Stock Analysis Forecast: Navigating Market Volatility with Data-Driven Insights

In today’s fast-paced financial landscape, making informed investment decisions is more critical than ever. A robust stock analysis forecast provides investors with the tools and insights needed to navigate market volatility and identify potential opportunities. This article delves into the methodologies, benefits, and challenges associated with forecasting stock performance, offering a comprehensive guide for both novice and experienced investors.

Understanding the Fundamentals of Stock Analysis

Stock analysis encompasses a range of techniques used to evaluate securities and make investment decisions. It can be broadly categorized into two main approaches: fundamental analysis and technical analysis.

Fundamental Analysis: Unveiling Intrinsic Value

Fundamental analysis involves examining a company’s financial statements, industry trends, and overall economic conditions to determine its intrinsic value. Key metrics analyzed include revenue growth, profitability margins, debt levels, and cash flow. By comparing a company’s intrinsic value to its current market price, investors can identify potentially undervalued or overvalued stocks.

For instance, a company with consistently strong earnings growth, a healthy balance sheet, and a competitive advantage in its industry may be considered a good investment based on fundamental analysis. Conversely, a company with declining revenues, high debt, and a weak competitive position may be deemed risky.

Technical Analysis: Charting Market Trends

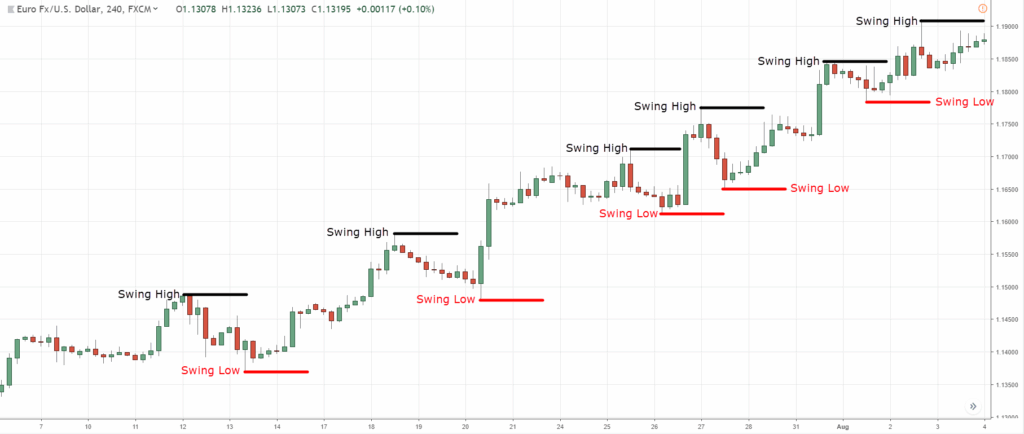

Technical analysis focuses on studying historical price and volume data to identify patterns and trends that can predict future stock movements. Technical analysts use various charts, indicators, and oscillators to identify potential entry and exit points. Common technical indicators include moving averages, relative strength index (RSI), and Moving Average Convergence Divergence (MACD).

Technical analysis is based on the premise that market prices reflect all available information and that historical price patterns tend to repeat themselves. While it can be a valuable tool for short-term trading, it’s important to note that technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

The Importance of Stock Analysis Forecast

A well-executed stock analysis forecast offers several key benefits:

- Informed Decision-Making: Provides investors with a data-driven basis for making investment decisions, reducing reliance on speculation and gut feelings.

- Risk Management: Helps identify potential risks associated with specific stocks or market sectors, allowing investors to adjust their portfolios accordingly.

- Opportunity Identification: Uncovers undervalued stocks or emerging trends that may present lucrative investment opportunities.

- Portfolio Optimization: Enables investors to construct a well-diversified portfolio that aligns with their risk tolerance and investment goals.

- Enhanced Returns: By making informed decisions based on thorough analysis, investors can potentially improve their investment returns over the long term.

Methodologies for Stock Analysis Forecasting

Several methodologies can be used to generate a stock analysis forecast. These methods range from simple trend extrapolation to complex statistical models.

Time Series Analysis

Time series analysis involves analyzing historical stock price data to identify patterns and trends that can be extrapolated into the future. This method typically uses statistical techniques such as moving averages, exponential smoothing, and ARIMA models. Time series analysis is best suited for short-term forecasting and may not be accurate over longer time horizons due to unforeseen market events.

