Swiss Bearer Bonds: A Deep Dive into Anonymity, History, and Modern Regulations

Swiss bearer bonds, once synonymous with financial secrecy and untraceable wealth, have a storied history intertwined with global finance and evolving regulatory landscapes. These instruments, characterized by their ownership being determined solely by possession of the physical certificate, provided unparalleled anonymity to their holders. This article delves into the intricacies of swiss bearer bonds, examining their historical context, the advantages and disadvantages they presented, and the reasons behind their decline in popularity due to increased international scrutiny and regulations aimed at combating money laundering and tax evasion.

The Allure of Anonymity: A Historical Perspective

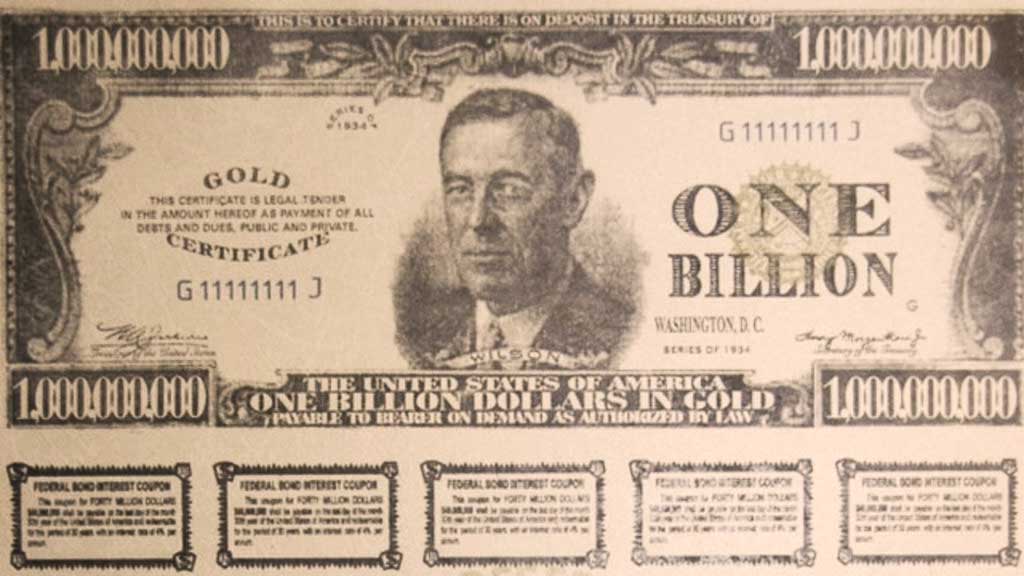

Bearer bonds, in general, are debt securities that are owned by whoever holds the physical bond certificate. Unlike registered bonds, where the owner’s name is recorded, swiss bearer bonds offered complete anonymity. This characteristic made them attractive to individuals and entities seeking to keep their financial dealings private. Historically, they were utilized for legitimate purposes, such as facilitating international trade and investment, but also became a tool for illicit activities.

Switzerland’s long-standing tradition of banking secrecy further amplified the appeal of swiss bearer bonds. The country’s stable political environment and robust financial infrastructure made it a safe haven for capital, attracting investors from around the globe. The combination of anonymity and security contributed to the widespread use of swiss bearer bonds in the 20th century.

Advantages and Disadvantages of Swiss Bearer Bonds

Advantages:

- Anonymity: This was the primary advantage. Ownership was determined by possession, making it difficult to trace the holder’s identity.

- Transferability: Swiss bearer bonds could be easily transferred from one party to another without the need for registration or complex paperwork.

- Tax Advantages: In some jurisdictions, the anonymity provided by swiss bearer bonds allowed holders to evade taxes.

- Confidentiality: The lack of a central registry ensured that the details of bond ownership remained confidential.

Disadvantages:

- Risk of Loss or Theft: Since ownership was based on possession, the loss or theft of a swiss bearer bond certificate could result in a significant financial loss.

- Illicit Activities: The anonymity afforded by swiss bearer bonds made them susceptible to use in money laundering, tax evasion, and other illegal activities.

- Regulatory Scrutiny: Increased international pressure led to stricter regulations and oversight of swiss bearer bonds, diminishing their appeal.

- Limited Liquidity: As regulations tightened, the market for swiss bearer bonds became less liquid.

