Understanding the Theory of Liquidity Preference: A Comprehensive Guide

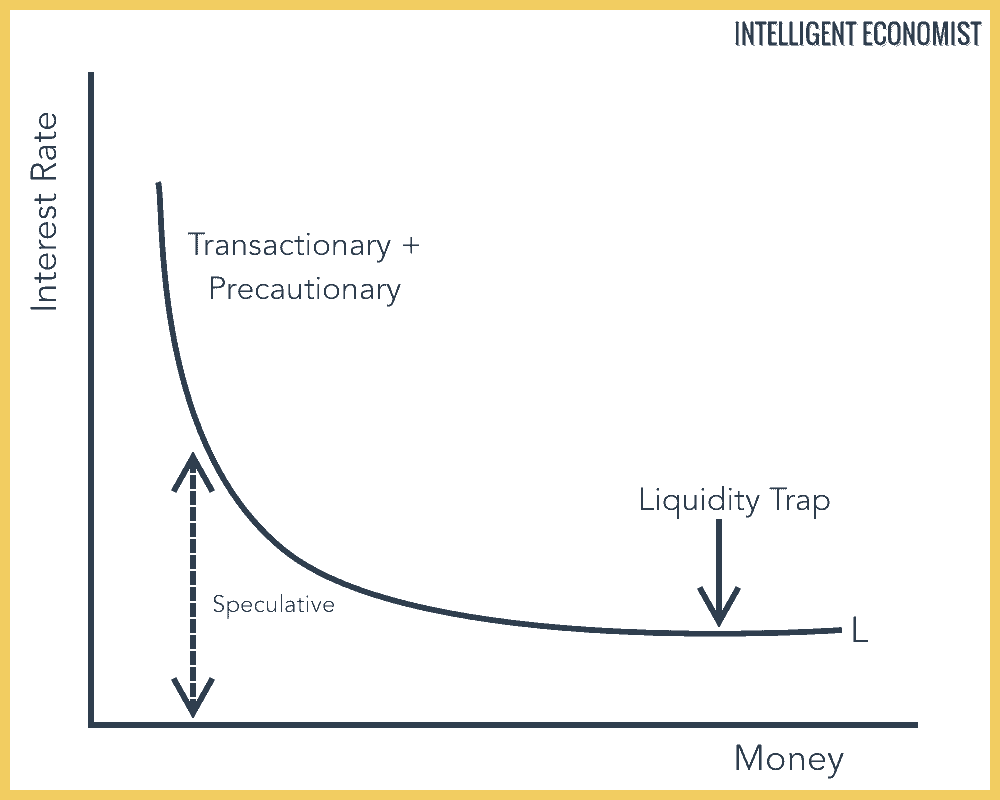

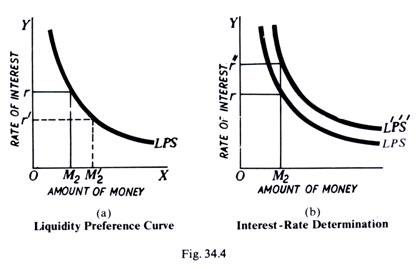

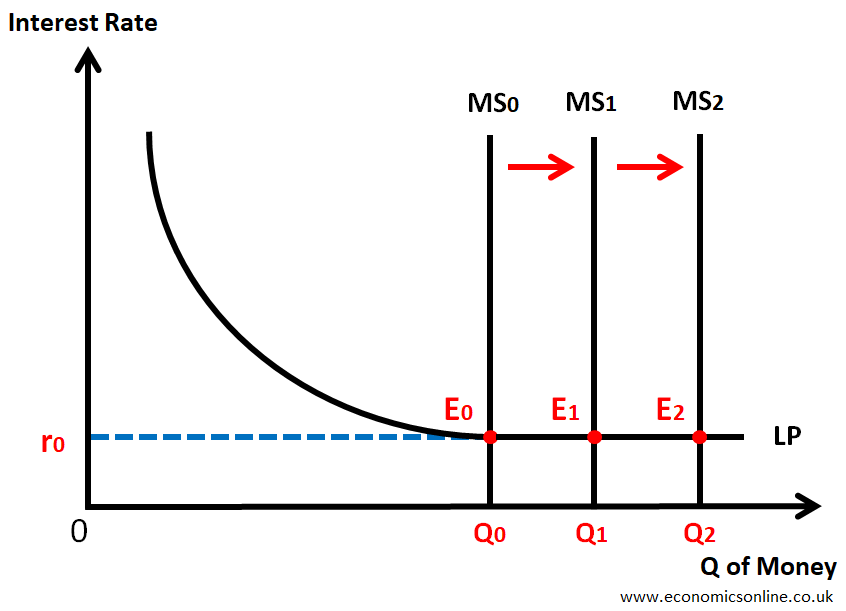

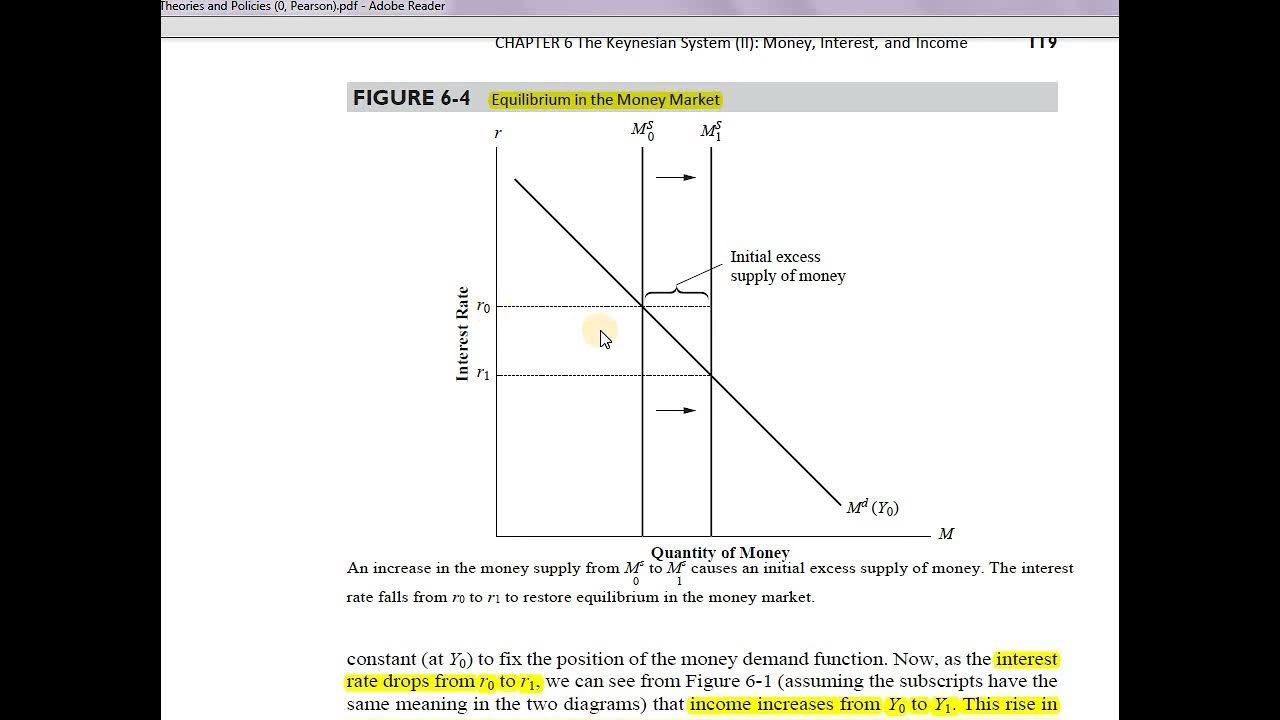

Understanding the Theory of Liquidity Preference: A Comprehensive Guide The theory of liquidity preference, a cornerstone of Keynesian economics, provides a framework for understanding how interest rates are determined by the supply and demand for money. It posits that individuals and businesses prefer to hold their wealth in the most liquid form – money – … Read more