The Definitive Technical Analysis Textbook: Mastering Market Prediction

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. Unlike fundamental analysts who attempt to evaluate a security’s intrinsic value, technical analysts focus on charts and patterns to identify trading opportunities. A comprehensive technical analysis textbook can be an invaluable resource for both novice and experienced traders seeking to refine their skills and improve their market timing. This article delves into the key elements that constitute a definitive technical analysis textbook, exploring its structure, content, and practical applications.

Understanding the Foundations of Technical Analysis

A robust technical analysis textbook should begin with a thorough introduction to the core principles. This includes explaining the assumptions underlying technical analysis, such as the belief that markets discount everything and that prices move in trends. It should also cover the history of technical analysis, tracing its roots back to Charles Dow and his Dow Theory. Key topics that must be addressed are:

- Dow Theory: Explaining the six tenets and their implications for market analysis.

- Chart Types: Covering different chart types like line charts, bar charts, candlestick charts, and point and figure charts. Each chart type offers a unique perspective on price action.

- Volume and Open Interest: Explaining the significance of volume and open interest in confirming price trends and identifying potential reversals.

Without a solid grasp of these foundational concepts, understanding more advanced technical analysis techniques becomes significantly more challenging. A good technical analysis textbook ensures that readers have a firm footing before progressing to more complex topics.

Key Technical Indicators and Oscillators

The heart of any technical analysis textbook lies in its coverage of various technical indicators and oscillators. These tools help traders identify potential buy and sell signals. The textbook should provide detailed explanations of how each indicator is calculated, how to interpret its signals, and its limitations. Essential indicators and oscillators to include are:

- Moving Averages: Simple Moving Averages (SMA), Exponential Moving Averages (EMA), and Weighted Moving Averages (WMA). How to use them for trend identification and support/resistance levels.

- Relative Strength Index (RSI): A momentum oscillator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): A trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

- Stochastic Oscillator: Another momentum indicator comparing a security’s closing price to its price range over a given period.

- Bollinger Bands: Bands plotted at standard deviation levels above and below a moving average. Used to measure volatility and identify potential breakout or breakdown points.

- Fibonacci Retracements: A tool used to identify potential support and resistance levels based on Fibonacci ratios.

The textbook should also discuss how to combine different indicators to confirm signals and filter out false positives. Practical examples and case studies are crucial for illustrating how these indicators work in real-world trading scenarios. A comprehensive technical analysis textbook will also cover the limitations of each indicator, highlighting situations where they may not be reliable.

Chart Patterns: Identifying Potential Trading Opportunities

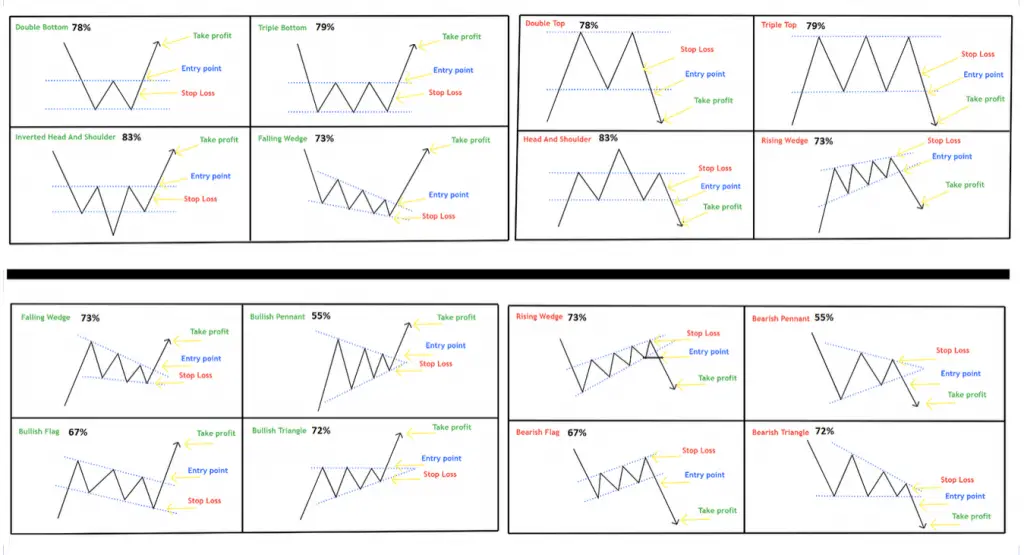

Chart patterns are visual formations on price charts that suggest future price movements. A comprehensive technical analysis textbook will dedicate a significant portion to explaining various chart patterns, including:

- Reversal Patterns: Head and Shoulders, Inverse Head and Shoulders, Double Top, Double Bottom, Triple Top, and Triple Bottom.