Regression Analysis

Regression analysis involves identifying the relationship between a stock’s price and various independent variables, such as economic indicators, industry trends, and company-specific factors. By quantifying these relationships, regression models can be used to predict future stock prices based on anticipated changes in the independent variables. [See also: Understanding Regression Models in Finance]

Machine Learning

Machine learning algorithms can be trained on vast amounts of historical data to identify complex patterns and relationships that may not be apparent through traditional analytical methods. Machine learning models can be used to predict stock prices, identify trading signals, and optimize portfolio allocation. Common machine learning techniques used in stock analysis forecast include neural networks, support vector machines, and random forests.

Sentiment Analysis

Sentiment analysis involves analyzing news articles, social media posts, and other sources of textual data to gauge investor sentiment towards a particular stock or market sector. Positive sentiment can often lead to increased buying pressure and higher stock prices, while negative sentiment can trigger sell-offs. Sentiment analysis can be a valuable tool for identifying short-term trading opportunities and managing market risk. [See also: How Sentiment Analysis Impacts Stock Prices]

Challenges in Stock Analysis Forecasting

Despite its benefits, stock analysis forecast is not without its challenges:

- Market Volatility: Unforeseen events, such as economic shocks, geopolitical crises, and unexpected corporate announcements, can significantly impact stock prices and render forecasts inaccurate.

- Data Availability and Quality: The accuracy of a stock analysis forecast depends on the availability and quality of the data used. Incomplete or unreliable data can lead to flawed predictions.

- Model Complexity: Complex forecasting models can be difficult to understand and interpret, making it challenging for investors to assess their reliability.

- Overfitting: Overfitting occurs when a forecasting model is too closely tailored to historical data and fails to generalize to new data. This can lead to inaccurate predictions in the future.

- Behavioral Biases: Investors’ own biases and emotions can influence their interpretation of data and lead to poor investment decisions.

Best Practices for Stock Analysis Forecast

To improve the accuracy and reliability of a stock analysis forecast, consider the following best practices:

- Use a Combination of Methods: Don’t rely solely on one forecasting method. Combine fundamental analysis, technical analysis, and sentiment analysis to gain a more comprehensive understanding of the market.

- Validate Your Assumptions: Carefully examine the assumptions underlying your forecasting models and ensure that they are realistic and supported by evidence.

- Backtest Your Models: Before using a forecasting model to make real-world investment decisions, backtest it on historical data to assess its performance.

- Stay Informed: Keep abreast of the latest market trends, economic developments, and company-specific news.

- Manage Your Emotions: Avoid making impulsive decisions based on fear or greed. Stick to your investment strategy and maintain a long-term perspective.

- Regularly Review and Adjust: Continuously monitor the performance of your portfolio and adjust your stock analysis forecast as needed to reflect changing market conditions.

Tools and Resources for Stock Analysis

Numerous tools and resources are available to assist investors in conducting stock analysis and generating forecasts. These include:

- Financial Data Providers: Bloomberg, Refinitiv, and FactSet provide comprehensive financial data and analytical tools.

- Online Brokerage Platforms: Many online brokerage platforms offer research reports, stock screeners, and charting tools.

- Financial News Websites: Websites such as The Wall Street Journal, Bloomberg, and Reuters provide up-to-date financial news and analysis.

- Financial Analysis Software: Software packages such as MATLAB and R can be used to develop and implement custom forecasting models.

Conclusion: Embracing Data-Driven Investment Strategies

In conclusion, a robust stock analysis forecast is an essential tool for navigating the complexities of the financial markets. By combining fundamental analysis, technical analysis, and other forecasting methodologies, investors can make informed decisions, manage risk, and potentially enhance their investment returns. While challenges exist, adhering to best practices and leveraging available tools and resources can significantly improve the accuracy and reliability of stock analysis forecast. As the market continues to evolve, embracing data-driven investment strategies will be crucial for success. The ability to perform an effective stock analysis forecast provides a significant competitive advantage in today’s dynamic financial environment. Investors who dedicate time to refining their stock analysis forecast skills will be well-positioned to capitalize on market opportunities and achieve their financial goals. Remember, continuous learning and adaptation are key to mastering the art of stock analysis forecast. [See also: The Future of Stock Market Analysis]