Stock Market Forecast Tomorrow: Navigating Uncertainty and Potential Opportunities

Predicting the stock market forecast tomorrow is a complex endeavor, influenced by a myriad of factors ranging from economic indicators and geopolitical events to investor sentiment and corporate earnings. While no forecast is foolproof, understanding the key drivers and potential scenarios can help investors make informed decisions. This article delves into the elements shaping the stock market forecast tomorrow, offering insights into potential trends and strategies for navigating the inherent uncertainty.

Understanding the Key Drivers of Stock Market Movement

Several factors play a crucial role in determining the direction of the stock market forecast tomorrow. These include:

- Economic Indicators: Gross Domestic Product (GDP) growth, inflation rates, unemployment figures, and consumer confidence are all closely watched indicators. Strong economic data typically supports a positive outlook for the stock market, while weak data can trigger concerns about a potential slowdown or recession.

- Interest Rates: The Federal Reserve’s monetary policy decisions, particularly regarding interest rates, have a significant impact on the stock market. Lower interest rates can stimulate borrowing and investment, boosting stock prices. Conversely, higher rates can dampen economic activity and lead to market corrections.

- Corporate Earnings: The performance of publicly traded companies, as reflected in their earnings reports, is a key driver of stock market sentiment. Strong earnings growth typically leads to higher stock prices, while disappointing results can trigger sell-offs.

- Geopolitical Events: Global events such as trade wars, political instability, and military conflicts can create uncertainty and volatility in the stock market. These events can disrupt supply chains, impact consumer confidence, and lead to risk aversion among investors.

- Investor Sentiment: The overall mood and expectations of investors can significantly influence market movements. Positive sentiment can drive a bull market, while negative sentiment can trigger a bear market. Factors such as news headlines, social media trends, and market momentum can all contribute to investor sentiment.

Analyzing Recent Market Trends and Indicators

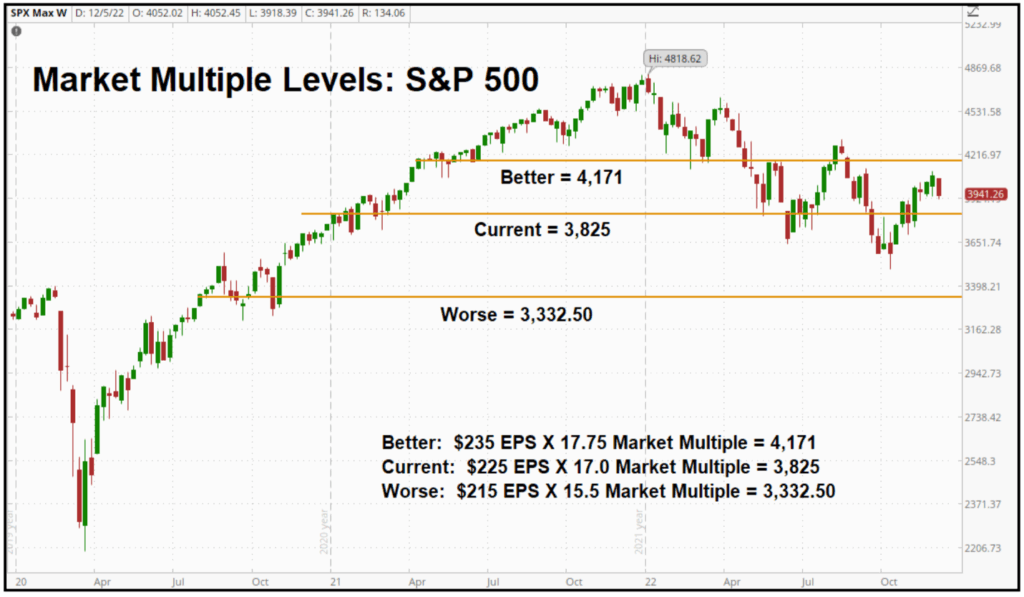

To formulate a reasonable stock market forecast tomorrow, it’s essential to analyze recent market trends and indicators. This involves examining key indices such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite, as well as monitoring economic data releases and corporate earnings reports.

For example, if recent economic data shows strong GDP growth and low unemployment, this could suggest a positive outlook for the stock market. However, if inflation is rising rapidly, the Federal Reserve may be forced to raise interest rates, which could dampen market sentiment. Similarly, strong corporate earnings could boost stock prices, but geopolitical uncertainty could create headwinds.

