The Best Books for Technical Analysis: A Trader’s Guide

Technical analysis is a powerful tool for traders and investors looking to understand market trends and make informed decisions. By studying historical price and volume data, technical analysts aim to identify patterns and predict future price movements. To master this skill, reading the right books is essential. This guide presents some of the best books for technical analysis, covering a range of topics from basic concepts to advanced strategies.

Why Learn Technical Analysis?

Before diving into the best books for technical analysis, it’s important to understand why this approach is so valuable. Technical analysis provides a framework for evaluating securities based on market activity, rather than fundamental factors like earnings or management. It can be used to:

- Identify potential entry and exit points for trades.

- Manage risk by setting stop-loss orders and profit targets.

- Understand market sentiment and investor behavior.

- Confirm or refute fundamental analysis findings.

Whether you’re a beginner or an experienced trader, a solid understanding of technical analysis can significantly improve your trading performance. The best books for technical analysis can provide that foundation.

Top Books for Technical Analysis

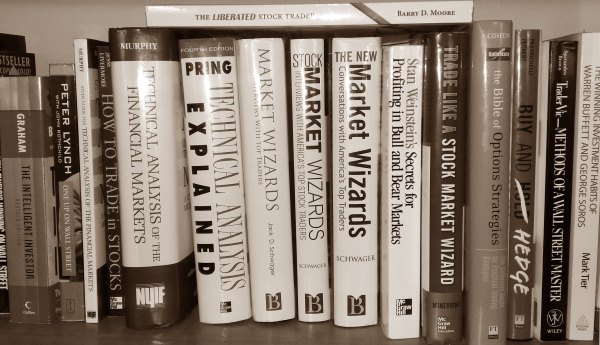

Choosing the right books can be overwhelming, so here’s a curated list of some of the most highly recommended titles:

Technical Analysis of the Financial Markets by John J. Murphy

Considered by many to be the bible of technical analysis, this book provides a comprehensive overview of the subject. It covers everything from basic chart patterns to advanced indicators and trading systems. Murphy’s clear and concise writing style makes complex concepts easy to understand. This book is a must-read for anyone serious about mastering technical analysis.

The book delves into various aspects of market analysis, including:

- Chart construction and interpretation

- Trend identification and analysis

- Key reversal patterns

- Moving averages and oscillators

- Time cycles

- Point and figure charting

- Candlestick charting

Murphy’s work also incorporates intermarket analysis, showing how different markets influence each other. This holistic approach makes it one of the best books for technical analysis.

Trading in the Zone by Mark Douglas

While not strictly a technical analysis book, *Trading in the Zone* addresses the psychological aspects of trading, which are crucial for success. Douglas explores the mental barriers that prevent traders from consistently executing their strategies and offers practical advice on overcoming these challenges. Understanding your own psychology is just as important as understanding chart patterns. This book will change your perspective on trading and help you develop a winning mindset. It’s a complement to learning technical analysis.

Japanese Candlestick Charting Techniques by Steve Nison

Candlestick charts are a powerful tool for visualizing price action and identifying potential trading opportunities. Nison’s book provides a comprehensive guide to candlestick charting, covering everything from basic patterns to advanced strategies. He explains how to interpret candlestick signals and use them to make informed trading decisions. Mastering candlestick charting is essential for any technical analyst, and this book is the definitive resource. It stands out as one of the best books for technical analysis focusing on visual patterns.

Nison covers a wide range of candlestick patterns, including:

- Doji

- Hammers and Hanging Men

- Engulfing Patterns

- Piercing Line and Dark Cloud Cover

- Morning Star and Evening Star

He also explains how to combine candlestick patterns with other technical indicators to improve trading accuracy.

How to Make Money in Stocks by William J. O’Neil

William J. O’Neil’s classic book outlines the CAN SLIM investing system, a blend of fundamental and technical analysis. While heavily focused on growth stocks, the technical analysis principles taught are invaluable. O’Neil emphasizes the importance of studying price and volume action, identifying chart patterns, and using stop-loss orders to protect capital. This book is a great resource for investors looking to combine technical and fundamental analysis. It provides a practical approach to stock selection and portfolio management and is considered among the best books for technical analysis by many.

Encyclopedia of Chart Patterns by Thomas N. Bulkowski

This comprehensive encyclopedia is an invaluable resource for traders looking to identify and trade chart patterns. Bulkowski’s book provides detailed analysis of hundreds of chart patterns, including their characteristics, performance statistics, and trading strategies. He also offers practical advice on how to avoid common mistakes and improve trading accuracy. This book is a must-have for any serious technical analyst. It’s a go-to reference for understanding the nuances of technical analysis.

Bulkowski’s encyclopedia covers a vast array of patterns, including:

- Double Tops and Bottoms

- Head and Shoulders

- Triangles

- Flags and Pennants

- Wedges

Each pattern is analyzed in detail, with statistical data on its success rate and optimal trading strategies.

Getting Started in Technical Analysis by Jack D. Schwager

For beginners, *Getting Started in Technical Analysis* by Jack D. Schwager is an excellent starting point. This book provides a clear and concise introduction to the basic concepts of technical analysis, including chart patterns, indicators, and trading systems. Schwager’s writing style is easy to understand, and he uses numerous examples to illustrate key concepts. This book is a great way to build a solid foundation in technical analysis. It’s designed to make technical analysis accessible to everyone.

Applying Technical Analysis

Reading the best books for technical analysis is just the first step. To truly master this skill, you need to apply what you learn in the real world. Here are some tips for applying technical analysis to your trading:

- Practice regularly: The more you practice, the better you’ll become at identifying patterns and making informed trading decisions.

- Use a trading simulator: A trading simulator allows you to test your strategies without risking real money.

- Keep a trading journal: A trading journal helps you track your trades, identify your strengths and weaknesses, and learn from your mistakes.

- Stay disciplined: Stick to your trading plan and avoid making impulsive decisions based on emotions.

- Continuously learn: The markets are constantly evolving, so it’s important to stay up-to-date on the latest technical analysis techniques and strategies.

Beyond the Books

While books are a great resource, don’t limit yourself to them. Consider these additional resources:

- Online courses: Many online platforms offer courses on technical analysis, covering a wide range of topics and skill levels.

- Trading communities: Joining a trading community allows you to connect with other traders, share ideas, and learn from their experiences.

- Financial news websites: Stay informed about market trends and economic events by reading financial news websites like Bloomberg, Reuters, and The Wall Street Journal.

Conclusion

Mastering technical analysis requires dedication, practice, and the right resources. By reading the best books for technical analysis and applying what you learn in the real world, you can develop the skills you need to succeed in the markets. Remember to combine your technical knowledge with a solid understanding of risk management and trading psychology. Good luck, and happy trading! Keep learning and refining your strategies, and you’ll be well on your way to becoming a successful technical analyst. The journey to mastering technical analysis is a continuous one, but the rewards are well worth the effort. Finding the best books for technical analysis is a great first step. Remember to complement your reading with practical experience and continuous learning. [See also: How to Read Stock Charts] [See also: Understanding Moving Averages] [See also: The Importance of Volume in Trading]