Understanding the Liquidity Preference Framework: A Comprehensive Guide

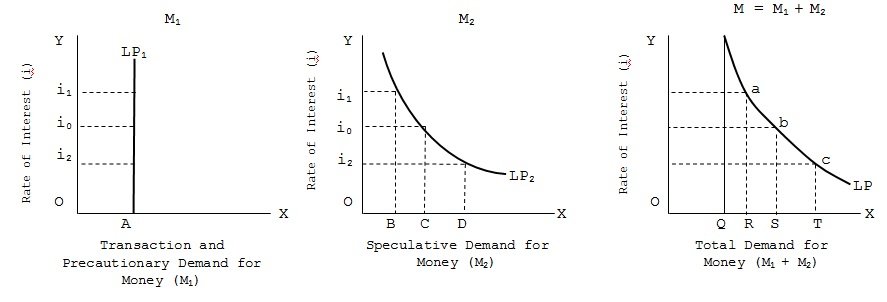

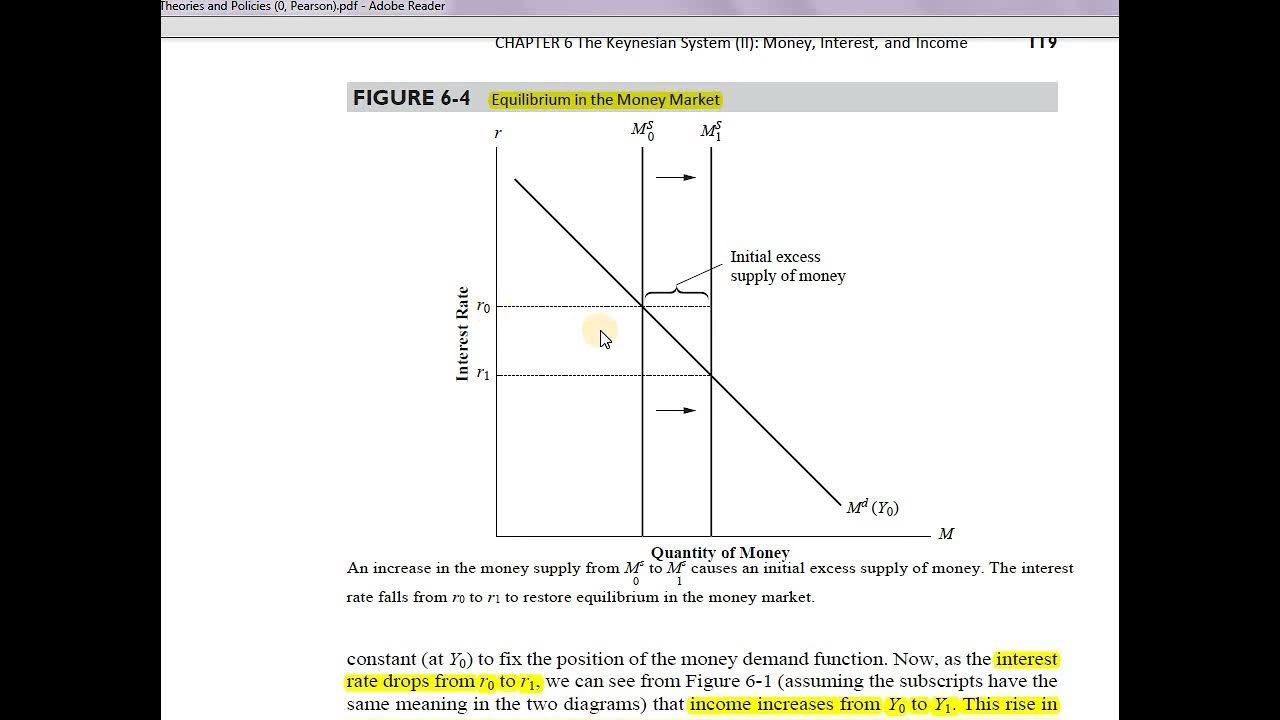

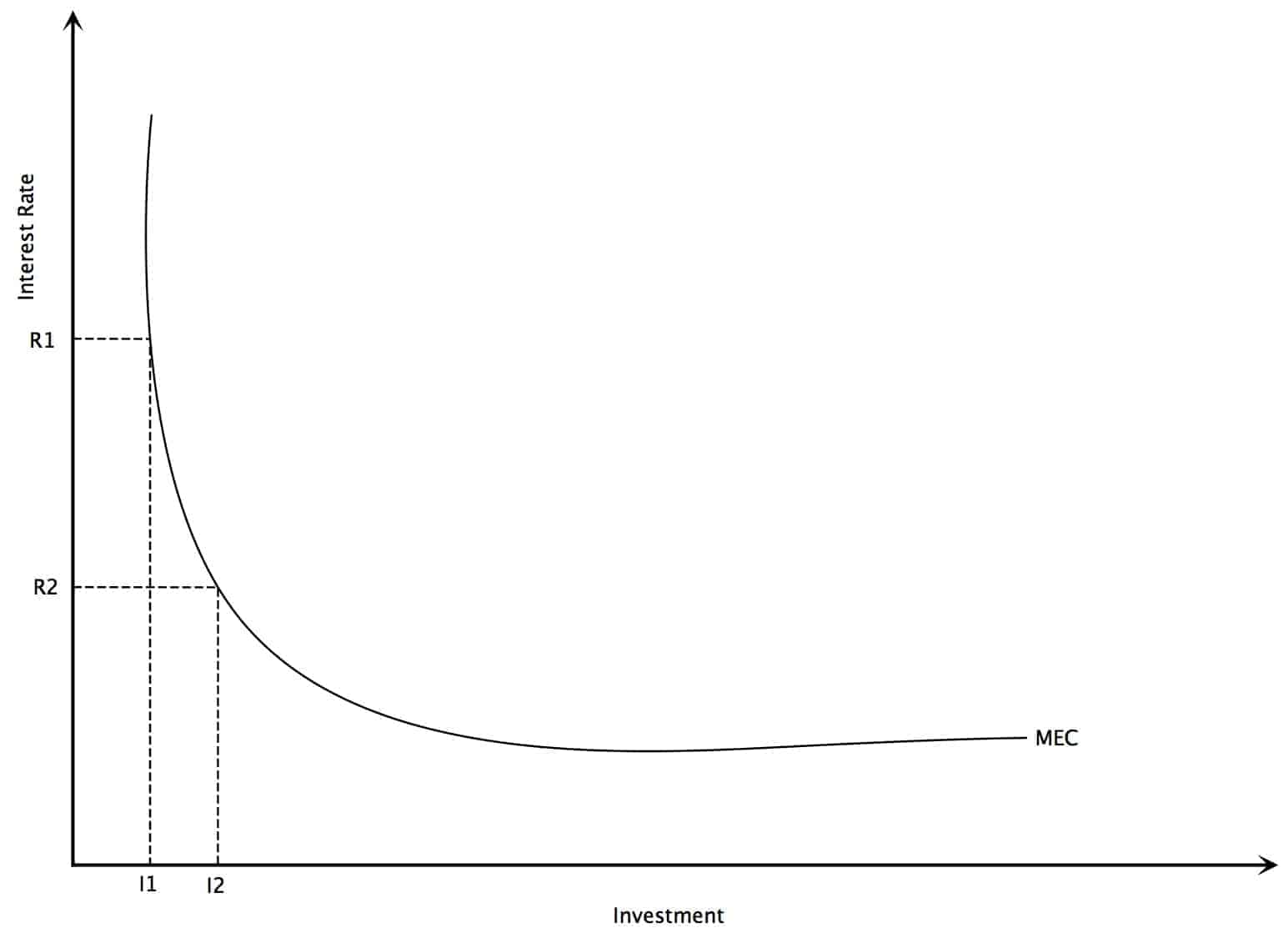

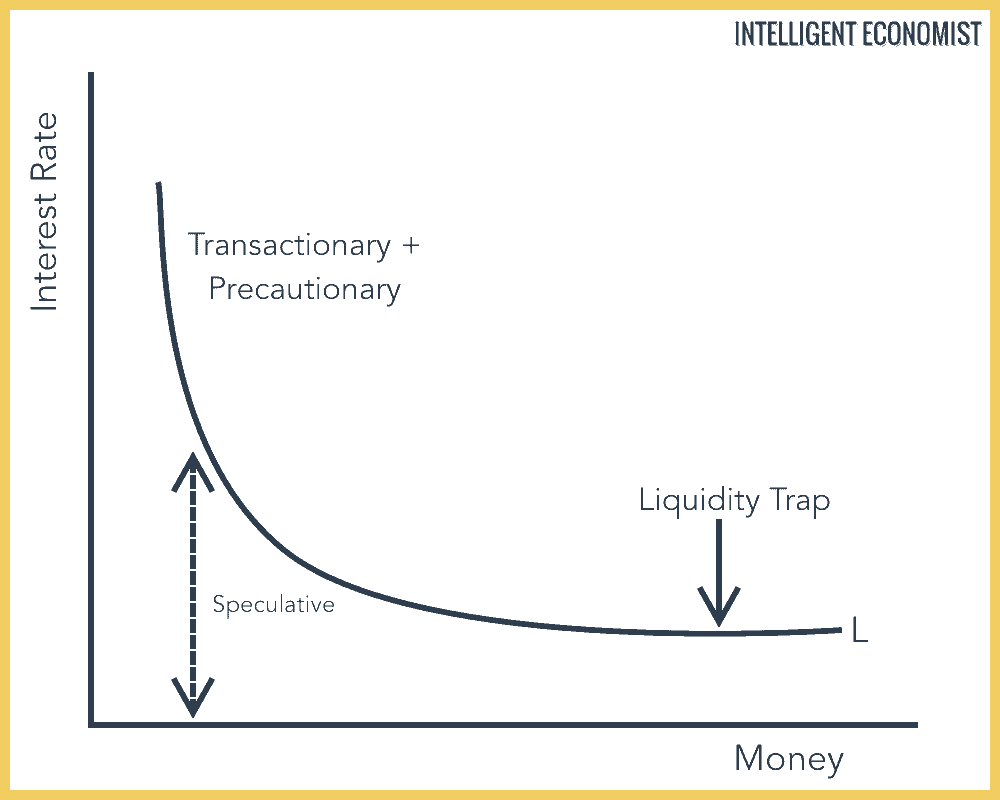

