Stakeholders vs. Shareholders: Understanding the Key Differences

In the complex world of business, understanding the nuances between different roles and responsibilities is crucial for success. Two terms that often get used interchangeably, but represent distinct groups with varying interests, are stakeholders and shareholders. While both are vital to a company’s operations, their relationship to the organization and their motivations differ significantly. This article will delve into what is the difference between stakeholders and shareholders, exploring their roles, interests, and impact on a company’s performance.

Defining Stakeholders and Shareholders

Before dissecting the differences, let’s define each term clearly.

What is a Stakeholder?

A stakeholder is any individual, group, or organization that has an interest in the success of a business. This interest can be financial, emotional, or even based on ethical considerations. Stakeholders can be internal, such as employees, managers, and owners, or external, such as customers, suppliers, creditors, the community, and even the government. Their stake arises from the potential impact the company’s actions can have on them.

What is a Shareholder?

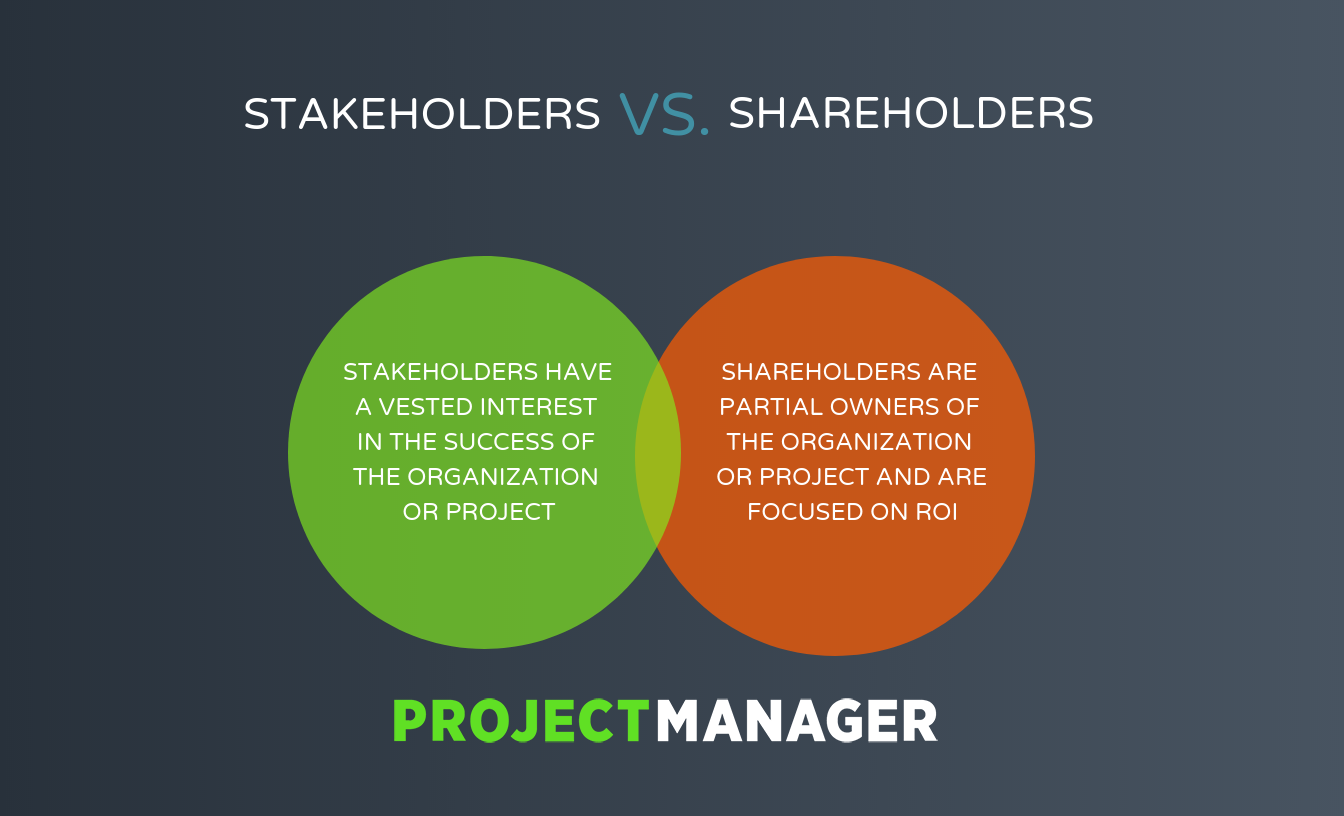

A shareholder, also known as a stockholder, is an individual or entity that owns shares of stock in a corporation. By owning stock, shareholders become part-owners of the company and are entitled to a portion of the company’s profits and assets. Their primary interest is usually financial – they aim to see their investment grow through stock appreciation and dividends. In essence, all shareholders are stakeholders, but not all stakeholders are shareholders.

Key Differences Between Stakeholders and Shareholders

The core distinction lies in the nature of their relationship with the company and their primary motivations.