The Decline of Swiss Bearer Bonds: Regulatory Changes and International Pressure

In recent decades, the global regulatory landscape has undergone significant changes, driven by efforts to combat money laundering, terrorist financing, and tax evasion. These changes have had a profound impact on the use of swiss bearer bonds. International organizations, such as the Financial Action Task Force (FATF) and the Organisation for Economic Co-operation and Development (OECD), have played a crucial role in promoting greater transparency and cooperation in financial matters.

Switzerland, once a staunch defender of banking secrecy, has gradually adapted its laws and regulations to comply with international standards. The introduction of automatic exchange of information (AEOI) agreements with numerous countries has made it more difficult for individuals to hide assets from tax authorities. Furthermore, regulations targeting swiss bearer bonds have been tightened, making them less attractive as a means of concealing wealth.

Many countries have either banned or severely restricted the issuance and use of bearer bonds. Switzerland itself has implemented measures to discourage their use, including stricter reporting requirements and increased scrutiny of transactions involving these instruments. [See also: Swiss Banking Secrecy Laws]. The shift towards greater transparency has significantly reduced the demand for swiss bearer bonds and their prevalence in the financial system.

Modern Regulations and the Current Status of Swiss Bearer Bonds

Today, swiss bearer bonds are subject to far greater scrutiny and regulation than in the past. While they may still exist in some limited contexts, their use is significantly restricted. Financial institutions are required to conduct enhanced due diligence on clients who hold or transact in swiss bearer bonds, and any suspicious activity must be reported to the relevant authorities. The anonymity once associated with these instruments has largely been eroded.

The Swiss government has taken steps to encourage the conversion of swiss bearer bonds into registered bonds, where the owner’s identity is recorded. This transition is intended to promote greater transparency and reduce the risk of illicit activities. The remaining swiss bearer bonds are subject to strict regulations, including requirements for mandatory registration and reporting.

The trend towards greater transparency in the financial system is likely to continue, further diminishing the role of swiss bearer bonds. As countries around the world work together to combat financial crime, the days of untraceable wealth are numbered. The future of finance lies in greater accountability and cooperation, making it increasingly difficult for individuals and entities to conceal their financial dealings.

The Legacy of Swiss Bearer Bonds

Despite their decline in popularity, swiss bearer bonds have left a lasting legacy on the global financial landscape. They serve as a reminder of the challenges associated with balancing privacy and transparency in the financial system. The lessons learned from the rise and fall of swiss bearer bonds have informed the development of more effective regulations and oversight mechanisms.

The story of swiss bearer bonds also highlights the importance of international cooperation in addressing financial crime. The concerted efforts of governments, international organizations, and financial institutions have been instrumental in curbing the use of these instruments for illicit purposes. The ongoing pursuit of greater transparency and accountability will continue to shape the future of global finance.

While swiss bearer bonds are no longer the ubiquitous tool they once were, their history provides valuable insights into the evolution of financial regulations and the ongoing struggle to combat money laundering and tax evasion. The increased focus on transparency and international cooperation represents a significant step forward in creating a more secure and equitable financial system. [See also: FATF Recommendations on Bearer Shares and Bearer Bonds]

Conclusion: The End of an Era for Swiss Bearer Bonds

The era of swiss bearer bonds as a means of ensuring complete financial anonymity is effectively over. Increased international pressure, evolving regulations, and a global commitment to transparency have significantly curtailed their use. While they once played a prominent role in international finance, swiss bearer bonds are now largely relegated to the history books, serving as a cautionary tale about the risks of unchecked financial secrecy. The future of finance lies in greater transparency, accountability, and cooperation, ensuring that the financial system is used for legitimate purposes and not as a tool for illicit activities. The story of swiss bearer bonds is a testament to the power of international collaboration in shaping a more ethical and secure financial future.

The legacy of swiss bearer bonds continues to influence discussions about financial privacy and the balance between individual rights and the collective need for transparency. As technology evolves and new financial instruments emerge, the lessons learned from the swiss bearer bonds era will remain relevant in the ongoing effort to create a fair and secure global financial system. [See also: OECD’s Work on Tax Transparency]. The focus now shifts to adapting regulations and oversight mechanisms to address the challenges posed by new technologies and evolving financial practices, ensuring that the principles of transparency and accountability remain at the forefront.