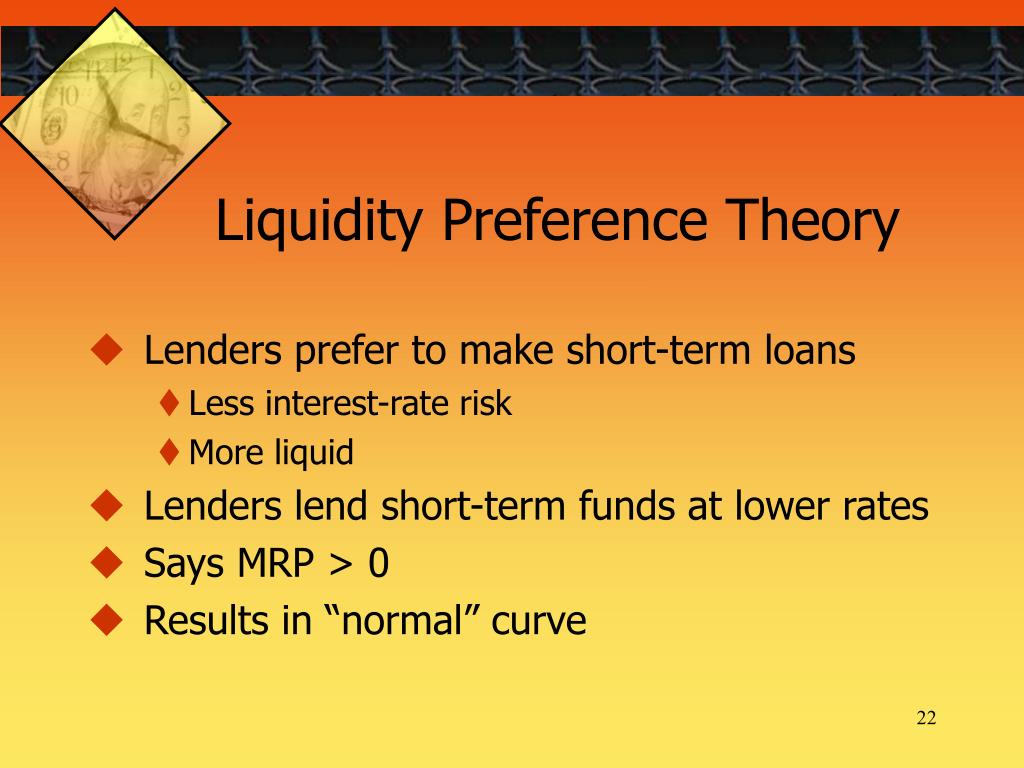

Understanding the Liquidity Preference Framework: A Comprehensive Guide The liquidity preference framework is a cornerstone of macroeconomic theory, offering a detailed explanation of how interest rates are determined in the short run. Developed by John Maynard Keynes, this framework posits that the interest rate is set by the supply and demand for money. Understanding the … Read more