Understanding the Liquidity Preference Theory: A Comprehensive Guide

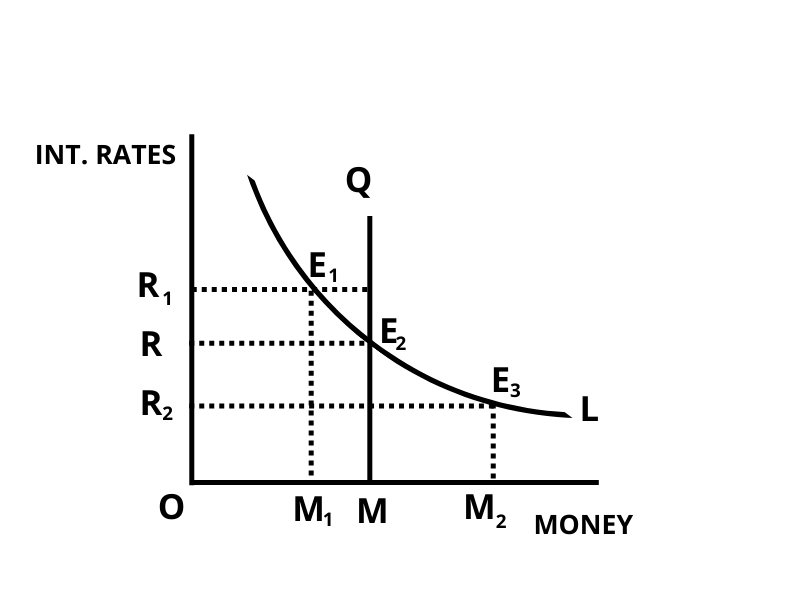

Understanding the Liquidity Preference Theory: A Comprehensive Guide The liquidity preference theory, a cornerstone of Keynesian economics, explains how individuals and businesses decide to hold cash versus other forms of assets. This theory posits that interest rates are determined by the supply and demand for money. Understanding the nuances of the liquidity preference theory is … Read more