Ownership vs. Interest

Shareholders have an ownership stake in the company through their stock holdings. This ownership gives them certain rights, such as voting rights on major company decisions and the right to receive dividends. Stakeholders, on the other hand, have an interest in the company’s performance, but not necessarily ownership. Their interest could stem from their employment, their reliance on the company’s products or services, or the company’s impact on their community. Understanding what is the difference between stakeholders and shareholders starts with this fundamental separation of ownership versus interest.

Motivation

The primary motivation for shareholders is typically to maximize their financial return on investment. They want to see the company’s stock price increase and receive dividends regularly. While other considerations might play a role, financial gain is usually the driving force. For stakeholders, motivations are more diverse. Employees want job security and fair wages. Customers want quality products and services. Communities want the company to be a responsible corporate citizen. Suppliers want reliable contracts and timely payments. The diversity of these motivations highlights what is the difference between stakeholders and shareholders beyond just financial gain.

Scope of Concern

Shareholders primarily focus on the company’s financial performance and its impact on their investment. They are interested in metrics such as revenue, profit margins, and earnings per share. Stakeholders, however, have a broader scope of concern. They are interested in the company’s social and environmental impact, its ethical practices, and its overall contribution to society. For example, a community stakeholder might be concerned about the company’s pollution levels, while a shareholder might only care about the impact of environmental regulations on the company’s profitability. This difference in scope further clarifies what is the difference between stakeholders and shareholders.

Influence and Decision-Making

Shareholders, especially those with significant holdings, often have direct influence on company decisions through their voting rights. They can vote on matters such as electing board members, approving mergers and acquisitions, and changing the company’s bylaws. Stakeholders, while lacking direct voting power, can still influence company decisions through various means, such as lobbying, public advocacy, and consumer boycotts. A company that ignores the concerns of its stakeholders risks reputational damage and loss of business. Understanding the different avenues of influence is critical to understanding what is the difference between stakeholders and shareholders.

Examples of Stakeholders and Shareholders

To further illustrate the distinction, let’s consider some specific examples.

Examples of Stakeholders

- Employees: They rely on the company for their livelihood and career opportunities.

- Customers: They depend on the company for products or services that meet their needs.

- Suppliers: They rely on the company for consistent orders and timely payments.

- Community: The local community is affected by the company’s operations, including job creation, environmental impact, and social contributions.

- Government: The government has an interest in the company’s compliance with laws and regulations, as well as its contribution to the economy.

Examples of Shareholders

- Individual Investors: People who buy shares of the company’s stock.

- Institutional Investors: Investment firms, pension funds, and mutual funds that hold large blocks of the company’s stock.

- Founders and Executives: Individuals who own a significant portion of the company’s stock.

The Importance of Balancing Stakeholder and Shareholder Interests

A successful company recognizes the importance of balancing the interests of both stakeholders and shareholders. Focusing solely on maximizing shareholder value can lead to negative consequences for other stakeholders, such as employee dissatisfaction, customer churn, and environmental damage. Conversely, neglecting shareholder interests can lead to a decline in the company’s financial performance and ultimately harm all stakeholders. Finding the right balance is a key challenge for corporate leadership. A crucial aspect of what is the difference between stakeholders and shareholders is understanding how these interests can be aligned.

The Stakeholder Theory

The stakeholder theory, developed by R. Edward Freeman, argues that a company should create value for all of its stakeholders, not just its shareholders. This theory emphasizes the interconnectedness of different groups and the importance of considering their needs and interests when making business decisions. By adopting a stakeholder-centric approach, companies can build stronger relationships, foster loyalty, and create long-term sustainable value. Understanding this theory helps to illustrate what is the difference between stakeholders and shareholders in a broader business context. [See also: Corporate Social Responsibility]

The Shareholder Primacy Theory

In contrast to the stakeholder theory, the shareholder primacy theory asserts that a company’s primary responsibility is to maximize shareholder value. This theory, often associated with Milton Friedman, argues that managers are agents of the shareholders and should act in their best interests. While this approach can lead to short-term financial gains, it can also create ethical dilemmas and harm other stakeholders in the long run. The debate between these two theories highlights what is the difference between stakeholders and shareholders and their impact on corporate governance.

Modern Business and the Evolving Role of Stakeholders

In today’s increasingly interconnected and socially conscious world, the role of stakeholders is becoming more prominent. Companies are facing growing pressure to address environmental, social, and governance (ESG) issues and to demonstrate a commitment to corporate social responsibility. Investors are also paying more attention to ESG factors when making investment decisions, recognizing that companies that prioritize stakeholder interests are often more resilient and sustainable in the long run. This shift underscores what is the difference between stakeholders and shareholders in the context of modern business practices.

Conclusion

Understanding what is the difference between stakeholders and shareholders is essential for anyone involved in the business world. While shareholders are owners with a primary focus on financial return, stakeholders have a broader range of interests and can include employees, customers, suppliers, communities, and governments. A successful company recognizes the importance of balancing the needs of both groups and creating value for all. As the business landscape continues to evolve, the role of stakeholders will likely become even more important, requiring companies to adopt a more holistic and inclusive approach to decision-making. Recognizing the distinction between stakeholders and shareholders allows for more informed business strategies and a greater understanding of corporate responsibility.