Potential Scenarios for Tomorrow’s Market

Given the complex interplay of factors influencing the stock market forecast tomorrow, it’s helpful to consider several potential scenarios:

Scenario 1: Continued Bull Market

In this scenario, strong economic growth, low interest rates, and positive corporate earnings continue to drive the stock market higher. Investor sentiment remains optimistic, and geopolitical risks are contained. This scenario could see the major indices reaching new all-time highs.

Scenario 2: Market Correction

In this scenario, rising inflation, higher interest rates, or geopolitical uncertainty trigger a market correction. Investor sentiment turns negative, and stock prices decline. This scenario could see a significant pullback in the major indices, potentially leading to a bear market.

Scenario 3: Sideways Market

In this scenario, the stock market trades within a narrow range, with no clear upward or downward trend. Economic data is mixed, corporate earnings are lackluster, and investor sentiment is neutral. This scenario could see the major indices fluctuating within a limited range.

Strategies for Navigating Market Uncertainty

Given the inherent uncertainty of the stock market forecast tomorrow, it’s crucial for investors to adopt strategies that can help them navigate potential volatility and protect their portfolios. These strategies include:

- Diversification: Spreading investments across different asset classes, sectors, and geographic regions can help reduce risk. Diversification can help cushion the impact of any single investment performing poorly.

- Long-Term Investing: Focusing on long-term investment goals rather than trying to time the market can help reduce the impact of short-term volatility. A long-term perspective allows investors to ride out market corrections and benefit from the long-term growth potential of the stock market.

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals, regardless of market conditions, can help reduce the risk of buying high and selling low. Dollar-cost averaging allows investors to accumulate shares over time, smoothing out the impact of market fluctuations.

- Risk Management: Assessing risk tolerance and setting appropriate stop-loss orders can help protect against significant losses. Risk management involves understanding the potential downside of investments and taking steps to mitigate those risks.

- Staying Informed: Keeping abreast of economic news, market trends, and corporate earnings reports can help investors make informed decisions. Staying informed allows investors to react quickly to changing market conditions and adjust their portfolios accordingly. [See also: How to Analyze Stock Market Trends]

The Role of Artificial Intelligence in Stock Market Forecasting

The increasing sophistication of artificial intelligence (AI) and machine learning (ML) has led to their growing use in stock market forecast tomorrow. AI algorithms can analyze vast amounts of data, identify patterns, and make predictions with greater speed and accuracy than traditional methods. However, it’s important to recognize that AI-powered forecasts are not infallible and should be used in conjunction with other sources of information.

AI models can incorporate factors such as historical stock prices, economic indicators, news sentiment, and social media trends to generate forecasts. These models can also adapt to changing market conditions and learn from their mistakes, improving their accuracy over time. [See also: AI and the Future of Investing]

Expert Opinions on the Stock Market Outlook

While no one can predict the future with certainty, it’s helpful to consider the opinions of market experts and analysts when formulating a stock market forecast tomorrow. These experts often have years of experience and a deep understanding of the factors driving market movements.

However, it’s important to remember that expert opinions can vary widely, and no single expert has a perfect track record. It’s best to consider a range of opinions and form your own conclusions based on your own research and analysis.

Conclusion: Navigating the Uncertainties of Tomorrow’s Market

The stock market forecast tomorrow is inherently uncertain, influenced by a complex interplay of factors. While no forecast is foolproof, understanding the key drivers of market movement, analyzing recent trends, and considering potential scenarios can help investors make informed decisions. By adopting a diversified, long-term investment strategy, managing risk effectively, and staying informed, investors can navigate the uncertainties of tomorrow’s market and achieve their financial goals. Remember, the key is not to predict the future with certainty, but to be prepared for a range of possibilities and to adapt your strategy accordingly. The stock market forecast tomorrow requires constant analysis and adjustment to the ever-changing landscape. Keep an eye on the stock market forecast tomorrow and adjust your strategies as needed. A solid understanding of the stock market forecast tomorrow can help you make informed decisions. Don’t rely solely on one source for the stock market forecast tomorrow. Always consider multiple factors when assessing the stock market forecast tomorrow. The stock market forecast tomorrow is constantly evolving. Understanding the nuances of the stock market forecast tomorrow is crucial for successful investing. Monitoring the stock market forecast tomorrow can help you identify potential opportunities. Be prepared for volatility when considering the stock market forecast tomorrow. The stock market forecast tomorrow is a valuable tool for investors. The stock market forecast tomorrow is an important consideration, but not the only one.