Understanding the Liquidity Preference Theory: A Comprehensive Guide

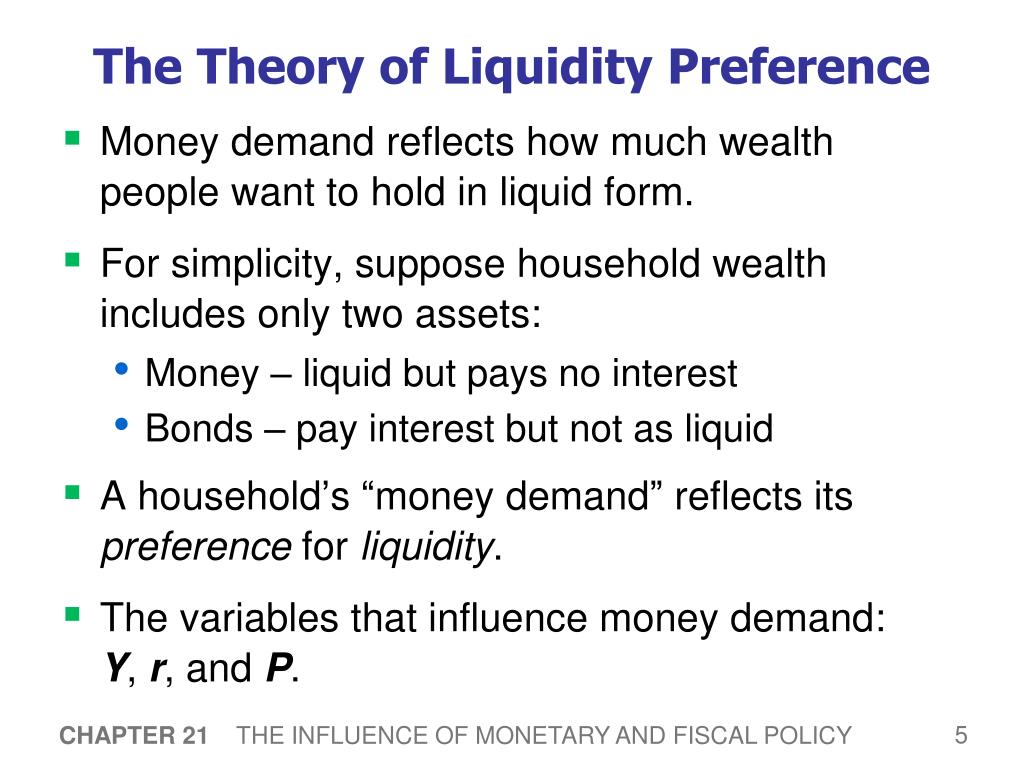

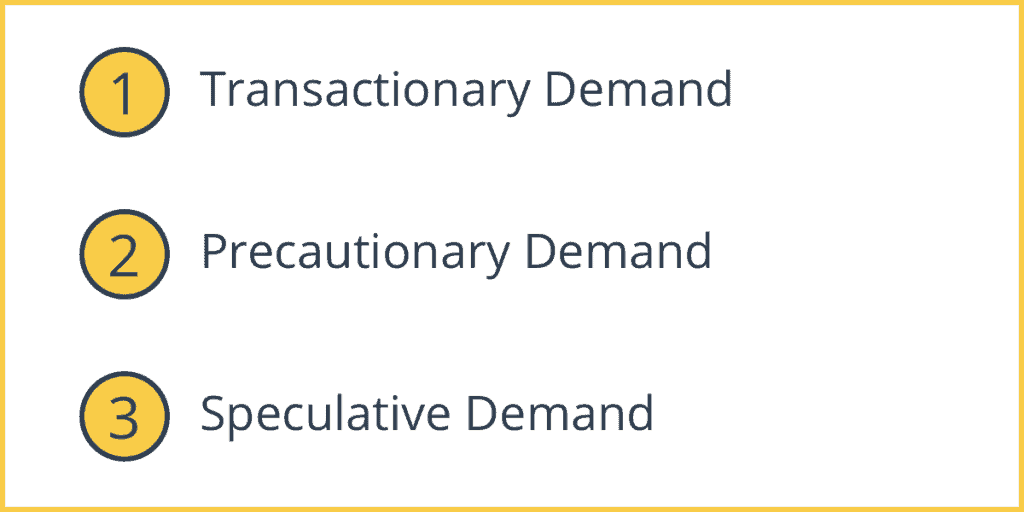

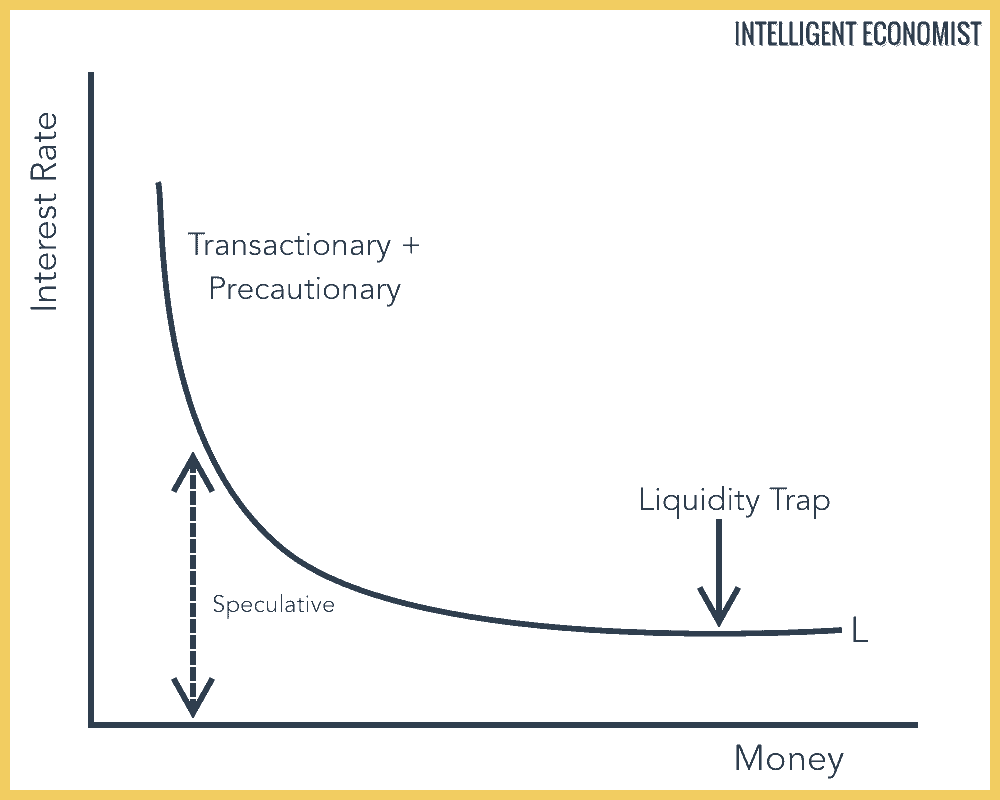

Understanding the Liquidity Preference Theory: A Comprehensive Guide In the realm of macroeconomics, understanding the forces that drive interest rates and investment decisions is crucial. One such force is explained by the liquidity preference theory, a concept developed by the renowned economist John Maynard Keynes. This theory posits that the interest rate is determined by … Read more