- Continuation Patterns: Triangles (Symmetrical, Ascending, Descending), Flags, Pennants, and Wedges.

- Bilateral Patterns: Rectangles, showcasing periods of consolidation before a potential breakout in either direction.

For each pattern, the textbook should explain its characteristics, the conditions under which it forms, and how to trade it. This includes identifying entry points, setting stop-loss orders, and determining profit targets. Clear diagrams and examples are essential for helping readers recognize these patterns on real charts. A valuable technical analysis textbook will emphasize the importance of confirming patterns with other technical indicators and volume analysis.

Risk Management and Trading Psychology

No technical analysis textbook is complete without addressing risk management and trading psychology. These are critical components of successful trading, often overlooked by beginners. The textbook should cover topics such as:

- Position Sizing: Determining the appropriate amount of capital to allocate to each trade based on risk tolerance and account size.

- Stop-Loss Orders: Setting stop-loss orders to limit potential losses and protect capital. Different methods for placing stop-loss orders should be discussed.

- Risk-Reward Ratio: Assessing the potential reward of a trade relative to its risk. A favorable risk-reward ratio is essential for long-term profitability.

- Trading Psychology: Understanding the emotional biases that can affect trading decisions, such as fear, greed, and hope. Strategies for managing emotions and maintaining discipline.

- Money Management: Developing a comprehensive plan for managing trading capital, including setting profit goals, loss limits, and withdrawal strategies.

A strong technical analysis textbook will provide practical advice and exercises to help readers develop sound risk management strategies and cultivate a disciplined trading mindset. [See also: Advanced Trading Strategies]

Advanced Technical Analysis Techniques

For more advanced readers, a technical analysis textbook may also cover more sophisticated techniques, such as:

- Elliott Wave Theory: A method of analyzing market cycles and predicting future price movements based on recurring wave patterns.

- Harmonic Patterns: Geometric price patterns that use Fibonacci ratios to identify potential reversal points.

- Intermarket Analysis: Analyzing the relationships between different markets (e.g., stocks, bonds, currencies, commodities) to gain insights into market trends.

- Algorithmic Trading: Developing and implementing automated trading strategies based on technical analysis rules.

These advanced techniques require a deeper understanding of market dynamics and mathematical concepts. The textbook should provide clear explanations and examples to help readers grasp these complex topics. A definitive technical analysis textbook may also explore the use of programming languages like Python for backtesting and automating trading strategies.

Practical Application and Case Studies

The true value of a technical analysis textbook lies in its ability to translate theoretical knowledge into practical application. The textbook should include numerous case studies and examples that illustrate how to use technical analysis techniques in real-world trading scenarios. These case studies should cover different markets, timeframes, and trading styles. Readers should be able to follow along with the analysis and understand the rationale behind each trading decision. It’s important that a technical analysis textbook not only present the theories but also show them in action.

Choosing the Right Technical Analysis Textbook

With so many technical analysis textbook options available, choosing the right one can be challenging. Consider the following factors when making your selection:

- Author’s Expertise: Look for authors with a proven track record in technical analysis and trading.

- Content Coverage: Ensure that the textbook covers all the essential topics, from basic principles to advanced techniques.

- Clarity and Accessibility: The textbook should be written in a clear and accessible style, avoiding jargon and technical terms that may confuse beginners.

- Practical Examples: The textbook should include plenty of practical examples and case studies to illustrate how to apply technical analysis techniques.

- Reviews and Recommendations: Read reviews and recommendations from other traders to get an idea of the textbook’s quality and effectiveness.

By carefully considering these factors, you can choose a technical analysis textbook that meets your needs and helps you achieve your trading goals. Remember that mastering technical analysis requires time, effort, and practice. A good textbook is a valuable tool, but it’s only one piece of the puzzle.

The Importance of Continuous Learning

The financial markets are constantly evolving, so it’s essential to stay up-to-date with the latest technical analysis techniques and tools. A good technical analysis textbook should serve as a foundation for continuous learning. Consider supplementing your textbook with other resources, such as online courses, trading forums, and mentorship programs. The key is to remain curious, experiment with different techniques, and adapt your strategies to changing market conditions. Investing in a solid technical analysis textbook is a great start, but the journey of becoming a successful trader is a lifelong pursuit.

In conclusion, a definitive technical analysis textbook is a comprehensive resource that covers the core principles, key indicators, chart patterns, risk management, and trading psychology. It provides practical examples and case studies to illustrate how to apply technical analysis techniques in real-world trading scenarios. By choosing the right textbook and committing to continuous learning, traders can improve their skills and increase their chances of success in the financial markets. The world of technical analysis is vast, but a solid foundation from a quality textbook is the first step towards mastering market prediction. [See also: Best Online Trading Courses]