Staking XRP: Exploring the Possibilities and Potential of Earning Rewards

XRP, the digital asset associated with Ripple Labs, has long been a subject of interest within the cryptocurrency community. While it’s primarily known for facilitating cross-border payments, the question of whether you can stake XRP has frequently surfaced. This article delves into the current state of XRP staking, explores potential future developments, and examines the broader implications for XRP holders.

Currently, staking XRP directly through the Ripple network is not possible. Ripple’s consensus mechanism, known as the Federated Consensus Protocol, doesn’t rely on staking to validate transactions. Unlike proof-of-stake (PoS) blockchains where users lock up their tokens to secure the network and earn rewards, XRP’s ledger operates differently. However, this doesn’t mean earning rewards on your XRP holdings is entirely out of reach. Third-party platforms and exchanges are exploring innovative solutions to offer something akin to staking XRP.

Understanding XRP and its Consensus Mechanism

To understand why direct XRP staking isn’t available, it’s crucial to grasp the fundamentals of XRP and its underlying technology. XRP operates on the XRP Ledger (XRPL), a decentralized cryptographic ledger. Transactions are validated by a network of independent validators who compare proposed transactions against the ledger’s current state. This consensus process is significantly different from the energy-intensive proof-of-work (PoW) or the capital-intensive proof-of-stake (PoS) mechanisms found in other cryptocurrencies. The XRPL is designed for speed and efficiency, focusing on facilitating fast and low-cost payments.

The Federated Consensus Protocol relies on a network of trusted validators. These validators, chosen for their reliability and reputation, vote on the validity of transactions. If a supermajority of validators agree, the transaction is confirmed and added to the ledger. This approach allows for rapid transaction processing and minimal energy consumption. However, it also means that regular XRP holders don’t directly participate in the consensus process and, therefore, cannot earn rewards through traditional staking.

Third-Party Solutions and Potential for Earning Rewards

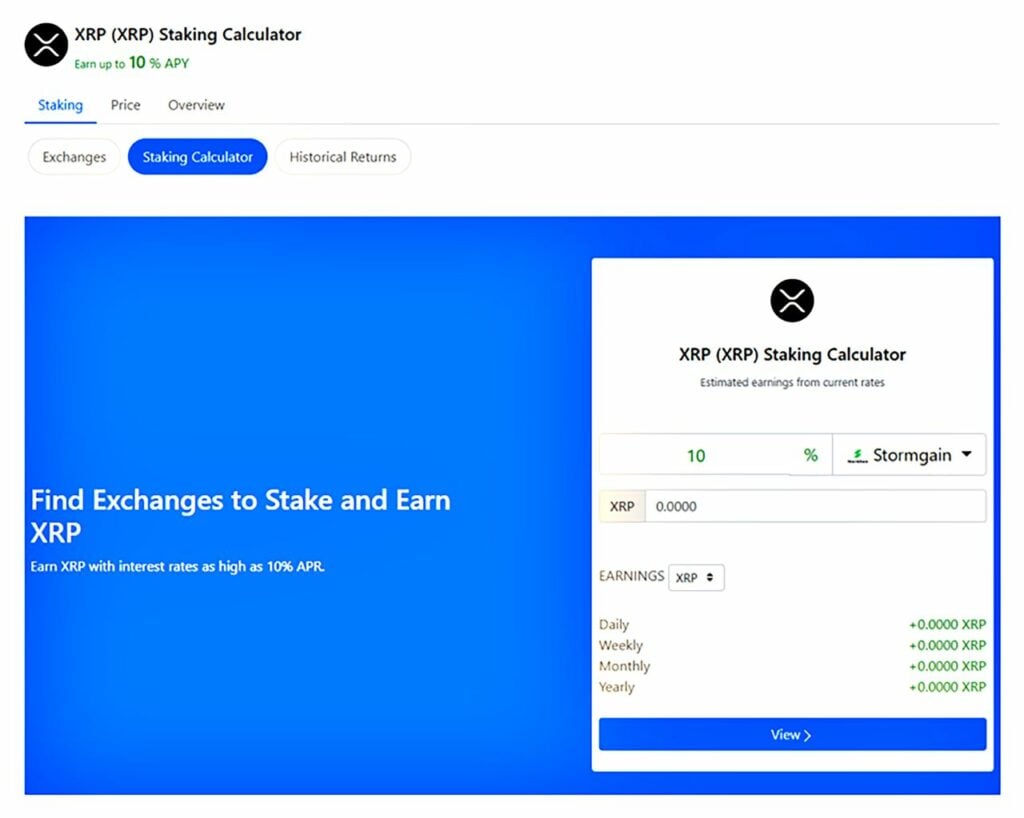

While direct XRP staking isn’t an option, several third-party platforms and cryptocurrency exchanges are exploring ways to offer XRP holders opportunities to earn rewards. These solutions often involve lending or providing liquidity to platforms that utilize XRP for various purposes. For example, some exchanges may offer interest-bearing accounts for XRP holders, where the deposited XRP is used for margin trading or other lending activities. In return, users receive a portion of the interest earned.

