Unraveling the Theory of Liquidity Preference: A Comprehensive Guide

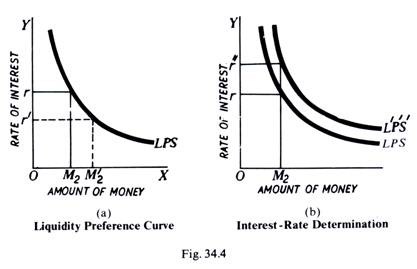

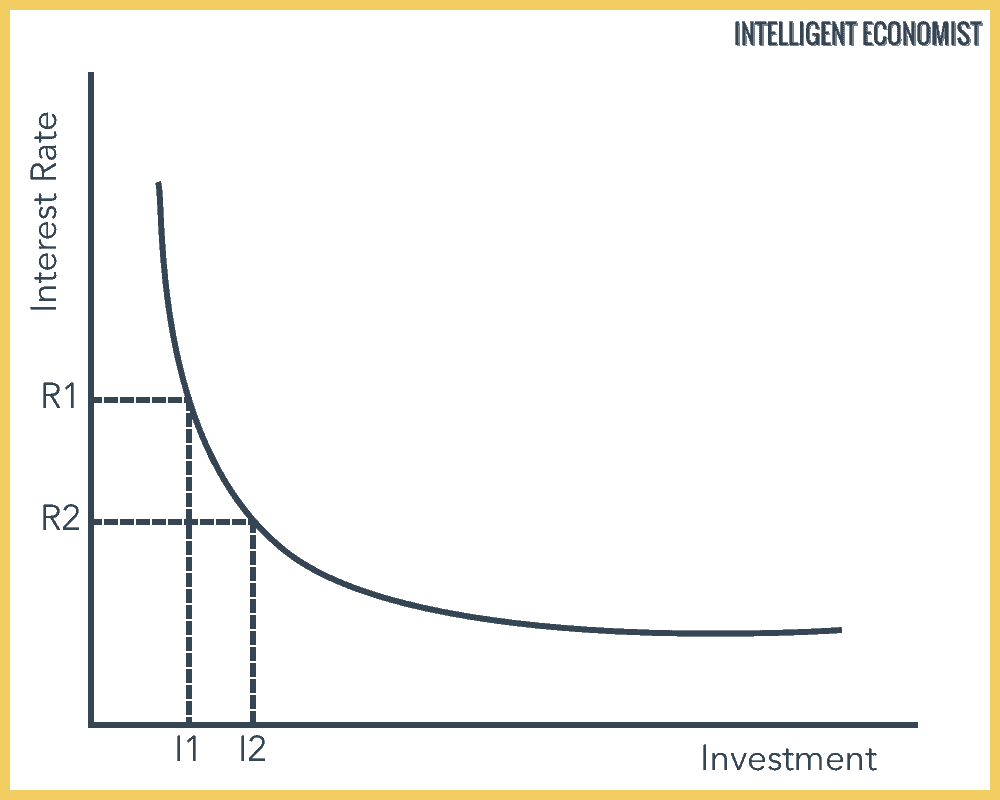

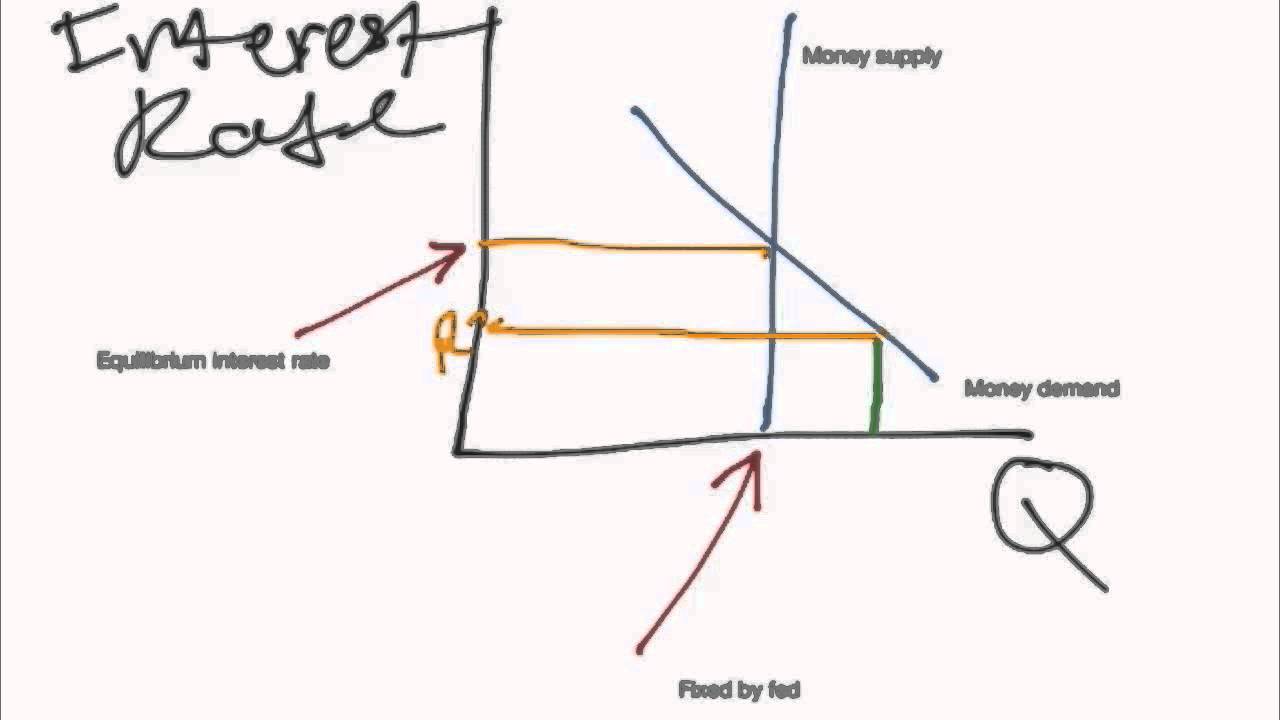

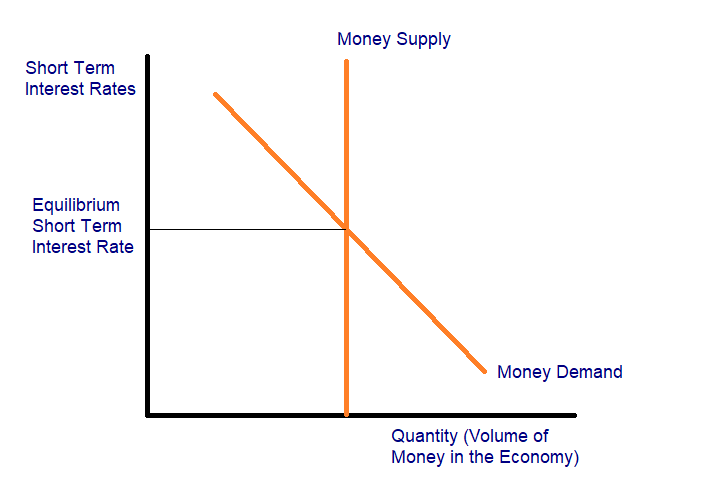

Unraveling the Theory of Liquidity Preference: A Comprehensive Guide In the realm of macroeconomics, understanding the forces that drive interest rates is crucial for grasping the overall health and direction of an economy. One of the key theories explaining these dynamics is the theory of liquidity preference. Developed by the renowned economist John Maynard Keynes, … Read more