that a happy workforce, satisfied customers, and supportive communities contribute to long-term profitability and resilience. On the other hand, shareholder primacy emphasizes the fiduciary duty of corporate executives to act in the best financial interests of the company’s owners. This view suggests that maximizing profits ultimately benefits society as a whole through economic growth and job creation.

The Importance of Stakeholder Engagement

Effective stakeholder engagement is crucial for building trust, managing risks, and fostering long-term success. Companies that actively engage with their stakeholders are better positioned to understand their needs and expectations, address their concerns, and build strong relationships. This engagement can take many forms, including surveys, focus groups, town hall meetings, and social media interactions. [See also: Effective Communication Strategies for Business]

Benefits of Stakeholder Engagement

- Improved Decision-Making: By considering the perspectives of different stakeholders, companies can make more informed and well-rounded decisions.

- Enhanced Reputation: Companies that are seen as responsive to their stakeholders are more likely to have a positive reputation.

- Reduced Risks: By identifying and addressing stakeholder concerns early on, companies can mitigate potential risks.

- Increased Innovation: By engaging with stakeholders, companies can gain valuable insights and ideas for new products and services.

The Future of Stakeholder Capitalism

There is a growing movement towards stakeholder capitalism, which emphasizes the importance of creating value for all stakeholders, not just shareholders. This shift is driven by a growing recognition that businesses have a responsibility to contribute to society and address pressing social and environmental challenges. Stakeholder capitalism recognizes that businesses are not simply economic entities but are also social institutions with a profound impact on the world around them. By embracing this perspective, companies can build a more sustainable and equitable future for all. Many large corporations are beginning to incorporate stakeholder considerations into their core business strategies. [See also: ESG Investing: A Comprehensive Guide]

Conclusion

Understanding the differences between stakeholders and shareholders is essential for navigating the complexities of the modern business world. While shareholders are owners of the company and primarily concerned with financial returns, stakeholders have a broader interest in the company’s performance and impact. Companies that prioritize stakeholder engagement and strive to create value for all stakeholders are more likely to achieve long-term success and contribute to a more sustainable and equitable future. Effective management requires a delicate balance between the needs of these two groups, ensuring that the company thrives while also fulfilling its responsibilities to the broader community. The ongoing shift towards stakeholder capitalism signals a recognition that businesses must consider their impact on all those affected by their operations, leading to a more responsible and sustainable approach to corporate governance. In summary, the distinction between stakeholders and shareholders is not just academic; it has profound implications for how businesses are managed and the role they play in society.