Another potential avenue for earning rewards is through decentralized finance (DeFi) platforms. Some DeFi protocols are exploring ways to integrate XRP into their ecosystems, allowing users to provide liquidity or participate in other DeFi activities using XRP. While these opportunities are still relatively limited compared to other cryptocurrencies, they represent a growing trend and could become more prevalent in the future. It’s important to thoroughly research and understand the risks associated with any third-party platform before entrusting them with your XRP holdings. [See also: DeFi and XRP Integration]

Potential Risks and Considerations

Before participating in any third-party solution that offers rewards for holding XRP, it’s crucial to be aware of the potential risks involved. These risks can include:

- Security Risks: Entrusting your XRP to a third-party platform always carries the risk of hacking or theft. It’s essential to choose platforms with a strong security track record and robust security measures.

- Counterparty Risk: There’s always a risk that the platform you’re using could become insolvent or experience financial difficulties. This could lead to the loss of your deposited XRP.

- Regulatory Risks: The regulatory landscape surrounding cryptocurrencies is constantly evolving. There’s a risk that new regulations could impact the availability or legality of certain third-party solutions.

- Smart Contract Risks: If you’re participating in DeFi protocols, you’re also exposed to the risks associated with smart contracts. Smart contracts can contain bugs or vulnerabilities that could be exploited by hackers.

It’s essential to conduct thorough due diligence and understand the terms and conditions of any platform before depositing your XRP. Never invest more than you can afford to lose, and always diversify your holdings across multiple platforms to mitigate risk.

The Future of XRP and Staking

While direct XRP staking isn’t currently available, the future could hold new possibilities. As the cryptocurrency landscape evolves, Ripple Labs and the XRP community may explore alternative consensus mechanisms or innovative ways to incentivize XRP holders. The demand for earning passive income on cryptocurrency holdings is growing, and it’s possible that Ripple could eventually introduce a form of staking or reward system for XRP holders.

One potential scenario could involve the development of sidechains or layer-2 solutions that allow for staking or other DeFi activities. These solutions could enable XRP holders to earn rewards without directly modifying the core XRP Ledger. Another possibility is that Ripple could partner with DeFi platforms to create new opportunities for XRP holders to participate in the DeFi ecosystem. [See also: Layer-2 Solutions for XRP]

However, it’s important to note that any future changes to the XRP Ledger or the introduction of staking mechanisms would require careful consideration and community consensus. Ripple Labs has historically prioritized stability and security, and any changes would need to be thoroughly vetted to ensure they don’t compromise the integrity of the network.

Alternatives to Staking XRP

Since traditional XRP staking isn’t an option, let’s explore some alternatives that XRP holders can consider to potentially increase their holdings:

- Trading: Actively trading XRP against other cryptocurrencies or fiat currencies can be a way to profit from price fluctuations. However, trading involves significant risk and requires a thorough understanding of market dynamics.

- Holding for Long-Term Appreciation: Many XRP holders believe in the long-term potential of XRP and choose to hold their tokens in anticipation of future price appreciation. This strategy requires patience and a strong belief in the underlying technology.

- Lending Platforms: As mentioned earlier, some platforms offer interest-bearing accounts for XRP holders. While this is not technically staking, it can provide a way to earn passive income on your XRP holdings.

- Participating in Airdrops: Keep an eye out for potential airdrops of new tokens to XRP holders. This can be a way to acquire new cryptocurrencies for free.

Staying Informed About XRP Developments

The cryptocurrency landscape is constantly evolving, and it’s essential to stay informed about the latest developments related to XRP. Here are some resources for staying up-to-date:

- Ripple’s Official Website: Visit Ripple’s official website for the latest news and announcements.

- XRP Community Forums: Participate in online forums and communities to discuss XRP with other enthusiasts.

- Cryptocurrency News Websites: Follow reputable cryptocurrency news websites for coverage of XRP and the broader cryptocurrency market.

- Social Media: Follow Ripple and prominent XRP figures on social media platforms like Twitter and LinkedIn.

Conclusion: The Current Landscape of XRP Staking

In conclusion, while direct staking XRP is not currently possible due to its unique consensus mechanism, the cryptocurrency ecosystem is dynamic. Third-party platforms and potential future developments may offer XRP holders opportunities to earn rewards. It’s crucial to approach these opportunities with caution, understanding the associated risks, and conducting thorough research before entrusting your XRP to any platform. The future of XRP staking remains uncertain, but the ongoing innovation in the cryptocurrency space suggests that new possibilities may emerge. Always stay informed, manage your risk responsibly, and make informed decisions based on your own investment goals and risk tolerance. The potential for earning rewards with XRP exists, but requires navigating the current ecosystem carefully. Always remember to validate information regarding staking XRP before committing any funds. The concept of staking XRP remains a hot topic. The future of staking XRP depends on the community. Many are hoping for the opportunity to stake XRP. The potential for future XRP staking options is being closely watched. Always research before attempting to stake XRP. Keep an eye on developments regarding staking XRP. The ability to stake XRP could change the landscape. The advantages of being able to stake XRP are appealing to many. The demand to stake XRP is high.